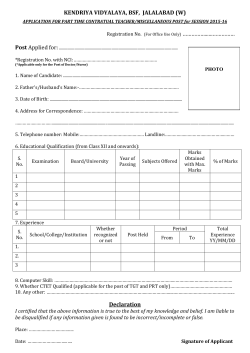

Commerce Syllabus _Final Copy_