Future of Automotive: SME Supply Chain Opportunities

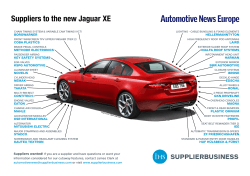

THE FUTURE OF AUTOMOTIVE THEBUSINESSDESK.COM SUPPLEMENT | WEST MIDLANDS | APRIL 2015 Opportunities for the SME Supply Chain Featuring Automotive priorities for new government. 5 Maximising skills for future success. 10 Is reshoring the way ahead? 15 in association with THE FUTURE OF 2 West Midlands Supplement Editor Foreword AUTOMOTIVE April 2015 Contents Sponsor forewords: Chris Barlow, MHA Bloomer Heaven; Sarah Riding, Irwin Mitchell; Andy Moss, Lloyds Bank. 3-4 T HE growth of the automotive industry during the 20th century became synonymous with the fortunes of the West Midlands economy as a whole. ➔ o much of the success of the region is due to S the health of automotive industry that when that sector sneezes then the whole of the West Midlands catches a cold. The next Government. Policies to support the growth of the automotive industry must be a priority. 5 ➔ Case study: Cube Precision Engineering. How investment enabled this start-up to experience year-on-year growth. 8 ➔ Bridging the skills gap. Skills challenges must be met if automotive growth is to be maintained. Case study: Sertec. How a ‘grow-your-own’ approach is sustaining this key supplier. 10 ➔ 13 ➔ Reshoring: The way ahead? Will firms have to bring more work in-house to guarantee business? 15 ➔ Case study: Barkley Plastics. Supplier on course for record turnover after reshoring success. 17 ➔ Round Table: Where are the growth opportunities? Can the SME supply chain meet future demand and is industry ready to help? 19 Can the SME supply chain meet the future demands of the automotive sector? This was graphically illustrated a decade ago with the collapse of MG Rover. A legacy of under-investment and poor product eventually took its toll and it was left to the efforts of a special taskforce to salvage what was worth saving. But for many, 2005 sounded the death knell for the Midlands motor industry. Still on life support, the industry was dealt a further setback just a few years later with the onset of global recession. That the industry survived such unprecedented events is testament to its strength and the resilience of its supply chain. Since 2009 there has been investment and expansion on an hitherto unseen scale as global demand for British-built vehicles has soared. Less anyone think expansion is solely down to the efforts of one business – Jaguar Land Rover – think again. Yes, JLR has been responsible for billions of pounds of new investment and the creation of thousands of new jobs but then BMW, Ford, Nissan, Honda, Toyota, Vauxhall and Volkswagen have all illustrated their faith in the abilities of the UK automotive industry. Now just weeks away from a General Election and a new Government set to take office, thoughts are turning to what the future may hold. Export demand for UK-built cars is faltering because of the situation in the Eurozone but domestic demand continues to fuel growth – the domestic market has just witnessed its strongest month this century. Therefore it will be incumbent on the new Government to ensure this growth continues. In doing so it will have to implement measures to support the supply chain by overcoming skills shortages and determining what levels of financial support it can inject into development programmes. ➔ TheBusinessDesk.com has joined forces with Lloyds Bank, MHA Bloomer Heaven and Irwin Mitchell to assess the strength of the automotive supply chain whether it is capable of meeting future demands. I hope you find the information useful. Cornwall House, Lionel Street, Birmingham B3 1AP. Duncan Tift, deputy editor, TheBusinessDesk.com – West Midlands Editor: Andy Coyne [email protected] « Previous | Back to Contents | Next » Land of opportunity 3 Sponsor forewords Automotive success key to economy THE West Midlands has a proud manufacturing heritage. Recognised and respected throughout the world for its quality and innovation. The success we have built up in the automotive sector has been at the core of the region’s economy for many years, not only the finished product but the vast array of component parts designed and made right here. Today the automotive industry is still thriving and the recent resurgence of JLR is a perfect example of how the innovation and skill base the region can offer from component parts to engines is still valued and developing. At MHA Bloomer Heaven we too are proud of our long history providing accountancy and business advisory services to manufacturers based in the region. We have advised clients for over 135 years and during that time we have particularly supported SME’s and family owned businesses navigate their way through the opportunities that arise across markets whether on the doorstep or overseas. Today accountancy and business advisory services are not just about tax planning and preparing spreadsheets filled with profit and loss analysis. At MHA Bloomer Heaven we work hard to provide our manufacturing clients both within the automotive sector and beyond with a wide range of services that we believe not only enhance our service but offer clients insights and analysis that helps them make better decisions for their business. Chris Barlow managing director, MHA Bloomer Heaven We have staged a series of events entitled “Britain’s Future” with key partners that not only give clients an opportunity to hear from industry experts on key issues facing the sector but an opportunity to come together and network and collectively share their experiences and challenges. ‘All successful manufacturers need to be innovative and be thinking about the market requirements of the future.’ All successful manufacturers need to be innovative and be thinking about the market requirements of the future. Experts will point towards the need for investment in Research and Development. This can be a challenging prospect. At MHA Bloomer Heaven we have a team of experts who help our clients identify the best way to finance this vital element in securing their business growth and can help navigate them through the complex landscape of grants and tax breaks that exist. Many of our manufacturing clients now see their market opportunity as a national and in many cases global one. Times have changed when small manufacturers could develop successful businesses on a local marketplace only. That is why our national association, MHA, is important. This not only gives us a national presence but access to specialists and resources across the UK and internationally in 130 countries. « Previous | Back to Contents | Next » We believe that manufacturers need a new type of support from their accountants and business advisors. It is more than the ability to produce accounts it is an ability to understand their business and the opportunities and challenges they face. It is about added value whether that is providing expertise through events or insight into the R & D landscape. But most importantly it is about building up trust and mutual respect- like everything in life it is about positive and effective relationships- ensuring we achieve that will always be our priority. Supply strength must be maintained OVER the last couple of decades, the UK automotive sector has changed immeasurably. We have moved from an era of rapid decline in outputs to a reinvigorated sector with renewed growth at all tiers and strengthened supply chain resilience. Sarah Riding commercial partner, Irwin Mitchell With a track record of advising clients in the sector, Irwin Mitchell has supported the automotive sector through its evolution and is ideally placed to provide advice and support at all levels of the automotive supply chain. Our market knowledge and understanding of sector specific issues, coupled with legal expertise helps our clients strengthen their position and develop their markets. We have partnered with clients to move traditional manufacturing into hi-tech, IP driven businesses adopting advanced manufacturing techniques across the automotive sector and helping them achieve competitive advantage and their growth ambitions. One of the key issues continues to be building resilience in the automotive supply chain. Supply chains in the sector have come under increasing pressure in recent times with the unstable economic climate. Supply chains are now more sophisticated and highly integrated and a failure at any level can seriously impact the rest of the chain. Our commercial and sourcing team regularly advise on both sourcing strategy and backshoring arrangements within the sector. The trend within the automotive sector has tilted more and more towards reshoring as organisations focus more on quality, lead times and innovation. The advantage gained by reducing the time from design to production and the intangible benefit of the supply chain being close by has resulted in a huge change in focus from the offshoring of recent years to local supply chains flourishing. both OEM’s and the SME market on ensuring that supply chains are as robust as possible, have the flexibility to adapt to new market conditions and future proof an organisations’ strategic objectives. The skills shortage remains one of the biggest issues in not only automotive but across the whole of the manufacturing sector and developing a more stable supply chain to attract the strong skills base around it is critical to developing a successful innovation led climate to continue the growth of the automotive industry. Irwin Mitchell has a long standing dedicated manufacturing team and have focussed on recruiting lawyers with a deep and extensive knowledge and experience of work in the manufacturing and automotive sectors. We aim to provide an extension to clients’ management teams, working alongside, rather than for our clients, to deliver best in class advice to our clients. It is of course important to maintain the strength of these local supply chains and our national team regularly advise Investment vital for future success THE AUTOMOTIVE sector is showing a particularly bullish attitude at present, and has emerged from recession in remarkably good shape, thanks in part to a number of Government initiatives in-line with a wider focus on supporting manufacturing in the UK. Andy Moss head of manufacturing - Midlands, Lloyds Bank One of the most vital stimuli has proven to be the establishment of the Automotive Investment Organisation. Spearheading inward investment, it has generated £450million in its first year, 2014, helping to secure 5,600 jobs. This creation of employment is helping to drive the growth of the industry, with 88 per cent of respondents in the first edition of our ‘Fuelling Growth’ industry research report - a survey of business owners, directors and senior managers – intending to create jobs in the next two years, with an estimated total of almost 50,000 new roles. With great job opportunity within the sector, of course, comes a requirement for more skilled workers to fill these new positions. To address the skills shortages in the UK automotive industry, new funding announced by the Business Secretary, Vince Cable, back in April 2014 is helping to enhance supply to meet demand, ensuring that quality workers are on hand to fill the newly created roles. As with all industries, an increase in overseas trading and exporting remains vitally important to encouraging growth within the automotive industry. Of all the vehicles built in the UK last year, more than three quarters were exported to foreign markets, and 74 per cent of respondents in our survey have cited further plans to invest in or engage « Previous | Back to Contents | Next » with new international customers within two years. As the manufacturing industry enjoys a renaissance as the economic recovery continues, the automotive sector is showing a particularly optimistic attitude. There are many encouraging statistics in our report, but perhaps the most promising is the fact that a further 18 per cent average growth over the next two years has been forecast by those surveyed. This, combined with the increased appetite to recruit and export, highlights that automotive manufacturing is a genuinely thriving industry, and the confidence of leading management figures is heightening expectation that this will continue in the coming months. ➔5 Politicians must sustain automotive growth T HE massive investment ploughed into the UK automotive industry in the first quarter of 2015 is further proof – if proof were needed - of the confidence vehicle manufacturers have in global demand for their products. It is also an indication of the level of confidence they have in the capabilities of British firms and their workers to ensure their goals are achieved. As the first three months drew to a close more than £1 billion of investment had been announced – the majority of it in the West Midlands. Jaguar Land Rover is to invest £600m into facilities at its Castle Bromwich plant for production of the new Jaguar XF – together with an expansion of its research and development facilities at Whitley; London Taxi Company has confirmed plans for a £250m plant at Ansty Park in Coventry to build an allnew electric taxi; and Honda is spending £200m to turn its Swindon plant into the global production hub of its next generation Honda Civic. While this has been done to fulfil long-term global strategies, the UK is a principal beneficiary of the investment. Not that its own car market is a minor one. In March 2015, 492,774 new cars were registered in the UK – the single biggest month this century. All this is a far cry from the situation faced by the industry just six years ago when several manufacturers were forced to go cap in hand to the government to ask for funding support and in an attempt to prop up flagging markets, the previous Labour administration introduced a scrappage scheme to encourage buyers to purchase new vehicles. Now, as the UK prepares to usher in a new government – whatever its make-up – the politicians manning the various ministries will be faced with a radically different industry. Nevertheless, important decisions will need to be made in order to determine « Previous | Back to Contents | Next » The sustained growth of the UK automotive industry will form a vitally important component of the next government’s industrial growth plan – therefore what policies will it need to consider to ensure that success continues? the levels of support required to ensure the industry continues with its growth. Trade body, The Society of Motor Manufacturers and Traders has already outlined its list of priorities for the new government. It said with 402,193 cars rolling off production lines in the UK during the first three months of 2015, car ➔ Professor Jon King is Research and Development Manager for Tata Steel. He is also responsible for the new R&D campus at the University of Warwick. He said there were many opportunities for growth within his company provided it could engage more Tier 2 and Tier 3 suppliers. However, he acknowledged this would not be easy. As such, successful collaboration with the government and other industry bodies will be crucial to achieving this goal. production is expected to exceed prerecession levels this year, buoyed by a strong export market that delivered revenues of £26.2 billion in 2014. In terms of industrial strategy therefore, it said the continued delivery of the Automotive Sector Strategy through the Automotive Council was essential if there was to be continued development of the industry’s supply chain, skills, technology and business environment. With technology - including ultra-low emission vehicles and connectivity advancing at such a rapid pace, it said investment in innovation continued to be a major priority. Increasing the rate of R&D (research and development) tax credit and bolstering funding for long-term initiatives such as the Advanced Propulsion Centre will help UK manufacturers lead this innovation, it adds. Investment in skills development is also critical to ensure the UK workforce has the capabilities to develop and manufacture the next generation of technologies. “There are plenty of opportunities for suppliers to grow their business. We have identified there may conservatively be £2 billion of opportunities for T2s and 3s in the supply industry,” he said. “However, the important thing for many of these companies is how they tap this. We need to improve our levels of communication so we can engage more of these firms. We have got to move from the generic to the specific and I think this will be an important priority for the new Industry Minister come June and July. “We have to convince smaller companies that if they are ambitious then they will quickly find the help they need to grow. For example, there are over 140 different government funding programmes which are available to manufacturers and this may change with the new government but fundamentally, how do the individual companies know what is best for them. Professor Jon King research and development manager, Tata Steel “We must end the confusion and make it easier for firms to identify the help they need.” King is also a member of The Automotive Council (AC), the body established in 2009 to enhance dialogue and strengthen co-operation between the UK government and the automotive sector. He said the body had been important in helping to re-establish the industry on a sound footing and was responsible for a number of key initiatives that would secure future growth. As such, he said future governments should embrace the role of the council and ensure its good work was allowed to continue. ➔ ‘We have to convince smaller companies that if they are ambitious then they will quickly find the help they need to grow.’ The SMMT, in common with many others, has also underlined the importance of the UK maintaining its links with the European Union. In a recent statement, SMMT chief executive Mike Hawes said: “Membership of the European Union is critical to the UK automotive industry; the (automotive) sector’s competitiveness is dependent on access to the European single market, integrated supply chains, international trade agreements, common regulations, funding for innovation and free movement of labour. “SMMT members want to see reform of the EU with greater emphasis on industrial competitiveness and better regulation but believe membership of the EU remains best for business.” « Previous | Back to Contents | Next » He pointed to the work carried out on the Advanced Propulsion Centre at the University of Warwick as an example of how the industry, working in collaboration with the government could achieve significant results. The role of the APC is to position the UK as a centre of excellence for low carbon propulsion development and production. The automotive industry is ploughing £500m – matched by the government – into the new centre so it can research, develop and commercialise the technologies for the vehicles of the future. Backed by 27 companies in the sector, including supply chain companies, the commitment is expected to secure at least 30,000 jobs currently linked to producing engines and create many more in the supply chain. The work forms part of ‘Driving Success’ – an industrial strategy for growth and sustainability in the UK automotive sector, published jointly by the government and industry. Professor Richard Parry-Jones, joint chair of the AC, said: “Businesses prefer With the next generation of vehicles set to be powered by radically different technologies we need to maintain this momentum and act now. Our industrial strategy will ensure we keep on working together to make our automotive industry a world leader.” It would appear highly likely that in view of the steps already laid, the next government will look to continue with this kind of project. It is an approach that has been welcomed by the banking sector. On the strength of the commitment from the government, the British Bankers Association established an automotive forum to enable it to work with the industry to create new opportunities for growth both for the OEMs and the supply chain. “In turn, this will enable them to go to the banks and funding organisations in a stronger position because they can say with certainty what they need the financing for and how their growth strategies are to be achieved.” The 27 companies backing the APC are: Bentley, BMW Group, Bosch, BP, Castrol InnoVentures, Caterpillar, Ford, GKN, High Value Manufacturing Catapult, Intelligent Energy, JCB, JLR, Lotus, MAHLE Powertrain, McLaren, Millbrook Proving Ground, MIRA, Morgan, Nissan, Optare, Productiv, RDM Ltd, Ricardo, SMMT, Tata Motors, Transport Systems Catapult Ltd, and West Midlands Rachel Eade, national automotive sector lead for the Manufacturing Advisory Service – and a fellow member of the AC – said support opportunities were available but it wasn’t just a question of throwing money at something in the Rachel Eade hope it would sort national itself out. automotive sector lead, “Companies at all Manufacturing levels look to support Advisory – recent history has Service shown us that – but it has to be more structured and about how we cascade these opportunities down to suppliers,” she said. ‘What we are all waiting to find out is what the new government will do to help with these opportunities and to stop work going overseas.’ consistency, stability and a clear path to the future in order to make investment plans. Driving Success sets out how industry will work together with the government over the next 20 or 30 years. This is critical to sustaining and growing a thriving UK automotive sector in a highly competitive global industry.” Vince Cable, who was fellow joint-chair of the AC during his tenure as Business Secretary, explained the ethos behind the initiative. He said: “The UK automotive sector has been incredibly successful in recent times, with billions of pounds of investment and new jobs. This has been achieved by government and industry working together. Manufacturing Consortium Ltd. “The kind of success envisaged by the Automotive Council won’t be achieved overnight – these are 10-year strategies that are being implemented,” said Prof King. “Therefore it is vital that this type of work be allowed to continue and we will be asking the next government to ensure that it does.” He said the benefits to the supply chain would be considerable because the advances being made by the APC would in turn, provide future growth opportunities for the firms working within it. “We are helping to create the future business cases for these firms,” he said. « Previous | Back to Contents | Next » “We will be looking about how these programmes can be improved; about what’s best for suppliers.” She said if the industry played its part in feeding back what it needed then hopefully something constructive would be done. “Pre-election we’re in a bit of a famine as regards grants programmes but post-election this is likely to be different because there will be new programmes, new releases of money,” said Eade. “There is now a window of opportunity to route this support back into the industry. What we are all waiting to find out is what the new government will do to help with these opportunities and to stop work going overseas.” Following the purchase of the machinery, the firm has been able to speed up its manufacturing process by 30%. This has enabled it to complete customer orders at a faster rate and increase its capacity to take on new contracts. ➔8 The company, which has a turnover of around £4m, also has plans to create additional jobs by expanding still further over the next six months. Neil Clifton, [left] with Mark Meakin, relationship manager at Lloyds Bank Commercial Banking Case study “The reduction in cycle times is Investment enhances production and creates jobs ESTABLISHING an engineering firm in the teeth of the deepest recession in living memory is a brave step by any measure. However, Rowley Regis-based Cube Precision Engineering is not your typical business. Driven by a strong management, headed by managing director Neil Clifton, the business, which manufactures press tools and large CNC machined parts, has gone from strength-to-strength and in its short existence has seen nothing but year-onyear growth. It quickly recognised that if the business was to stay competitive in its chosen supply sectors – automotive, aerospace and defence – it needed regular investment in order to grow its capabilities. Neil Clifton managing director, Cube Precision Engineering Clifton, managing director at Cube Precision Engineering, said: “We had been experiencing a high level of demand for our large CNC machining components and, in order to fulfil this, we needed to increase our manufacturing capabilities by purchasing new machinery. Recognising that commitment, the business has been backed by Lloyds Bank, which has hailed it as a role model for others to follow. The bank stepped in to help the company in 2013 when it secured a significant new exporting contract. Cube Precision used the £200,000 funding facility from the bank to fulfil its export contract with German business Westfalia to manufacture parts for BMW. When it looked to implement its latest expansion, the firm again turned to Lloyds for help. Clifton told the bank that in order for the business to grow then it needed to expand its product range. It also identified the need to invest in new machinery to speed up its manufacturing process in order to meet demand. Recognising the firm’s capabilities, Lloyds Bank Commercial Banking provided £460,000 of asset finance to support the purchase of two new milling machines for cutting large, complex components. Additional funding of £115,000 was secured through the Regional Growth Fund, which supports businesses looking to invest in new assets and create local economic growth. The fact the firm was able to create four new jobs was a key factor in it securing the additional funding. « Previous | Back to Contents | Next » significant and this is straight into the bottom line, meaning these machines will pay for themselves in a couple of years. “The team at Lloyds Bank have played an instrumental role in helping us make this investment and we are now able to manufacture our products at a timelier rate. Moving forward we plan to pursue a growth-through-acquisition strategy by vertically integrating our suppliers into the business, and we are grateful for the bank’s support.” Keith Moore, regional manager at Lloyds Bank Commercial Finance, said: “The asset finance facility was an ideal option for Cube Precision as it allowed it to purchase new machinery without putting pressure on its working capital, giving the business a strong platform to fulfil its future growth ambitions.” Mark Meakin, relationship manager at Lloyds Bank Commercial Banking, said: “Cube Precision is a well-established local business in a highly skilled area of manufacturing, and this investment in new machinery marks an important milestone for the business in achieving its growth plans.” Made for Manufacturers MHA Bloomer Heaven’s clients in manufacturing and engineering benefit from our team’s expertise in the sector. Our advice enables businesses to produce. We help by advising on... Business structure Bank and financier negotiations, managing cash flow Tax initiatives; Research & Development, Capital Allowances and Patent Box Accountancy, Audit and Tax Compliance To find out how we can help your business contact Chris Barlow, Managing Director & Head of Manufacturing, MHA Bloomer Heaven t: 0121 236 0465 e: [email protected] w: www.mhabloomerheaven.co.uk ➔ 10 Working hard to bridge the skills gap “I F WE want to keep the work we have and maximise new opportunities then we have to ensure we develop our skills base.” These are the words of Rachel Eade, national automotive sector lead for the Manufacturing Advisory Service and a leading advocate for skills development. She said that while the UK automotive industry was currently experiencing almost unprecedented growth, with vehicles being sold in record numbers around the globe, there was a cloud on the horizon which threatened to derail that progress within a very short space of time – the skills issue. Rachel Eade national automotive sector lead, Manufacturing Advisory Service In common with firms across the manufacturing spectrum, many automotive suppliers have aging workforces, a legacy of needing to retain skills within the business. Sadly for the industry, as the recession began to bite deeper firms were forced to trim costs from their businesses if they were to survive and for many this meant to loss of training programmes – always considered a short-sighted decision as when the boom times return then the business is immediately resource-poor and ill equipped to meet the challenges required for growth. However, this is just one element of the problem. Attracting young people into the manufacturing industry as a career is proving tough, with many teenagers incorrectly identifying the industry as a dirty, smelly unrewarding profession and one unlikely to be much fun. Many prefer to pursue careers in the service sector, leaving manufacturing vulnerable to an ever widening skills gap. The pattern has been graphically illustrated within the last few weeks, « Previous | Back to Contents | Next » The UK automotive sector is experiencing major success with its vehicles being sold in record numbers around the globe, however, sustaining success depends on attracting new talent to the industry. with the Black Country University Technology College announcing its closure just four years after opening, citing an inability to attract teenagers to pursue its engineering courses. It was only five years ago that such institutions were being heralded as the saviour of the manufacturing sector. However, if such a facility cannot attract sufficient pupils from what is, a manufacturing heartland then the situation may be worse than many ➔ fear. “As an industry, we need to improve our communication skills and show youngsters that the manufacturing industry is one that offers a rewarding career,” said Eade. already taking on record numbers of apprentices and graduates, the phased introduction of new production programmes would mean further job opportunities for some time to come. “We all talk about the need to bring in young people and upskill existing workers; we all talk about the need to bring in skilled people from other sectors – but the time for talking is over. We need action… now. “The investment we have pledged we haven’t had the full benefit of yet,” he said. “We are not alone out there in wanting skilled labour – the rail industry, aerospace, oil & gas, the nuclear industry are all looking to recruit and so if we don’t attract the future talent then there are plenty of opportunities elsewhere – and where will that leave us? “We have to become better at promoting manufacturing in the UK; promoting the career paths that exist within the industry.” Mike Mychajluk supply chain development manager in government programmes, Jaguar Land Rover Mike Mychajluk, supply chain development manager in government programmes, Jaguar Land Rover, said even within a business of the size of JLR, skills were a factor that could not be ignored. “Skills are an issue, there’s no denying that and so we have to adopt the right measures to bridge the gap,” he said. “The development of new facilities at Solihull with the XE and the F-Pace hasn’t flowed through yet so it hasn’t formed any part of data studies.” The company celebrated the launch of production of the Jaguar XE at Solihull this month, following a major investment. The cascade effect from this will be a significant boost for the industry and the supply chain but this is just one element of the company’s latest growth. It has also announced a £600m expansion of production facilities at Castle Bromwich for the new Jaguar XF and is set to double the size of its research and development facilities at its Coventry base. Mychajluk said the glamorous profile enjoyed by the company meant it had little difficulty attracting apprentices. However, he said it recognised this was not the case for the majority of the industry. Recognising its unique position to be a force for good, he said that when the company went to skills shows or recruitment fairs then it would often invite some of its key suppliers to accompany them to their stand. He said if people could be educated that it was often a lot more exciting to work at some of the supply companies rather than at JLR itself, where a lot of the work was just final assembly and project management then the better that would be for the industry as a whole. The company is also investigating whether it may be possible to initiate a database of the apprentices which it does not take on. This could then be shared with the rest of the industry. “We get asked by many SMEs what happens to the apprentices which we don’t take on,” said Mr Mychjaluk. “JLR now has two people focussed on supply chain development and helping firms meet their skills needs is an ➔ area we are interested in. ‘We have to become better at promoting manufacturing in the UK; promoting the career paths that exist within the industry.’ “For us, being part of the EU is a great benefit because this enables us to pull in a wealth of skilled labour. If you walk across the shopfloor at Jaguar Land Rover then you will hear a variety of different accents – and with a name like mine, I should know. “An issue we have to be wary of is that the majority of Tier 1 suppliers are foreign-owned and therefore UK skills development isn’t that much of an issue for them.” With the rapid growth of JLR he said skills development had to be a priority for the business and the good thing so far as the future of the company – and the wider industry – was concerned was that much of its latest expansion had yet to filter through. Therefore while the company was « Previous | Back to Contents | Next » “We are encouraging our suppliers to visit our plants to show them what goes on and to help them better understand their role in our supply chain and how it benefits our business.” The willingness to collaborate in such a way is already proving beneficial to suppliers such as Sertec (see separate case study), Automotive Insulations and Rosti McKechnie. However, not everyone in the supply chain is in a position to do this. Paul Cadman managing director, Futura Design Paul Cadman, managing director of Oldbury-based Futura Design, said the approach his company had adopted was to create its own training academy. “We run an academy teaching people to be modellers, where there is a definite shortage. We set up the academy because we want to bring on young talent. We have about 12 at the moment – 50% of these have design degrees and the remaining 50% we have engaged because of their commitment,” he said. “The latter can be in work by up to an hour early. The majority have come from backgrounds where they have worked as carpenters or bricklayers and the like and they have a very strong work ethic because of that. Sadly that’s not the case with everyone these days.” JLR supplier Brose UK is adopting a similar approach but on a larger scale. The Coventry company, which supplies window regulators and rear seating systems, is investing £3m into a new academy to ensure its future workers have the necessary skills in order to sustain the growth of the business. This will be important as the company is committed to a £34m expansion scheme which will see the development of a new factory and the creation of 372 new jobs by 2021, with a further 74 generated in the UK supply chain. A number of the recruits to the new factory will be apprentices and graduates. The expansion is necessary because of increased product demand from the likes of JLR. However, responsibility for skills development does not rest solely with the industry. The coalition government implemented a series of measures to try and bridge the skills gap. One of its last was an initiative in collaboration with the industry. Working alongside leading automotive manufacturers, it injected £11.3m into a project developed through the Automotive Council’s Business Environment and Skills Group. The project, supported by £16.4m from the industry, brought together major automotive businesses to ensure future skills needs are met for both vehicle manufacturers and supply chain companies. It followed a successful bid from the group for funding through the government’s Employer Ownership Pilot. The then business secretary Vince Cable said: “This investment puts our automotive sector in the driving seat to design the skills our manufacturing companies need. There is a risk that without adequate investment in skills, the industry will run into serious skills bottlenecks. “Employment in the automotive industry is set to grow in the coming years, with multi-billion pound investments taking hold and production volumes on course for record levels. With developments such as connectivity and advanced manufacturing taking the sector into exciting new territory, recruitment is a major challenge facing the industry.” Jo Lopes, chair of the Automotive Industrial Partnership and head of technical excellence, Jaguar Land Rover, said: “The Automotive Industrial Partnership brings together industry employers on an unprecedented scale. By working collaboratively and taking an innovative and sector-wide approach, we are ensuring that the UK’s automotive sector can grow and retain the skills talent that is so vital for the industry’s continued success.” Besides JLR, the other manufacturers involved in the scheme are Aston Martin, Bentley, BMW, Ford, General Motors, GKN, Honda, Nissan and Toyota. They will work together with the government, SEMTA and the Society of Motor Manufacturers and Traders (SMMT) through the Automotive Council to boost workforce skills, now and for the long term. The strategy includes creating an industry standard ‘jobs framework’ and identifying potential employment hot spots. Initiatives include: 5 g iving 4,500 nine-year-olds an experience of working in the industry through a one day production simulation 5 t aking on 960 11 to 16 year-old as Industrial Cadets, to develop industry-critical skills in team working, communications and problem solving 5 p roviding a route to work for 225 19-plus year-olds, with a 15-day bootcamp offering vocational training and simulated work activities designed by their potential future employers. Assessing functional and employability skills will lead to further work experience at a host company, helping young people with little or no workplace experience and vocational skills on a route to possible future apprenticeships. The government hopes existing employees at all levels will also benefit from the industry collaboration, with technical, management and leadership skills all improving. SMEs will be supported in gaining access to industry standard skills development. While talented, qualified engineers from other professions, such as the Armed Forces, will also be able to train to apply their knowledge and skills in the automotive industry. The automotive sector will be looking for similar initiatives from the next government, whatever its makeup. ‘There is a risk that without adequate investment in skills, the industry will run into serious skills bottlenecks.’ « Previous | Back to Contents | Next » “We have a ‘grow your own’ approach towards the development of our new apprentices. We have new, smart factories and there are still people walking through the doors that don’t realise it’s a factory,” he said. ➔ 13 “What we do with the staff is to take them into JLR so they see how what they are doing ends up on the finished vehicle. It’s very rewarding for them and we thank JLR for their co-operation on this.” He said this kind of collaboration was vital as the industry moved forward because if OEMs got their suppliers to share their vision then the supply chain would work more efficiently. Chris Pennick, relationship director, Lloyds Bank Commercial Banking (left) and Martyn Hughes, group finance director, Sertec Case study Skills development gives Sertec the edge BIRMINGHAM-based Sertec is a global leader in a range of steel and aluminium manipulation and assembly processes, including transfer and progression presswork, tube manipulation, wire forming, deep drawing, welded and self-piercing riveted components. Established in 1962, the business has three plants around the West Midlands and an annual turnover of more than £130m. It is a long-standing strategic supplier to Jaguar Land Rover and supplies every model in the JLR range. It supplies parts into the JLR factory in China and has now been commissioned to supply a total of 202 parts for the new Jaguar XE. Martyn Hughes group finance director, Sertec “The key is communication and sharing the vision,” said Hughes. To support the launch of the XE, Sertec has invested £15m in new presses, robotics and site upgrades, primarily to its Tyseley plant. The XE programme alone has created 107 new jobs, with an additional 400 new workers employed across the operation to support the wider JLR business. Not surprisingly, finding suitable staff remains an on-going challenge for the business. Martyn Hughes, group finance director at the firm, said with the commitments the “JLR is good at that. The earlier we can get production information, details about volumes etc then the earlier we can share that with our own suppliers and implement our own plans. “Our workers feel empowered because they are then sharing in Jaguar Land Rover’s success.” ‘We have a ‘grow your own’ approach towards the development of our new apprentices.’ company had, it had to have adequately trained staff to meet its needs and to ensure it was capable of continuing to meet challenges in the future. Much of its strategy is about engaging staff in the company ethos and also showing them how what they do is a crucial element of the finished product – a strategy which sees it work in close collaboration with its principal customer. « Previous | Back to Contents | Next » SUPPORTING UK BUSINESS FAST OUR BUSINESS NEEDS TO MOVE TO SEIZE EVERY OPPORTUNITY When a businessopportunitycomesyour way, you’llwanttoseize the moment. Our Relationship Managershave a lending discretion ofup to£500k,helping youtostay one step ahead ofthe competition,when you need tomake a quickdecision. T ofind outhowwe are supporting businesseshere in the Midlands,contactAndyMoss,Senior Manager Manufacturing,on 07834 945478 . Seize the momentatl l o y ds b a nk . c o m/ f a s t ANY PROPERTY GIVEN AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR OTHER DEBTS SECURED ON IT. Lending discretions of Relationship Managers varies and some applications may be referred for further credit checks. All lending is subject to a satisfactory credit assessment. Lloyds Bank plc. Registered office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no.2065. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. We subscribe to the lending code; copies of the code can be obtained from www.lendingstandardsboard.org.uk ➔ 15 Will reshoring guarantee growth? I DENTIFYING new export opportunities has to be high on the growth agenda of any company, and when your business operates in a global sector such as automotive manufacturing then it becomes of paramount importance. However, there remain many obstacles to overcome before a business can secure new export agreements. Reputation, trust, quality of goods and service – all these play a part in winning those all important contracts. The rise of high volume, low cost manufacturing in the emerging markets of China and elsewhere sounded the death knell for many of the West Midlands’ most successful manufacturers. Despite producing the best components available, many lost out to foreign competition because they were unable to compete on cost. OEMs (Original Equipment Manufacturers) unwilling to pass on high costs to their consumers opted – quite sensibly – to protect their bottom line by utilising cheap imports. Sure, the quality wasn’t that high but there was enough volume to minimise any failures. For years now, British companies having been fighting back against the tide of cheap components flooding into the UK from the emerging markets and slowly there is a change in the wind. Prestige OEMs mindful of the exclusive nature of their products, are keen to source only the highest quality parts and for many that means a more accountable – and shorter – supply chain. Preferably one based in the UK. Within the UK automotive supply chain many companies are adapting to the changing needs and by stressing the quality and availability of their products are winning back business. Many are also benefiting from the fact parts manufactured abroad in so-called low cost economies are no longer as cost-effective as they were, with labour « Previous | Back to Contents | Next » Securing growth for many businesses in the current economic climate will often depend on their levels of overseas trade. However, with more and more automotive component firms being told they have to reshore work, what is the best business strategy for them to employ? and production costs both much higher than a few years ago. Birmingham-based Sertec is a major supplier into Jaguar Land Rover. Several years ago it purchased a plant in Estonia in order to secure access to low cost manufacturing. However, last year the company opted to sell off its subsidiary. ➔ Martyn Hughes group finance director, Sertec Martyn Hughes, group finance director at Sertec, explained the reasoning behind the decision. fortunate that where our facilities are located we don’t have restrictions on them so we can happily accommodate growth but the challenge is to meet that in a progressive and sustainable fashion.” “We have reshored our product and we can now supply it much more effectively from the UK,” he said. Provided firms are willing to be flexible then the rewards could be considerable. “We have brought turnover back into the UK and our opportunities to supply firms in the Baltic are now better done from the UK. This has to be a good news story for the UK.” Hughes said firms within the supply chain had to look at the challenges they were facing and realise they needed to look beyond the domestic market. “When you are dealing with an international company such as JLR they want you to be supportive in other environments. We also have new facilities in China but this is a short term measure until they can be built locally,” he said. The Automotive Council has predicted component firms stand to benefit from a £2bn bonanza as UK carmakers enjoy an unprecedented period of success. In a report last year, the body assessed the capacity for the UK to increase the local supply of components and raw materials currently sourced from abroad. It said successful reshoring would up the percentage of UK-made components in British vehicles and create major new orders for suppliers. The AC said the £2bn figure came on top of the £3bn of opportunities (now revised as being closer to £4bn) identified the previous year for component supply direct to vehicle manufacturers. ‘We have brought turnover back into the UK and our opportunities to supply firms in the Baltic are now better done from the UK.’ “In the meantime, there are still parts that we make here that will never be made in China because of the cost. We have a buoyant UK market but as our customers are growing and develop a worldwide footprint then we are increasingly aware that we will have to service that aspect as well.” Explaining his own company’s willingness to be flexible, he said: “We moved into a new facility in November 2013 and in February 2014 someone came to me asking if we could have a third again capacity extension. “I thought they were joking but in point of fact they weren’t. Despite making a move only three months earlier we knew that if we were to continue to match the demands of our customers then we had to have the extra space. “So, we signed off on that and have not regretted the decision. Sure, we are Currently around one third of the components in a UK-built vehicle are sourced in the UK. The report said the realistic aim should be to increase this local content to around 60% – similar to other European countries such as France, Germany, Italy and Spain. Another key finding to emerge from the report was that UK automotive suppliers were – in the main – confident about their future prospects. Of the companies surveyed, 80% said they expected their business to grow in the near-term. Due to the continued expansion of the motor industry, these figures have changed little. Dave Allen, purchasing director, Jaguar Land Rover and chair of the Automotive Council Supply Chain Group, said: “The current success of the UK automotive sector presents a renewed opportunity « Previous | Back to Contents | Next » for automotive suppliers to invest in the UK and to increase local sourcing of the high value components that the UK’s world-class vehicle makers require. “We now have good visibility of the depth and value of the opportunity throughout the supply chain, together with deliverable actions to turn this opportunity into reality.” Local research from Business Birmingham has also suggested an overwhelming willingness among automotive companies to bring production back to the UK. However, it concluded many automotive companies were failing to reshore production because of engagement issues within the domestic supply chain. The research suggested firms continued to take production abroad due to poor understanding of the options available within the domestic supply chain. Notably, the research found that there was an ‘information gap’ in the supply chain, whereby companies were often unaware of the options available within the domestic or regional supply chain, resulting in production being moved abroad unnecessarily. Business Birmingham said it was working hard to address the issue by implementing a sectorfocused engagement programme in collaboration with the Greater Birmingham Local Enterprise Partnership. David Shepherd, automotive sector relationship manager at Business Birmingham, said: “There is a strong appetite among automotive companies to bring production back home to the UK. But to encourage them to do that we need to improve the level of engagement within the supply ➔ chain.” However, many firms are not in a position to capitalise, often being restricted by capacity issues such as insufficient space within the production operation, factories which are too small for current needs or a lack of skilled labour. Case study Nevertheless, industry insiders have said the problem is that unless firms are willing to embrace change then they risk losing out to foreign competition where attitudes are more flexible. APS Metal Pressings in Birmingham is typical of the hundreds of SME suppliers that have reached a pivotal point in their development insomuch as they are keen to develop growth but face restrictions in doing so. Steve Tinley, commercial manager at the firm said: “We are a family-run business and are running at near capacity. Where we are based, close to a residential area means we can only run two shifts. “The next stage of our development would be to move to a new site but this would require as big a leap of faith as the company has ever experienced. “All the ducks would need to be in a row before we could ever commit to such a move.” He said the costs involved in such a move would be severe and could damage the firm’s competitiveness. “I’d be reluctant to move on to the next stage of development. It’s difficult to remain competitive as it is – I’m already under pressure to reduce costs as it is and the risk of having to pass these on to our customers is simply too high,” he added. However, there are others that are more willing to consider change. Cube Precision Engineering director Neil Clifton said his firm had only been established since 2009 and despite being formed in the teeth of a severe recession, it had seen nothing but yearon-year growth. The company has committed to new investment in machinery and last year secured £750,000 from Lloyds Bank to buy two new machines. “As a result of the investment, the reduction in cycle times is significant and this is straight into the bottom line, meaning these machines will pay for themselves in a couple of years,” said Clifton. [L-R] Peter Tedd, Matt Harwood and Mark Harwood, all Barkley Plastics Barkley Plastics on course to smash £7m turnover target DURING its 50 years in business, Birmingham injection mouldings manufacturer Barkley Plastics has seen several growth cycles within the region’s automotive sector. Basking in the boom of the 60s and 70s, the firm was one of those to suffer due to the collapse of MG Rover in 2005. Nevertheless, it survived the global recession and is now benefiting from a successful reshoring strategy. When the business was set up in 1965 by John Barkley - after he recruited toolmakers Bob Chittleborough, Bob Fisher, Maurice Harwood and Tony Challinor – it was as a result of the need to supply nearby automotive suppliers. The quartet initially kept their day jobs at Lucas, choosing to work the evening at ‘John Barkley Plastics’, before a surge in demand from Mini, Rolls-Royce as well as Lucas made them all take the plunge and go fulltime. The firm has come a long way since those days and its name is now recognised throughout the industry for its injection moulding and toolmaking. Currently it supplies components to carmakers BMW, McLaren and Jaguar Land Rover. Automotive continues to play a major « Previous | Back to Contents | Next » part in its turnover, with flashing beacons and interior components still made for many carmakers, plus door handles for JLR and rear lamp components for Nissan. A current speciality is light guides, which are now being introduced in many new cars to create ambient lighting. The growth in demand from the automotive sector business is one of the main reasons why the company is now on course to smash the £7m barrier for the first time in its history. However, Matt Harwood, business development manager at the firm, said there may be some obstacles to overcome in the future in order to sustain growth. “We want to get into more Tier 1s. We supply BMW and four to five Tier 1s that supply into JLR,” he said. “We have had a lot of inquiries from Tier 1s, some of them wanting a cash-back bonus before we agree to supply. This makes it very difficult for us.” Nevertheless, Mark Harwood, the current managing director of the firm, said: “It’s fantastic that we are on course to hit a record £7m turnover in 2015, a great way to mark the efforts of every member of staff that has contributed to 50 years of manufacturing.” Supporting your business with specialist legal advice Automotive Services - We provide a cutting edge commercial service for our clients in the automotive sector, representing them in a full range of their business interests. We undertake quality legal work for a diverse range of clients, strengthened by following the latest industry standards, supporting our clients with value through efficiency. We have a national network of UK offices and offer a full commercial service out of our Leeds, Sheffield, London, Birmingham and Manchester offices. 0370 1500 100 BLS-0018-AD www.irwinmitchell.com For a list of our offices visit our website. Irwin Mitchell LLP is authorised and regulated by the Solicitors Regulation Authority. 19 Round table Where are the growth opportunities? I N 2014 UK car production reached a seven-year high with 1,528,148 vehicles rolling off production lines around the country, with the vast majority destined for export markets around the globe. The prediction is that this level of production is likely to continue, presenting huge opportunities for firms that operate within the industry’s supply chain. While contracts issued by the various OEMs (Original Equipment Manufacturers) run into the billions, not every firm is in a position to complete for business. However, in a boom period for the industry, should this be the case? “If you’re not growing your market share in a successful market then you aren’t doing enough as a business.” These are the words of Professor Jon King, research & development manager at Tata Steel and also a senior figure on the Automotive Council. He said there were typically three challenges which held back SMEs from competing successfully for business from the OEMs or large Tier 1 suppliers. They are: skills, finance and innovation. Sometimes the priority order changes but effectively, these are the main issues inhibiting most firms from capitalising on the growth opportunities offered by the expansion of the UK automotive industry. The massive expansion in the UK automotive industry is offering numerous growth opportunities for SMEs within the sector supply chain – but are all the firms within it capable of meeting the challenges required. Here we debate the issue. “Finance used to be the main issue but this is less so now, now skills are the main issue,” said Prof King. “We are short of around 70,000 engineers in the UK so we do have to try and address this. There is availability of finance but to access it you still have to have a sound business case. Fortunately, the automotive industry growth is supplying that business case for many of these firms but nevertheless there are still many who struggle. “We (the Automotive Council) think « Previous | Back to Contents | Next » there are around £3bn of opportunities the OEMs would like to place in the UK with the Tier 1s. This represents a big reshoring opportunity for the supply chain. “We estimate that somewhere between £1 and £2bn of these opportunities have been taken, we have done an update ➔ on that and partly due to assembly The Attendees Chris Barlow – managing director, MHA Bloomer Heaven Paul Cadman – managing director, Futura Design Neil Clifton – director, Cube Precision Engineering Rachel Eade – national automotive sector lead, Manufacturing Advisory Service Matt Harwood – business development manager, Barkley Plastics Martyn Hughes – group finance director, Sertec Professor Jon King – research & development manager, Tata Steel Charles Morgan – former managing director, Morgan Motor Company Andy Moss – head of manufacturing – Midlands, Lloyds Bank volumes increasing, we think the figure is now closer to £4bn.” As a result of the growth, many more firms within the SME community are looking to take advantage and are asking how they can tap into those opportunities. If the large Tier 1 suppliers get more business from the OEMs then this should filter down the supply chain - at least in principle. “We (the AC) have identified there may conservatively be £2bn of opportunities for Tier 2s and Tier 3s within the supply industry,” added Prof King. Within this, King said there was something like £140m worth of business for forging companies alone but this offered just as many problems as it did opportunities. He said it was great that such contracts existed but this was only a positive provided the firms new of the opportunities in the first place. The industry therefore needs to improve its channels of communication, he added. “A lot of the work being offered is very similar so there are many supply chain opportunities for small-build component manufacturers to sell into larger components and systems – which is great provided the firms know how to access the work,” said King. “We have got to move from the generic to the specific. This is something we have started to discuss in the SME group (of the AC). I think this is also something likely to occupy the time of the new Industry Minister come June and July.” Mike Mychajluk – supply chain development manager in government programmes, Jaguar Land Rover The panel said that while industry had a responsibility to do all it could, the onus had to be on the individual businesses to take control of their own destiny. Sarah Riding – commercial partner, Irwin Mitchell With car volumes set to rise past two million in three to four years’ time depending on global market condition, the panel said firms not looking to increase their business in line with this were doing themselves a disservice. Steve Tinley – commercial manager, APS Metal Pressings Chaired by Duncan Tift, TheBusinessDesk.com “The growth in volumes has been significant,” said King. “Doubling business levels takes a lot of work over a 10-year period but if firms are not looking to keep pace with this then all I will say is that there are plenty companies that are - and many of these are outside the UK. « Previous | Back to Contents | Next » “There needs to be more bottom up engagement and we haven’t got that yet. We (the AC) have to convince smaller companies that if they are ambitious then they will quickly find the help they need to grow.” Jaguar Land Rover due to its unprecedented growth is one company that is looking to both increase levels of engagement and raise the level of business it does with UK suppliers. It has consistently backed the introduction of new models with a flood of supply contracts and is keen to collaborate with its suppliers as much as possible. Mike Mychajluk, supply chain development manager at JLR, said it was his role to aid suppliers to grow their business and encourage reshoring. “We need a successful supply chain in order to sustain our growth and we want to get as many suppliers on board with us as we can, “he said. “Therefore, we have tried to increase our levels of engagement in order that we can show suppliers how they fit into our overall plans. “Jaguar Land Rover now has two people focused on supply chain development. We want to show them what goes on and help them understand how the supply chain works and where they stand in it.” It is a model the panel believe should be adopted throughout the industry. Birmingham-based Sertec is a major supplier into JLR and its recent growth mirrors that of the OEM. Martyn Hughes, group finance director at Sertec said while the strength of its products and service owed much to the firm’s growth, the willingness of JLR to readily communicate with the ➔ business was also a key factor. The company’s growth was recognised when Chancellor George Osborne agreed to officially open the new base. The funding deal agreed with the Lloyds Bank Commercial Banking team based on Colmore Row in Birmingham included a £7m increase in trade finance facilities to support Sertec’s exposure to tool stamping imports from China. The finance package also included term loan and asset finance facilities to fund future capital expenditure projects, and the deal took the business’ total funding facility with Lloyds Bank to more than £38m. “For us the key is good communication, and always has been. JLR is good at that and there is no doubt our business has benefited as a result,” he said. “The earlier we can get production information, volumes likely to be required etc, then the sooner we can implement our own plans and feed this down to our suppliers so they can then put their own plans in place.” An insight by the OEMs into likely lifecycles is also beneficial to a successful supply chain, said Hughes. “Successful communication shows us that average product lifecycles are likely to be somewhere between five to sixyears. It is again critical to us to have this information because it enables us to plan our investment strategies,” he added. “We will know how much money we are going to need from the banks and therefore we can go to them with a solid business plan and outline what we need. “Fortunately JLR has also got a lot better at engaging with the financial sector than it has ever done before so the banks know that it’s not always us that is saying what’s needed. It’s all part of a linked programme.” In the past five years Sertec has been able to secure three successful funding deals in order to facilitate its growth ambitions. Rachel Eade, national automotive sector lead for the Manufacturing Advisory Service, said collaboration of this kind was key to the sustained long-term success of the automotive industry. However, it was not the only issue which would lead to a successful industry. “Identifying opportunities, successful reshoring, innovation, good design, skills development, these are all just as important as successful collaboration,” she said. “Look at the skills base; we all talk about and hear about the generic engineering skills gap. We talk about the need to bring in young people and upskill existing workers. We also have to bring in skilled people from other sectors. “Unfortunately for the automotive sector, the rail industry, oil and gas, nuclear are all trying to do the same. We’re all fishing in the same skills pool. Promoting manufacturing in the UK will help; promoting the career paths that are there. I believe we all have a requirement and commitment to do that.” She said it was also a case of not just throwing money at a problem. “There are support opportunities available out there and it’s how we cascade to those opportunities that will be important. Companies at all levels look to support, we all know that. It’s not just about giving firms money; it’s about how programmes can be improved. Pre-election we’re in a bit of a famine as regards grants programmes but post- ‘Identifying opportunities, successful reshoring, innovation, good design, skills development, these are all just as important as successful collaboration.’ “The key is adding value and creating jobs. If we want to keep work, develop work and grow opportunities then innovation and design and the skills to do that are integral to winning new work.” Last year it secured a £20m funding package to help fund the relocation of its new head office and investment in new equipment. She said there were many external factors that were likely to weigh on this. The introduction of new models, relaunches, the development of weightsaving technologies, new alternative fuels and low emission vehicles, connectivity and infotainment systems, engaging with government support programmes and developing training programmes would all have a bearing. The company needed the additional space to cope with a big increase in orders from its principal customer, Jaguar Land Rover, following its expansion into China. “Engaging the supply chain in all of this will be important as we move forward. Getting this knowledge to firms and making them aware of what is needed will be vital. Therefore, we have to Part of the success has been due to the good levels of communication between the industry and the financial sector. improve our levels of communication,” she added. « Previous | Back to Contents | Next » election this will be different because there will be new programmes, new releases of money.,” she said. “Therefore we have to put the right processes in place now, so we can all move forward later.

© Copyright 2026