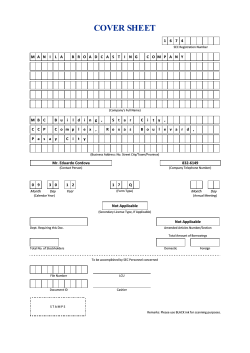

SEC Definitive Information Statement 2015