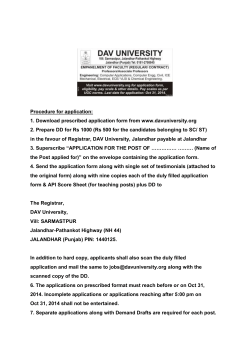

QUARTERLY REPORT MARCH 31, 2015