Disrupting Asset Management: Harnessing Collective

Disrupting Asset Management: Harnessing Collective

and Machine Intelligence to Empower Investors

Prashant B. Bhuyan - Alpha Modus Internal Research (A.M.I.R)

June 11, 2015

Disclaimer

The following is intended to outline our general product direction. It is intended for information purposes

only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or

functionality, and should not be relied upon in making purchasing decisions. The development, release, and

timing of any features or functionality described for Alpha Modus’ products remains at the sole discretion of

Alpha Modus.

The Problem with the Asset Management Industry Today

The problem with the investment management industry is that most investors are being over charged for

investment advice. A significant portion of insitutional and retail investors alike are being over charged for

both professionally managed active and passive investment strategies across many different asset classes.

Institutional investors such as pension funds that often represent the likes of firefighters and teachers ultimately

do not believe that they have the capacity to generate alpha internally. Geographically situated far away from

global money centers like New York City and London many institutional investors believe that they cannot

attract top notch human capital to cities such as Minneapolis and Cleveland. Consequently, institutional

investors outsource the management of assets to professional advisors such as hedge funds and mutual funds

and pay exorbitant fees to access ‘talent’.

In reality, most professional advisors add absolutely no value to these institutions and their constituents.

Many of the managers that do deliver positive returns do so by either exploiting asymmetrical informational

advantages that are borderline illegal or by assuming disproportionate risk and being lucky. The dirty secret of

the asset management business is that in most cases investors would do much better if they simply purchased

index funds due to the amount of money they would save in compounding fees.

The problem is that many professional investment managers sell investors on their ability to generate alpha

and take advantage of the fact that institutions have difficulty discerning between a manager’s luck and

skill. Rather than producing alpha-driven returns that are independent of benchmark market indices most

investment professionals deliver to clients nothing more than beta. Beta should be free.

Dis-intermediation of the investment management business entails removing categorical barriers such as

Retail Investor, Institutional Investor, Passive Investor, Mutual Fund Investor, Hedge Fund Investor, etc.

These categorical distinctions exist primarily for intermediaries to differentiate between the many different

compensation structures. Instead, compensation for professional investment managers should simply be a

function of how much alpha the investment manager generates.

Alpha Pretenders

As Jim Maclachlan, Global Head of Equity Research at Towers Watson, explained to Chief Investment Officer

Magazine in May, 2012,

"I have come to the view that many investment managers are "alpha-pretenders". That is, I believe that

generating positive ex-ante alpha is a secondary consideration for many investment management firms. The

1

primary concern for such firms appears to be exploiting the fact that randomness in returns will at times cause

a mediocre investment process to exhibit positive ex-post alpha. Pretending to be an alpha-generator while in

fact selling noise can be a successful business strategy because it is very difficult for a prospective investor to

sort out whether ex-post alpha was generated by ex-ante alpha or noise. Consequently, investors overweight

the importance of past performance, and often select managers whose future alpha-generation prospects are

no better than chance." (Jim MacLachlan, How to Weed Out Alpha Pretenders, Chief Investment Officer

Magazine, May 2012)

In the fall of 2014 the New York Times reported,

"Assets at hedge funds, once a niche investment vehicle for ultra-wealthy investors, hit a record 2.8 trillion

dollars this year. There are now more than 10,000 hedge funds and counting. Their steep fees have minted

scores of billionaire managers and spawned not a few criminals in what has turned into a gold rush of the 21st

century. Their high-water mark may turn out to be Sept. 15, 2014. That’s the day Calpers, the California

Public Employees’ Retirement System, announced that it was terminating its 4.5 billion dollar hedge fund

portfolio to reduce complexity and costs."(James B. Stewart, Hedge Funds Lose Calpers, and More, The New

York Times, September 2014)

In a sign that pension funds are beginning to seek alpha for themselves it was reported in June 2015 that the

Canada Pension Plan Investment Board, which invests on behalf of 18 million Canadians, won the $12 billion

bid for General Electric’s private equity lending business beating out private equity firms Apollo Global

Management LLC and KKR & Co. According to the the Wall Street Journal,

"The investment board at Canada’s pension fund, along with the managers of some other big Canadian funds,

has moved toward a much greater emphasis on direct investing which allows it to save money on fees to third

party managers."(Ben Dummet and Ryan Dezember, Canada Pension Plan Investment Board Wins Duel

Over GE Capital Lending Unit, The Wall Street Journal, June 10, 2015)

Active Investment Management

Active management is a portfolio management strategy whereby the portfolio manager makes investments with

the primary objective of outperforming an investment benchmark index. Based on promises of outperformance

active managers such as hedge funds typically charge high net worth clients and institutional investors fees of

2% of assets under management and 20% of performance. Investors pay these fees primarily because they

believe they are paying for alpha.

Alpha is a parameter in the capital asset pricing model (CAPM). It is the intercept of the security characteristic

line (SCL) or the coefficient of the constant in a market model regression given by:

SCL: Ri,t − Rf = αi + βi (RM,t − Rf ) + i,t

If markets are efficient, then the expected value of alpha, represented by α, is zero. If αi > 0, then the

investment has returned in excess of the reward for the assumed risk. If αi = 0, then the investment has

earned a return adequate for the risk taken. Finally if αi < 0, then the investment has earned an inadequate

return for the amount of risk taken.

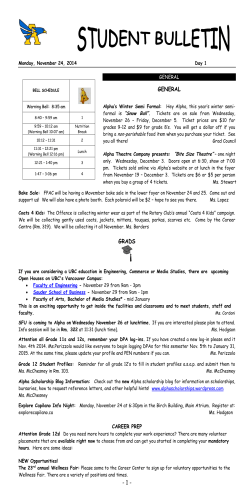

As can be seen in the following analysis of long short equity hedge fund performance over the past four years

actively managed equity long short strategies have in aggregate produced a negative alpha with an extremely

high correlation to the overall stock market benchmarked by the S&P 500 ETF (SPY) as well as a very high

beta coefficient. In other words, these strategies are taking too much risk to generate a particular return and

overcharging investors for returns that they could easily replicate themselves.

Using monthly return data for equity long short strategies provided by EDHEC-RISK Institute, we find:

## Loading required package: xts

## Loading required package: zoo

##

## Attaching package: 'zoo'

2

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

##

The following objects are masked from 'package:base':

as.Date, as.Date.numeric

Attaching package: 'PerformanceAnalytics'

The following object is masked from 'package:graphics':

legend

Loading required package: quantmod

Loading required package: TTR

Version 0.4-0 included new data defaults. See ?getSymbols.

As of 0.4-0, 'getSymbols' uses env=parent.frame() and

auto.assign=TRUE by default.

This behavior will be phased out in 0.5-0 when the call will

default to use auto.assign=FALSE. getOption("getSymbols.env") and

getOptions("getSymbols.auto.assign") are now checked for alternate defaults

This message is shown once per session and may be disabled by setting

options("getSymbols.warning4.0"=FALSE). See ?getSymbols for more details.

## [1] "SPY"

Aggregate performance of equity long/short strategies from 2011-2014 compiled from EDHEC-RISK Institute

(Head, Tail):

##

##

##

##

##

##

##

2014-08-31

2014-09-30

2014-10-31

2014-11-30

2014-12-31

2015-01-31

Long/Short Equity

0.0128

-0.0093

-0.0013

0.0116

0.0012

-0.0009

##

##

##

##

##

##

##

2011-01-31

2011-02-28

2011-03-31

2011-04-30

2011-05-31

2011-06-30

Long/Short Equity

0.0052

0.0139

0.0021

0.0139

-0.0108

-0.0117

3

0.10

0.5

−0.05

0.2

−0.1

S&P 500Rets EquityLSRets

Cumulative Monthly Returns

0

10

20

30

40

50

Months (2011−2014)

Over the last several years the cumulative monthly performance curve of actively managed equity long short

strategies in aggregate mirrors the shape of the S&P 500 SPY ETF performance curve. However, the S&P

500 curve outperformed the equity long short curve by a factor greater than two.

Underperformance relative to the market index would be acceptable under the given fee structure if these

strategies were producing a positive alpha coefficient and returns independent of the market benchmark index.

The reason for this is that strategies that produce independent returns primarily from alpha would provide

active investors with a consistent return stream unaffected by changes in overall market conditions.

That is, when the benchmark market index inevitably moves into a bear cycle the alpha generating strategy

would presumably outperform the benchmark index because returns would be derived from skill in finding

statistically significant patterns of market inefficiencies. These inefficiences would persist irregardless of the

behavior of the overall market. Returns derived from alpha, or skill, allow for capital to compound over long

periods of time.

Most hedge fund investors believe they are paying fees to managers because they are accessing talent that

is skilled enough to generate returns derived from alpha. Investors often are fooled into thinking positive

returns are the same as alpha. Too many investors are getting fooled by randomness!

Below we see that equity long/short strategies actually produced positive returns comprised of a negative

alpha of -.062% and a beta coefficient of .472 over the last four years with a correlation to the benchmark

S&P 500 index of nearly 90%.

##

##

##

##

##

##

##

##

##

##

Call:

lm(formula = df$monthlyretsels ~ df$monthlyretsspy)

Residuals:

Min

1Q

Median

-0.015512 -0.005174 -0.000731

Coefficients:

3Q

0.005612

Max

0.014265

Estimate Std. Error t value Pr(>|t|)

4

##

##

##

##

##

##

##

##

(Intercept)

-0.000629

0.001129

-0.56

0.58

df$monthlyretsspy 0.472201

0.033189

14.23

<2e-16 ***

--Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.00755 on 47 degrees of freedom

Multiple R-squared: 0.812, Adjusted R-squared: 0.808

F-statistic: 202 on 1 and 47 DF, p-value: <2e-16

## Warning: "data" is not a graphical parameter

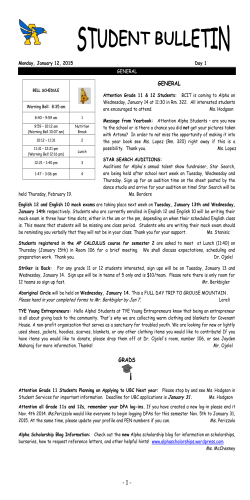

0.04

0.02

0.00

−0.04 −0.02

Monthly Long/Short Equity Return

Equity Long/Short Perf Vs S&P 500 (SPY) 2011−2014

−0.05

0.00

0.05

0.10

Monthly S&P 500 SPY ETF Return

alpha Coefficient:

## [1] "alpha= -0.063 %"

Beta Coefficient:

## [1] "Beta= 0.472"

Equity Long/Short Performance Correlation with the S&P 500 ETF:

##

monthly.returns

## Long/Short Equity

0.9009

In reality, investors that are investing in long short equity hedge funds are paying huge fees for returns that

they could easily generate themselves by simply purchasing index funds through an online brokerage account.

These investors believe they are paying for strategies that would survive all market conditions when in fact

they are paying a huge price for little more than glossy marketing materials and a lottery ticket.

5

Passive Investment Management

Passive management such as dollar cost averaging into index funds and traditional allocation between stocks

and bonds, for example, is simply beta. Any professional investment advisor that creates an investment

strategy that generates beta should not charge for that advice. Beta requires no skill to generate. There are

thousands of hedge funds, mutual funds and retail financial advisors charging for beta-driven returns which is

analogous to charging for randomness.

Fully automated passive beta allocation strategies will be available via the Alpha Modus Mod Library;

however, such strategies will be free of charge to users. Alpha Modus believes that users should never be

charged for anything that they could easily do themselves.

Imagination is More Important than Knowledge

Einstein famously said that imagination is more important than knowledge. The financial industry is

incredibly unimaginative. Rather than re-investing fees into r&d in order to innovate investment advisors

tend to herd together in the pursuit of the same asymmetrical information edges in hopes of ‘beating’ the

market. Rapid advances in technology and the data explosion have changed the game. No longer is talented

human capital concentrated only in highly networked global money centers. In fact the very definition of

talent has changed and the landscape has gone virtual.

Generating excess risk adjusted returns independent of market benchmarks has unequivocally become a

big-data problem. The reason most advisors cannot deliver alpha to clients is because most advisors’ skills

have become obsolete. In fact the very concept of intelligence is evolving but most advisors are reluctant

to adapt. Intelligence is no longer the province of the individual. Rather, intelligence has evolved into a

characteristic of the collective mind augmented by machine intelligence.

How Does Alpha Modus Alleviate Investor Pain?

Alpha Modus alleviates investor pain by dis-intermediating the investment management model through the

creation of a virtual financial technology marketplace. Alpha Modus provides highly skilled geographically

diversified teams of data scientists and engineers with subsidized resources ranging from high resolution tick

data and cloud computing clusters to artificial intelligence so that they can produce competitive value added

trading and investment strategies.

These intelligent strategies are curated, standardized and integrated into the Alpha Modus’ high performance

execution infrastructure and distributed directly to end users via the Alpha Modus Mod Library as applications

called mods. These strategy mods are priced in line with the amount of alpha produced. The target user is any

investor that seeks professional portfolio management services (active, passive or anything in between) and is

currently fed up with professionals over charging and under-delivering. Users deploy fully automated strategy

mods via the Alpha Modus cloud (infrastructure as a service) directly on their own brokerage accounts.

Mod developers in turn earn 70 percent of the subscription rate of mods that they sell and end users benefit

from having a catalogue of highly sophisticated, data driven, transparently priced and fully automated active

and passive investment strategies at their fingertips for a small fraction of the cost of traditional professional

investment advisors.

What Can Be Achieved By Harnessing the Collective Intelligence

of Highly Skilled Man-Machine Teams From Around the World?

Collective Intelligence is group intelligence that emerges from collaboration and competition of many

individuals thereby shifting the knowlege and power from the individual to the collective entity. Technologies

6

such as Skype, TeamViewer, Basecamp, Linkedin, What’s App, Github and the opensource movement are

central to the seamless collaboration of highly skilled individuals from around the world. Individuals with

similar motivations, such as those seeking non-linear returns on technical skills, tend to group together.

Whereas highly skilled groups extend the intelligence of the individual, machine learning further compounds

the intelligence quotient of the collective mind. Machines can be programmed to learn from data to make

predictions about the future. In the context of Alpha Modus, machines can learn from a variety of inputs

to help mod developers forecast asset prices, suggest to users optimal portfolios of mods that maximize

objectives, or parse natural language to handle first level sales support.

Below is a strategy mod that was created by a man-machine team of geographically diversified data scientists

and engineers that solves the alpha generation problem.

This pure alpha mod produces the following performance:

##

##

##

##

##

##

SharpeRatio

APR

ProfitFactor

MaxDrawDown

BetaCoefficient

Mod Performance Metrics

5.3681

0.1985

3.7100

0.0252

0.0000

Below is a multi-year backtest of the pure alpha mod. Live performance is benchmarked against the multi-year

backtest to ensure implementation shortfall is negligible. If live performance deviates from the backtest then

that is a clear indication to both the mod developer and user that there is either something wrong with the

model or that the inefficiency has been arbitraged away.

It is important to note that a variety of cross validation and sampling techniques are applied to ensure that

models are not overfit and that assumptions are well defined and clearly communicated to Alpha Modus users.

Users are encouraged to submit questions for mod developers via the Mod Library prior to subscribing to any

mod.

7

Quantitative investment funds that have achieved pure alpha are typically shrouded in mystery and closed

to all but a few lucky investors. Further these funds typically spend tens of millions of dollars per year on

research and development. On the contrary Alpha Modus users do not require multi million dollar research

and development budgets nor do they require any specialized technical skills to benefit from strategies like

Alpha Modus’ pure alpha mod, a truly revolutionary concept. Viewed another way, Alpha Modus extends

the intelligence and capacity of its users thus empowering them to achieve objectives that were previously out

of reach.

Never before have investors had fingertip access to such an array of sophisticated quantitatively driven

cross-asset algorithmic strategies with turn-key high performance infrastructure as a service with such pricing

transparency.

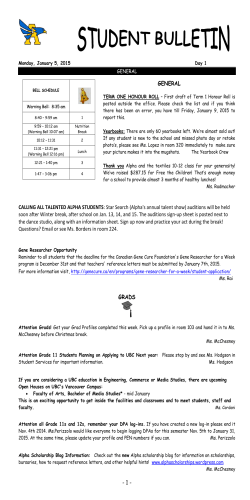

The Mod Library

In the Alpha Modus Mod Library users benefit from an entire catalogue of highly intelligent active and

passive investment strategies across multiple asset classes with the flexibility to subscribe, unsubscribe, mix

and match strategies with the click of a mouse. Users can run a variety of strategies on their own cloud based

infrastructure through a variety of different brokers (via brokerage adaptor mods). Ultimately, Alpha Modus’

artificially intelligent recommendation engine will recommend permutations and combinations of strategy

mods that will optimize user objectives given current and pending market conditions.

For example, shown above is a suite of active beta strategy mods that were created from research into chaotic

systems using advanced machine learning techniques by another man-machine team.

8

One of these active beta suite of mods is an Equities Tactical Strategy that takes positions in two underlyings,

the S&P 500 and the Euro Stoxx 50.

The strategy implements temporary exposures to the underlyings, therefore representing a purely tactical

and timing-based process, without any factor (value, growth), market-cap (small cap) or risk-weighted

(equal-weight, minimum variance, etc.) approach.

The strategy’s default mode is 100% cash. When probable bullish or bearish movements are detected the

strategy enters tactical tilts of limited duration, long or short the underlyings 50%, respectively. A behavioural

analysis determines the excesses of the underlyings, and contrarian tilts are therefore implemented to trade

against those excesses (underweight when bullish excess, overweight when bearish excess).

The active beta Equities Tactical Strategy performance metrics are as follows:

##

##

##

##

##

##

SharpeRatio

APR

MaxDrawDown

BetaCoefficient

AnnualizedVolatility

Mod Performance Metrics

4.4900

0.2725

0.0180

0.3800

0.0562

9

The Equities Tactical Strategy mod is just one of many active beta mods available to users in the Mod Library.

The Equities Tactical Strategy sells for 50 dollars per 100,000 dollars in notional account value and can be

run in the Alpha Modus cloud directly on the accounts of Interactive Brokers customers (facilitated by the

freely available IB Adaptor located in the Mod Library).

10

Products

In addition to strategies, Alpha Modus also creates a marketplace for value-added data-driven products

such as the Early Look Market on Close Imbalance Meter for NYSE Listed Stocks. The Early Look Meter

aggregates unstructured curated market on close imbalance data captured by NYSE Floor Brokers each day

using voice recognition. The information is relayed to users as a web-based visualization that gives users a

statistically valid indication of stock market direction into the close of trading. The meter is especially useful

on index re-balancing days.

Where Are Financial Markets Headed?

In a paper published by KPMG in 2014 the authors investigate the following question,

"Have you ever considered what the investment management industry will look like in 2030? Nobody can

predict the future . . . but one thing is clear, it will be very different to today. The pace and complexity of

change is overwhelming and it will only increase. . . Given the current lack of innovation and the speed of

technological development, we believe there is potential for more radical disruption from new entrants and

propositions." (KMPG, p.33-73, Investing in the Future, 2014)

According to an excellent article published in Institutional Investor titled, “The Rise of the Tech Model May

Soon Make You Obsolete”, the authors remark,

"Among other benefits, placing their trust in the virtual financial center will help institutional investors access

the promise of machine learning and data mining. They’ll also begin to overcome the geographical restrictions

that have kept them from attracting top talent. (It isn’t clear that top talent will continue to work at traditional

firms, as technology companies continue to attract young professionals who might formerly have gone to Wall

Street.)

In short, everywhere one looks, technology has begun to reverse a relatively conservative, slow moving industry.

Over the past 30 years, advances in technology have served to empower financial intermediaries. Going

forward, technology may threaten their existence . . . in the meantime, a new - virtual - financial center is

rising." (Institutional Investor, The Rise of the Tech Model May Soon Make You Obsolete, March 2015)

According to IBM, we as a civilization create more than 2.5 quintillion bytes of data each day and 90% of all

data that exist in the world have been created in the last 2 years alone. We are headed into a future where

financial markets will be governed by complexity created primarily by the non-linear growth in technological

advancement and data generation. Traditional investment managers that operate within the confines of

11

hugely inefficient closed systems hoping to maintain absurd compensation structures will not be able to

survive in this brave new world.

In contrast the future is bright for nimble forward thinking startups such as Alpha Modus that know how to

leverage collective and machine intelligence to solve complex problems with incredible efficiency. The market

opportunity for Alpha Modus is in distributing transparently priced high quality solutions to complex fin-tech

problems directly to end users.

For more information please visit www.alphamodus.com.

12

© Copyright 2026