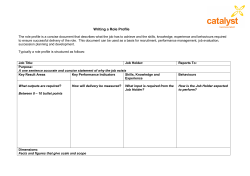

Using Channel Key Performance Indicators to

l White Paper Using Channel Key Performance Indicators to Grow Channel Sales Introduction Who are the most successful salespeople in any business-to-business channel organization? They are the “challengers,” — people who challenge the status quo and bring actionable new insights to their customers. This conclusion is based on exhaustive research conducted by the Corporate Executive Board (CEB), an organization that helps senior executives and their teams improve business performance. The Sales Executive Council of CEB studied thousands of sales reps across a range of industries and geographies. As a result, they created five major “profiles,” including: Hard Workers, Relationship Builders, Challengers, Lone Wolves and Reactive Problem Solvers. One might think that “Relationship Builders” would have the best sales success records. In fact, they were the least successful. Instead, the “Challenger” group dominated in today’s complex B2B selling environment. Challengers influenced the sales process in three ways: • They brought new financial insights to the customer using an educational approach • They tailored their insights to the customer’s immediate business problems • They controlled all aspects of the sale from beginning to end The details of challenger selling can be found in “The Challenger Sale” (Matthew Dixon and Brent Adamson, CEB, 2011). However, our focus is to examine where the insights come from that provide the fodder for “challenger” selling in the channel. One source for these insights are Key Performance Indicators (KPIs). What are Key Performance Indicators (KPIs)? progress toward a goal, or a change in percentage. In any case, they must be quantifiable to be measured. According to Bernard Marr, a leading business and data expert, KPIs can be defined as “the most important performance information that enables organizations or their stakeholders to understand whether the organization is on track or not.” KPIs are based on the principle of “What gets measured gets managed.” Source and frequency are two important components of KPIs. Where does the information come from, and how frequently can it be made available for analysis? In this regard, Channel Data Management (CDM) solutions play an important role. CDM applications draw point-of-sale (POS), APOS, inventory and SISO data directly from channel sources at multiple tiers (distributors, resellers, etc.). And they do so in real time, making the data instantly available for business analysis. KPIs don’t exist in a vacuum. They are built on business or departmental goals, and they help businesses stay on strategy and achieve desired results. KPIs can take the form of raw numbers, I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 1 l White Paper KPIs are the vital signs of a healthy business Channel Key Performance Indicators were defined back in 2005 by two professional services firms, KPMG and EY (Ernst & Young), so that managers would know what was important to measure when growing the channel. Channel KPIs are vital to keeping a channel business or department on strategy. KPIs vary not only by business, but also by function within the business. Marketing and sales, finance, operations—each department needs a different set of channel Key Performance Indicators (KPIs) to determine how it’s performing against established goals. Moreover, managers in these disciplines need an application of push notifications to alert them when KPIs stray outside of pre-established boundaries, and reports that pop up in their workflow to let them know when the business is out of sync with the business plan. Literally hundreds of KPIs can be tracked for any complex business. However, tracking everything defeats the purpose of having KPIs, especially for the channel. In the rest of this paper, we’ll examine some channel KPIs common to businesses that depend on channel sales for their survival and exponential growth. Channel KPIs depend on accurate, reliable and timely information Businesses that operate with a multi-tier distribution model need channel KPIs that measure channel partner performance for each tier. This includes Tier 2 organizations executing a pull through sales strategy as well as Tier 1 distributors pushing inventory daily to maximize sales. Using Alert Notifications, KPIs can be used to provide the region or division to proactively respond before the weekly global sales meeting. Traditionally, information about what was going on downstream in the channel was hard to come by. Distributors, resellers, and other channel partners did not readily share data about sales and inventory status unless something was in it for them, and now there is. A recent survey sponsored by Channelinsight and Baptie & Company found that 75% of reporting partners want clean channel information too, just like the manufacturer. Manufacturers who set up internal applications to gather this information are challenged to collect and integrate the data they ask for. POS, APOS, Inventory and SISO data is often self-reported by channel partners, so its accuracy and reliability is questionable. Inaccurate data, in turn, impacts the accuracy of incentive payments. As a case in point, one customer who recently signed on with Channelinsight discovered, after their data had been cleansed, that 7% of the transactions on which they were paying incentives were duplicates, significantly distorting the program’s ROI. Conflicting data must be reconciled through either a manual or BPO (Business Process Outsourcing) process. POS, APOS, Inventory and SISO data (Sales In, Sales Out) data coming from different platforms must also be standardized so it can be integrated into a single, useable repository to allow for channel master data management. Once the data is cleansed to ensure its accuracy, and standardized so that apples can be distinguished from oranges, it then needs to be analyzed and compared to whatever metrics have been established. Channel KPIs monitor all of this at both the executive and tactical business operations level. All this effort can consume a great deal of a company’s internal human, IT, and financial resources. Channel Data Management Options Applica'ons Informa'on Gather Piecemeal & Internally Web Scrape 3rd Party Data Service 45 days after the fact Guess? Use Smart Channel Information Total Addressable Market Implementing any of thesethere solutions cana range Fortunately for manufacturers, are now deliver vastly different results and costs… of options to accomplish this task. (See illustration) With the advent of cheaper data storage and easyto-use analytical tools provided by third-party vendors, this herculean task is now manageable. Manufacturers and vendors can stop worrying about the mechanics of acquiring accurate, reliable information from the channel. Instead, they can focus on establishing meaningful channel KPIs. I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 2 l White Paper Gaining insight into the channel KPIs for Channel Sales Having accurate, reliable information is predicated on good data collection processes. Channelinsight’s eBook on Best Practices for Channel Data Collection points out that businesses that implement a program to obtain reliable channel data could avoid incentive overpayments by 6%. Next in importance are dashboards with the ability to proactively notify the CFO, Channel Chief, CMO, or CEO how the channel is performing compared to the company’s business plan. This dashboard functionality is accomplished through alerts, flash reports, and notifications that automatically pop up in a manager’s workflow when a KPI falls outside its set parameters. The manager can then interpret and investigate the data to identify the source of the problem. For companies deriving a majority of their business from the channel, gaining a handle on channel sales is critical. Yet manufacturers and vendors often struggle to know where their products are ultimately sold, to whom, and at what price. Good data collection practices, proactive dashboards, managerial experience and sound thinking ability are the elements that provide a solid footing on which to establish, track and gain insight from channel KPIs. As noted previously, this challenge can be met by the use of a CDM (Channel Data Management) cloud application that offers channel KPIs, dashboards, alerts, flash reports, and workflow notifications about the business and the market as a whole via a back-end process that automatically collects, cleans, standardizes and enhances POS, APOS, Inventory and SISO data from multiple tiers of the channel. First, it’s important to relate channel KPIs to the company’s business plan and channel strategy, ensuring that they are well defined, quantifiable, and consistent from year to year. It’s also important to set a threshold or benchmark for each channel KPI. Smart Data Data = Smart = Channel ChannelOptimization Optimization Total Available Market Price Erosion Collabora7on with Customer Maintain Margins Average Selling Price Incentive ROI Dashboards, KPIs, Flash Reports, Alerts, Applica7ons & Workflow 7:57 AM Cleansed, Enriched, Enhanced, Matched & Learned POS, APOS Inventory & SISO 7:55 AM 7:54 AM © 2015 Proprietary & Confidential POS, APOS, Inventory & SISO, in numerous formats & order: EDI, CSV, Excel, etc., (7 X24X365), with 17 accoun7ng & ERP applica7ons, a global network of distributors & resellers geXng clean data sent back 1 I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 3 l White Paper For example, “Increased channel sales” is a poorly defined channel KPI without a target. Instead, “Grow channel sales among our top 20 distributors by 10% by year’s end” is a more precisely defined and targeted KPI; another might be pulling 70% of sales through to the tier 2 reseller and deploying the appropriate inventory at the tier 2 level to deliver on a 20% sales growth number. Sales per Partner Another important consideration is to understand how KPIs relate to one another. For example, sales growth is a desirable metric, but not at the expense of eroding price margins. Knowing how one KPI impacts another is required to gain a big picture view of the business. Bookings represent a commitment to buy, or a sale not yet made. This metric can help with sales forecasting. An increase or decrease in bookings by partner, region, end-customer, or end-market in a given time period can provide insight into potential problems or opportunities. Sales-related KPIs can be developed around any number of criteria, including, for example, the published recommendations by KPMG, EY, and NEDA (National Electronics Distributors Association). Average Sales Order Price Following are a few examples of channel-specific KPIs: Sales Growth Sales growth tells you whether revenue is increasing or decreasing, and at what rate. This metric can be applied to individual partners, geographic regions, individual products or services, end-customers or end-markets. Over time, trends will emerge that can provide insight for strategic decision-making. Global Coverage Use this metric to gauge the ability of individual partners to generate revenue for the company. Trending data can help you separate the good performers from the poor ones so you can take appropriate action. Sales Bookings This metric measures the average value of each purchase order processed by channel partners. Purchase orders include product names, number of units, and sales price. This information can help quantify opportunities associated with endcustomers. Combining this KPI with others such as units per transaction can offer insight into future inventory requirements. Top Active Opportunities An active opportunity is a qualified lead. Measuring the number of top active opportunities by partner helps with sales forecasting. A growth or decline in this metric also helps identify top performing partners, or points to problems that should be addressed. Lead to Shipped Orders How long does it take from the time a lead is generated until the sale is consummated and the order shipped? This metrics speaks to the efficiency of the sales process and the ability of the partner’s sales force to close deals. Fulfillment by Units and Dollars Sold © 2015 Proprietary & Confidential 20 How efficient is the order fulfillment process? Converting orders to cash impacts not only the revenue side of the business, but also customer satisfaction. This KPI measures how quickly, accurately, and completely orders are processed. I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 4 l White Paper Cancelled Orders tracking performance against established program goals could provide the insight needed to adjust program elements, or curtail or expand a program. This metric may point to a fall-off in demand or a problem with product quality, among other possibilities. Following are a couple of marketing-related KPIs that can help channel marketers gain insight into their strategies: The sales KPIs noted above represent a mere sampling of potential KPIs that could be used to gauge partner and product performance in the channel. Which KPIs you choose to track will depend on your business model and company goals. Return on Investment (ROI) This KPI measures revenue generated by an incentive program (or other marketing tactics) compared to the cost of running the program. The ability to gather POS data instantaneously using a CDM application allows channel marketers to assess programs midstream and make adjustments on the fly. KPIs for Channel Marketing Sales incentive programs are one of the key tactics used in channel marketing. In a recent survey1, manufacturers reported running an average of 21 channel incentive programs annually, spending on average 11% of channel revenue. These programs involved incentives such as back-end rebates, revenue rebates, MDFs (Marketing Development Funds), deal registrations and co-op funds. Market Performance However, manufacturers also reported having a difficult time knowing what they were getting from these programs. For example, only 38% of manufacturers reported that they were able to calculate ROI on their incentive spend. Following is a list of criteria that manufacturers rated as important when it comes to incentive programs: • Testing and modeling before launch • Immediate visibility into performance • Ability to compare performance against goals • Ability to identify under/over performing programs • Speed of incentive payment In the survey, however, only 34% of respondents indicated satisfaction with their ability to meet these criteria. Manufacturers were also troubled by overpaying incentives (by an average of 6% according to this survey), and channel partners were bothered by late payments from manufacturers. Having accurate, reliable, and timely POS information allows manufacturers to establish KPIs that address some of these issues and concerns. Tracking how quickly incentive payments are made to channel partners, for example, could provide insight into the health of the relationship with key partners. And 1 Silicon Valley Research Group, 2012 Incremental Sales © 2015 Proprietary & Confidential 19 This metric measures the contribution that an incentive program (or other marketing tactic) makes toward increasing sales. It’s a measure of net revenue increase above a benchmark, and it provides insight into the effectiveness of the program being measured. KPIs for Channel Inventory Keeping track of inventory and anticipating future needs is important to keep the channel pipeline running smoothly. A CDM application gives you real-time reporting on the status of your inventory. Following are some KPIs that can provide deeper insight: Order Tracking This indicator tracks the current status of all orders and classifies them based on criteria such as shipped, I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 5 l White Paper back-ordered or on-hold. It provides a snapshot view of inventory in the channel at any given time. Inventory Turnover This KPI measures how many times a year your channel partners are able to sell their entire inventory. It’s an indicator of channel efficiency, and also provides insight into partner performance, product quality and product mix. Back Order Rate This KPI measures orders that cannot be filled at the time of purchase. Customers who have to wait for the products they ordered are likely to be dissatisfied and may eventually go elsewhere. A high back order rate points to a problem with inventory management. Again, the examples noted above simply illustrate a few of the many KPIs that could be established related to channel inventory. The key point is that a CDM application can track these metrics in real time, using clean, standardized data. This makes inventory management in the channel a whole lot easier and more efficient. KPIs for Channel Finance In a recent post, Bernard Marr, a noted consultant and author, described his top 25 “need to know” KPIs. He prefaced his list by saying that these KPIs should be relevant to most companies. However, each company should develop and track its own industryspecific KPIs. He organized his top 25 list into four categories. Following are the KPIs he listed for measuring and understanding financial performance: • Revenue growth rate (The rate at which a company’s income is increasing) • Net profit (Income minus expenses) • Net profit margin (Percentage of revenue which is net profit) • Gross profit margin (Percentage of revenue which is gross profit, or revenue generated for each dollar of sales) • Operating profit margin (Operating income divided by revenue) • Return on investment (ROI) (Revenue generated by investing into an aspect of a company’s operations, relative to the cost of that investment) Obtaining accurate and reliable information from channel partners in order to track these metrics is the real challenge. CDM software is designed to recognize revenue from channel partners as it occurs so that KPIs such as these can be used to measure a company’s performance in the channel. KPI-Based Scorecards KPIs are key metrics providing insight into various aspects of channel business. Scorecards consolidate these metrics by business function, and provide a means to evaluate channel partner performance. Why use scorecards? Because they can help you identify the channel partners who are making the greatest contribution to your business and who deserve the greatest support. Manufacturers and vendors need channel partners who are aligned with their business model, and who share their goals, objectives, and values. They also want partners who focus on the vertical markets and end-customers with greatest potential to drive mutual growth. Finally, in today’s rapidly changing business climate, manufacturers need partners who are prepared to navigate change. Scorecarding is a way to identify and evaluate these types of partners. Scorecarding should begin with introspection and self-knowledge. A company must have a well-defined sense of direction before it sets out to measure the performance of its channel partners. Given clarity of purpose, the foundation of a good scorecarding system is measurable data. This is where KPIs come into play. Choosing KPIs for your scorecard is a matter of relevancy. What elements of channel partner performance are most relevant to your business? For example, growing revenue might be a top priority. In which case, you’ll want to list KPIs that relate to your partners’ revenue-generating ability. These KPIs can be generated from POS data. They might include: • Total Sales Revenue (period-over-period) • Win/Loss Opportunities and ROI • Lead to Shipped Orders and ROI • Average Price • Order Rate I Continued channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 6 l White Paper If your priority is optimizing channel performance, relevant KPIs could include: • Total Addressable Market • Margin Integrity • Price Erosion • Lead/Opportunity/Sales/Inventory/Ship Analysis Or you might want to focus on your partners’ supply chain efficiency with KPIs such as these: • Sales/Inventory Analysis • Days of Supply • Projected On-hand Inventory • Inventory Accuracy • Order Fill Rate • Inventory Turns Whatever your goals, KPIs are the building blocks of your scorecard. Summary Channel KPIs are a business solution that measure progress toward success. Since each individual business defines success in its own terms, channel KPIs can vary considerably from company to company. However, every organization can benefit from the discipline of developing and tracking KPIs. Businesses whose livelihood depends on channel sales struggled in the past to acquire KPI tracking data. But now CDM applications can collect, clean, CORPORATE HEADQUARTERS 1875 Lawrence Street, Suite 1200 Denver, CO 80202 Phone: 303-293-0212 855-5-Ci-Data Fax: 303-293-0213 Email: [email protected] Web: www.channelinsight.com standardize, and enhance channel data in real time. This allows channel-dependent businesses to use KPIs as effectively as direct sales operations. The knowledge and insight gained from channel-specific KPIs can then be used in a “challenger” selling approach to grow business in the channel. About Channelinsight Channelinsight’s cloud-based Channel Data Management application and enablement services provides manufacturers with visibility into every distributor, reseller, and end-customer in every transaction, with real time channel information to anticipate changing channel business needs & requirements. Channelinsight collects “raw” POS and inventory data from tens of thousands of channel partners globally 7x24x365, processes over $120 billion in actionable channel information annually, and delivers critical key performance indicators to customers for: available markets, price erosion, real-time channel sales visibility and operational cost reduction. Customers benefiting from this solution include HP, AMD, Corning Life Sciences, ams AG, Fluke Networks, Microsoft and more. Channelinsight is backed by Rho Ventures, Sequel Venture Partners and Vedanta Capital, and is headquartered in Denver, CO with offices in Palo Alto, CA, Maidenhead, UK and Singapore. For more information on Channelinsight’s products and services, please visit www.channelinsight.com. CHANNELINSIGHT SILICON VALLEY 525 University Avenue, Suite 1350 Palo Alto, CA 94301 CHANNELINSIGHT EMEA 1 Bell Street, Maidenhead Berkshire, SL6 1BU CHANNELINSIGHT APAC Wisma Atria, 11th Floor 435 Orchard Road Singapore, 238877 channelinsight.com l [email protected] l 1875 Lawrence Street l Suite 1200 l Denver, CO 8O2O2 l © channelinsight 2015 l 7

© Copyright 2026