FMDQ Presentation at the AACN 2015 Conference

FMDQ OTC PLC Leading The Nigerian Debt Capital Market Revolution A Presentation at the 2015 Annual Investor Day Conference Tumi Sekoni Head, Business Development May 7, 2015 Global Competitiveness Operational Excellence Liquidity Diversity Outline 1 Outline Outline Part 1 Evolution of FMDQ OTC PLC 3 Part 2 Nigeria’s Foremost Debt Capital Securities Exchange 4 Part 3 Value Proposition 6 Part 4 OTC Market Size 13 Part 5 FMDQ Secondary Market Architecture 14 2 Outline Evolution of FMDQ OTC PLC The Financial Markets Dealers Association (FMDA), formerly Money Market Association of Nigeria (MMAN) was established in 1976 and formally registered in 1989 as an association of the treasurers of licensed banks and discount houses in Nigeria Since 2005, corporate organisations as well as individuals have been granted membership following the adoption of the Association’s new constitution The 24 banks and 5 discount houses resolved at the FMDA EGM between July 16-17, 2010 to operate all their current OTC activities under a Securities and Exchange Commission (SEC)-registered SelfRegulatory Organisation (SRO) and be governed by this authorised body The CBN showed its support for the initiative via a sizeable set-up contribution FMDQ OTC PLC was incorporated on January 6, 2011 On the November 6 2012, the SEC registered FMDQ OTC PLC to perform the function of Over-TheCounter (OTC) market in the Nigerian capital market which makes FMDQ a securities exchange and SRO MMAN 1976> FX, Money Market FMDA 2006> FX, Money Market and FGN Bonds FMDA 2010> FX, Money Market, FGN Bonds, Corporate & Sub-National Bonds, Commodities and Derivatives 3 FMDQ OTC SRO Pre- and post-trade transparency Governance Clearing arrangements FMD …empowering the OTC markets Outline FMDQ: Nigeria’s Foremost Debt Capital Securities Exchange Incorporated Jan. 6, 2011 Licenced Nov. 6, 2012 to perform the function of OTC securities exchange in the Nigerian capital market Launched Nov. 7, 2013 Background Ownership Structure OTC Market Organiser Self-Regulatory Organisation (SRO) Twin-Oversight Responsibilities Membership Dealing Members Central Bank of Nigeria (CBN) Financial Markets Dealers Association (FMDA) The Nigerian Stock Exchange through NSE Consult Limited 24 banks and discount houses Associate Members: InterDealer Brokers, Brokers and Clients Registration Members: Listings and Quotations FMDQ Business Segments †Regulation & Supervision †Market & Business Development †Market Services & Research †Systems & Technology 4 Outline FMDQ: Nigeria’s Foremost Debt Capital Securities Exchange../2 To be No. 1 in Africa in the Fixed Income and Currency markets by 2019 Teamwork & Collaboration Innovation Integrity To empower the financial markets to be innovative and credible, in support of the Nigerian economy Value-Adding FMDQ business models are and driven by its Global Competitiveness Operational Excellence Liquidity 5 “ ” Agenda Diversity Outline Value Proposition Listings & Liquidity Enhancement Product Innovation Market Governance & Development 6 Financial Market Support for Economic Development Price Formation & Transparency Outline Value Proposition Listings & Liquidity Enhancement Product Innovation Market Governance & Development 7 Financial Market Support for Economic Development Price Formation & Transparency Outline Price Formation & Transparency Providing unprecedented transparency to the Nigerian Fixed Income markets Online market activity information – prices, bid and ask quotes, trade sizes, rates, deal times etc. Continuous disclosure of relevant information on quoted instruments – issuer information, outstanding value, issuer history etc. Price formation, liquidity enhancement, transparency and efficiency 8 Outline FMDQ e-Discovery 9 Outline FMDQ Website Quotation Issue history of issuer is also provided 10 Outline FMDQ Website Quotation../2 11 Outline FMDQ Bloomberg E-Bond Quotation 12 Outline OTC Market Sizing Improving liquidity in the OTC market. A steady move towards realising of the goal… Turnover (US$'million) Jan - Apr* 2013 2014 2015 Foreign Exchange Foreign Exchange Derivatives Treasury Bills FGN Bonds Other Bonds Eurobonds Repurchase Agreements/Buy-Backs Unsecured Placements/Takings Money Market Derivatives 122,788 71,291 49,360 8,206 165,726 417,371 No. of Business Days Average Daily Turnover * Data up to April 24, 2015 Avg. USD/NGN Rates – 2013: $1/N159.21; 2014: $1/N160; 2015: $1/N194.76 Other Bonds include Agency, Sub-national, Corporate and Supranational Bonds13 248 1,683 202,030 40,965 164,349 48,339 1,422 147,885 42,014 318 647,321 254 2,549 51,568 13,807 59,208 14,131 42 2 64,154 22,473 167 225,551 78 2,892 Outline FMDQ Secondary Market Architecture Trading (Fixed Income, Currencies & Derivatives) • FMDQ Dealing Members • FMDQ-Bloomberg E-Bond Trading System • Thomson Reuters FX Tracker System Settlement Treasury Bills, Bonds & FX • CBN RTGS • CBN S4 • NIBSS • CSCS •SWIFT/RTGS Custody RTGS – Real-Time Gross Settlement S4 – Scripless Securities Settlement System NIBSS - Nigeria Inter-Bank Settlement System PLC CSCS - Central Securities Clearing System PLC FGN – Federal Government of Nigeria 14 T.Bills & FGN Bonds Non-FGN Bonds FX • Custodians FMD …empowering the OTC markets Outline 15 Thank you for your attention Global Competitiveness Operational Excellence Liquidity Diversity Outline APPENDICES 17 FMD …empowering the OTC markets Outline Fixed Income Primary Market & FX: Overview Product FGN Bonds Other Bonds Treasury Bills FX Issuer/Supplier FGN State Government, Government Agencies, Corporates & Supranationals FGN Oil companies, export proceeds, FPIs; earners, CBN Issuing/Sales Agent DMO Issuing Houses DMO N/A Issuance Type Auction (single price) Book Building Auction (multiple price) Frequency Monthly As needed Fortnightly As available Participants Primary Dealers Investors Money Market Dealers Authorised Dealers; FX end-users Tenor(s) 3, 5, 7, 10 & 20 years As structured 91, 182 & 364 days NA Maximum Allotment 30% of issue size At issuer’s discretion 30% of issue size NA Settlement T+2 NA T+1 Supplier’s discretion CBN - Central Bank of Nigeria; DMO - Debt Management Office; FGN - Federal Government of Nigeria; T Auction date; bn – Billion; 18 FMD …empowering the OTC markets Outline Debt Capital Market Transformation Focus FMDQ will focus its development of the Nigerian DCM in the following broad areas: Liquidity Enhancement Market Governance Listings & Quotations and Product Development Market Transparency Trading & Settlement Infrastructure FMDQ 19 Capacity Building Outline Financial Market Support for Economic Development FMDQ Transparency Global Visibility Secondary Market Liquidity Price Formation Product Innovation & Market Development Competitive Pricing Agriculture 20 “Power Fund” Outline Key Milestones April 2015 Market Transparency & Service Enhancement Reforms & Regulation Launch of FMDQ Bloomberg E-Bond Transparency & Sustainability Nigerian Inter-bank Offered Rate (NIBOR) Reform Codification of Market and Trading Rules Introduction of Daily Quotations List (DQL) Publication of the FGN Bond Index Agreement Licensing of Dealing, Associate and Registration Members Introduction of Infractions Penalties Guide Release of CP Quotations Process Issuance of Market Bulletin Collection of weekly trade data Release of CP Quotation Rules Website Launch Approval of Bond Listing and Inaugural to Substantive Board (represented by shareholders) 1st All Members’ Meeting on FMDQ Market Architecture Quotation Rules by SEC Formal collaboration Central Bank of Nigeria 21 with & Activation of Transaction Fees Change in Board Members from Nov 2013 Execution of Dealing Membership Trading System (E-Bond) Activation of Quotations Service on website Deployment of Thomson Reuters FX System Daily Market Activity Report Debut of FMDQ Newsletter Publication of OTC Market Turnover Report Introduction of Dealing Members’ League Table the Price discovery trajectory: Launch of FMDQ e-Discovery E-Bond price global display Commencement of bonds listing

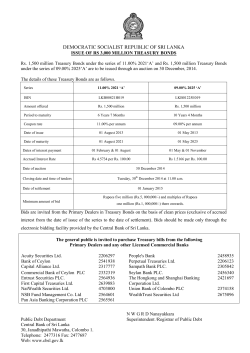

© Copyright 2026