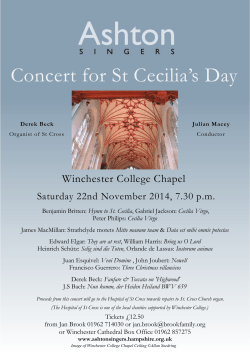

LUDWIG BECK