| Commodities | DAILY TECH PICK Has

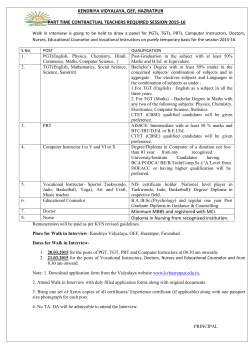

DAILY TECH PICK | Commodities | 30 Mar 15 MCX Apr Natural Gas; a sharp breakdown below the 170 levels has kept the prices again into bearish territory. Overall outlook remains weak and further decline is possible towards 163 & 160 levels. Hence, upside resistance pegged at 168.60 levels. Action Has SELL Entry Around 168.60 Target 163 Stop 171.40 MCX Apr Copper was begun the day with a selling note and there after continued the same trend. Currently, 381 levels will act as an immediate support on downside; flip below the same next level at 377 levels. However, any rise can be utilized to create fresh shorts at 387 levels. Action SELL Entry Around 387 Target 381 Stop 390.40 MCX APR CPO has intact further weakness by voilatng its rising trend-line support at 438.70 levels. This signifies that the trend remains weak and further fall can see towards 427 levels. Hence, upside resistance resides at 438 levels. Action SELL Entry Around 438 Target 430/427 R WAY2WEALTH Brokers Private Ltd., No. 14, Frontline Granduer, Walton Road, Bangalore-560001 Email: [email protected] website: www.way2wealth.com Way2wealth Research is also available on Bloomberg WTWL <GO> Stop 442 DAILY TECH PICK I EQUITIES I I Commodities I Outlook & Intraday Strategy Last R1 R2 Trade 26831 26953 27045 38395 38800 39356 384.85 387.00 390.40 839.90 846 859.00 Commodity Expiry S1 S2 Intraday Recommendation Gold Silver Copper Nickel 05'Apr 05'May 30'Apr 30'Apr 26754 38030 381.40 827 26650 37540 377.70 816 Bullish Bullish Bearish Bearish Buy at S1 TGT R1 SL 26650 Buy at S1 TGT R1 SL 37540 Sell at R1 TGT S1 SL 390.40 Sell at R1 TGT S1 SL 859 Zinc 30'Apr 130.35 129.50 130.90 132.15 133.35 Bullish Buy at S1 TGT R1 SL 129.50 Lead Aluminum Crude Oil Natural Gas Mentha Oil Cotton Chana 30'Apr 30'Apr 20'Apr 27'Apr 31'Mar 31'Mar 20'Apr 114.40 111.10 3113 163.4 807 15170 3590 113.60 109.80 3072 160.0 793.0 15040 3556 115.00 112.40 3152 166.6 819.0 15280 3615 116.35 112.85 3186 168.6 827.0 15430 3653 117.40 113.70 3233 171.40 840.00 15570 3687 Bullish Bearish Bearish Bearish Bearish Bullish Sideways 3382 3445 3476 Bullish 546.0 555.95 560.0 566.0 Bullish 3350 3306 3367 3375 3405 Bearish 1657 14287 7500 8577 3630 1633 14150 7440 8502 3597 1672 14430 7574 8631 3674 1696 14545 7623 8720 3710 1715 14673 7687 8810 3756 Bullish Bearish Bearish Bullish Sideways Buy at S1 TGT R1 SL 113.60 Sell at R1 TGT S1 SL 113.70 Sell at R1 TGT S1 SL 3233 Sell at R1 TGT S1 SL 171.40 Sell at R1 TGT S1 SL 840 Buy at S1 TGT R1 SL 15040 Wait for call Buy above 3395 TGT 3445 SL 3365 Buy at S1 TGT R1 SL 546 Sell below S1 TGT S2 SL 3375 Buy at S1 TGT R1 SL 1633 Sell at R1 TGT S1 SL 14673 Sell at R1 TGT S1 SL 7687 Buy at S1 TGT R1 SL 8502 Wait for call Soya Bean 20'Apr 3365 3331 Soya Oil 20'Apr 551.3 RM Seed 20'Apr Cocud cake Jeera Turmeric Dhaniya Castor seed 20'Apr 20'Apr 20'Apr 20'Apr 20'Apr DISCLAIMER The contents of this material are general and are neither comprehensive nor appropriate for every individual and are solely for the informational purposes of the readers. This material does not take into account the specific investment objectives, financial situation or needs of an individual/s or a Corporate/s or any entity/s. A qualified professional should be consulted before making an investment decisions or acting on any information contained in this material. All investments involve risk and past performance does not guarantee future results. Investigate before you invest. You are strongly cautioned to verify any information before using it for any personal or business purpose. Way2wealth Brokers (P) Limited (herein after called Way2Wealth) does not guarantee the accuracy, quality or completeness of any information. Much of the information is relevant only in India. Way2wealth makes no warranties, either express or implied, including, but not limited to warranties of suitability, fitness for a particular purpose, accuracy, timeliness, completeness or non-infringement. In no event shall Way2Wealth be liable for any damages of any kind, including, but not limited to, indirect, special, incidental, consequential, punitive, lost profits, or lost opportunity, whether or not Way2Wealth has advised of the possibility of such damages. This material contains statements that are forward-looking; such statements are based upon the current beliefs and expectations and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. These uncertainties include but are not limited to: the risk of adverse movements or volatility in the securities markets or in interest or foreign exchange rates or indices; adverse impact from an economic slowdown; downturn in domestic or foreign securities and trading conditions or markets; increased competition; unfavorable political and diplomatic developments; change in the governmental or regulatory policies; failure of a corporate event and such others. This is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any particular trading strategy. No part of this material may be copied or duplicated in any form by any means or redistributed without the written consent of Way2Wealth. In no event shall any reader publish, retransmit, redistribute or otherwise reproduce any information provided by Way2Wealth in any format to anyone. Way2Wealth and its affiliates, officers, directors and employees including persons involved in the preparation or issuance of this report may from time to time have interest in securities thereof, of companies mentioned herein. WAY2WEALTH Brokers Private Ltd., No. 14, Frontline Granduer, Walton Road, Bangalore-560001 Email: [email protected] website: www.way2wealth.com Way2wealth Research is also available on Bloomberg WTWL <GO>

© Copyright 2026