May the Soul of the IFS Financial System Definition RIP in

M PRA Munich Personal RePEc Archive May the Soul of the IFS Financial System Definition RIP in Developing Countries Simplice Asongu 11. January 2014 Online at http://mpra.ub.uni-muenchen.de/63156/ MPRA Paper No. 63156, posted 22. March 2015 14:31 UTC AFRICAN GOVERNANCE AND DEVELOPMENT INSTITUTE A G D I Working Paper WP/14/021 May the Soul of the IFS Financial System Definition RIP in Developing Countries Simplice A. Asongu African Governance and Development Institute, Yaoundé, Cameroon. E-mail: [email protected] 1 © 2014 African Governance and Development Institute WP/21/14 AGDI Working Paper Research Department May the Soul of the IFS Financial System Definition RIP in Developing Countries Simplice A. Asongu1 January 2014 Abstract In this paper, we dissect with great acuteness contemporary insufficiencies of the IFS (2008) definition of the financial system and conclude from sound theoretical underpinnings and empirical justifications that the foundation, on which it is based, while solid for developed countries, holds less ground in developing countries. Perhaps one of the deepest empirical hollows in the financial development literature has been the equation of financial depth in the perspective of money supply to liquid liabilities. This equation has put on the margin (and skewed) burgeoning phenomena of mobile banking, knowledge economy (KE), inequality…etc. We conclude that the informal financial sector, a previously missing component in the IFS conception and definition of the financial system can only be marginalized at the cost of misunderstanding recent burgeoning trends in mobile phone penetration, KE and poverty. Hence, the IFS definition has incontrovertibly fought its final dead battle and lost in the face of soaring trends highlighted above. Despite the plethora of econometric and policy-making sins the definition has committed in developing countries through bias estimates and misleading inferences, may its soul RIP. JEL Classification: E00; G20; I30; O17; O33 Keywords: Banking; Mobile Phones; Shadow Economy; Financial Development; Poverty Acknowledgement The author is highly indebted to the editor and referees for useful comments. 1 Simplice A. Asongu is Lead economist in the Research Department of the AGDI ([email protected]). 2 1. Introduction The title of this paper will strike some as fanciful and earthshaking, heartbreaking and eye-catching for others. The International Financial Statistics (IFS, 2008) definition by the International Monetary Fund (IMF)? To rest in peace (RIP)? Surely not. Or at least surely not for developed countries. However, this lamentation is a subject to controversy in developing countries and motivates no tears or elements of consolation. Not least, because one of the deepest empirical hollows in the financial development literature has been the equation of financial depth in the perspective of money supply to liquid liabilities. This equation has put on the margin, some burgeoning phenomena in the informal financial sectors of developing countries. Among others, mobile banking and microfinance (or in one conception ‘informal finance’) are elements of consolation for developing countries as the soul of the IFS conception and definition of the financial system RIP. In this paper we dissect with great acuteness and contextualize the IFS definition of the financial system in developing countries in order to provide an updated account of the circumstances surrounding the definition in these countries. Hence, we present theoretical justifications and empirical validity as to why, the conception and definition of the financial system by the IFS from a macroeconomic perspective is anachronistic and antagonistic. To this effect, we present recent findings on the weight of the informal financial sector (that is neglected in the definition); notably its nexuses with mobile banking, knowledge economy (KE) and inequality. Recent findings on the dynamics of the KE-finance nexuses have shown: (1) the informal financial sector (a previously missing component in the definition by the IFS) significantly affects dimensions of KE; (2) disentangling the existing measurement (of the financial system) into its constituent components of formal (banking) and semi-formal (or other financial institutions) sector indicators improves dynamics of the KE nexus; (3) introducing measures of sector importance (competition) is relevant in understanding the dynamics of financial sector competition on KE (Asongu, 2012). In fact, recent findings have 3 prompted a complete rethinking of the definition of financial depth in developing countries after the burgeoning phenomenon of mobile banking could not be effectively appreciated with traditional financial development indicators. Accordingly, with a relaxation of the IFS assumption on the marginality of the informal sector adopted, the informal financial sector has been found to be endogenous to how mobile phone penetration has positively affected financial development in developing countries (Asongu, 2013). Sound empirical evidence has also shown that, the informal financial sector significantly mitigates poverty through its positive income redistributive effect on household income (Asongu, 2013, 2014a). In light of the weight of sound theoretical underpinnings (to be detailed below) and the empirical justifications highlighted above, the IFS (2008) definition for the financial system in developing countries has fought its final dead battle and lost2. Accordingly, even before the strong advent of information & communication technologies (ICT) and KE in developing countries, it was factual that: “a great chunk of the monetary base (M0) in developing countries does not transit through the formal banking sector, hence, the equation of money supply (M2) to liquid liabilities fails to take account of the informal financial sector which substantially contributes to the circulation of currency”. The rest of the paper is organized as follows. Section 2 discusses recent trends on linkages between informal finance and burgeoning phenomena. Section 3 states the problem, rethinks financial development indicators and presents first generation solutions. Second generation solutions are discussed in Section 4. We conclude with Section 5. 2. The burgeoning phenomena of informal finance, KE, mobile banking and, poverty 2.1 Informal finance and Knowledge Economy (KE) Consistent with the World Bank (2007, p.73), a KE cannot be built without finance. For small entrepreneurial projects in developing countries, funding needs may be relatively 4 small (informal) and microfinance mechanisms are sufficient. Hence, the need for sectorimportance (and informal financial) measurements which appreciate microfinance mechanisms. Spreading rapidly throughout the world following the pioneering initiative of the Bangladesh Grameen Bank, microfinance hinges on the social responsibility of borrowers belonging to a narrow group to ensure repayment (Asongu, 2012). Other entrepreneurial projects require a great amount of development capital. Indeed a broad range of financial services (formal, semi-formal and informal) are necessary to support growth and entrepreneurship in knowledge-based economies in the developing world, as elsewhere (World Bank, 2007). But why is KE relevant in developing countries? It has become crystal clear that for any country, region or continent to be actively involved in the global economy it has to be competitive in KE. Europe and North America have mastered the dynamics of KE and inexorably driving development in the global and international arena. Other regions like Asia and South America are reacting in calculated steps that underscore the role of KE in the current pursuit of national, regional and international initiatives (Tchamyou, 2014). The governments of The Newly Industrialized Economies (Hong Kong, Korea, Taiwan & Singapore, Malaysia and China) led by Japan are playing a substantial role in their moving towards KE from the ‘product economy’ in the postindustrialization period (Chandra & Yokoyama, 2011). The main idea is that the process of creation and diffusion of knowledge is contingent on financial sectors that are the outcome of financial policies. Hence, it is important to identify how financial sectors promote the diffusion of knowledge. 2.2 Informal finance and mobile banking The mobile revolution has transformed the lives of many people in developing countries, providing not just communications but also basic financial access in the forms of phone-based money transfer and storage (Jonathan & Camilo, 2008; Demombynes & Thegeya, 2012). The high growth and penetration rates of mobile telephony that are 5 transforming cell phones into pocket-banks in developing countries is providing opportunities to increase affordable and cost-effective means of bringing on board a large chunk of the population that hitherto has been excluded from formal financial services for decades. Such a transformation is the focus of interest not only to banks and Micro Financial Institutions (MFIs) but also to governments, financial regulators as well as development partners who are providing support to improve the livelihoods of the poor through poverty reduction and sustained economic growth. There are four principal avenues along which the incidence of mobile phone penetration on mobile banking could be discussed. The first strand captures the usefulness of mobile financial informal transactions (store of value, conversion of cash and, transfer of stored value). In the second strand, the concepts of savings (basic or partially integrated) in mobile banking are elucidated. The third strand relates mobile banking to GSM phones whereas the fourth presents some statistics on the proliferation of mobile banking in some developing countries (Asongu, 2015ab). In the first strand, Jonathan & Camilo (2008) have emphasized, most mobile transactions3 in the developing world enable users to do three things. (a) Store and preserve value (currency) in an account accessible through a handset. When the user already has a bank account, this is generally an issue of linking to a bank account. If the user does not have an account, then the process creates a bank account for him/her or creates a pseudo bank account, held by a third party or the user’s mobile operator (Asongu, 2013). (b) Convert cash into and out of the account that stores value. When the account is linked to a bank account, then users can visit banks to cash-out and cash-in. In many cases, users can also visit the GSM 3 “In order to have a mobile money account and make a deposit, a customer must own a cell phone SIM card with the mobile operator and register for a mobile money account. The customer then makes cash deposits at the physical offices of one of the operator’s mobile money agents. These cash deposits create electronic money credit in the account. Customers can make person-to-person transfers of mobile money credit to the accounts of other mobile money users in the same network. They can also use their mobile money credit to pay bills and to buy phone airtime. Withdrawals (conversion to cash) could be made at the offices of the network’s mobile money agents. There is also a possibility for a mobile money customer to make a transfer to someone who is not registered with the same network. In this case, when notice of the transfer is received through an SMS text message, the recipient can receive the cash at a mobile money agent (Demombynes, & Thegeya, 2012)” (Asongu, 2013). 6 providers’ retail stores. In most flexible services, a user can visit a corner kiosk or grocery store (maybe the same one where he/she purchases airtime) and perform a transaction with an independent retailer working as an agent for the transaction system. (c) Transfer of stored value between accounts. Users can generally transfer funds between accounts linked to two mobile phones, by using a set of SMS (or menu commands) and PIN codes. The new services offer a way to move money from place to place and present a genuine alternative to the payments system offered by banks, pawn shops, remittance firms…etc. The growth of mbanking (payments) systems has been particularly significant in the Philippines (where three million customers use systems offered by mobile operators Smart & Globe; Neville, 2006); Kenya (where nearly two million users registered with Safaricom M-PESA system within a year of its nationwide rollout, Vaughan, 2007; Ivatury & Mas, 2008) and South Africa where 450, 000 people use Wizzit (‘the bank in your pocket’; Ivatury & Pickens, 2006) or one of two other national systems (Porteous, 2007). The second strand elucidates the concept of savings. Demombynes & Thegeya (2012) have tackled the mobile-finance nexus through this concept. They distinguish two types of mobile savings. (a) Basic mobile savings; that is purely and simply the use of a standard mobile money system such as M-PESA to store funds. These basic mobile savings are not subject to interest. Bank-integrated mobile savings approaches have received a great deal of attention as a way to provide banking services to the poor. They have the edge of offering access to basic banking services without requiring substantial proximity to a physical bank branch. Therefore, with a bank-integrated mobile savings account, basic banking services can be accessed via network of mobile phone agents, which in Kenya outnumber the weight of bank branches significantly (Mas & Radcliffe, 2011). (b) The term ‘partially integrated’ mobile savings system is also used to describe situations where bank account access through mobile phones depends on the establishment of a traditional account at a physical bank. Additionally, banks are beginning to build their own agent networks in order to assume a 7 more competitive bargaining standpoint in accessing mobile service platforms. Fully and partially integrated savings present different types of contracts between the partnering bank and mobile service provider. Consistent with Demombynes & Thegeya (2012); on the one hand, a partially integrated product clearly delineates the role of the bank (which provides and owns banking services) from that of the mobile service provider (which provides mobile telephony infrastructure and controls the agent network). Hence, the bank compensates the mobile service provider for access to the network and enjoys the remaining profits. This type of contract more closely looks like a debt contract between parties (Asongu, 2013). On the other hand, a fully integrated solution may not account for the same distinction between bank and mobile service providers. In this case, the distribution of surplus depends on the relative bargaining power of the bank and mobile service provider. This type of contract more closely looks like an equity contract between two parties. Equity-oriented contracts are more likely to be complex and therefore more difficult to negotiate than debt-like contracts, there-by presenting a potential hurdle towards the goal of increasing access (Asongu, 2015ab). In the third strand, we analyze how mobile banking is linked to GSM phones. Ondiege (2010), Chief Economist of the African Development Bank has looked at the mobile-finance nexus from four perspectives. Firstly, the mobile phone can serve as a virtual bank card where customer and institution information can be securely stored, thereby mitigating the cost of distributing cards to customers. In fact he suggests, the subscriber identity module (SIM) card inside most (if not all) GSM phones is in itself a smartcard (similar to the virtual bank card). Hence, the banks customer’s PIN and account number can be stored on this SIM card to perform the same functions as the virtual card of the bank. Secondly, the mobile phone could also serve as a point of sale (POS) terminal. Accordingly, a mobile phone could be used to transact and communicate with the appropriate financial institution to solicit transaction authorization. These are similar functions of a POS terminal at mails, retail or other stores. A mobile phone can duplicate these functionalities quite easily. Thirdly, the mobile phone can 8 also be genuinely used as an ATM. A POS is therefore used to pay for goods and services at the store. If cash and access to savings were to be acknowledged as ‘goods and services’, that customers buy and store, then the POS will also serve as a cash collection and distribution point that basically is the function of an automatic teller machine (ATM). Fourthly, the mobile phone could be used as an Internet banking terminal. This implies, it offers two fundamental customer services: a) ability to make payments and transfers remotely and; b) instant access to any account. Ultimately, the mobile phone device and wireless connectivity bring the internet terminal into the hands of otherwise unbanked customers (Asongu, 2015ab). For a clearer perspective, it is worthwhile blending the above facts (on the proliferation of mobile banking) with figures and statistics in the fourth strand. Consistent with Mbiti & Weil (2011), the story of the growth of mobile phones in Africa is one of a tectonic and unexpected change in communications technology. From virtually unconnected in the 1990s, over 60% of Africa now has mobile phone coverage and there are now more than 10 times as many mobiles as landline phones in use (Aker & Mbiti, 2010). In accordance with Aker & Mbiti (2010), mobile phone coverage in Africa has soared at staggering rates over the past decade. In 1999, only 11% of the African population had mobile phone coverage, in Northern Africa for the most part (Egypt, Algeria, Libya, Morocco and Tunisia), with also significant coverage in Sothern Africa (Kenya and South Africa). By 2008, 60% of the population (477 million) could get a telephone signal and an area of 11.2 million square kilometers had mobile phone coverage: equivalent to the United Sates and Argentina combined. By the end of 2012, it is estimated that most villages in Africa will have coverage with only a handful of countries relatively unconnected. In line with Demombynes & Thegeya (2012), Kenya has undergone a remarkable ICT revolution. Towards the end of the 1990s, less than 3% of Kenyan households owned a telephone and less than 1 in 1000 Kenyan adults had mobile phone service. However, by the end of 2011, 93% of Kenyan 9 households owned a mobile phone. This substantial soar is largely credited to the M-PESA mobile-banking network (Demombynes & Thegeya, 2012, pp. 23-25; Asongu, 2015ab). 2.3 Informal finance and poverty The role of informal finance in poverty alleviation is too obvious to be discussed owing to space constraint (Asongu, 2014a). It would be interesting however to devote space in discussing how mobile penetration mitigates poverty through a form of informal finance. Many lives have been transformed by the mobile revolution, which is providing not just communication but also basic financial access in the forms of phone-based money transfer and storage (Jonathan & Camilo, 2008; Demombynes & Thegeya, 2012; Asongu, 2015ab). At the 2007 ‘Connect Africa’ summit, Paul Kagame, president of Rwanda eloquently emphasized: “in ten short years, what was once an object of luxury and privilege, the mobile phone has become a basic necessity in Africa” (Aker & Mbiti, 2010, p. 208). An article in The Economist (2008) had earlier made this claim: “a device that was a yuppie toy not so long ago has now become a potent for economic development in the world’s poorest countries”. As far as we have reviewed, one of the most exhaustive accounts on the ‘mobile penetration’ development literature concludes: “Existing empirical evidence on the effect of mobile phone coverage and services suggest that the mobile phone can potentially serve as a tool for economic development in Africa. But this evidence while certainly encouraging remains limited. First, while economic studies have focused on the effects of mobile phones for particular countries or markets, there is little evidence showing that this has translated into macroeconomic gains…” (Aker & Mbiti, 2010, p. 224). Empirical validity for these slogans is presented in the second part of Section 4.2.3. Consistent with Asongu (2015ab), the equalizing and ‘poverty mitigating’ incidences of mobile phone penetration could be explained from several angles. Firstly, many lives have been transformed by the mobile revolution thanks to basic financial access in the form of phone-based money transfer and storage (Jonathan & Camilo, 2008; Demombynes & 10 Thegeya, 2012; Asongu, 2015a). Therefore, the significant growth and penetration rates of mobile telephony that is transforming cell phones into pocket-banks in Africa is providing countries in the continent with increase affordable and cost-effective means of bringing on board a large part of the population that have until now been excluded from formal financial services for decades. Secondly, mobile phones can assist households’ budget when confronted with unpredictable shocks which drive poverty. The probability of a poor family incurring drastic loss due to an unpredictable shock is certainly mitigated and lowered when families are able to respond to the shock in a more timely fashion. Therefore, the mobile phone could have the greatest effects on poverty reduction during vulnerable shock experiences via driving down costs associated to the shock. Better financial management and coping with shock include: incurring lower travel costs, less trauma, more efficient action and, improved access to information. Immediate positive feedbacks of income saving and cost mitigation are found particularly during vulnerable situations like death or illness within the family. It is also worthwhile to cite security increases for poor families through reduced loss of poverty. For instance, a family’s ability to scale-down the number of overnight hospital days or capacity to avoid transport cost during desperate situations are some major cost saving strategies implemented with the quick dial of the mobile phone (Asongu, 2015a). In a nutshell, the communication device provides a means of timely response, reduced surprises, multi-task and plans during shocks, as well as less time required to physically search individuals during difficult ordeals. Thirdly, mobile phones could empower women to engage in small businesses (and/or run existing businesses more efficiently), thus enabling them to bridge the gap between gender income inequality. It is also worthwhile to point-out that mobile phones represent long-term economic growth investments for the disadvantaged in income-distribution. Therefore, many households maybe willing to cope with unpleasant sacrifices (such as 11 reduction in food consumption or sanitation in the perceived short-term) in the hope that, the mobile phone would improve their opportunities with income and jobs in the long-run (Asongu, 2015b). 3. Problem statement and solutions A bias in the definition of the financial system by the IMF is core to this problem statement because it is biased toward the developed world. According to the IFS, the financial system is made-up of the formal and semi-formal sectors; that is, deposit money banks and other financial institutions (see lines 24, 25 and 45 of the IFS, 2008). Whereas this definition could be quasi-true for developed countries, it fails to take account of the informal financial sector in undeveloped countries. This begs the concern of knowing if the roles of the informal sector (in economic development) discussed in Section 2 above is not just thin air. In this section, we first provide the IFS conception of the financial system in the context of developing countries, before rethinking the premises on which the definition is based and, finally discussing first generation solutions. 3.1 The International Financial Statistics’ (2008) conception of the financial system As detailed in Table 1 below (by Asongu (2012) inspired by Steel (2006)), formal finance refers to services that are regulated by the central bank and other supervisory authorities. Semi-formal finance provides a distinction between formal and informal finance. This is the segment of finance that occurs in a formal financial environment but not formally recognized. A good example is microfinance. Informal finance is one that is not arranged through formal agreements and not enforced through the legal system. From the fourth column, the last two types of ‘saving and lending’ are very common in developing countries, particularly among the financially excluded or those on low incomes. Unfortunately, the IFS definition completely marginalizes the last types. We postulate that based on the weight of 12 available evidence, informal finance should no longer be undermined in the definition of the financial system. Table 1: Segments of the financial system by degree of formality in Paper’s context Formal financial system Semiformal and informal financial systems Paper’s context Formal Financial sector (Deposit Banks) IMF Definition of Financial System from International Financial Statistics (IFS) Semi-formal financial sector (Other Financial Institutions) Tiers Formal banks Specialized non-bank financial institutions Other nonbank financial institutions Missing component in IFS definition Informal financial sector Definitions Informal banks Licensed by central bank Legally registered but not licensed as financial institution by central bank and government Not legally registered at national level (though may be linked to a registered association) Institutions Principal Clients Commercial and development banks Rural banks, Post banks, Saving and Loan Companies, Deposit taking Micro Finance banks Large businesses, Government Credit Unions, Micro Finance NGOs Microenterprises, Entrepreneurial poor Savings collectors, Savings and credit associations, Money lenders Large rural enterprises, Salaried Workers, Small and medium enterprises Self-employed poor Source (Asongu, 2012) 3.2 Rethinking financial development indicators Consistent with Asongu (2012, 2013), financial development indicators have been universally employed without due regard to regional/country specific financial development realities (contexts). The employment of some indicators simply hinge on the presumption that they are generally valid (Gries et al., 2009)4. As far as we have reviewed, but for Beck et al. (1999) and Asongu (2012, 2013, 2014abc), the absence of studies that underline the quality of financial development indicators with regard to contextual development is a significant missing component in the financial development literature. Some studies have identified the 4 Gries et al. (2009) state: “In the related literature several proxies for financial deepening have been suggested, for example, monetary aggregates such as Money Supply (M2) on GDP. To date there is no consensus on the on the superiority of any indicator” (p. 1851). 13 issue, but fallen short of addressing it. Hence, it has been well documented that the financial depth indicator as applied to developing countries is very misleading as it does not integrate the realities and challenges of financial intermediary development (Demetriades & Hussein, 1996; Khumbhakar & Mavrotas, 2005; Ang & McKibbin, 2007; Abu-Bader & Abu-Qarn; 2008). Therefore, a motivation of this work hinges on an existing debate over the contextual quality of financial development indicators. Indeed, as we shall cover in the section on second generation solutions, recent findings have shown that traditional financial indicators based on the IFS definition of the financial system do not capture certain dimensions of KE (e.g mobile banking). 3.3 First generation solutions Consistent with Asongu (2014a), reforms of the first generation embody a stream of the literature that has raised the concern in the IFS definition but failed to substantially address it because the informal financial sector is not incorporated into the measurement of the financial system. The fundamental concern raised in this strand is that the principal measurement of financial development in the literature has been money supply (M2): an indicator that has been substantially used over the decades to proxy for liquid liabilities (World Bank, 1989; King & Levine, 1993). While M2 can proxy for liquid liabilities in advanced countries, there are a number of shortcomings in the equation of the former to the latter in developing countries. The basis for the criticism is that in nations with less developed financial systems, growth in M2 may not necessarily represent an improvement in bank deposits or liquid liabilities. We discuss proposed solutions in three main strands. First, Demetriades & Hussein (1996) have addressed the issue by deducting currency that flows outside of the banking system from M2. This new measurement of liquid liabilities reflects the situation of developing countries. While this form of adjustment has been used substantially in the literature (e.g Abu-Bader & Abu-Qarn, 2008), in the correction of the 14 problem, the authors have failed to incorporated the missing informal financial sector that has been traditionally neglected by the IFS financial system definition. Second, the concern has been tackled by another stream of authors using principal components analysis. In this process, financial depth is combined with other financial development indicators to derive a composite index (Ang & McKibbin, 2007; Gries et al., 2009; Khumbhakar & Mavrotas, 2005; Asongu, 2014a). The fundamental draw-back in this approach is that M2 is mixed with a plethora of financial development variables which in conception and definition may not be directly related to financial depth. For instance, some variables that are combined with M2 include, inter alia financial dynamics of activity (private domestic credit), efficiency (bank credit/bank deposits), size (deposit bank assess/total assets). Third, Asongu (2012, 2013, 2014abc) has proposed a solution to the problem in which neither financial concepts are mixed nor is the informal financial sector neglected. The author has documented a pragmatic method of articulating the effects of various financial sectors incorporated in M2. Given the substantial weight of the informal financial sector discussed in Section 2, we present the third strand in detail as a second generation solution. 4. Second generation solutions There are three main justifications for qualifying these solutions as ‘second generation’ (Asongu, 2014a). First, the missing element of the informal financial sector in the financial system is clearly articulated. Second, the existing indicator of financial system is decomposed into formal and semi-formal financial sectors. Third, this solution clearly incorporates contemporary financial development tendencies like KE dynamics, mobile banking and the burgeoning phenomenon of mobile phone penetration that is substantially positively (negatively) correlated with the informal (formal) sector. 15 4.1 Propositions Table 2: Summary of propositions Propositions Proposition 1 Proposition 2 Proposition 3 Proposition 4 Panel A: GDP-based financial development indicators Name(s) Formula Elucidation Formal financial development Semi-formal financial development Bank deposits/GDP Informal financial development Informal and semiformal financial development (Money Supply – Financial deposits)/GDP (Money Supply – Bank deposits)/GDP (Financial deposits – Bank deposits)/ GDP Bank deposits5 here refer to demand, time and saving deposits in deposit money banks. Financial deposits6 are demand, time and saving deposits in deposit money banks and other financial institutions. Panel B: Measures of financial sector importance Proposition 5 Proposition 6 Proposition 7 Proposition 8 Financial intermediary formalization Financial intermediary ‘semiformalization’ Financial intermediary ‘informalization’ Financial intermediary ‘semiformalization and informalization’ Bank deposits/ Money Supply (M2) From ‘informal and semi-formal’ to formal financial development (formalization)7 . (Financial deposits - Bank deposits)/ Money Supply From ‘informal and formal’ to semi-formal financial development (Semi-formalization)8. (Money Supply – Financial deposits)/ Money Supply From ‘formal and semi-formal’ to informal financial development (Informalisation)9. (Money Supply – Bank Deposits)/Money Supply Formal to ‘informal and semi-formal’ financial development: (Semi-formalization and informalization) 10 N.B: Propositions 5, 6, 7 add up to unity (one); arithmetically spelling-out the underlying assumption of sector importance. Hence, when their time series properties are considered in empirical analysis, the evolution of one sector is to the detriment of other sectors and vice-versa. Financial development can either by direct or indirect. Whereas, the former is through financial markets and the latter is via the banking sector or financial intermediary development. In this study, we are limited to the latter dimension, which according to Beck et al. (1999) can be further classified into financial development components of depth (M2), allocation efficiency11, activity12 and size13. We have already seen that among the indicators, M2 is the most widely employed in the financial development literature. 5 Lines 24 and 25 of the IFS (October 2008). Lines 24, 25 and 45 of the IFS (2008). 7 In undeveloped countries M2 is not equal to liquid liabilities (liquid liabilities equal bank deposits: bd). Whereas, in undeveloped countries bd/M2<1, in developed countries bd/M2 is almost equal to 1. This indicator measures the rate at which money in circulation is absorbed by the banking system. Financial formalization here is defined as the propensity of the formal banking system to absorb money in circulation. 8 This indicator measures the level at which the semi-formal financial sector evolves to the detriment of formal and informal sectors. 9 This proposition shows the rate at which the informal financial sector is developing at the cost of formal and semi-formal sectors. 10 The proposition appreciates the deterioration of the formal banking sector to the benefit of other sectors (informal and semi-formal). From common sense, propositions 5 and 8 should be perfectly antagonistic, meaning the former (formal financial development at the expense of other sectors) and the later (formal sector deterioration) should display a perfectly negative coefficient of correlation (See Appendix 2). Proposition 7 has a high positive correlation with Proposition 8 and therefore, only the former will be used in the empirical section. 11 Bank credit on bank deposits. 6 16 After decomposing M2 into financial sector components and extending the IFS financial system definition, propositions in Table 2 from Asongu (2012) are obtained. These proportions are founded on insufficiencies of the financial system definition presented in Table 1 and discussed in Section 3.2. Therefore, the previously missing informal financial sector has been incorporated in Asongu (2012, 2013, 2014a). The author has disentangled the existing indicator into formal and semi-formal financial sectors. Moreover, the new measurements proposed could also be used as indicators of financial sector competition. The following sections discuss recent empirical evidence based on the new financial system definition and corresponding indicators. 4.2 Recent empirical evidence 4.2.1 Knowledge economy and informal finance Based on the propositions above, Asongu (2012) has assessed how financial sector competition plays-out in the development of knowledge economy (KE). He has contributed at the same time to the macroeconomic literature on measuring financial development and responded to the growing field of KE by means of informal sector promotion, micro finance and mobile banking. The study has indeed tested the feasibility of disentangling the effects of various financial sectors on different components of KE. The variables identified under the World Bank’s four knowledge economy index (KEI) have been employed in testing three main hypotheses based on seven propositions in Table 2. Hypothesis 1: The informal financial sector (a previously missing component in the definition of the financial system) significantly affects KE. Propositions 3 & 4 have tackled this hypothesis. Hypothesis 2: Disentangling different components of the existing measurement (financial system) into formal (banking) and semi-formal (other financial institutions) sector indicators 12 13 Private domestic credit. Deposit bank assets / Central bank assets plus deposit bank assets. 17 could improve understanding of the KE-finance nexus. Propositions 1 & 2 have addressed this hypothesis. Hypothesis 3: Introducing measures of sector importance is relevant to understand financial sector competition in KE 14. Propositions 5, 6 & 7 have examined this hypothesis. Results summarized in Table 3 below have shown that: (1) the informal financial sector, a previously missing component in the definition of the financial system by the IMF significantly affects KE dimensions; (2) disentangling different components of the existing measurement of the financial system improves dynamics in the KE-finance nexus and; (3) introduction of measures of sector importance provides relevant new insights into how financial sector competition affects KE. These finding are broadly consistent with theoretical underpinnings covered in Section 2.1 Table 3: Summary of results on the KE-finance nexuses Education Educatex E UH ICT ICTex E UH Economic Incentive Creditex Tradex E UH E UH Innovation Journals FDI Inflows E UH E UH Hypothesis 1 Prop.3 Prop.4 n.a n.a + + n.a n.a n.a n.a n.a n.a + + + + n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a Hypothesis 2 Prop.1 Prop.2 n.a n.a + - n.a -° + - + + - n.a n.a - + n.a + + + n.a Hypothesis 3 Prop.5 Prop.6 Prop.7 n.a + n.a + - n.a n.a + - n.a + n.a + + + + n.a + n.a n.a + - n.a + n.a + - E: Controlling for Endogeneity. UH: Controlling for the Unobserved Heterogeneity. Prop: Proposition. n.a: not applicable due to insignificance of estimated coefficient. °: invalid instruments. Educatex is the first principal component of primary, secondary and tertiary school enrolments. ICTex: first principal component of mobile, telephone and internet subscriptions. Creditex: first principal component of Private credit and Interest rate spreads. Tradex: first principal component of Trade and Tariffs. Results are based on robust panel 2SLS to control for endogeneity and panel fixed effects to control for the unobserved heterogeneity. 4.2.2 Mobile phone penetration and informal finance In the first macroeconomic empirical assessment of the relationship between mobile phones and finance, Asongu (2013) has examined the correlations between mobile phone penetration and financial development using two conflicting definitions of the financial system in the financial development literature. As presented in Table 4 below, with the traditional IFS (2008) definition, mobile phone penetration has a negative correlation with 14 To put this in other terms, the need to evaluate how one financial sector develops at the expense of another (and vice-versa) and the incidence of these changes on various components of KE could be crucial in grasping the KE-finance nexus. 18 traditional financial intermediary dynamics of depth, activity and size (Panel A). Conversely, when a previously missing informal-financial sector component is integrated into the definition, mobile phone penetration has a positive correlation with informal financial development (Panel B). Three implications have resulted from the findings: there is a growing role of informal finance; mobile phone penetration may not be positively assessed at a macroeconomic level by traditional financial development indicators and; it is a wake-up call for scholarly research on informal financial development indicators which will guide monetary policy. These finding are broadly in accordance with theoretical underpinnings covered in Section 2.2. Table 4: Impact of mobile phone penetration on financial development Panel A Dependent variables: Traditional financial intermediary dynamics Financial Depth Financial Efficiency Financial Activity Fin. Size Economic Financial Depth Banking System Efficiency Banking System Activity Financial System Size Mobile Phone Penetration Financial System Depth - - na Financial System Efficiency na Financial System Activity - - - Panel B Dependent variables: Measures financial sector importance Proposition 1 Proposition 3 Proposition 7 Proposition 8 - na + + Mobile Phone Penetration Fin: Financial. Results are based on cross-sectional OLS with robust HAC standard errors and specified with RAMSEY RESET. n.a: not applicable due to insignificance of estimated coefficient. 4.2.3 Inequality and informal finance a) From the propositions In assessing the effects of the propositions on inequality, Asongu (2014a) has tested the following hypotheses. Hypothesis 1: The informal financial sector (a previously missing component in the definition of money supply) is good for the poor. Hypothesis 2: Disentangling different components of the existing measurement (financial system) into formal (banking sector) and semi-formal (other financial institutions) financial sector indicators contribute significantly to the finance-inequality nexus debate. 19 Hypothesis 3: Introducing measures of sector importance provides interesting dynamics of financial sector competition in the finance-inequality nexus. The main finding as summarized in Table 5 shows that, from an absolute standpoint (GDP base measures), all financial sectors are pro-poor. From specific standpoints, three interesting findings are drawn from measures of sector importance: (1) the expansion of the formal financial sector to the detriment of other financial sectors has a disequalizing incomeeffect; (2) growth of informal and semi-formal financial sectors at the expense of the formal financial sector has an income equalizing effect; (3) the positive income redistributive effect of semi-formal finance in financial sector competition is higher than the corresponding impact of informal finance. These findings broadly corroborate the postulations in Section 2.3. Table 5: Impact of propositions on income-inequality (GINI Index) Full data Proposition 1 Proposition 2 Proposition 3 Proposition 4 Proposition 5 Proposition 6 Proposition 7 na na Proposition 1 Proposition 2 Proposition 3 Proposition 4 Proposition 5 Proposition 6 Proposition 7 na na na na na na - na Full data na na na na - na Panel A: First Specification 2 Year NOI 3 Year NOI na na na na na na na na na na na na na na na na Panel B: Second Specification 2 Year NOI 3 Year NOI na na na na na na na na + + - na na - 5 Year NOI na na - + na na na - na 5 Year NOI na na - + na na - NOI: Non Overlapping Intervals. na: not applicable because of insignificant estimates. Results are based on dynamic system panel GMM. The blank spaces indicate propositions that were not taken into account in the specifications owing to issues of multicolinearity. Different control variables are used in the two specifications. b) From mobile phone penetration To provide additional insights into the effect of Propositions 3 & 4 on incomeinequality, Asongu (2015a) has examined how the sentiments and slogans discussed in Section 2.3 are reflected in the incidence of ‘mobile phone penetration’ on incomeredistribution in 52 African countries. The findings shown in Table 6 overwhelmingly suggest that mobile penetration is pro-poor, as it has an equalizing income effect. ‘Mobile phone’- 20 oriented poverty reduction channels have already been covered in Section 2.3. The study is significant because it deviates from mainstream country-specific and microeconomic surveybased approaches in the literature and provides a macroeconomic assessment of the ‘mobile phone’-inequality nexus. Table 6: Impact of mobile penetration on income-inequality (GINI Index) Dependent Variable: GINI Index Panel A: OLS with RAMSEY RESET Regressions without HAC standard errors Mobile penetration Model 1 - Model 2 - Model 4 Model 5 Model 3 - Model 2* - Model 3* - Panel B: Two-Stage Least Squares Model 6 Model 4* Model 5* Model 6* Regressions without HAC standard errors Mobile penetration - - Regressions with HAC standard errors na Model 1* - Regressions with HAC standard errors na - - na: not applicable because of insignificant estimates. 5. Conclusion and policy recommendations In this paper, we have dissected with great acuteness contemporary insufficiencies of the IFS (2008) definition of the financial system and concluded from sound theoretical underpinnings and empirical justifications that, the foundation on which it is based, while solid for developed countries, holds no ground in developing countries. Perhaps one of the deepest empirical hollows in the financial development literature has been the equation of financial depth in the perspective of money supply to liquid liabilities. This equation has put on the margin (and skewed) burgeoning phenomena of mobile banking, knowledge economy (KE), inequality…etc. We conclude that the informal financial sector, a previously missing component in the IFS conception and definition of the financial system can only be marginalized at the cost of misunderstanding recent burgeoning trends in mobile phone penetration, KE and poverty. Hence, the IFS definition has incontrovertibly fought its final dead battle and lost in the face of soaring trends highlighted above because, it is inherently antagonistic and anachronistic. Despite the plethora of econometric and policy-making sins the definition has committed in developing countries through bias estimates and misleading inferences, may its soul RIP. 21 References Abu-Bader, S., & Abu-Qarn, A. S., (2008). “Financial Development and Economic Growth: Empirical Evidence from Six MENA countries”, Review of Development Economics, 12(4), pp. 803-817. Aker, J., & Mbiti, I., (2010). “Mobile Phones and Economic Development in Africa”. Journal of Economic Perspectives, 24(3), pp. 207-232. Ang, J. B., & McKibbin, W. J., (2007). “Financial Liberalization, financial sector development and growth: Evidence from Malaysia”, Journal of Development Economics, 84, pp. 215-233. Asongu, S. A., (2012). “Financial Sector Competition and Knowledge Economy: Evidence from SSA and MENA Countries”, Journal of the Knowledge Economy http://link.springer.com/article/10.1007/s13132-012-0141-4 Asongu, S. A., (2013). “How has mobile phone penetration stimulated financial development in Africa”, Journal of African Business, 14(1), pp. 7-18. Asongu, S. A., (2014a). “New financial development indicators: with a critical contribution to inequality empirics”, International Journal of Economic Behavior, 4(1), pp. 33-50. Asongu, S. A., (2014b). “Liberalization and financial sector competition: a critical contribution to the empirics with an African assessment”, South African Journal of Economics. http://onlinelibrary.wiley.com/doi/10.1111/saje.12048/abstract Asongu, S. A., (2014c). “Knowledge economy and financial sector competition in African countries”, African Development Review, 26(2), pp. 333-346. Asongu, S. A., (2015a). “The impact of mobile phone penetration on African Inequality”, International Journal of Social Economics: Forthcoming. Asongu, S. A., (2015b). “Mobile banking and mobile phone penetration: which is more propoor in Africa?”, African Finance Journal: Forthcoming. Beck, T., Demirgüç-Kunt, A., & Levine, R., (1999). “A New Database on Financial Development and Structure”, Financial Sector Discussion Paper No. 2. Chandra, D. S., & Yokoyama, K., (2011). “The role of good governance in the knowledgebased economic growth of East Asia – A study on Japan, Newly Industrialized Economies, Malaysia and China”, Graduate School of Economics, Kyushu University. Demetriades, P. O., & Hussein, K. A., (1996). “Does Financial Development Cause Economic Growth? Time-Series Evidence from Sixteen Countries,” Journal of Development Economics, 51, pp. 387-411. Demombynes, G., & Thegeya, A., (2012, March). Kenya’s Mobile Revolution and the Promise of Mobile Savings. World Bank Policy Research Working Paper, No. 5988. 22 Gries, T., Kraft, M., & Meierrieks, D., (2009). “Linkages between financial deepening, trade openness, and economic development: causality evidence from Sub-Saharan Africa”, World Development, 37(12), pp. 1849-1860. IMF (2008, October). “International Financial Statistics Yearbook, 2008”, IMF Statistics Department. Ivatury, G., & Mas, I., (2008). The early experience with branchless banking. Washington, DC:CGAP. Ivatury, G., & Pickens, M., (2006). Mobile phone banking and low-income customers: Evidence from South Africa. Washington, DC: Consultative group to assist the poor (CGAP) and the United Nations Foundation. Jonathan, D., & Camilo, T., (2008). “Mobile banking and economic development: Linking adoption, impact and use”. Asian Journal of Communication, 18(4), pp. 318-322. Kumbhakar, S. C. & Mavrotas, G., (2005). “Financial Sector Development and Productivity Growth”. UNUWIDER Research Paper: 2005/68, World Institute for Development Economics Research at the United Nations University. King, R. G., & Levine, R., (1993). “Finance and Growth: Schumpeter Might Be Right”, Quarterly Journal of Economics, 108, pp. 717-737. Mas, I., & Radcliffe, D., (2011). Mobile Payments Go Viral: M-PESA in Kenya. Capco Institute’s Journal of Financial Transformation, No. 32, p. 169, August 2011 YES AFRICA CAN: SUCCESS STORIES FROM A DYNAMIC CONTINENT, P. Chuhan-Pole and M. Angwafo, eds., World Bank, August 2011. Mbiti, I., & Weil, D. N., (2011, June). “Mobile Banking: The Impact of M-Pesa in Kenya”. NBER Working Paper No.17129. Neville, W., (2006). “Micro-payment systems and their application to mobile networks”. Washington, D.C: infoDev/World Bank. Available at: http://www.infodev.org/en/Publication.43.html. Ondiege, P., (2010). “Mobile Banking in Africa: Taking the Bank to the People”. Africa Economic Brief, 1(8), pp. 1-16. Porteous, D., (2007). Just how transformational is m-banking? Retrieved 10 January, 2008, http://www.finmarktrust.org.za/accessfrontier/Documents/transformational_mbanking.pdf Steel, W. F., 2006. “Extending Financial Systems to the poor: What strategies for Ghana”, Paper presented at the 7th ISSER-Merchant Bank Annual Economic Lectures, University of Ghana, Legon. Tchamyou, S. V., (2014). “The Role of Knowledge Economy in African Business”, HEC-Ulg University of Liege. The Economists (2008). Halfway There: How to promote the spread of mobile phones among the world’s poorest. http://www.economist.com/node/11465558?story_id=11465558. 23 The World Bank (2007). Building Knowledge Economies. Advanced Strategies for Development. World Bank Institute Development Studies. Washington DC. Vaughan, P. (2007). Early lessons from the deployment of M-PESA, Vodafone‟s own mobile transactions service. In D. Coyle (Ed.), The transformational potential of mtransactions (pp. 6-9). London: Vodafone Group. World Bank, (1989). World Bank Development report 1989, New York, Oxford University Press. 24

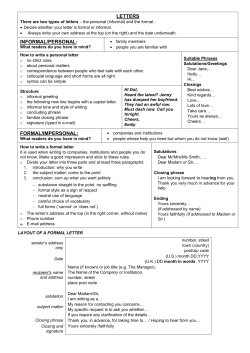

© Copyright 2026