3 Choosing a Form of Business Ownership Chapter 3

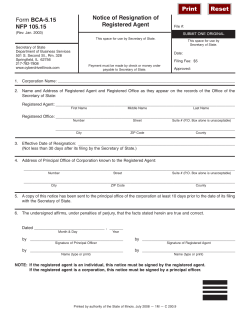

Business 101 — The Basics CH 3] 3-1 Chapter 3 Choosing a Form of Business Ownership Learning Goals 1. Describe the three basic forms of business ownership. 2. Define the advantages and disadvantages of sole proprietorships. 3. Discuss the advantages and disadvantages of partnerships. 4. Explain the differences between general partnerships and limited partnerships. 5. Discuss the advantages and disadvantages of corporations. 6. Describe how a corporation is organized and operated. 7. Define vertical, horizontal, and conglomerate mergers. 8. Explain the recent trends influencing corporate organizations. 9. Describe the differences among private ownership, public ownership, and cooperative ownership. 3 3-2 Forms of Business Ownership [CH 3 Chapter Overview Ask anyone if they want to be in business for themselves. They will most assuredly answer in the affirmative; some eagerly and some wistfully thinking of someday. They see themselves as being their own boss, successful in the community with a ready clientele trekking to their establishment to buy those necessary and not so necessary goods. Ask what does it take to start a business of your own? And you will likely hear “a small fortune,” “lot’s of Experience,” “a good location,” “a good product,” “lots of help!” So do you go it alone, or should you have partners? What about different methods of financing your adventurous business and are there legal requirements or limitations that one should know about. One thing is for certain, before you do venture into a business, get lots of sleep, for being the owner sleep you won’t get. If it is business ownership or else, then what form of business should you start with? Determining the legal form of business ownership when starting a business can be a complex and critical decision. For certain there is information one needs to know about business structures, their advantages and disadvantages. Every business, whether a John Deere Inc. or the neighborhood taco stand, must choose a form of business ownership that best meets its needs. Various factors are considered when choosing a form of business ownership. Some of the variables include ease of formation, financial liability, availability of financial resources, the ability to raise capital, taxation, technical expertise, management skills, and the interests of those involved. There are three fundamental forms of business and they are: sole proprietorship, partnerships and corporations. All other forms are variations on those three. In this chapter you will explore their advantages and disadvantages and discusses alternative forms of public and cooperative ownership. Starting a Business Every day in the United States someone is opening a new business for the first time. Restaurants, e-businesses, nonprofit organizations, farms and ranches, and shops. Someone with a dream is behind all of this activity and it does not confine itself to age, gender or ethnicity. The dream of opening and owning your own business is a common one. For a few of these individuals, that dream awakes into another tremendous success story. Starting a company is a risky proposition for anyone. There are not guarantees for success. In fact, most new businesses close their doors unceremoniously failed. Not everyone is cut out to be an entrepreneur, after all it is a learned trait. But hope upon hope always rises, for as it is, the successful entrepreneur when first starting out failed, on average, in four attempts before getting that first success—and over time they learned a lot. When starting a business, one must think about and examine the following factors: 1. Capital requirements: This is the amount of money and resources that will be needed to finance and operate your business. 2. Risk: The amount of personal property you are willing to lose when starting a business. 3. Control: The amount of authority as an owner you want to exercise. 4. Managerial abilities: What skills are needed to plan, organize and control the business. 5. Time requirements: The time needed to operate the business and supervise the employees. 6. Tax Liability: What are the tax obligations associated with running a Business 101 — The Basics CH 3] 3-3 Illustration 3.1 Chris Weber, owner of Plant Interiors by Weber in Dayton, Ohio, is one of many self-employed people who operate businesses from their homes as sole proprietorships. Weber maintains many of the plants he sells and leases to local businesses at a greenhouse in his home. business; which government agencies will be interfering with your business. Each of these points need to be considered along with your own personal values, your work ethic, your integrity and desire to succeed. Many entrepreneurs prefer to work for someone else while they learn the ropes of a particular business or industry. They use this as a training ground. Others will jump right in and learn as they go. All entrepreneurs will face the issue of the type of legal form to use for the structural basis for their company. In essence, aspiring business owners have three business forms to choose from: (1) Sole Proprietorship, (2) Partnership, and (3) Corporation Sole Proprietorships When you think of going into business for yourself, you are thing of a business ownership form know as a sole proprietorship; this is an organization owned and usually operated by a single individual. It is the simplest form of ownership and easiest to enter. Legally speaking, there is exists no distinction between the sole proprietor as an individual and as the business owner. A business's assets, its earnings, and debts are the owners and though one may account for business income and personal income, legally they come under the owners umbrella of ownership.. Although sole proprietorships are used in a variety of industries, they are concentrated primarily among small businesses such as mechanics shops, retail outlets, service organizations like restaurants, and farms and ranches. Advantages of Sole Proprietorships. Sole proprietorships offer advantages many business owners like, such as retention of all profits, they are easy to form and dissolve, low start-up costs, relatively free from regulations (as compared to corporations and partnerships), the owner is in direct control of the business, and there are tax advantages to the small business owner. In fact our tax laws are sole proprietorship Ownership (and usually operation) of an organization by one person. 3 3-4 Forms of Business Ownership [CH 3 meant to advantage the individual who is in business for themselves. Legal requirements. There are a minimum of legal requirements and hurdles when opening a sole proprietorship. Generally, the only legal requirements for starting a sole proprietorship are filing a fictitious name statement at the county courthouse and acquiring the necessary operating licenses when required. The fictitious name statement is used to protect dual use of the same name and many communities have licensing requirements for restaurants, motels, retail stores and repair shops. One therefore needs to review local statutes and agencies on their regulations. Many neophyte entrepreneurs mistakenly believe that they need permission to go into business, which is not the case. Pride of ownership is a driving force to entrepreneurship as well as the aspect of direct control. Owners get to make the decisions, and they can make those decisions without consulting others. Prompt action can be taken when it is needed and preserve their “trade secretes.” All of these contribute to the personal satisfaction of “being the boss.” A fallacy of ownership is that the owner doesn’t have to work for someone else or have a boss. The fact is we all work for someone else and we do have a boss, and they are the customer. Disadvantages of Sole Proprietorships. Some disadvantages of the sole proprietorship include: financial limitations restricted to the personal capital resources of the owner, management restrictions and technical expertise limitations, unlimited liability (relief can be garnered through bankruptcy), and a lack of continuity. Financial limitations to personal capitalization. Sole proprietorship capital resources are general limited to the ability of the owner to raise money. The capital resources are generally limited to the owner's personal funds and the money that can be borrowed. Financial institutions are reluctant to loan money to start-up business because of the lack of business history, market share, and ownership equity that start-ups general pose. Financing limitations can retard expansion of the sole proprietor's business, the owner must learn to “grow a business.” Management restrictions and technical expertise limitations. Sole proprietors get to wear many different hats in their business; they get to be the general manager, the personnel manager, financial manager, the buyer, the sales trainer, the sales representative, the janitor, the manufacturing engineer, and the production supervisor. Businesses often fail because the owner lacks the technical expertise to make their business successful. To illustrate, a sole proprietor wants to open a printing shop because they see a need for one in their community, but they now nothing about printing presses —their care and technical operation— this is a lack of technical expertise, but it can be overcome. As the business grows, the wide range of responsibilities become too large in volume and the owner may be unable to perform all duties with equal effectiveness. Unlimited liability. Because there is no legal distinction between the business owner and their business in a sole proprietorship, the owner is personally liable for all business debts. If the debts of the business cannot be satisfied by the assets of the business, then the owners personal assets, those not associated with the business, may be required to satisfy the debts of the business. In a debt liquidation proceeding, the sole proprietor may be required to sell household furniture, real property (their family home), and personal automobile in order to satisfy business debts. Business failure for a sole proprietor can mean financial ruin that takes years to recover. Lack of Continuity. Sole proprietorships terminate upon the death of the owner. Even if they would like to pass the business on to their children, CH 3] Business 101 — The Basics 3-5 Inheritance taxes of a prohibitive and require the children to sell the family business just to meet the tax obligations. A change in personal interests and retirement can also terminate a sole proprietorship. Partnerships Partnerships are another form of private business ownership. A partnership is another form of private business ownership. A partnership is defined in The Uniform Partnership Act as an association of two or more persons who operate a business as co-owners by voluntary legal agreement (contract). Partnerships are used by individuals who are not related and want to go into business together. Commonly one hears about professional organizations such as law firms, and accounting firms as being partnerships. However, as a professional organization grows, they will want to limit their liabilities and therefore incorporate and take on the designations of P.C. (professional corporation), S.C. (service corporation), and P.S. (public service). A general partnership is a business structure where all of the partners act as co-owners, sharing liability equally and unequally for the business's debts—that is each partner shares unlimited liability, as described for sole proprietors. Another form of partnership is the limited partnership. A limited partnership requires at least one general partner, more general partners may exists, and one or more limited partners. A limited partnership grants limited partners limited liability, and general partners unlimited liability. The liability risk for a limited partner is the extent of their financial contribution to the partnership provided that they have no active management role in the business, whereas the general partner may be required to sell off their personal assets to cover the debts of the business. The sale of limited partnership shares is a common way of financing businesses today. Master Limited Partnership. Master limited partnerships were devised as an investment that would combine the tax benefits of a limited partnership with the liquidity of publicly traded securities. Firms set up as master limited partnerships function like corporations in that they publicly trade stock on the major exchanges; yet, in some master limited partnerships, the earnings are taxed only once, to the partners. This form of ownership, begun in 1981, initiated with the oil and real estate industry booms. The Tax Reform Act of 1986, which increased the corporate tax burden, began to set limits on MLP’s. However, these partnerships spread to other industries and are used by both large and small firms. The Disney Corporation used MLP’s to finance a number of films under Screen Partners. A joint venture, another type of partnership, involves two or more parties forming a temporary business for a specific undertaking—for example, a group of investors who import a shipment of high-tech equipment from China with the purpose of selling the it to resellers in the United States. Joint ventures are often used in real estate investments. This type of partnership is often used in international business ventures. Advantages of Partnerships. Partnerships are easy to form, offer broader management skills, expanded financial resources and tax advantages. It is relatively easy to establish a partnership. As with sole proprietorships, the legal requirements usually involve filing a fictitious business name statement and acquiring any and all necessary municipal licenses. Limited partnerships must also comply with state legislation based on the Uniform Limited Partnership Act, which define the requirements for this type of business organization. Partnership agreement. A partnership may be formed on a handshake or be based on a childhood friendship. However, it is best to establish written articles of partnership specifying the details of the partners' agreement. This clarifies the relationship within the firm and protects the original agreement upon which the partnership Two or more persons operating a business as coowners. general partnership Partnership in which all partners are liable for the businesses debts. limited partnership Partnership composed of one or more general partners and one or more partners with limited liability. master limited partnership A limited partnership that is publicly traded and functions like a corporation. joint venture Partnership formed for a specific undertaking. 3 3-6 Forms of Business Ownership [CH 3 partnership is based. Even though partnerships are formed, and survive, on the basis of mutual trust, it is best to have a written agreement. Broader management base. A common reason for setting up a partnership is to take advantage complementary managerial skills. People involved in sole proprietorships all have their strengths and weaknesses. By reorganizing the firms in a partnership each is in a position to take advantage of the others strength. For example, a general partnership might be formed by an accountant, an architect, and a real estate broker who plan to develop real estate and sell homes. If additional managerial and supervisory talent is needed, it may be easier to attract people as partners than as employees. Expanded financial resources. Partnerships offer an expanded financial base through the money invested by each of the partners. This is an expanded source of risk capital and because each is contributing to a larger pool of money, they also usually have greater access to borrowed funds than do sole proprietorships. Because each general partner is subject to unlimited financial liability, financial institutions are often more willing to advance loans to partnerships. Disadvantages of Partnerships. As with other forms of business ownership, partnerships have their disadvantages, including being able to find suitable partners, unlimited financial liability for general partners, lack of continuity, and divided authority. Each general partner is responsible for the debts of the firm, and each individual is legally liable for the actions of the other general partner(s). Suitable partners. Finding suitable partners for a business is not the same as finding someone to play ball with. The hours are different, the commitment is different and each individuals strengths are different. Personnel and personality conflicts occur, even in partnerships. All partnerships, from law firms to rock-androll bands, face the problem of personal and business disagreements among its participants on a wide range of areas that include: who does what, where responsibilities begin and end and what products should be sell. In some cases, if these conflicts cannot be resolved, it is sometimes best to dissolve the partnership. Unlimited liability. As with sole proprietorships, general partners have unlimited liability and may be required to pay the balance of debt owed by a partnership when the assets of the partnership business are not sufficient to those debts. This liability is shared equally and unequally, that is if even one partner contributed less than any other partner, that partner may be liable for repayment that exceeds their apportioned financial contribution to the partnership. Even if there is only one partner that has any personal wealth, that partner may be required to pay the entirety of the partnership debt. In a limited partnership, limited partners are protected from this pass-through debt liability. As long as a limited partner plays no active management role in the business activities, the limited partners risk is only the amount of capital that they invested into the partnership. Thus a limited partner enjoys limited liability. Continuity. Partnerships suffer the same issues regarding Continuity as a sole proprietorship. If one general partner dies, the general partnership is dissolved. For its business activities to continue, a new partnership needs to be formed. For practical purposes, on the death of a partner, the business doors close and re-open as quickly as you have read this sentence. The reason is that no one wants a profitable business to permanently close, just think of the lost tax revenue. But the symbolic closing is to establish a basis for the “death taxes” to be paid and the deceased partners estate must have a final settlement from the partnership. Divided authority. Like finding suitable partners, establishing and maintaining divided authority in a partnership requires is a stumbling block. One must be able to delegate responsibility with high expectations and then step aside to allow business to take its course. There are some managers (partners) who are not able to relinquish control and allow others to see the job through. CH 3] Business 101 — The Basics 3-7 When employees suspect that one partner cannot delegate, they will act like children and begin a process of divide and conquer. Partners must establish clear lines of responsibility with equally clear lines of communication. Corporations A corporation is a legal person (not a real person). A corporation functions with a business intent and has owners, but the assets and liabilities of the corporation are separate from those of its owner(s). A corporation is formed by filing Articles of Incorporation with Secretary of State—the most common state is Delaware, but Nevada is actively seeking businesses to incorporate in it. Evidence of ownership in a corporation is represented by shares of stock one holds and their ownership is transferable without changing the nature of the business. Shares are usually be bought and sold readily on the open market. A stock certificate is shown in Illustration 3.2. Not all corporations are large-scale enterprises like General Mills, most of them are small. In fact, almost 80 percent of all active corporations in the United States have under $500,000 in business receipts. The corporate form is becoming increasingly popular among smaller firms because of the advantages that incorporation affords owners. Advantages of Corporations. Corporate ownership offers considerable advantages, including limited financial liability, specialized management, transferable ownership, easier capital formation, continuous existence. Limited liability. Because corporations are considered legal persons, they are separate from the stockholders (owners) and offer the owners limited financial liability. That is, the owner (a shareholder) has a financial liability exposure to the extent of their invest in the company or the value of the shares that they hold. If a corporation enters into a default then the share holders personal assets cannot be touched by the creditors of a corporation. The limited liability of corporate ownership is clearly designated in the names used by firms throughout the world. U.S. corporations will regularly use designation "Incorporated" or "Inc." Corporate Illustration 3.2 Example of a Stock Certificate Source: Courtesy of Walt Disney Productions. corporation A legal entity with authority to act and have liability separate and apart from its owners. Articles of incorporation are the stipulations under which a business incorporates. It establishes nature of business, stock, and officers. 3 3-8 Forms of Business Ownership [CH 3 enterprises in Canada and the Great Britain use "Limited" or "Ltd." In Australia, limited liability is shown by "Proprietary Limited" or "Pty. Ltd." This limited liability is the most significant advantage of corporate ownership over other forms of ownership. Specialized management. Corporations, because of their financial resources, can offer longer-term career opportunities for qualified people with specialized managerial skills. In contrast to sole proprietorships and partnerships, this advantage of shared workload allows a company to advance an grow to meet the needs of its market. Easier capital formation. Sole proprietorships and partnerships are limited to the financial resources of the owners. The corporate structure allows an expanded financial capability that assists a corporation as it grows and becomes more efficient. Because corporate ownership is divided into many small units (shares), it is usually easier for a firm to attract capital. People with large or relatively small resources can invest their savings in a corporation by buying its shares of stock. Corporate size and stability may make it easier for corporations to borrow additional funds. Continuous existence. Because the corporation is a legal person, it is said to have a continuous existence which address the issue of continuity that faces sole proprietorships and partnerships. In both of those business forms, because there is no legal distinction between the business an the owner, when an owner dies, the business is, in the eyes of the state, also dead. By comparison, a corporations ownership is represented by the shares of stock, and those owners are distinct from the business. When a share holder dies, it is merely their portion of the corporation that is subject to inheritance taxation and the corporation keeps on keeping on. dividends Payments to stockholders from a corporation's earnings. S corporation Corporations that are taxed as a partnership while maintaining the advantages of a corporation. Disadvantages of Corporations. The disadvantages associated with the corporate form of ownership are inherent in the characteristic of corporations. The cumbersomeness of corporations are related to the legal regulations that are associated with it. The disadvantages include: Legal regulations: Because of their structure corporations are subject to more stringent legal requirements in both under state regulations and federal regulations that sole proprietorships and partnerships do not face. They are restricted to the stipulations of their forming charter which defines the activity they may engage in; and their charter is filed with the Secretary of State in the state in which they were formed. Corporations must also file annually various reports about their operations which are placed with the Security Exchange Commission. (SEC). Taxes: Because corporations are a legal person their income is subject to both federal and state income taxes, the same as an individual. The balance after the these taxes are paid may be paid out to the shareholders where they will pay an additional tax (double taxation) on the revenue derived from the dividends that they received. In contrast, the earnings of a sole proprietorship and partnership are taxed only once as the owner receives those earnings. In some states corporations are provided some tax relief when they meet specific size and stock ownership requirements by recognizing them as S corporations (formerly called Subchapter S corporations). These corporations can elect to be taxed for federal purposes as partnerships while maintaining the advantages of corporations. The Subchapter S Revision, Act of 1982 established the maximum number of corporate shareholders at 35. The act also required that one shareholder must hold at least 50 percent of the stock to be a Subchapter S Corporation. Formation costs: It is generally much more expensive to establish a corporation as compared to the sole proprietorship and partnership. These costs Business 101 — The Basics CH 3] 3-9 Illustration 3.3 The 8 Largest U.S. Corporations by sales in 2004 Ranking 1 2 3 4 5 6 7 8 Company Wal-Mart Stores Exxon General Motors Ford Motor General Electric ChevronTexaco ConocoPhillips Citigroup Location Bentonville, Ark Irving, Texas Detroit, Mich Dearborn, Mich. Fairfiled, Conn. Chicago, Il Oklahoma City, OK New York, N.Y. Sales ($ millions) 280,360.0 270,764.0 193,452.0 170,839.0 151,300.0 142,897.0 118,719.0 108,276.0 3 Source: Business Week, Feb 28, 2005, pg 89 are related to drafting the articles of incorporation and the various filing regulations the need to be met. Starting a Corporation You have investigated the different forms of business organization, and because of the nature of your business activity you decide that the corporate form best suits your needs. What do you do to set up a corporation? Although one can incorporate without a business without the help of a competent corporate attorney, however, it is probably best to use an attorneys services. Do see them a good attorney first as you start through the incorporation process. Next on the list is to select a state in which to incorporate. Because regulations, incorporation costs, state fees, taxes, and ownership rights vary among the 50 states this is an important decision. For example, if you intend to operate primarily within California you should probably incorporate in that state. However, if your business will be in Decalb County, Georgia then it is probably best to incorporate in Georgia. Besides the convenience of incorporating in your home state, businesses competing for state-awarded contracts receive preferential contracts from local government agencies. Classifying Corporations Corporations are classified as domestic, foreign, or alien, and this classification is based upon where there are doing business in relation to the state in which they are incorporated (domiciled). A corporation is considered a domestic corporation in the state in which it is incorporated. If it expects to do business in states other than the state of incorporation, then it will register as a foreign corporation in those other states. When a business is incorporated in one country but is operating in another, then the company is an alien corporation in the nation that it is doing business. Sears and Roebuck, the well known retailer and catalog marketer, operates as a domestic, foreign, and alien corporation. In today’s global market, access to the internet allows customers to do business on the World Wide Web. Sears is incorporated in Delaware (domestic corporation), with its headquarters in Chicago, where it operates and has stores in the other 49 states and territories (foreign corporation). The firm also operates in Canada where it is an alien corporation Incorporating the Business In most states the state agency and office that administers corporate oversight is usually the Secretary of State. Corporate charters, or Articles of incorporation are the forms that must be filed with the appropriate state agency. Corporate charters usually include similar information: the corporate name, domestic corporation Firm doing business in the state in which it is incorporated. foreign corporation Firm doing business in a state other than the one in which it is incorporated. alien corporation Firm organized in one country but operating in another. Forms of Business Ownership 3-10 [CH 3 Illustration 3.4 How a Corporation Works The Stockholders The Board of Directors The Chief Executive Officer Top Management Middle Management Supervisory (First-Line) Management elect who assume responsibility for overall corporate policy and strategy; and hires who is responsible for overall operation of the organization and oversees who handles major corporate decisions and delegates other decisions who handles most operating decisions and delegates actual supervision of operative employees who actually directs the activities of other employees address, corporate purpose, number, class, and par value of authorized capital stock, registered office and agent, name of the incorporator and address, and board of director information. Stockholders stockholders People who acquire the shares of, and therefore own, a corporation. close corporation Corporation owned by relatively few stockholders who control and manage its activities. preferred stock Stock that has the first claim to the corporation's assets after all debts have been paid. common stock Stock whose owners have only a residual claim to the firm's assets but who have voting rights in the corporation. proxy Authorization by stockholders for someone else to vote their shares. . Stockholders are the owners of a corporation. Each share that they hold represents that portion of ownership in the corporation. A family farm that is incorporated will have relatively few stockholders—and is probably structured as an S corporation. Since some corporations owned by few individuals and are not publicly traded are known as a close corporation— the stockholders also control and manage the corporation's activities. In a larger corporation, such as Disney, the ownership is diversified and publicly traded. Because of the enormity of stockholders in General Motors, exceeding 1 million, individual owners exert little control or influence on this company. And if they decide to sell their shares there is a ready market for it in the stock market. Annual stockholders’ meetings are held during which management presents reports on the corporations activity, questions may be asked by stockholders and the board of directors are elected at. If there any issues that the stockholders need to vote on, they are generally occur at the annual meeting. A corporations stock is generally classified as common or preferred. Common and preferred stock define the pay order and represent rights to the companies assets if, say, the company goes broke. Preferred stock owners hold first claim to the corporation's assets after all indebtedness is paid off, and they usually do not have voting rights at the stockholders' meetings. Common stock owners hold what is termed a residual claim to the companies assets. That is after the debts are paid off, and the preferred stock holders are paid, then the balance of the assets are paid to the common stockholders. Because the common stockholders actually have the greatest risk, they have voting rights in the company, such as to elect the board of directors.When a vote is taken, each share of common stock is worth one vote. For example, a person with 350 shares has 350 votes. When stockholders cannot attend the annual meetings, quite often they will authorize someone else to vote their shares on their behalf. This is called a proxy authorization to vote the shares to someone who will attend. One will easily recognize that comparing the voting power of a stock holder who has 350,000 shares possesses more voting clout than share holder with 350 shares. Therefore, small stockholders generally have little influence on corporate management. Business 101 — The Basics CH 3] 3-11 Illustration 3.5 Advantages and Disadvantages of Each Form of Private Ownership Form of Ownership Advantages Disadvantages Sole Proprietorship 1. Low Start-up costs 2. Owner in direct Control 3. Tax Advantages 4. Retention of all profits 5. Freedom from regulations 1. Unlimited financial liability 2. Financing limitations 3. Management deficiencies 4. Lack of continuity Partnership 1. Ease of formation 2. Broader Management Base 3. Additional sources of Risk Capital 4. Tax Advantages 5. Low Start-up Costs 6. Limited outside regulations 1. Unlimited liability 2. Suitable Partners 3. Lack of continuity 4. Divided Authority Corporation 1. Limited financial liability 2. Legal person 3. Specialized management 4. Continuous Existence 5. Easier to raise capital 6. Ownership transferable 1. Difficult and costly ownership form to establish and dissolve 2. Tax disadvantage 3. Closely regulated 4. Charter restrictions 5. Management more complex 3 Board of Directors The board of directors are the governing authority for the corporation and they are elected by the stockholders. In turn then the board of directors selects its own officers, the chairman, vice-chairman, and a secretary. Generally three directors are required as officers of a corporation in most states and a least one annual meeting of the board. However, most corporate board’s of directors meet quarterly. It is the board of directors that authorize major transactions involving the corporation and establish overall corporate policy. Upon recommendations from their selected management team, the board makes decisions about the company’s stock, dividends, financing arrangements and major changes in corporate holdings, such as buying land or another company. For the management team, its is the board of directors responsibility hire the corporations chief executive office (CEO), who will then seek out a competent chief financial officer (CFO), and chief operations officer (COO). Then the management team will select the subordinate managers for other important management positions. After the management team is selected, then the board of directors takes on a role of a review panel for management decisions. However, in your small corporations (S corporation) the board of directors often will play an active roll in the management of their company affairs. Management Management is a process of gathering the best qualified people with expertise and skills that make a business profitable. The chief executive officer need not be the best in all fields of the business, but he needs to be able to attract those kinds of people that will complement the business, because they are responsible for the actual operation of the corporation, subject to board approval. Then it becomes a matter of establishing a corporate direction and delegating the authority to carry it out. The corporate organization and its operation, as charted in Illustration 3.4, illustrates the types of decisions and activities at each level in the organization. Mergers and Acquisitions Over the past century, merger and acquisition (M&A) activity have surged occurred at various times. In 2001, more than 8,000 M&A deals were transacted in board of directors Governing body of a corporation are elected by the stockholders. 3-12 Forms of Business Ownership [CH 3 Illustration 3.6 These are some of the stockholders attending the annual meeting of H. J. Heinz Company. During the meeting, stockholders elected 15 members to the board of directors, elected Coopers & Lybrand as auditors for Heinz, and approved company stock option plan. Photo source: Courtesy of H.J. Heinz Company. merger Combining tow or more businesses into a single entity. acquisition The process in which one firm buys the assets and assumes the obligations of another company. vertical merger Merger that occurs between firms at different levels in the production and marketing process. the United States with a net value exceeding $800 billion. A merger is when two or more corporations join together to become a single corporation. For example, Tenneco's JI Case division merged with the agricultural division of International Harvester to form Case IH. The new company is the second largest agricultural and farm equipment manufacturer in the United States, and is an international company with operations in Argentina, Australia, Africa, Asia, and Brazil. They formed another division, Case Construction, an international leader of construction equipment. Case is supported by more than 12,000 dealers in more than 160 countries. An acquisition is when one company purchases outright the property and assets of another company, and takes on the debt obligations of that company. When Chrysler Corporation acquired American Motors, the most prominent asset was the JEEP line of automobiles. In recent years, the purchase of U.S. firms by foreign buyers has escalated such as with British Petroleum's (BP) $7.6 billion purchase of Standard Oil Company, and British Petroleum acquisition of American Oil Company (Amoco). CSX Corporation agreed to purchased Conrail Inc. for $8.4 billion in cash and stock, creating a freight company that will service rail delivery in the eastern United States. The federal government is concerned with M&As if there is a reduction in competition. Mergers that reduce market competition can result in government action under the Celler-Kefauver Act and review by the Federal Justice Department and the Federal Trade Commission (FTC) Types of Mergers When discussing mergers, one must recognize that there are three types of corporate mergers: vertical, horizontal, and conglomerate. A vertical merger CH 3] Business 101 — The Basics occurs between firms that are on different levels in the production-marketing process. You should recall the discussion on levels of productivity; there is primary production (farms, forestry, fisheries, and minerals), secondary level of production (manufacturing and processing), and tertiary levels of productivity (retail sales). For example: PepsiCo, a secondary level of production, acquired Kentucky Fried Chicken and Taco Bell a tertiary retail outlet. This acquisition assured PepsiCo a retail outlet for its soft-drink processor Pepsi Cola and a stronger competitive foothold against its number one rival Coca-Cola. A horizontal merger occurs between firms in the same industry such as Chrysler acquiring American Motors. This kind of merger will have an objective for a company of diversify its product line to offer a more complete and complimentary product line such as PepsiCo (soft drinks) owning Frito-lay (snack chip processor). A conglomerate merger is a merging formation of unrelated firms. An example is JC Penney’s acquisition of Eckerd Drug stores and Stonebridge Life Insurance Company. The dominant purposes of most conglomerate mergers are diversification, sales growth, and attempts to wisely invest cash surpluses, which might make a company a tempting target for a takeover effort. Although conglomerate mergers have cycles in the business world. Some firms that formed conglomerate mergers did not have the management skills needed to operate firms in unrelated industries. An example is Mobil Corporation's attempt to diversify beyond its oil operations by buying retailer Montgomery Ward & Company in 1976. Mobile Oil found that the retailing firm was not a good mix for its overall structure and management and eventually sold it off. Montgomery Ward eventually declared Chapter 11 bankruptcy to restructure itself for better competition. It was eventually acquired by General Electric Capital Services but again filed Chapter 11 bankruptcy shuttering 250 stores in 30 states. Montgomery Ward was a 128 year-old company, the first to develop mail-order catalogues. The Chicago-based chain, credited for creating the Rudolph the RedNosed Reindeer character and coining the "satisfaction guaranteed or your money back" marketing slogan fell victim to an increasingly competitive retail environment, a fast-paced world where aggressive discounters force stores to change marketing structure or become a footnote to history. 3-13 horizontal merger Merger between firms in the same industry. conglomerate merger Merger of unrelated firms. Friendly and Unfriendly Takeovers Most mergers can be classified as friendly in that both parties agree to the revised organization. However, in some instances the merger offer is unsolicited and unwanted: the so-called unfriendly merger. Comcast Corporations move to take over the Walt Disney company is an example. Unfriendly takeovers typically begin with the tender offer, in which the buying party (usually called the "raider") offers to purchase all or part of a companies stock at a premium over its current price. However, if there is an internal management fight, then the “raider” will wait for the feuding parties to drive the value of the stock down. And the management of the targeted company may counter with defensive actions ranging from pleas to stockholders not to sell to the filing of legal challenges. A strategy used by corporations to discourage a hostile takeover by another is referred to as taking a poison pill. There are two types of poison pills: 1. A "flip-in" allows existing shareholders (except the acquirer) to buy more shares at a discount. 2. The "flip-over" allows stockholders to buy the acquirer's shares at a discounted price after the merger. By purchasing more shares cheaply (flip-in), investors get instant profits and, more importantly, they dilute the shares held by the competitors. As a result, the competitor's takeover attempt is made more difficult and expensive. An example of tender offer When someone offers to buy all or a portion of a firm's stock at a premium over its current price. poison pill A takeover deterrent whereby stockholders are allowed to buy additional shares below market value. 3 3-14 Forms of Business Ownership [CH 3 Illustration 3.7 CSX Corporation purchase of Conrail Inc. for $8.4 billion in cash and stock will create a freight company that will dominate rail delivery in the eastern United States. shark repellent A provision that requires that a large majority of stockholders approve any takeover. white knight A friendly takeover whereby the acquired firm remains independent and keeps its existing management. golden parachute An executive severance package available to those who lose their jobs through acquisition or merger. proxy fight A situation where both management and an outside party seek control of a firm through solicitation of proxies. a flip-over is when shareholders have the right to purchase stock of the acquirer on a 2-for-1 basis in any subsequent merger. Another strategy used is shark repellent, which is any corporate activity undertaken to discourage a hostile take over such as “scorched earth policy.” The “scorched earth policy” involves liquidating valuable assets and assuming liabilities in an effort to make the proposed takeover unattractive to the acquiring company. Another strategy is to look for a friendly merger with another firm (the white knight) that will retain current management and allow the acquired firm to operate as an independent unit. If a top executive would loose their job in takeover, then they may seek to protect their interests with an elaborate severance package that would otherwise not be available. Such a severance package is called a golden parachute. Terrence Elkes, chief executive officer of Viacom, received an estimated $25 million golden parachute after Sumner Redstone acquired his firm. When there is a dispute among corporate board members, one member may try to oust another by outvoting him. They will attempt to acquire the votes by soliciting proxies from the other shareholders of the corporation These rival efforts are known as a proxy fight. Arguments abound on both sides of unfriendly corporate takeovers. Management often argues that corporate raiders are more concerned with short-term profit in stock gains that will certainly ruin the company as opposed to creating jobs. On the other hand the raider may argue that the current management is more concerned with protecting their own jobs rather than benefiting the stockholders with higher profits. Steve Forbes of Forbes, Inc. sees some investors looking at corporations that they hold stock in as being poorly run. He recommends that a significant shareholder could come and threaten to take a company over and through the management team out; believe that management will then operate the company more efficiently and profitably. 1 CH 3] Business 101 — The Basics 3-15 Illustration 3.8 BreakMate is a compact fountain dispensing systems manufactured by Siemens, a German appliance manufacturer. Coca-Cola acquired the worldwide marketing and distribution rights for BreakMate to give it another advantage in the distribution of soft drink syrups. Photo source: Courtesy of Coca-Cola USA. “Coca-Cola” and “Coke” are trademarks of the Coca-Cola Company. Merger Alternatives Contradictory trends are also evident in today's corporate environment. Some of the most significant are divestiture, taking a firm private, leveraged buyouts, and employee ownership. Many of these trends are related. Divestiture is the selling off of a corporation's divisions or units. Mobil Oil in selling off Montgomery Ward, embarked on a divestiture program in an effort to refocus the firm's resources on its core business oil processing and retailing. Corporations divest for a variety of reasons: to raise cash, to remove units that are not closely matched to the firm's other businesses, and to cut operating losses. Sometimes these units are converted into private firms, purchased via a leveraged buyout arrangement, or acquired by their employees. Sometimes management or a group of major stockholders will offer to buy all of a company’s stock, thus making it a privately held company. The stock will no longer be publicly traded. This scenario is known as "taking a firm private." Seven Up Company, for example, went private in 1986 when John Albers, the soft-drink manufacturer's chief executive officer, and an investor group purchased the company from Philip Morris. Seven Up later merged with Dr. Pepper, which is owned by Cadbury Schweppes plc of London. Now Dr. Pepper/7UP, licenses its products to various bottlers around the country, some of which are affiliated with the Pepsi Cola Company. The leveraged buyout (LBO), a strategy involving the acquisition of another company using borrowed money (bonds or loans). The acquiring company uses its own assets as collateral for the loan in hopes that the future cash flows will cover the loan payments. The company’s assets are typically used as collateral for the loan, whereby a ratio of 90% debt to 10% equity are used to close the purchase. Because of this high debt/equity ratio, the bonds are usually not investment grade and are referred to as junk bonds. Employee Ownership. Employees sometimes buy a plant or division from a company in order to preserve their jobs. A leveraged buyout is common in these situations. The corporate organization format is retained, but now the stockholders are also employees. United Airlines and Delta Airlines are employee owned. divestiture The selling off of a corporation’s divisions or units leveraged buyout (LBO) The use of borrowed money to purchase a company or division 3 3-16 Forms of Business Ownership [CH 3 Subsidiary Corporations subsidiary Corporation with all or a majority of its stock owned by another corporation. parent company Corporation that owns all or a majority of another corporation’s stock (called a subsidiary). When all or a majority of a corporation's stock is owned by another corporation, it is a subsidiary of that corporation. The owner is usually called the parent company. Typically, management of the subsidiary is appointed by the chief executive of the parent company, subject to the approval of the parent's board. Many well-known corporations are actually subsidiaries of other corporations. Weight Watchers International, Star-Kist Foods, and Ore-Ida Foods are subsidiaries of H. J. Heinz Company. The Lender's Bagels was a division of Kraft Foods Inc. and is now a division of Kellogg Co. the baker of Eggo frozen waffles and purveyor of Frosted Flakes and Rice Krispies cereals. Public and Cooperative Ownership The majority of businesses are privately owned by individuals or small groups, some are owned by municipalities and state governments, and some are owned cooperatively by a number of people. Public Ownership public ownership An enterprise owned and operated by a governmental unit. There are services that have been deemed important to a community and competition would be a detractor to the community. As an alternative to private ownership, government agencies sanction the public ownership of a business and thus create a highly regulated monopoly. Public Utilities are typical of this kind of organization. A public utility can have stockholders as the owners, but because of the service that they provide, such as electricity, they are granted a monopoly status but are highly regulated to insure that they do not overcharge their customers. Local governments own parking structures and water systems, establish roads for commercial use. The Pennsylvania Turnpike Authority operates a vital highway link across its state. The federal government established the Tennessee Valley Authority to provide electricity to the rural south. The Trend toward Privatization. In recent years, there has been actions taken at deregulation of public utilities and push them towards privatization—an attempt to increase competition and lower prices in the services provided. Some public services like prisons and fire protection are provided by private companies, and there are proposals to turn publicly owned airports and power companies over to private investors. The privatization trend has also been evident outside the United States such as the United Kingdom and Canada. Though met with resistance they become successful, profitable and more efficient. Cooperatives cooperative Organization that is operated collectively by the owners. A cooperative is an organization of member-owners that associate to cooperatively operate all or part of their industries. Cooperatives are common in agricultural industries (cotton, citrus, nut processing), but some even exist in urban settings, such as food banks. Cooperatives are often created by large numbers of small producers who want to take advantage of economies of scale and thus become more competitive and profitable in the marketplace. Illustration 3.9 shows an advertising piece featuring some owners of Blue Diamond Growers, an agricultural cooperative of 5,100 California almond growers. These owner/operators are waist deep in billions of almond kernels. Their message—we grow the product and we are proud of it—is designed to increase the consumption of Blue Diamond brand snack almonds in the United States. Other well-known cooperatives are Sunkist Growers, Associated Mills Producers, and Recreational Equipment Inc. (REI). REI was formed in 1938 by Lloyd and Mary Anderson along with 23 fellow Northwest climbers. The group formed a consumer cooperative to supply themselves with high-quality ice axes and other climbing gear. They figured that if they could purchase consumer goods in bulk that the per CH 3] Business 101 — The Basics 3-17 Illustration 3.9 Advertisement Featuring a Cooperative’s Owners Blue Diamond® Growers is the world's largest tree nut processing and marketing company. Founded in 1910, the cooperative celebrated its 90th anniversary in 2000. Blue Diamond® led the development of California's almond industry from a minor domestic specialty crop to the world leader in almond production and marketing. We continue to build markets and create new products, new uses, and new opportunities for members of Blue Diamond® Growers. Headquartered in Sacramento, California, nearly 4000 California almond growers deliver over onethird of California's almonds annually to their cooperative. The crop is marketed to all 50 states and more than 90 foreign countries, making almonds California's largest food export, and the sixth largest U.S. food export. The California crop is valued annually at about $1 billion dollars. Source: Courtesy of Blue Diamond Growers unit cost would be less than if each went out and purchased the items individual. Taking advantage of an economy of scale. A requirement of cooperatives is that the owners of a cooperative must be its membership and they elect their board of directors from among the owners. The board then hires a team of professional managers to handle the business functions of the cooperative. A cooperative is a business, and its capital is put to use to make a profit for its owners. The initial operating capital comes from the owners, but it must make a profit to stay in business. Unlike stockholders who invest funds in a corporation to receive dividends, the owners of a cooperative invest funds to assure themselves of markets for their products, lower their costs of operation and secure sources of supplies and services. The member-owners of Blue Diamond Growers, for example, support the cooperative's Almond Research Center, to find new ways to use almonds as a food product, confection, and develop marketing tools. The membership funds help promote Blue Diamond almonds with nationwide television and print advertising campaigns. Blue Diamond Growers export almonds to more than 90 countries which account for much of the cooperative's sales. Owners' financial support of these product development and promotional efforts is important in developing new markets and expanding existing ones. Marketing cooperatives with major-branded products, such as Ocean Spray Cranberries, bring a premium for the products that they sell and generally it is higher than if the grower tried to go it along in the market. Syndicates A syndicate is a temporary association of individuals or firms organized to perform a specific task that requires a large amount of capital. The syndicate is formed because no one person or firm is able to fund the entire capital requirements for the undertaking. Like a joint venture, a syndicate is dissolved as soon as its purpose has been accomplished. However, the participants in a syndicate do not form a separate firm, as do the members of a joint venture. syndicate A temporary association of i ndi vi dual s or f ir ms organized to perform a specific task that requires a large amount of capital. 3 3-18 Forms of Business Ownership [CH 3 Syndicates are most commonly used to underwrite large insurance policies, loans, and investments. Banks have formed syndicates to provide loans to developing countries, to share the risk of default. Stock brokerage firms usually join together in the same way to market a new issue of stock. Limited Liability Company (LLC) A legal form that provides all the benefits of a partnership, but limits the liability exposure of each investor to the amount of his or her investment. Operating Agreement An agreement that sets the rules for governing the company as well as the rights and responsibilities of the members toward the company and one another. Limited Liability Company The limited liability company (LLC) is a hybrid type of business ownership combining several features of corporation and partnership structures. It is neither a corporation nor a partnership; some erroneously refer to it as a limited liability corporation, however it is correctly titled Limited Liability Company. The owners are called “members,” not partners (as in a partnership) or shareholders (as with a corporation). The number of members is unlimited and my be individuals, corporations, or other LLC’s. The LLC provides all the benefits of a partnership, but limits the liability exposure of each investor to the amount of his or her investment. Further, unlike a limited partnership where the limited partner cannot participate in management of the company, anyone can participate in the management of an LLC and still enjoy limited liability protection. Filing and recording an LLC is generally accomplished by completing a simple form filed with the secretary of state of the state in which the firm will be conducting its business, and a small filing fee (anywhere from $200 to $700). Usually the secretary of state's office will check to see that the firm name is not already in use. If not, granting the LLC is typically perfunctory and occurs within a few weeks (the process is usually faster if you use an attorney). The LLC is also required to prepare an "operating agreement," which is similar to a partnership agreement. The operating agreement sets the rules for governing the company (such as the rules for meetings, if any) as well as the rights and responsibilities of the members and company to each other. The operating agreement will state the members' understanding of who is responsible for and amount of capital contributions; who is to receive distributions and how much; who is to be allocated the various tax attributes of the company such as profits, losses, gains and credits, and under what circumstance the company will dissolve, among others. The operating agreement is not filed with any state agency but, rather, is kept by a designated member of the LLC or an assignee, such as an attorney. When two or more people go into business together, they've automatically formed a general partnership; they don't need to file any formal paperwork. By contrast, to form an LLC, business owner's must file formal articles of organization with their state's LLC filing office (usually the secretary of state or Department of State) and comply with other state filing requirements. Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership meaning that creditors of the partnership can go after the partners' personal assets while members (owners) of an LLC are not personally liable for the company's debts and liabilities. There is one similarity between LLCs and partnerships, however. They both offer "flow through" taxation, which means that the owners report business income or losses on their individual tax returns; the partnership or LLC itself does not pay taxes. Advantages of a Limited Liability Company. There are many advantages to an LLC. Combining the best features of both partnerships and corporations, the main advantages of an LLC include the following: CH 3] Business 101 — The Basics Limited Liability. The investors in an LLC enjoy limited liability for the commitments and actions of the company. Thus, their personal assets are not at risk as long as the company does not engage in fraudulent business practices. Flexible Profit Distribution. Limited liability companies can select varying forms of profit distribution. Unlike a common partnership where the split is 50-50, LLC have much more flexibility. Flow Through Taxation. As with sole proprietorships, partnerships, and S corporations, the LLC is not separately taxed. Profits and losses of the LLC "flow through" to the owners and are taxed according to the individual income tax rate. Investors Can Manage. Unlike a limited partnership, which does not allow limited partners to manage, the LLC allows any shareholder to also be a manager without risking limited liability status. This advantage is significant, especially to the founders of a company who want to contribute funds and be part of the active management team. Unlimited Membership. The LLC has no restrictions regarding the number of individuals who may participate as shareholders. In most states, the S corporation restricts the number of investors to thirty-five individuals. An LLC can have as many "members" as necessary. Ease of Organizing. Organizing an LLC is usually a simple matter, requiring only the filing of articles of organization with the appropriate state secretary of state and paying required fees. Although it is not required in many states to draft an operating agreement, it is advisable. Much like corporate by-laws or partnership agreements, the operating agreement can help define your company profit sharing, ownership, responsibilities, and ownership changes. Each state has different rules governing the formation of a limited liability company. For instance, in North Dakota, a foreign LLC is not allowed for banking or farming. Some states will want a publication notice with the local newspaper that a company has been formed. Check with your local state office for their particular requirements. Disadvantages of a Limited Liability Company. The disadvantages of an LLC revolve around limited life, financial limitations, transferability and reporting complexities. Limited Life. An LLC does not have a reliable continuity of existence. The articles of organization must specify the date on which the LLC's existence will terminate. Unless otherwise provided in the articles of organization or a written operating agreement, an LLC is dissolved at the death, withdrawal, resignation, expulsion, or bankruptcy of a member (unless within ninety days a majority in both the profits and capital interests vote to continue the LLC). Financial limitations. The LLC does not allow for the issuance of stock shares. Rather, individuals who invest in an LLC are known as "members." Many seasoned and savvy investors are less comfortable with this form of investment, preferring to have actual stock certificates on file with their attorneys. Transferability. Business owners with plans to take their company public, or issuing employee shares in the future, may be best served by choosing a corporate business structure. No one can become a member of an LLC (either by transfer of an existing membership or the issuance of a new one) without the consent of members having a majority in interest (excluding the person acquiring the membership interest) unless the articles of organization provide otherwise. 3-19 3 Forms of Business Ownership 3-20 [CH 3 Reporting Complexity. Running a sole-proprietorship or partnership will have less paperwork and complexity. An LLC may federally be classified as a soleproprietorship, partnership, or corporation for tax purposes. Classification can be selected or a default may apply. Summary of Learning Goals 1. Describe the three basic forms of business ownership. The three forms of business ownership are sole proprietorship, partnership, and corporation. The most common form of ownership is the sole proprietorship, a business owned and operated by a single person. A partnership is operated by two or more people as co-owners where one individual must be a general partner. A corporation is a legal entity separate from its owners. 2. Define the advantages and disadvantages of sole proprietorships. The advantages of sole proprietorships are retention of all profits, ease of formation and dissolution, and ownership flexibility. The disadvantages are unlimited financial liability, financing limitations, management deficiencies, and lack of continuity. 3. Discuss the advantages and disadvantages of partnerships. The advantages of partnerships are ease of formation, complementary management skills, and expanded financial capability. The disadvantages are unlimited financial liability, possible interpersonal conflicts, lack of continuity, and complex dissolution. 4. Explain the differences between general partnerships and limited partnerships. General partnerships are those in which all partners carry on the business as co-owners and are liable for the debts of the business. Limited partnerships are those composed of one or more general partners and one or more limited partners. Limited partners are not active in the operation of the partnership, and their possible losses are limited to the amount of their investment. 5. Discuss the advantages and disadvantages of corporations. The advantage of corporations are limited financial liability, specialized management skills, expanded financial capability, and economies of larger-scale operation. The disadvantages are high taxes and legal restrictions. 6. Describe how a corporation is organized and operated. In organizing a corporation, consideration should be given to hiring an attorney, selecting the state in which to incorporate, and following the correct legal procedures for incorporating. Registration as a domestic, foreign, or alien corporation is also important. Stockholders own the corporation, the board of directors governs it, and top management is responsible for its actual operation. Subsidiaries are corporations owned by other corporations, or so-called parent corporations. 7. Define vertical, horizontal, and conglomerate mergers. Vertical mergers occur between firms at different levels in the production marketing process, such as a producer and a large retailer. Vertical mergers provide firms with expanded distribution outlets (forward vertical merger) and raw materials and supplies (backward vertical merger). Horizontal mergers involve firms in the same industry. They help firms diversify and expand product lines. Conglomerates are mergers of unrelated firms. They facilitate diversification into new business areas, rapidly increase sales growth, and profitably use cash Business 101 — The Basics CH 3] 3-21 surpluses. 8. 9. Explain the recent trends influencing corporate organizations. One recent trend is an increased number of unfriendly takeovers, in which the merger offer is unsolicited and unwanted. Contradictory trends are also evident in contemporary business. Some corporations are selling divisions or units, a process known as divestiture. These units may be converted into private firms, purchased via a leveraged buyout where investors use borrowed funds to acquire the business, or acquired by the unit's employees. Describe the differences among private ownership, public ownership, and cooperative ownership. Private ownership refers to an organization owned by an individual or individuals, regardless of whether it was set up as a sole proprietorship, partnership, or corporation. One alternative to private ownership is public ownership, in which a government unit or its agency owns and operates an organization on behalf of the population served by the unit. Another alternative is the cooperative, in which there is cooperative ownership of production, storage, transportation, and/or marketing activities. Questions for Review and Discussion 1. Outline the ownership structure of American business. 2. What factors would be important to you if you were selecting a form of business ownership for a new enterprise? 3. What is meant by a sole proprietorship? Why is it the most popular form of business ownership? Are there any negatives to this form of business ownership? 4. Assume you are involved in establishing the following businesses. What forms of business ownership would you use? a. Roadside fruit stand (assume you own an orchard) b. Hair styling salon c. Management consulting firm d. Small foundry 5. How does the Uniform Partnership Act define a partnership? What are the benefits and disadvantages of this form of business ownership? 6. Distinguish between a general partner and a limited partner. Explain why this distinction exists and how it is used in different types of enterprises. 7. Explain the concept of a master limited partnership. 8. Explain an LLC and discuss its advantages. 3 Forms of Business Ownership 3-22 [CH 3 9. Describe the features and operations of a corporation. 10. What is the primary advantage of the corporate form of business ownership? 11. Differentiate among a domestic corporation, foreign corporation, and alien corporation. 12. The business section of today's newspapers are full of terms like poison pill, shark repellent, white knight, and golden parachute. Explain what these terms mean as well as the current business trend from which they are derived. 13. How are cooperatives different from other forms of business enterprises? End notes; 1. Thomas, Samuel Buzz, III, “Senator Buzz Thomas' Friday Report, A Clear Vision of Events in Detroit, Lansing and Washington DC.”, Fri, 13 Feb 2004 18:06:26 -0500, <[email protected]> 1. “Forbes on FOX: The next big takeover target: Get the name!”, 21 February 2004

© Copyright 2026