Open Skies - Emirates.com

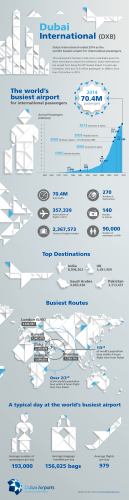

The International and Government Affairs Journal of Emirates Issue 21 | May 2015 Open Sky In this issue … 2 Subsidy? Tosh! 4 Emirates’ single-carrier, global network 6 78 years with…an Open Skies policy 7 The handy guide to select legacy carrier language 8 Emirates and Monte Vibiano – an Italian perspective on growth and jobs 9 The illusory level playing field – a few expert views 2.9 billion $ is the estimated annual local economic impact of Emirates services to US airports and their surrounding regions 2 routes on which Emirates competes directly with Delta, United and American airlines 849m 10 They said it best... 11 A focus on the environment 12 Incremental growth in India 13 The cost of non-Europe - in aviation 14 Sector Insight – from a US consumer perspective 15 The economic value of cargo 16 ‘A Greener Tomorrow’ initiative enters its second year US$ Emirates’ contribution to India’s GDP annually 518,000 tonnes of cargo was transported by Emirates to and from 17 EU Member States in 2013/14 THE EMIRATES GROUP ENVIRONMENTAL REPORT 2013-14 Airport ($m) ENVIRONMENTAL REPORT 2013-14 | 1 Seattle San Francisco Los Angeles Chicago Boston New York Dallas/Fort Worth Houston Orlando $132m $227m $257m $624m $200m $166m $445m $720m $100m Subsidy? Tosh! Roughly ten years have passed since the oft-repeated anti-Emirates smears really started to take off. An easy deduction to make today is that we are exactly where we were then; a time loop where some competitors repeat the same allegations again and again and Emirates proves the allegations false. We have done that over the past ten years, and will gladly do it again. Today it is the three biggest US airlines – Delta, United and American – that are running a campaign aimed at limiting the growth of Emirates, Etihad and Qatar in the US market. These US airlines have published a white paper, in which they claim Emirates has received billions of dollars in subsidies. It also says Emirates is competing unfairly under the terms of the open skies agreement between the US and the UAE. For the record, Emirates does not receive and never has received any form of subsidy from the UAE Government. And considering that we have operated to the US since 2004, we fail to understand how we can possibly be competing unfairly in 2015. The real issue at hand is that the three biggest US carriers, who together with their joint venture (JV) partners already control about two-thirds of international flights from the US, want to further limit the international air transport choices available to American consumers, airports, local and regional economies. US consumers must wonder why they deserve less competition in the marketplace when Delta, American, and United are amongst the most profitable airlines in the world, but nowhere close to being ranked amongst the best airlines for service or product. 2 Airports, tourism boards, chambers of commerce and businesses, should in turn be asking regulators and legislators why valuable, direct international air links - which are so important for businesses and critical for tourism - should be limited only to a few airport hubs served by the big three US carriers and their JV partners with whom they co-ordinate prices and capacity under anti-trust immunity. The US carriers allegedly took two years, and goodness knows how much shareholder money, to assemble a stack of allegations which included wrong assumptions and leaps of logic. We are currently working on our point-by-point rebuttal, but we can tackle the main accusations against Emirates immediately. Myth vs Fact Allegation: Emirates benefited from $2.7b in subsidies from the government’s assumption of fuel hedging losses, and the government also provided Emirates $1.6b in letters of credit. Emirates’ response: That is untrue. All cash losses incurred by Emirates as a result of its fuel trades in place in 2008/09 were settled in full from the airline’s own cash reserves and not paid for by the Government of Dubai. The letters of credit mentioned in the white paper were in fact provided by Emirates to our owners, Investment Corporation of Dubai, in support of the fuel trades novated, not the other way round. Allegation: Emirates benefited from $2.3b in subsidised airport infrastructure since 2004, which is a “major competitive advantage”. Emirates’ response: Infrastructure investment is long term in its nature. The Government of Dubai has made these investments, like other progressive emerging market economies (e.g. China, Singapore) with long term benefits in mind. Comparably lower airport charges or charge exemptions for transfer passengers are neither a subsidy nor discriminatory as all airlines who use the infrastructure at Dubai International (DXB) benefit. Emirates pays the full published rates at DXB, which are highly competitive, commercially based, and in fact higher than a number of other comparable major airports such as Kuala Lumpur (KUL). Allegation: Gulf carriers take passengers and revenues from US carriers, and force US carriers to reduce, terminate or forego services on international routes. Emirates’ response: Despite what some carriers may think, air passengers are not proprietary to airlines. What Emirates is doing is competing in the marketplace - we don’t “take” or “steal” customers. We offer a great product at a competitive price, which appeals to the consumers who choose to fly with us. The three US carriers’ obsession with market share makes all the more apparent what they are really after: not competition, not open markets or Open Skies, but outright government-directed market allocation. Rather than harming US interests as the white paper claims, Emirates’ services have increased consumer choice, filled a gap in the market by taking travellers to numerous destinations not served by others, and helped contribute to the US economy, trade and tourism. Importantly, Emirates also provides a much-needed competitive alternative to the three airline alliances, with anti-trust immunity, permitting them to keep fares artificially high. Emirates has understood the tectonic shift in 21st century aviation and despite being a transparent, efficient and commercially run carrier, we recognise that our steady growth and success has made us the scapegoat of choice among the few that prefer less competition – particularly when the competition comes from business models different to their own. The unintended consequences of this could well be intra-industry polarisation that challenges the make-up of the traditional alliances and splits airline trade bodies. The Association of European Airlines (AEA) has seen a number of carriers quit the group after fundamental disagreement on airline competition. Within Airlines for America (A4A), member views also differ drastically on that topic. The few will continue their gross misrepresentations about us to serve their narrow interests. We have nothing to hide and we welcome appropriate discussion on our activities. In the meantime, our partners, regulators and decision-makers in the aviation sphere, need to consider whether artificially protecting three carriers on the basis of questionable allegations is worthwhile if it leads to higher prices, limited choice, poor service and unrealised economic activity. Erecting barriers does not create value. More competition, more connectivity and more choice for consumers and businesses does. 3 Emirates’ single-carrier, global network Far too often, many US carriers have been content to play it safe with long-established, trans-Atlantic and trans-Pacific routes, and either ignore new and growing markets such as India and Africa, or simply hand over passengers to their European alliance partners. The leading US airlines have been busy consolidating through domestic mergers and practising “capacity discipline,” and in the process have ignored many opportunities in emerging markets. In contrast, Emirates – which is independent of traditional alliance partners and not beholden to feed an alliance network that often inconveniences passengers with circuitous routings, multiple connecting stops and longer travel times – has since 1985, built a network to capitalise on these emerging traffic flows and better serve the requirements of passengers. Emirates’ unique global connectivity to the US • Emiratescommencednon-stop passenger flights between Dubai and New York City in June 2004 and has since expanded to eight more destinations - Houston, Los Angeles, San Francisco, Dallas, Seattle, Washington DC, Boston, and Chicago, operating a total of 84 passenger flights per week. Services to Orlando, Emirates’ 10th US destination will commence in September 2015. • EmiratesfliestheBoeing777tofiveofits US destinations and operates the Airbus A380, powered by US-made GE GP7200 engines, to Dallas, Houston, Los Angeles, New York and San Francisco. Emirates has created a hub in Dubai that allows passengers in any of the nine US cities it serves to fly one-stop to 15 different Middle Eastern destinations; 23 African destinations; and 35 Asian destinations – all with connections optimally timed for passenger convenience. In contrast, the three US network airlines only serve a combined four points in Africa and four in the Middle East (not including overlapping points). Emirates’ links from the US to emerging markets – for example 305 weekly flights to the five BRICS countries and 94 weekly flights to Pakistan and Bangladesh – will further drive American economic growth, trade and US job creation. However, the three leading carriers, along with their European partners, offer only modest air services in several of these markets, limiting consumer choice and sacrificing lucrative business. The table below demonstrates Emirates’ strong commitment to these emerging markets with the number of points served directly, compared with the three leading US carriers. Middle East 15 2 4 0 Africa 23 4 1 0 Asia 35 13 13 • Emirates’flightscarrytravellersfrom the US to 57 destinations in Africa (19 points), Asia Pacific (26 points) and the Middle East (12 points) that are not served by any American carrier, and we do this with just one plane change in Dubai. • Since2004,11.3millionhigh-yield tourists and business passengers have travelled on our US flights coming from and going to important developing markets in the Middle East, Africa and Asia. • Thehighaverageseatloadfactorsof over 80% in 2014 on our US flights demonstrate the customer demand for Emirates’ services. • Emirates’flightsbetweentheUSand Dubai have carried over 518,000 tonnes of high value goods since 2004. • Therehasbeena442%growthinUS exports to the UAE since Emirates started services to the US in 2004, and today the UAE is the #1 market for US exports in the Middle East. Seattle San Francisco Los Angeles Chicago Boston New York Dallas/Fort Worth Houston Orlando Estimated annual local economic impact of Emirates operations Source: Economic impact studies from respective airports or regions. Data not available for Washington DC 4 5 Airport ($m) $132m $227m $257m $624m $200m $166m $445m $720m $100m Total impact: $2.9bn Route network comparisons The maps below show that Emirates is providing vital routes to the US, via its hub in Dubai, that the three leading US carriers do not offer. So despite their claims that Emirates is “stealing passengers,” these maps illustrate that in reality there are very few network similarities between Emirates and the big three US carriers United, Delta and American Airlines. Many of Emirates’ routes are to developing markets which are not currently served by American carriers. These air links facilitate US foreign trade and open up new markets for US exporters, helping to further drive American economic growth, trade and job creation. Delta Air Lines Emirates United Airlines Emirates American Airlines Emirates Glen Hauenstein Delta Air Lines, Inc Chief Revenue Officer answering a question on competition between Delta and Middle Eastern carriers during an investor relations call, December 2013: “I think there are two components to your question. One is the third and fourth freedoms, which would be the traffic from the United States and from Europe into the Indian subcontinent and Asia. Delta has never been a big player in that market. Our partners, Air France and KLM, were probably not as heavily invested as Lufthansa or British Airways for that matter. So they probably have a little less impact although it’s significant, because those are traffic pools that they were relevant players in. The thing about their location is they are about halfway around the world from us, and that’s kind of the good news and the bad news. The good news is they are halfway around the world from us and we don’t really participate in a lot of the flows that they have the primary gateway for. The second piece is, if you look at their order books it’s hard for us to imagine that those aircraft could all be delivered in the same time frame to the same region without imploding all of them.” Source: OAG Analyser 5 Open Sky usually features a ‘60 seconds with…’ section to provide readers with a snapshot overview of the dynamics in a given market. This issue’s snapshot is dedicated to Dubai’s longstanding Open Skies policy which has been in place since 1937. We call it ‘78 years with…’ 78 years with… an Open Skies Policy Dubai’s Open Skies policy is a key component of its economic and trade policy. It calls for liberalised rules and regulations to foster a market forcesdriven, competitive environment for aviation to attract airlines and enable them to operate freely. 1985 Many recognise the benefits of Dubai’s forward thinking aviation policies: 2015 How did it all start? The “Dubai Commercial Air Agreement” on July 22, 1937 triggered the Open Skies policy of Dubai. That agreement gave the British Government landing permission en route to India and elsewhere. It was quickly evident that it helped strengthen Dubai’s position as an important trading outpost in the Gulf. In the 1950s, HH Sheikh Saeed bin Maktoum Al Maktoum, the ruler of Dubai at the time, decreed a policy of open seas, open skies and open trade, in part to help eliminate the dependence on oil resources. This was one of the first contributions to building the business-friendly Dubai of today which subsequently has been complemented with the creation of free zones and other business investment friendly incentives. Today oil revenue constitutes a mere 1.8% of Dubai’s GDP, whereas aviation related activities and tourism make up approximately 30%. Nicholas E. Calio President and CEO of A4A on the growth of non-US carriers, specifically discussing the “integrated aviation eco-system” in Dubai in his remarks before the International Aviation Club, October 2014. “I’m not being critical, I’m being clinical. This is brilliant. This infrastructure enables the carriers growth, lowers flight delays and costs, and delivers newer and higher quality infrastructure. The closely integrated Dubai aviation sector strives for maximum throughput since costs for one segment is revenue for another. The bottom line is that Middle Eastern carriers benefit from smart, forward-looking governmental strategies to stimulate passenger growth by setting low airport fees, low corporate taxes and minimal passenger-related fees and taxes which drives significant economic benefit to the host countries.” 6 Considering how protectionism within national airspaces has been a typical, historical norm – and still is in places – Dubai’s Open Skies policy has remained virtually unchanged for close to 80 years. This has encouraged competition amongst airlines, and as a result multiple foreign carriers have enjoyed the ability to pick up and drop off passengers in Dubai for onward flights. Currently more than 130 airlines operate to and from Dubai generating revenue for Dubai’s economy and supporting its commercial activities, whilst also putting constant competitive pressure on Emirates. H.E. Mohammed A Ahli Director General, Dubai Civil Aviation Authority “Dubai is one of the true pioneers of aviation liberalisation having adopted an open skies policy as one of the cornerstones of its economy ever since late Sheikh Saeed bin Maktoum Al Maktoum O.B.E signed the Dubai Commercial Air Agreement with His Majesty’s Government in July 1937, long before Emirates was established in 1985. Access to Dubai, one of the world’s largest and fastest-growing hubs, allows carriers of the world to grow their services and also boost exports and trade to their own markets. For Dubai it gives consumers more choice, stimulates traffic growth and is good for business. Considering that ICAO predicts there will be 6 billion people travelling by air in 2030 compared to 3 billion today, Dubai is well-placed to capitalise on this growth. I am confident that Dubai’s steadfast commitment to Open Skies is a source of inspiration for other countries.” 28 Fair Competition • [fai r] [kom-pi-tish-uhn] 1. Competition rules defined by legacy carriers. 2. A fair and equal opportunity to compete, which ignores geography, different market realities and government policies, and supersedes the consumer’s right to choose. U nfair A d vantage • [uhnfair] [ad-van-tij] 1. Situation in which a non-legacy carrier takes advantage of natural competitive advantages like geography, progressive aviation policy, low tax regimes or supportive airport conditions such as 24 hour flying or affordable parking and handling charges. Capacity Dumping • [kuh-pas-i-tee] [duhmp-ing] 1. When a non-legacy carrier provides more seats between two countries than a legacy carrier to meet the demand at profitable and competitive rates. 2. When third country airlines serve routes that have long been neglected and deemed unprofitable by legacy carriers. 3. When an airline offers the consumer an alternative option by creating connections through non-traditional and nonlegacy carrier hubs. Theft of passengers • [theft] [ohv] [pas-uh n-jerz] 1. When passengers, as a result of competitive prices, connectivity and superior service, choose to travel with non-legacy carriers from the home of a legacy carrier. 2. Also assumes prior ownership of said passengers by said legacy carriers. Level playing field • [levuhl] [pley-ing] [feeld] 1. An aviation industry in which the rules are set by and acceptable to some EU legacy carriers. 2. Competition that ignores market realities and the consumers right to choose. o t e id u g y d n a h e Th SELECT LEGACY R E I R R A C LANGUAGE 7 Emirates and Monte Vibiano – an Italian perspective on growth and jobs With operations to Europe since 1987 and annual investments in products and services amounting to € 4.3 billion in 2013/14, Emirates has long-standing relationships with a large number of European businesses and suppliers. Next to providing connectivity and direct employment, this large-scale economic activity through purchases of goods and services has a multiplier effect which creates indirect and induced employment. The report, ‘Emirates’ Impact in Europe’ by Frontier Economics, quantifies Emirates’ operational impact in Europe and provides detailed coverage of these impacts in all of the EU Member States that Emirates operates to. In Italy for example, Emirates’ direct, indirect and induced impact from its operations amount to 10,270 jobs and €747 million in GDP contribution. The indirect impact can be narrowed down further: in Italy’s agricultural heart, amongst Umbria’s rolling hills, is a 500 hectare farm which is a recognised premium olive oil and wine producer. Castello Monte Vibiano Vecchio is known for supplying Emirates with the small olive oil and balsamic vinegar bottles served at meal times in the premium cabins. Emirates has procured olive oil from Castello Monte Vibiano Vecchio since 2003 and this business relationship is just one among many examples of how Emirates’ direct expenditure and the consequential multiplier effect together contribute to economic activity and job growth in Italy. For Emirates, the on-board consumption of extra virgin olive oil with balsamic vinegar in 2013 was 3,703,000 bottles and in 2014, it grew to 3,816,000 bottles. 307,000 bottles of extra virgin olive oil were also consumed in 2013, a number which grew to 453,000 bottles in 2014. This supply makes up 25% of Castello Monte Vibiano Vecchio production and contributes to sustaining a niche supplier of a quality product. It has also had a measurable effect on employment – Castello Monte Vibiano Vecchio had 15 employees in 2003 and in 2014 the number of employees had grown to 70. Emirates and Italy – fast facts Lorenzo Fasola Bologna CEO of Monte Vibiano “Our long-standing partnership with Emirates now spans more than a decade and it has not only helped Monte Vibiano gain global recognition, but also played a significant role in our ability to gradually expand our production and hire new staff.” •In 2008, Emirates entered into a partnership with Bvlgari for the supply of products and bags for First and Business class amenity kits. In 2013/14 more than 2 million of these kits were given to First and Business class passengers. 76,000 bottles of Italian wine were consumed on Emirates flights. •Emiratescurrentlyemploysmorethan800 Italian nationals. •In2014morethan •In2013/14Emiratesprocuredmorethan 200 million euros worth of goods from Italian businesses. •EmiratesprovidespassengersflyingtoandfromMilan,RomeandVenicewith 8 unique one-stop connections that no other carrier or alliance can offer. 8 The illusory level playing field – a few expert views Jaap de Wit Professor of Transport Economics, University of Amsterdam The concept of a level playing field is not unique to aviation, nor is the debate around the feasibility of it. Open Sky asks three industry experts their perspective... is the level playing field illusory? If we apply the level playing field concept to international markets it not only means equal rules for international trade between states, but also identical economic and institutional conditions within states. The existing diversity in national, institutional and economic arrangements already underlines that the international playing field is not level. Despite these inevitable differences, substantial efforts have been undertaken in the context of ICAO to harmonise safety, security and economic regulation in the global airline industry. However, differences among states with regard to fiscal policy, labour policy and bankruptcy conditions will have an ongoing impact on competitive conditions in the international airline industry. Moreover, in politics the role of the airline industry in society is perceived in different ways by individual states. The political emphasis can range on one hand, from fostering the national airline as an instrument that enables economic development through optimal international accessibility by air, and on the other hand to an ordinary standalone economic activity subject to the full internalisation of its external costs and additional taxes. These different political perspectives among states can fundamentally affect the playing field in international air transport markets, as illustrated by the EU, the US, China and the Gulf states. However, what makes the level playing field fundamentally unlevel in the international airline industry is not politics but geography. The geographical location of a state on the globe determines its Ricardian comparative advantages in developing an international air transport network. For example, the location of Emirates’ hub in Dubai has been decisive in the development of a full-scale long-haul hub-and-spoke system. Such a network provides optimal cost advantages derived from aircraft size economies and average distance flown. Since hub location of European airlines dictates the need for costly short haul feeder systems, the playing field with the Gulf carriers is inevitably unlevel. John Balfour Consultant, Clyde & Co, London “Fair and equal opportunity” is a familiar concept in bilateral air services agreements, but it has not been much tested under the traditional, uncompetitive, international air transport system. However, increasing liberalisation and competition requires that airlines should be able to compete under fair competitive conditions, although this is easier said than done. Airlines start with differing advantages and disadvantages depending on the factual and historical matrix, e.g. geographical location; size and wealth of home market, and potential connecting passenger market; the historical legacy of traffic rights and established markets; and differences in home state laws - in particular labour and tax laws. One topical issue is state aid - rightly, given the competitive distortions it can cause, but rules appropriate on an international basis are not easy to agree. In the EU during the 1990s airlines were allowed to receive over €10 billion of state aid, principally in order to help them restructure to meet the new competitive environment, although a much stricter approach is now taken. A strict approach may not be appropriate for airlines in other parts of the world, at different stages of need or development. For example, the US was a stern critic of EU practice during the 1990s, but took a different view to requests by its airlines for aid post 9/11 - and the EU then became the critic. The more liberalisation stimulates competition in international air transport, the more important it is for airlines to have fair and equal opportunity to compete. This is not easy, but the effort must be made if competition is to be ultimately sustainable. Alan Khee-Jin Tan Professor of Aviation Law, National University of Singapore In the grand sport of aviation politics, the playing field is seldom level to begin with. Nor is it always possible to try levelling it. States are simply not born equal. Some have superior geography, others have a big population base for their airlines to benefit from. Through the decades, it is the successful, well-run airline from the small, strategically-located country that has maximized its advantages, often in tandem with a government willing to provide airport hub infrastructure and other incentives. KLM, Singapore Airlines, Korean Air, Emirates, Qatar Airways, Ethiopian Airlines and Copa fit that bill to varying degrees. These sixth-freedom carriers are able to maximize (some say exploit) their advantages to collect and funnel passenger “feed” from other countries through their well-located and efficient hubs. The success of this strategy depends largely on geography, of course, but also generous or unlimited third-and-fourth freedom rights exchanged with other countries. Such rights are often withheld by larger countries seeking to protect their own carriers’ business and yes ... to level the aero-political playing field. But the airline from the small state is seeking to level the field too – by using its comparative advantages to make up for the lack of a domestic base. So if all are trying to level the field to their own advantage, there may be no level field in the end. For what’s really happening is that one side is working to deny the other’s advantage. In the process, we ignore the interests of those who count for more: the passengers, exporters, and national economies as a whole – in terms of how these will benefit from more competitive fares and greater connectivity. 9 They said it best... Open Sky brings you the best quotes on liberalisation, alliances, aeropolitical protection, free and fair trade, economic policy and global business. Jim Compton, United Airlines Vice Chairman “Our industry is ferociously competitive… Middle East carriers benefit from positive rather than detrimental national aviation policies.” September 2014 If airlines want to ask for less regulation, then why are they also asking for the government to intervene when they see competition from certain regions? It’s no wonder governments think they’re getting mixed signals from airlines.” Brian Havel, director of the International Aviation Law Institute at Chicago’s DePaul University “It is also worrying to see protectionism rearing its head again, notably in the US where some carriers complain the Open Skies arrangements are benefiting non-US airlines, most particularly the Gulf carriers.” - Willie Walsh, CEO of International Airlines Group “What India needs is a complete policy reversal in aviation. We should go for unbridled open skies, with global airlines free to operate any number of flights at any Indian airport. This will help improve the local economy, employment, investment and tourism. Sixty-seven years of protectionism has got Indian aviation nowhere. It is time to test new ideas.” - Amber Dubey, partner and India head of aerospace and defence at global consultancy KPMG “Britain has benefited from being home to the world’s largest port or airport for the last 350 years, connecting British business people and their exports to the world’s markets, but lack of capacity at Heathrow means we have lost our crown to Dubai. It is hard to find a serious economic player that doesn’t aspire to having what London has taken for granted, which is why Istanbul, Dubai, Chicago, Hong Kong and Beijing are investing in their hub airports. It’s not too late: We can have the vision and confidence to develop Heathrow into the world’s best connected airport if we take decisions now.” - John Holland-Kaye, Heathrow CEO “Delta’s work groups have rejected nine proposals to unionize, making us the only major airline outside the Middle East that is largely non-unionized.” - Richard Anderson, Delta Air Lines CEO “… airlines do themselves no favors if they play the game of (rightly) rejecting regulation where it is not necessary, but (wrongly) seeking it when it suits them….Requesting help to keep out competition sends mixed signals to Washington and opens a back door to the era of heavy-handed economic regulation. Remember when CAB defined what could count as a “sandwich”? These same US carriers are turning to the Asia market and transpacific routes to get a bigger slice of that fast-growing market; one made possible through Open Skies. If US carriers seek regulatory help to fend off Gulf competition in North America, then they have no recourse should Asian flagships do the same to them.” - Karen Walker, Executive Editor, Air Transport World “Our position on some important policy issues is not aligned with some other AEA legacy airlines. In particular, we believe global liberalization of our industry is fundamental to our future growth and we are not willing to compromise on this fundamental matter.” International Airlines Group (IAG) in an emailed statement “Lufthansa who would rather limit traffic rights of Gulf carriers through political lobbying, is complaining about government aid, even though Lufthansa has long benefited from it - most recently the Austrian state has paid the old debts of Austrian when Lufthansa took over Austrian.” - Sueddeutsche Zeitung, one of Germany’s leading daily newspapers “The Gulf countries have recognised the value of aviation for an economy. I would also like to see Europe to understand this value too.” - Carsten Spohr, Lufthansa CEO in an interview with the German newspaper Sueddeutsche Zeitung 10 A focus on the environment Emirates recently released its 4th annual Environmental Report, covering the financial year 2013-14. The report, which is verified by PwC, presents environmental data and case studies covering both air and ground based operations across the Emirates Group. Fuel THE EMIRATES GROUP ENVIRONMENTAL REPORT 2013-14 Fuel efficiency is central to Emirates’ business: reducing unnecessary consumption not only reduces the environmental impact, but also has a direct benefit on the bottom line. As the network and fleet expand, Emirates continues to develop efficiency and environmental initiatives which help to balance this growth. During the reporting year, capacity grew 14.6% in available seat kilometres and 14.4% in available tonne kilometres through the addition of 18 passenger aircraft and two freighters, which increased overall fuel consumption. Thanks in large part to the young and efficient fleet - 6.2 years average fleet age compared with the IATA wide-body fleet average of 11.7 years* - Emirates’ fuel efficiency improved 0.5% yearon-year to 0.3089 litres per tonne kilometre and remained 14.5% better than the IATA average. Fuel efficiency for the freighter fleet improved a substantial 8.2% to 0.190 litres per freight tonne kilometre. Noise Since Emirates started reporting on environmental performance the fleet has become steadily quieter. This year, the noise footprint per tonne kilometre of payload improved 2.4% for take-off and 10% for landing. All of Emirates’ aircraft comply with the most stringent ICAO Chapter 4 noise standards**. Ground operations At Dubai International Airport, dnata cleaning crews collected more than 1,700 tonnes of used newspapers and magazines for recycling from Emirates’ aircraft. dnata’s Aircraft Appearances team, who are responsible for washing the exteriors of Emirates’ aircraft, initiated a water consumption measurement programme that helped save 333,500 litres of water. Details of all of these projects and the corresponding environmental data are in the Environmental Report 2013-14, available at http://www.emirates.com *IATA – WATS 58th Edition. **Excludes two wet-leased Boeing 747-400 freighters. 6.2 years 14.5 % 8.2 % Emirates’ average fleet age compared with the IATA wide-body fleet average of 11.7 years ahead of the IATA industry average in terms of fuel efficiency improvement in fuel efficiency for our freighter fleet ENVIRONMENTAL REPORT 2013-14 | 1 Case Studies Partnerships in the air Partnerships with air traffic management (ATM) providers enable aircraft to fly shorter routes and take advantage of favourable winds, as well as making use of other operational enhancements. Emirates expanded its participation in international ATM collaborations by joining the Asia and South Pacific Initiative to Reduce Emissions (ASPIRE) programme, adding to the existing membership in the counterpart Indian Ocean regional programme, INSPIRE. The results of the INSPIRE programme indicate potential savings of 740 kg of fuel, or 2.3 tonnes of CO2, per flight across the Indian Ocean. Reducing emissions Flight crews use a variety of procedures to help save fuel and reduce emissions where it is safe and practicable to do so. The use of idle reverse thrust saved 4,129 tonnes of fuel, equivalent to 13,006 tonnes of CO2. Shutting one engine down while taxiing saved 1,947 tonnes of fuel, or 6,133 tonnes of CO2. Conservation Emirates’ contribution to conservation projects has continued at the Dubai Desert Conservation Reserve and at Emirates One&Only Wolgan Valley in Australia. A total of 15,000 indigenous ghaf trees were planted in the Dubai reserve, irrigated by solar-powered pumps, and 1,000 endangered houbara bustards were released into the wild. Wolgan Valley renewed its carbonneutral certification with carboNZero, and deepened its wildlife research collaborations with university partners. 11 Incremental growth in India Prime Minister Modi has set a target for India’s international aviation market to expand from its current position as 10th largest in the world, to third largest, with 85 million international passengers by 2020. Based on Airports Authority of India 2013/14 data, international passenger capacity will need to grow by more than 80% over the next 5 years. This is achievable, but cannot be done by domestic carriers alone. In February 2014, the aeronautical authorities of India and Dubai negotiated the first expansion in market access since 2008. The implementation of Emirates’ share of this capacity commenced in the summer 2014 schedule, and will gradually increase until the summer 2015 schedule. This capacity will be used to replace older aircraft with modern larger capacity aircraft, including the deployment of a daily Airbus A380 service to Mumbai. The impact of this increase has been modelled by India’s National Council of Applied Economic Research (NCAER). Building on the results from their 2014 interim report, they found that once the additional capacity is fully implemented in 2015, Emirates’ operations will contribute US$848.6 million to India’s GDP and support 86,254 jobs on an annual basis. NCAER also predicts that Emirates will facilitate 673,544 foreign tourist arrivals per year and generate US$1.75 billion in Foreign Exchange Earnings (FEE). The following table shows Emirates’ economic and employment impact figures from the 2012 NCAER report compared with the new modelling NCAER have completed incorporating the capacity increase. The results clearly show that the capacity increases will stimulate investment and growth in India. Year Seats Direct economic impact Total economic impact 2012 54,200 US$274 m 2015 60,200 US$371 m Total jobs supported No. of foreign tourists per year Foreign exchange earnings US$596 m 72,323 529,928 US$1.15 b US$849 m 86,254 673,544 US$1.75 b Emirates currently connects 10 Indian cities, via one stop, to 15 cities in the Middle East, 23 in Africa, 37 in Europe and 13 in the Americas. 80% of Emirates’ destinations in these regions are not served by any Indian carrier. Oslo Stockholm St. Petersburg Oslo St. Petersburg Stockholm Moscow Glasgow Copenhagen Newcastle Hamburg Manchester Dublin Moscow Glasgow Copenhagen Newcastle Amsterdam Birmingham Warsaw London Dusseldorf Dublin Manchester BrusselsHamburg Prague Liege Amsterdam Birmingham FrankfurtWarsaw Paris Vienna London Dusseldorf Basel Brussels Munich Budapest Prague Geneva Zurich Frankfurt Vienna Paris Lyon MilanVenice Munich Budapest Nice Geneva Zurich Zaragoza Rome Lyon Istanbul MilanVenice Barcelona Madrid Nice Athens Lisbon Rome Tunis Istanbul Algiers Barcelona Madrid Malta Larnaca Casablanca Athens Lisbon Tunis Algiers Malta CairoLarnaca Seattle Seattle Toronto Boston New York Washington, DCBoston Toronto San Francisco Chicago New York Washington, DC Atlanta Los Angeles San Francisco Chicago Los Angeles Dallas/Fort Worth Houston Dallas/Fort Worth Houston Mexico Casablanca Orlando Dakar Ouagadougou Dakar Conakry Conakry Quito Erbil Medina Jeddah Baghdad Basra Kuwait Dubai São Paulo Buenos Aires Buenos Aires Khartoum Bangk Chennai Bengaluru Mumbai Hyderabad H Kozhikode Kochi Chennai Bengaluru Thiruvananthapuram Colombo Phuket Kozhikode Kuala Lumpur KochiMalé Sin Thiruvananthapuram Djibouti KhartoumAddis Ababa Accra Abuja Lagos Addis Ababa Eldoret Entebbe Nairobi Accra Luanda Viracopos São Paulo Muscat Kano Abuja Lagos Luanda Tehran Dammam Bahrain Doha Riyadh Abidjan Abidjan Middle East Network Beirut Amman Dubai Dubai Cairo Orlando Entebbe Dar es Salaam Nairobi Seychelles Dar es Salaam Lilongwe Lusaka Harare Seychelles Mauritius Lusaka Harare Johannesburg Rio de Janeiro Rio de Janeiro Johannesburg Cape Town Peshawar Islamabad Sialkot Lahore Delhi Karachi Dhaka Guang Delhi Ahmedabad Kolkata Chittagong Karachi H Mumbai Ahmedabad Hyderabad Kolkata Kabul Mauritius Durban Durban Cape Town Orlando commences in September 2015 12 ---- Ja The cost of non-Europe – in aviation The European Parliament recently released ‘The Cost of Non-Europe in the Single Market (Cecchini Revisited)’. This report, requested by Members of the European Parliament, assesses the barriers, gaps and market inefficiencies that plague the European tourism and transport sectors, and quantifies the benefits of finalising the single market in the transport sector. After 20 years of action, the common transport market remains incomplete, making the sector vulnerable to external shocks and subject to unnecessary cost inefficiencies. According to the report, some of the main obstacles in finalising the single market come from difficulties and variable implementation of new legislation - as well as stakeholders’ opposition and vested interests. The report advocates that a better control of state aid to EU carriers will be key in unlocking the potential for growth in the aviation sector, and notes that the new 2014 guidelines on state aid rules for airports and airlines “will still allow current market distortions and potential misuse of public resources for at least five more years.” The findings recommend that the EU should also ensure optimal use of airport capacity by ensuring non-discriminatory slot allocation, improve ground handling services, harmonise airport charges, and better invest in intermodal infrastructure. Rather than focusing on the effect of global competition on EU carriers, the report foresees that the removal of internal barriers, matched with the gradual opening of the market to non-European air carriers through Open Sky agreements, would result in a more balanced distribution of intercontinental gateways in Europe. Based on these assumptions, the report estimates that the average annual benefits from completing the single market in air transport would be between €910 million and €1.8 billion. This would, in turn, benefit the tourism sector and ultimately support economic and employment growth. Emirates very much agrees that a more integrated and efficient European aviation environment would enhance the competitiveness, cost-efficiency and environmental performance of all air carriers, for the benefit of European businesses, customers and tourists from all over the world. Direct quantified gains Complete Single Market Improved efficiency Market opening and harmonisation Internalisation of environmental externalities Lower operational costs,travel time and fuel consumption Improved infrastructure and cross-border links Geographical balance Expected annual savings between €0.9 and 1.8 bn Enhanced competition Length efficiency Reduced environmental impact Source: The Cost of Non-Europe in the Single Market (Cecchini Revisited). 13 Sector Insight Charles Leocha is Chairman of ‘Travelers United’ (formerly Consumer Travel Alliance), which advocates for travellers to US legislators, regulators and industry associations. The US Secretary of Transportation has appointed Mr. Leocha to the Advisory Committee for Aviation Consumer Protections because of his in-depth knowledge of issues faced by travellers. How in your view has Open Skies benefited consumers? Do you see downsides? Charles Leocha Chairman of ‘Travelers United’ (formerly Consumer Travel Alliance) From the point of view of American travellers, Open Skies has been a boon for international travel and trade. More US cities have nonstop flights to foreign destinations than ever before. This connectivity has encouraged more international tourism travelling to the US and has made the rest of the world more accessible for Americans. Plus, with Open Skies, airline competition can flourish as airlines add routes to the US from new cities. And, that helps keep international airfares in check and improves the interaction between the US and other parts of the world both interpersonally and through business and trade. As an advocate for passengers, are you concerned by calls by some airlines and unions for the US to reverse course on its Open Skies policy, including reopening some existing Open Skies agreements and applying a different policy prospectively? Our organisation, Travelers United, has been steadfast in our belief that airline consumers need truth in advertising and a free market that will ultimately work to the passengers’ benefit. The airline and labour unions calls for limitations on Open Skies agreements are pure protectionism. These efforts are attempts to roll back decades of negotiations between the US and foreign governments. That is not in America’s interest. And, it does not allow for the free market and free trade to operate and grow. As a result, consumers would be harmed by less competitive choice and less passengerfriendly innovation which is spurred by greater competition. More open skies agreements rather than protectionist regulatory limitations are clearly in the interest of American consumers as well as our travel and tourism industry. Emirates has been operating services to the US for 10 years. In a global aviation market increasingly characterised by consolidation and three expanding alliances, how important are non-aligned carriers to ensuring competitive choice for consumers? This competition is extremely important, as I noted above. However, even more important is the streamlined access that airlines such as 14 Emirates provides to south Asia and Africa. The countries in these parts of the world, largely unserviced by US carriers, are the areas with the greatest growth of the middle class and emerging businesses. They will only become more important in the future. It is increasingly in the US national interest, and vital to US exports and export-related jobs, to have efficient and competitive air service links with these dynamic markets. Do you worry that competitive choice for passengers is under threat? Travelers United has been clear about the threat to consumers by airline consolidation. In the US, we have just finished (hopefully) with consolidation of our major domestic carriers. We now have four carriers that control more than 85% of the national market. Internationally, the three US network airlines have formed huge alliances, many with antitrust immunity, that operate as one airline with coordinated routes, schedules and airfares. These three alliances control more than 80% of international airline traffic between the US and the rest of the world. That kind of concentration is not healthy for consumers, either in the US or elsewhere in the world. If the US had not pursued Open Skies, how do you think the global air service landscape would look for passengers today? Without Open Skies agreements, hub and spoke networks focused on a handful of major gateways would have become even more dominant. There would not be as many nonstop connections between smaller countries and the US, or foreign countries and US cities that are not network airline hubs. Plus, the focus would have remained on the already developed US-European routes with a system of feeder networks that would move US passengers to the rest of the world. Open Skies allowed the opening of new and more economical routes, such as those flown by Emirates, that are changing the economic shape of the world, especially the developing nations in Asia and the southern hemisphere where economies are growing and natural resources are plentiful. Open Skies-related competition also has fuelled consumer-friendly service innovation which, without such competition, would have been unlikely because airlines would have had significantly less commercial imperative to improve their products. ...from a US consumer perspective An Open Skies environment, government recognition that aviation spurs economic growth and a favourable geographical position support Emirates’ ability to tap into the 21st century travel flows. Is this unfair competition? The exponential growth of Emirates is not being fed by poaching air traffic from other established airlines, but because of a major shift in demographics and economies. Emirates finds itself in a strategically important position as economic and middle-class growth has moved the travel, trade and tourism centre of influence from an almost exclusively Euro-American-Japanese affair, to a shared 21st century matrix where countries below the equator are developing and the economic focus of the world is shifting. Being able to take advantage of changing demographics and economics is a part of competition. A large portion of Emirates’ success has come about because the major US and European airlines did not change their networks as the new economies developed. I expect to see the three major airline alliances make serious efforts to shift their networks and expand capacity to take advantage of the emerging developing world. This is what competition is all about — and it’s not unfair. The economic value of cargo The Frontier Economics report ‘Emirates’ economic impact in Europe’ highlights the value of the unique connectivity provided by Emirates, especially to secondary cities. This unique connectivity is beneficial not only to passengers – it helps facilitate the movement of cargo benefiting the overall EU economy. Frontier’s analysis showed Emirates offers 21 unique direct connections and 199 unique one-stop connections which cannot be offered by any other airline or alliance partner. Additionally Emirates offers 119 more frequent connections, providing consumers with greater choice. In 2013/14, Emirates transported over 518,000 tonnes of cargo to and from 17 EU Member States, 58% of which was exports from the EU. Nearly 77% of the total exports carried by Emirates came from Germany, the UK, Italy, Spain and France. In 2014, Emirates was the third largest mover of UK origin cargo, with a 9.72% share of the UK export market – behind British Airways and Virgin Atlantic. Items exported included horses, livestock, luxury cars and vehicles, foodstuff including salmon and shellfish, specialised engineering products, ships and aircraft spares, aero-vehicle-marine engines and building materials. These items were bound for Dubai and onward destinations such as Shanghai, Singapore, Hong Kong and Kuala Lumpur. Glasgow Manchester Dusseldorf Lyon Barcelona Madrid Hamburg Lahore Dubai Manila Durban New Silk Road Automotive and Textile, yarn, footwear, auto/ship parts to Perth silk etc to Adelaide Pharma and biologicals to Lahore Perth Brisbane Adelaide Sydney Aircraft spares and parts to Manila Chemicals, dyes, resins etc to Durban Machinery, equipment, tools etc to Brisbane Perishables - Foodstuff, beverages to Sydney Milan accounts for more than 50% of the exports that Emirates carries from Italy. As one of the leading fashion capitals of the world, the types of goods carried include made-in-Italy high fashion items such as garments, bags and shoes and valuable cargo such as gold and jewellery. Foodstuffs including cheese and vegetables, machinery and spare parts, furniture and chemicals find their way to destinations such as Melbourne and Johannesburg as well as Dubai. With ten freighters a week from Amsterdam, the Netherlands ranks sixth in terms of volume of cargo exported by Emirates from the EU. Items carried include plants and flowers, ship spares and pharmaceuticals to Dubai and points beyond – Sydney, Brisbane and Baghdad for example. The unique connectivity that Emirates provides allows the businesses, shippers and freight forwarders alike to move items quickly and with ease, getting goods to market in the shortest time possible. 15 ‘A Greener Tomorrow’ initiative enters its second year On the back of its successful debut project, Emirates has announced the continuation of its ‘A Greener Tomorrow’ initiative, allocating US$ 150,000 raised through Emirates’ internal recycling programmes, to support environmental or conservation-based not-for-profit organisations in safeguarding their local environment. The recipients of last year’s awards addressed a diverse range of issues, from fuel-efficient cooking in Malawi, eco-villages and sustainable farming practices in Pakistan, and the conversion of Manila’s iconic ‘jeepneys’ into battery-operated versions that reduce emissions in the city. When the project was first launched, more than 400 organisations globally were nominated for the award by passengers, Emirates’ social media network, universities, environmental and conservation organisations and the general public. Applications came from countries across the Emirates network and beyond, and spanned environmental initiatives such as animal, land and tree conservation, biogas, environmental research, and green transportation. Organisations are now invited to submit project plans describing their project and the impact it will have on the local environment. Application forms must be submitted by 7th May 2015. Individuals who wish to nominate an organisation for the award can send the organisation’s name, email address and contact telephone number to: [email protected]. More information about the initiative and application criteria can be found at: www.emirates.com/greenertomorrow. To read more about last year’s projects, please visit: http://www.emirates.com/english/ environment/greener-tomorrow/a-greenertomorrow-2013.aspx Fast Facts Aircraft in fleet No. of destinations Passengers* Cargo* Passenger Seat Factor* Employees - Airline* Emirates flights daily *2013-14 233 144 44.5 million 2.3 million tonnes 79.4% 52,000 472 Financial Auditor Financials (Airline)* Fuel Costs (Airline)* First flight New passenger routes in 2015 A380 fleet Boeing fleet Oslo Stockholm St. Petersburg Glasgow Copenhagen Newcastle Dublin Manchester Hamburg Amsterdam Birmingham Warsaw London Dusseldorf Brussels Prague Liege Frankfurt Vienna Paris Basel Munich Budapest Geneva Zurich Lyon MilanVenice Nice Zaragoza Rome Istanbul Barcelona Madrid Seattle Toronto New York Washington, DC Chicago San Francisco Los Angeles Boston Lisbon Atlanta Dallas/Fort Worth Houston Algiers Tunis Malta Casablanca Moscow Larnaca Ouagadougou Conakry Abidjan Quito Beirut Amman Medina Jeddah Baghdad Tehran Dammam Bahrain Doha Muscat Buenos Aires Seoul Tokyo Osaka Malé Seychelles Shanghai Taipei Hong Kong Manila Bangkok Ho Chi Minh City Phuket Kuala Lumpur Singapore Jakarta Bali Lilongwe Mauritius Rio de Janeiro Johannesburg Durban Dubai Chennai Bengaluru Kozhikode Kochi Thiruvananthapuram Colombo Eldoret Nairobi Dar es Salaam Lusaka Harare Viracopos São Paulo Djibouti Addis Ababa Accra Luanda Basra Kuwait Riyadh Khartoum Entebbe Middle East Network Erbil Kano Abuja Lagos Peshawar Islamabad Sialkot Lahore Delhi Karachi Dhaka Guangzhou Ahmedabad Kolkata Chittagong Hanoi Mumbai Hyderabad Kabul Dubai Mexico Dakar Beijing Athens Cairo Orlando PwC Revenue $22.5bn, profit $887m $8.4bn 25 October 1985 Bali and Orlando 60 (on order 80) 147 (on order 199) Cape Town Route Map April 2015 Brisbane Perth Adelaide Melbourne Passenger Routes Freighter Routes Passenger & Freighter Routes ---- Upcoming Passenger Routes Please visit our website for more information on Emirates’ International, Government and Environment Affairs department www.emirates.com or write to us [email protected] 16 Sydney Auckland Christchurch

© Copyright 2026