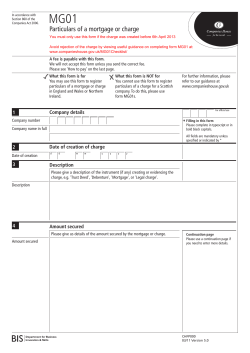

MORTGAGE NOTE AND

Reset Show Field Borders 666 Purchase -> Note and Mortgage, short form, plain English format, 11-98 Click Here www.blumberg.com NOTE AND MORTGAGE Date......................................................... $............................................ Parties Mortgagor Mortgagee Address Promise to Pay Mortgagor promises to pay to Mortgagee or order the sum of dollars($ principal amount (debt) interest payments with interest at the rate of Mortgagor will pay the debt as follows: Application of payments The Mortgagee will apply each payment first to interest charges and then to repayment of the debt. Address for payment Transfer of rights in the Property Property Mortgaged Future advances ) %% per year from the date above until the debt is paid in full. W E Payment shall be made at Mortgagee's address above or at any other address Mortgagee directs. Additional promises and agreements of the Mortgagor: I V E R P W E I V E R P 1. The Mortgagor hereby mortgages to the Mortgagee the Property described in this Note and Mortgage. Mortgagor can lose the Property for failure to keep the promises in this Note and Mortgage. 2. The Property mortgaged (the "Property") is All 3. The Mortgagee may make advances in the future to the Mortgagor or future owners of the Property. In addition to the above Debt this Note and Mortgage is intended to secure any more debts now or in the future owed by the Mortgagor to the Mortgagee. The principal amount of the above Debt shall be the maximum amount of debt secured by this Note and Mortgage. Mortgagee is not obligated to make future advances. Purchase -> Click Here Purchase -> Insurance Maintenance No sale or alteration Taxes, etc. Mortgagee's right to cure Statement of the amount due Title Lien law section 13 Default, when full amount of debt due immediately Sale Receiver Payment of rent and eviction after Default Applicable law No oral changes Notices Who is bound Signatures 4. Mortgagor will keep the buildings on the Property insured against loss by fire and other risks included in the standard form of extended coverage insurance. The amount shall be approved by Mortgagee, but shall not exceed full replacement value of the buildings. Mortgagor will assign and deliver the policies to Mortgagee. The policies shall contain the standard New York Mortgage clause in the name of Mortgagee. If Mortgagor fails to keep the buildings insured Mortgagee may obtain the insurance. Within 30 days after notice and demand, Mortgagor must insure the Property against war risk and any other risk reasonably required by Mortgagee. 5. Mortgagor will keep the Property in reasonably good repair. 6. The Mortgagor may not, without the consent of Mortgagee, (a) alter, demolish or remove the buildings and improvements on the Property, or (b) sell the Property or any part of it. 7. Mortgagor will pay all taxes, assessments, sewer rents or water rates within 30 days after they are due. Mortgagor must show receipts for these payments within 10 days of Mortgagee's demand for them. 8. Mortgagor authorizes Mortgagee to make payments necessary to correct a default of Mortgagor under Paragraphs 4 and 7 of this Mortgage. Payments made by Mortgagee together with interest at the rate provided in this Note and Mortgage from the date paid until the date of repayment shall be added to the Debt and secured by this Mortgage. Mortgagor shall repay Mortgagee with interest within 10 days after demand. 9. Within five days after request in person or within ten days after request by mail, Mortgagor shall give to Mortgagee a signed statement of the amount due on this Note and Mortgage and whether there are any offsets or defenses against the Debt. 10. Mortgagor warrants the title to the Property. Mortgagor is responsible for any costs or losses of the Mortgagee if an interest in the Property is claimed by others. 11. Mortgagor will receive the advances secured by this Note and Mortgage and will hold the right to receive the advances as a trust fund. The advances will be applied first for the purpose of paying the cost of improvement. Mortgagor will apply the advances first to the payment to the cost of improvement before using any part of the total of the advances for any other purpose. 12. Mortgagee may declare the full amount of the Debt to be due and payable immediately for any default. The following are defaults: (a) Mortgagor fails to make any payment required by this Note and Mortgage within 15 days of its due date; (b) Mortgagor fails to keep any other promise or agreement in this Note and Mortgage within the time set forth, or if no time is set forth, within a reasonable time after notice is given that Mortgagor is in Default. 13. If Mortgagor defaults under this Note and Mortgage and the Property is to be sold at a foreclosure sale, the Property may be sold in one parcel. 14. If Mortgagee sues to foreclose the Note and Mortgage, Mortgagee shall have the right to have a receiver appointed to take control of the Property. 15. If there is a Default under this Note and Mortgage, Mortgagor must pay monthly in advance to Mortgagee, or to a receiver who may be appointed to take control of the Property, the fair rental for the use and occupancy of the part of the Property that is in the possession of the Mortgagor. If Mortgagor does not pay the rent when due, Mortgagor will vacate and surrender the Property to Mortgagee or to the receiver. Mortgagor may be evicted by summary proceedings or other court proceedings. 16. Mortgagee shall have all the rights set forth in Section 254 of the New York Real Property Law in addition to Mortgagee's rights set forth in this Note and Mortgage, even if the rights are different from each other. 17. This Note and Mortgage may not be changed or ended orally. 18. Notices, demands or requests may be in writing and may be delivered in person or sent by mail. 19. If there are more than one Mortgagor each shall be separately liable. The words "Mortgagor" and "Mortgagee" shall include their heirs, executors, administrators, successors and assigns. If there are more than one Mortgagor or Mortgagee the words "Mortgagor" and "Mortgagee" used in this Mortgage includes them. W E I V E R P W E I V E R P Mortgagor has signed this Note and Mortgage as of the date at the top of the first page. State of New York, County of On Click Here SS.: ACKNOWLEDGMENT RPL309-a (Do not use outside New York State) before me, the undersigned, personally appeared personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s), or the person upon behalf of which the individual(s) acted, executed the instrument. ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggggggg ggggggggggggggggggggggggggg (signature and office of individual taking acknowledgment) Purchase -> Click Here

© Copyright 2026