2014 State of Downtown Report - Baltimore Development Corporation

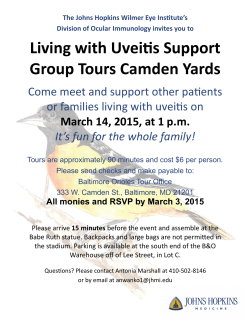

STATE OF DOWNTOWN REPORT 2014 ISSUED MARCH 2015 DOWNTOWN BALTIMORE Station North 2 0 1 4 O N E - M I L E R A D I U S T O TA L S Employment ......................... 123,879 Residents ............................... 41,606 Office Space .........................28M S.F. Hotel Rooms ............................8,000 Bolton Hill State Center Johnston Square Mount Vernon University of Maryland Medical Center Midtown Kennedy Krieger Institute Heritage Crossing Old Town Seton Hill Preston Gardens Cathedral Hill Mercy Medical Center Bromo Poppleton Historic Jonestown UMB Charles Center VA Hospital of Maryland University of Maryland Medical Center City Hall Fells Point Royal Farms Arena Little Italy Inner Harbor Ridgely’s Delight/ Stadiums Harbor East Otterbein Pigtown/ Washington Village Johns Hopkins Hospital Camden Yards Harbor Point SharpLeadenhall South Baltimore Westport One mile radius from Pratt & Light intersection Federal Hill Locust Point Mario Polèse, author of The Wealth and Poverty of Regions: Why Cities Matter, has observed that, “Not so long ago, most urbanists were predicting the demise of downtowns. The data, after all, pointed unambiguously to declining central-city populations and expanding suburban ones in nearly every American metropolitan area between 1950 and 1980. But downtowns didn’t go the way of the dinosaur. In fact, most of them have begun to grow again.” He’s right. Nationally, employment in city centers is growing while suburban employment growth is beginning to decline. Citing numerous studies, Polèse finds that the keys to this growth include a resurgence in business services jobs, neighborhoods that are active 24 hours a day, and, perhaps most importantly, a mixed-use symbiosis created when people cluster where they work with where they live. Downtown Baltimore, in 2014, continued to capitalize on all these trends, growing its employment and residential base, adding retail, welcoming performance venues like Chesapeake Shakespeare Theatre, and seeing increased private sector activity that included high-value commercial real estate transactions and progress on long-awaited projects such as One Light Street, Mechanic Center, and the former McCormick site. T O P 2 5 L A R G E S T U . S . M E T R O A R E A S : O N E - M I L E R A D I U S S TAT I S T I C S AVERAGE HOUSEHOLD INCOME POPULATION 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 New York San Francisco Chicago Philadelphia Los Angeles Seattle Boston Washington, DC Baltimore (8) San Diego Denver Miami Minneapolis Houston Portland Atlanta Pittsburgh Orlando Dallas Charlotte Phoenix St. Louis Tampa San Antonio Detroit 188,496 119,707 92,316 80,406 77,013 61,211 49,620 44,120 41,606 40,486 38,873 36,819 34,856 24,144 22,787 20,163 18,145 17,986 16,488 16,202 15,313 12,231 10,627 9,061 6,881 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 New York Washington, DC Chicago Boston Charlotte Houston Philadelphia Tampa Dallas San Diego San Francisco Miami Minneapolis Seattle Baltimore (14) Portland Denver Pittsburgh Orlando San Antonio Atlanta St. Louis Los Angeles Detroit Phoenix $157,807 $120,671 $119,862 $115,738 $97,266 $93,140 $91,570 $86,941 $82,168 $76,310 $74,371 $73,258 $71,870 $71,793 $71,625 $71,298 $68,751 $63,177 $58,120 $56,639 $56,269 $54,089 $44,781 $44,407 $37,922 HOUSEHOLDS OVER $75,000 ANNUAL INCOME 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 New York Chicago San Francisco Philadelphia Seattle Washington, DC Boston Denver San Diego Minneapolis Miami Los Angeles Baltimore (12) Dallas Portland Charlotte Houston Orlando Tampa Atlanta Pittsburgh St. Louis Phoenix San Antonio Detroit 67,566 31,114 21,141 18,243 12,811 12,790 12,685 7,924 7,892 6,566 6,321 5,916 5,854 4,111 3,708 3,215 2,977 2,614 2,413 1,726 1,655 1,597 817 736 706 EMPLOYMENT 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 New York 1,193,065 Chicago 378,993 Washington, DC 308,639 Boston 244,628 Philadelphia 231,937 San Francisco 217,366 Seattle 211,125 Houston 199,186 Los Angeles 149,091 Minneapolis 135,186 Denver 133,089 Baltimore (12) 123,879 Dallas 121,460 Pittsburgh 110,539 Atlanta 99,413 Charlotte 81,047 San Diego 78,773 San Antonio 77,621 Detroit 65,011 Miami 59,944 Phoenix 58,689 Orlando 56,752 St. Louis 55,235 Tampa 43,145 Portland 38,896 ( ) - last year’s ranking *Source: Claritas 2 01. OFFICE SPACE There was a good deal of commercial activity in 2014 as international investors capitalized on Downtown’s growing market value, particularly in Charles Center where almost twenty major new projects were underway and companies such as Cigna and KAO announced they would be moving into Downtown and signed leases totaling more than 35,000 square feet. Three office towers sold for strong prices and multiple additional properties were listed by year’s end. Pratt Street office occupancy rates remained in the high 90th percentile last year in 2014, led by companies like R2Integrated (15,400 square-foot expansion) and Shapiro Sher Guinot & Sandler (new 15,000 square-foot lease). Last year also marked a significant turn-around for Downtown in terms of attracting large companies from suburban Maryland. Pandora, KAO, and MAIF were among the firms that departed locations in adjacent counties and relocated into Downtown to take advantage of its diverse and growing pool of worker talent. Downtown-wide, some commercial brokerage analyses saw vacancy rates rise modestly, while others observed a decrease. Averaging these out, the vacancy rate was up very slightly to 16.8% in 2014 versus 16.1% in 2013, with Class A lease rates remaining unchanged at $22-$27 per square foot. NOTABLE LEASE TRANSACTIONS Name Address OneMain Financial 100 International Dr. Relocation Financial Services Firm Pandora Jewelry, LLC Maryland State Retirement and Pension System Downtown Partnership of Baltimore, Inc. Behavioral Health System Baltimore Cigna CBRE Group, Inc. Shapiro Sher Guinot & Sandler KAO USA Inc. 250 W. Pratt St. 120 E. Baltimore St. 20 S. Charles St. 1 N. Charles St. 111 S. Calvert St. 100 E. Pratt St. 250 W. Pratt St. 100 N. Charles St. Jewelry Manufacturing & Distribution State Government Nonprofit Organization Nonprofit Organization Insurance Company Commercial Real Estate Firm Law Firm Beauty Product Manufacturing & Distribution 2014 VACANCY: NATIONAL & REGIONAL STANDINGS 5% 16.83% 14.97% 13.92% 14.56% 10% 15% New Lease Renewal & Expansion Relocation Relocation New Lease Relocation Relocation New Lease Business Type Downtown Baltimore Baltimore City Baltimore Metro National Sq. Footage 109,156 87,862 72,373 22,027 21,998 21,417 15,971 15,530 14,486 2014 OFFICE MARKET STATISTICS 20% * Downtown Baltimore, Baltimore City, and Baltimore Metro Vacancy Sources: CBRE, Cushman & Wakefield, DTZ, JLL, MacKenzie, Newmark Grubb Knight Frank, and Transwestern * National Vacancy Sources: CBRE, Cushman & Wakefield, DTZ, JLL, and Newmark Grubb Knight Frank 3 Type of Lease Year End 2013 Vacancy Rents – Class A Rents – Class B Year End 2014 16.1% 16.8% $22-$27 $16-$19 $22-$27 $16-$20 * Class A/B Rent Sources 2013: Cassidy Turley, CBRE, Cushman & Wakefield, and Newmark Grubb Knight Frank * Class A/B Rent Sources 2014: CBRE, Cushman & Wakefield, DTZ, JLL, MacKenzie, and Newmark Grubb Knight Frank * Downtown Baltimore Vacancy 2013 Sources: Cassidy Turley, CBRE, Cushman & Wakefield, MacKenzie, Newmark Grubb Knight Frank, and Transwestern * Downtown Baltimore Vacancy 2014 Sources: CBRE, Cushman & Wakefield, DTZ, JLL, MacKenzie, Newmark Grubb Knight Frank, and Transwestern 02. EMPLOYMENT After adding 10,000 jobs in 2012 and more than 9,000 jobs in 2013, Downtown employment increased by approximately 1,600 jobs in 2014. With a total of nearly 124,000 jobs, Baltimore maintained its rank as the 12th largest downtown employment center among the top 25 largest metro areas in the U.S. EMPLOYMENT BY INDUSTRY SECTOR: PERCENT OF TOTAL EMPLOYEES 5% 10% 15% 20% 19% Healthcare & Social Assistance 14% 12% Professional, Scientific & Technical Services Public Administration 11% 8% 6% Accommodation & Food Services Finance & Insurance Information 4% 4% Construction 4% 19% Retail Trade Educational Services Other* * The “Other” category consists of the following sectors: Agriculture, Utilities, Manufacturing, Wholesale Trade, Transportation and Warehousing, Real Estate, Management of Companies, Administrative, Other Services, and Arts Entertainment and Recreation. Each of these categories consisted of less than 5% of total employment * Source: Claritas 4 03. HOUSING Downtown’s overall apartment occupancy rate was a strong 94%. A lack of available new units constrained supply, capping 2014 net population growth to just 635 people despite continued strong demand. Three large new buildings hit the market – 301 N. Charles (96 units), 520 Park Avenue (171 units), and The Lenore (102 units). Each has been leasing up ahead of schedule. Downtown’s overall population rose to just over 41,000. Despite the increase, Downtown’s national rank for population dropped one spot to 9th, as Washington, DC rose to number 8 with 44,000 residents. The rate of Downtown’s population increase is expected to rise more quickly as the pace of residential delivery speeds up. Almost 5,100 units are in the pipeline through 2017. Major properties expected to hit the market in 2015 include 10 N. Calvert (188 units), 10 Light Street (420 units), and 26 S. Calvert (167 units). NOTABLE RESIDENTIAL OPENINGS Project Name Address Project Type Housing Type The Lenore 114 E. Lexington Street Conversion Rental — Market Rate # of Units 102 301 North Charles 520 Park 301 N. Charles Street 520 Park Avenue Conversion & New Construction Conversion Rental — Market Rate Rental — Market Rate & Affordable Housing 96 171 FOR SALE HOUSING MARKET SUMMARY Housing Type Properties Sold Average Sale Price Median Sale Price Condo 101 $374,131 $280,000 Townhome 312 $298,931 $276,250 AT THE END OF 2014 93.7% OF THE APARTMENTS *Source: MRIS THAT ARE AVAILABLE IN DOWNTOWN CLASS A APARTMENT BUILDING RENTAL RATES Apartment Size Average Price per S.F. Studio $2.68 1 Bedroom 2 Bedroom 3 Bedroom All unit types $2.21 $2.04 $2.29 $2.20 * Includes 13 buildings within the one-mile radius defined by the following criteria: built after 1995; 100 units or greater; building amenities and quality finishes in units 5 BALTIMORE WERE RENTED 2014 DOWNTOWN HOUSING PIPELINE Residential projects that were under development at the end of 2014. Station North Bolton Hill State Center Johnston Square Science + Technology Park at Johns Hopkins Mount Vernon University of Maryland Medical Center Midtown Kennedy Krieger Institute Heritage Crossing Old Town Seton Hill Preston Gardens Cathedral Hill Poppleton Mercy Medical Center Bromo Historic Jonestown UMB UMB Biopark Charles Center VA Hospital of Maryland University of Maryland Medical Center Hollins Market Johns Hopkins Hospital Washington Hill City Hall Royal Farms Arena Little Italy Inner Harbor Ridgely’s Delight/ Stadiums Fells Point Pigtown/ Washington Village Harbor East Otterbein Camden Yards Harbor Point SharpLeadenhall South Baltimore Westport Residential properties in the pipeline through 2017 One mile radius from Pratt & Light intersection Federal Hill Locust Point 04. HOSPITALITY & HOTELS The Star Spangled Spectacular and strong convention attendance improved hotel performance across indices, with an impressive average occupancy rate of 69% – nearly back to pre-recession levels. Once again, Downtown hotels outperformed the region and the nation in terms of occupancy, average daily room rates, and revenue earned per room. NOTABLE HOTEL OPENINGS Project Name Address Hyatt Place – Baltimore / Inner Harbor 511 S.Central Ave. Conversion/Renovation Project Type No. of Rooms 208 DOWNTOWN *Source: Smith Travel Research 7 ROOMS 149 REV PAR $74.28 $115.32 ADR OCCUPANCY REV PAR BALTIMORE METRO 64.4% $121.36 65.6% 0 $114.60 $50 25% 69.0% 50% $165.99 $100 $79.56 ADR ADR OCCUPANCY 75% REV PAR $150 OCCUPANCY 100% 492 HOTEL UNDER CONSTRUCTION HOTEL PERFORMANCE $200 IN 2014 THERE WERE NATIONAL MORE ROOMS IN PLANNING 05. RETAIL Photo by Mark Dennis More than 90 restaurants and retailers opened, or signed leases, in 2014. With employment and residential densities that rank among the top 20 downtowns nationally, the most transit options within the region, and an average household income of $71,600, Downtown Baltimore is an increasingly strong retail location that should become stronger as new residents drive demand, national retailers look more aggressively for urban space, and office and apartment developments continue to add ground-floor retail space. NOTABLE RETAIL OPENINGS AND LEASES Name Address Business Type Status* AGGIO 614 Water St. Restaurant Open Blue Moon Café Chick-fil-A Chicken Rico Dinosaur Bar-B-Que Encantada Family Meal Floyd’s 99 Barbershop LUSH Fresh Handmade Cosmetics Madewell Maiwand Grill Nalley Fresh Shake Shack 1024 Light St. 400 E. Pratt St. 55 Market Pl. 1401 Fleet St. 800 Key Hwy. 621 E. Pratt St. 511 S. Central Ave. 1001 Aliceanna St. 811 Aliceanna St. 324 W. Baltimore St. 400 E. Pratt St. 400 E. Pratt St. Restaurant Restaurant Restaurant Restaurant Restaurant Restaurant Retail Retail Retail Restaurant Restaurant Restaurant Coming Soon Coming Soon Open Coming Soon Coming Soon Open Coming Soon Open Open Open Coming Soon Open * Family Meal, Madewell, and Shake Shack opened in Winter 2015 RETAIL VACANCY RATES 2% 7.1% 5.0% 10.2% 4% 6% 8% 10% THE TOTAL AMOUNT OF 2014 RETAIL SALES IN DOWNTOWN BALTIMORE WAS National Baltimore Metro 1.58 BILLION D O L L A R S Downtown* – Multi-tenant Projects *Includes Lockwood Place, Harborplace, The Gallery, and Harbor East *Source: Claritas 8 WELCOME BACK CHARLES CENTER Charles Center is more than Downtown’s historic core. A host of development projects are adding new residents, theatres, restaurants, and employees. 2014 COMPLETED 1. Chesapeake Shakespeare Company 7 S. Calvert Street Conversion to 260-seat theater. Developer: Chesapeake Shakespeare Company 2. 25 S. Calvert Street Landscaping and fencing of vacant lot. Developer: Downtown Partnership of Baltimore 3. Water & Light Apartments 25 Light Street & 104 Water Street Conversion to 14-unit market rate apartments. First floor retail retained. Developer: Republic Investment Company 4. Lord Baltimore Hotel 20 W. Baltimore Street Renovation of former Radisson hotel. 12. Calvert & Water Apartments 26-36 S. Calvert Street & 31 S. Grant Street Conversion to 189-unit market rate apartments and first floor retail. Q2 2015 delivery. Developer: PMC Property Group 13. Equitable Building 10 N. Calvert Street Conversion to 188-unit market rate apartments & first floor retail. Q2 2015 delivery. Developer: JK Equities 14. The Munsey Apartments 7 N. Calvert Street Elevator, lobby and unit renovations of market rate apartments. Ongoing. Developer: Village Green Developer: Rubell Hotels 5. The Lenore 114 E. Lexington Street Conversion to 102-unit market rate apartments and first floor retail. Developer: Baybridge Properties 6. 301 N. Charles Street Conversion to 97-unit market rate apartments. Developer: PMC Property Group 7. McDonald’s Facade Improvement 101 E. Baltimore Street Restoration of historic building. Developer: McDonalds Corporation IN PROGRESS 8. Crowne Plaza Hotel 1 E. Redwood Street Conversion to 150-key Crowne Plaza Hotel and first floor retail. Q3 2015 delivery. Developer: Tran Group 9. 10 Light Street Conversion to 420-unit market rate apartments and 25,000 SF retail. Q2 2015 delivery. Developer: Metropolitan Baltimore 10. Mechanic Centre 1 W. Baltimore Street Mixed-use, 306-unit market rate apartments; 110,000 SF retail; 404 parking spaces. 2016 delivery. Developer: David S. Brown Enterprises, Ltd. 11. Wilkes Lane Landscaping, pedestrian lighting, Wi-Fi, and outdoor dining area. Developer: Downtown Partnership of Baltimore & adjacent owners PLANNING 15. Hotel RL Baltimore 207 E. Redwood Street Conversion to 130-key hotel. Q3 2015 delivery. Developer: Red Lion Hotels 16. Courthouse Plaza 100 block of St. Paul Street Renovation and beautification. Q4 2015 delivery. Developer: Downtown Partnership of Baltimore & City of Baltimore 17. Preston Gardens St. Paul Street Reconfiguation, stabilization and beautification project. 2016 delivery. Developer: Downtown Partnership of Baltimore, City of Baltimore & State of Maryland 18. Liberty Park 144 W. Fayette Street New construction, 92 mixed-income apartments. 2016 delivery. Developer: New Urban Equities 19. Central Savings Bank 1 E. Lexington Street Conversion to 26-unit market rate apartments and 9,000 SF retail. 2016 delivery. Developer: Poverni Sheikh 20. 225 N. Calvert Street Conversion to 350-unit market rate apartments. 2016 delivery. Developer: Monument Realty 21. One Light 5-11 Light Street & 105-115 E. Baltimore Street Mixed-use, 362-unit market rate apartments; 287,000 SF office; 9,000 SF retail; 657 parking spaces. 2017 delivery. Developer: Metropolitan Baltimore 9 Fayette St Hopkins Plaza Royal Farms Arena Lombard St Grant St Baltimore St Calvert St Wilkes Ln War Memorial Gay St Lexington St Holliday St St St Paul St Preston Gardens Guilford St Fayette St Center Plaza Charles St Lexington St N. L iber ty Clay St 10 PRESENTING SPONSORS: LEADERSHIP SPONSORS: PATRON SPONSORS: ARCHITECTURE LANDSCAPE ARCHITECTURE INTERIOR DESIGN PLANNING FRIEND SPONSORS: WRH Property Management, LLC This report is produced by Downtown Partnership of Baltimore, which is solely responsible for its content. Data is collected by, or on behalf of, Downtown Partnership from multiple sources and covers activity within a one-mile radius of the intersection of Pratt and Light streets. Charts, graphs, maps, and images are the property of The Partnership unless otherwise noted. Downtown Partnership of Baltimore is a 501(c)(6) non-profit incorporated in the State of Maryland. It has approximately 650 member firms throughout the midAtlantic region from dozens of industry sectors. For more information about Downtown Partnership, its reports, or to become a member, please visit www.GoDowntownBaltimore.com, call us at 410.244.1030, or email us at [email protected]. You can also find Downtown Partnership of Baltimore on Facebook and twitter @DowntownBalt. DESIGNED BY INSIGHT180 BRANDING & DESIGN

© Copyright 2026