Brochure - Trading with confidence and bank guarentees

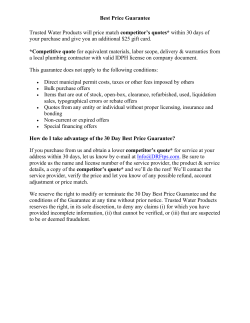

Corporate and Investment Banking Trading with confidence with bank guarantees Bank Guarantees Standard Bank – your trade partner in, for and across Africa Trading with confidence with bank guarantees Requesting bank guarantees in a commercial contract is a common practice in the market. In large-scale transactions, especially in international trade, it goes without saying that bank instruments that secure performance and payment obligations are a vital part of managing risk in business. When concluding contracts, it is prudent to partner with a bank that has the cross-border transactions expertise and knowledge of international trade to provide tailored solutions and sage advice. Among national and international banks, Standard Bank is a preferred trade bank with the client base and accolades to stand testimony to our capabilities. 3 Bank Guarantees Types of guarantees matched to your needs Standard Bank facilitates the issuance of this guarantee on your behalf, and also receive on your behalf the advance payment amounts to your accounts held with us. Standard Bank can advise on and issue guarantees on your behalf. We also provide guarantees to you on behalf of our international bank clients when requested by your clients. Retention guarantees Tender guarantees Also known as a bid bond, a tender guarantee discourages companies from submitting tenders only to: Securing performance and payment obligations Through bank guarantees, Standard Bank provides you and your contracting parties with assurance through a written undertaking that the terms and condition of the contract will be met. This is crucial for international trade, where you enter into commercial contracts with parties from different legal and cultural backgrounds. Standard Bank intervenes and provides you and counterparties with the assurance we will pay a predetermined amount of money in the event of default. When purchasing goods or services offshore, it is difficult to assess the potential expertise or financial prospects of your supplier of goods and services. For this reason, you should request your counterparties to provide a bank guarantee that the supplier will perform as agreed. Standard Bank facilitates the issuance of this guarantee to you through our widespread network of international banks, that covers where your counterparties are banked. Sellers of goods can also require you to provide guarantees to secure your payment obligations. 4 • withdraw from the tender before its expiry Why Standard Bank? • attempt to amend the tender • refuse to sign the contract when awarded to them With over 150 years’ experience, representation in 20 countries in Africa and key financial centres, Standard Bank is best equipped to connect your company to Africa and to the world. • fail to furnish the required performance bond or other required guarantees. We have well-established partnerships with banks in countries where we are not present to facilitate the issuance of guarantees where a local bank is required. However, Standard Bank guarantees are generally acceptable by beneficiaries world-wide. Our in-house specialists bring in-depth knowledge and experience to bear on all aspects of your international trade needs. These specialists have comprehensive knowledge and wide-ranging experience in different legal regimes in Africa. We support you with international best practices as outlined in the International Chamber of Commerce rules (ICC). With a guarantees book in our Africa operations in excess of R40 billion, Standard Bank has the scale and experience to issue guarantees in Africa and beyond. In choosing Standard Bank as your financial partner and guarantor bank, you can rest assured that your transactions are in good hands and you can trade with confidence. In helping you to secure the contract, we can issue these guarantees on your behalf when tendering for a contract where tender guarantees are required with tender documents. Performance bonds Once a tender has been awarded to you, you may be called to issue a performance guarantee to guarantee performance under the contract. Standard Bank can help you structure and issue a performance bond to satisfy the request of the company. Advance payment guarantees Following the award of a tender, you may require an advance payment before you commence the contract. In return, your client may require an advance payment guarantee. A contract may permit your client to retain a certain percentage of payments due to you as security against latent defects on your workmanship. Standard Bank can issue this guarantee on your behalf so you have immediate release of retention money that would otherwise be withheld for the retention period. Warranty/maintenance guarantees This type of guarantee protects your client by covering the cost of any defect or malfunction that may manifest itself after the completion of the project. Standard Bank can help you structure and issue this guarantee to satisfy the requisite requirements. Facility guarantee While this is not normally trade-related, it provides security to another bank to advance money to a related company. It is often used when the company does not have any credit record and wishes to expand offshore. Standard Bank can issue this guarantee to the lending bank to support your related company when looking to borrow monies or for general credit facilities with a particular bank. Shipping guarantees and airway release guarantees This guarantee mitigates the risk of liability where shipping documents have been lost or delayed. 5 Standard Bank can issue this guarantee to indemnify a shipping company against any liability that may arise from releasing imported goods to the consignee without the documents of the title (bill of lading). Standby letter of credit This has similar wording to other documentary credits but includes the qualities of a demand guarantee as it provides you with security of payment in the event of default. Contact us for expert advice and information on guarantees in, for and Africa For further information on our products and services, contact: Email: [email protected] Standby letters of credit are predominantly used in the United States where banks are legally barred from issuing certain types of guaranties. We work with you on negotiating contracts and issuing guarantees to give you the edge in international trade Our Trade Sales Managers can advise you on the type of guarantee to meet your specific needs and assist you with wording the guarantee. This ensures that you enter into a contract with the backing of a bank with the experience and capability to help your business succeed. Disclaimer This document has been prepared solely for information purposes by The Standard Bank of South Africa Limited, acting through its Corporate and Investment Bank Division (“SBSA”). Any indicative terms provided to you are provided for your information and do not constitute an offer, a solicitation of an offer, invitation to acquire any security or to enter into any agreement, or any advice or recommendation to conclude any transaction (whether on the indicative terms or otherwise). Any information, indicative price quotations, disclosure materials or analyses provided to you have been prepared on assumptions and parameters that reflect good faith determinations by us or that have been expressly specified by you and do not constitute advice by us and it should not be relied upon as such. The information, assumptions and parameters used are not the only ones that might reasonably have been selected and therefore no guarantee is given as to the accuracy, completeness, or reasonableness of any such information, quotations, disclosure or analyses. No representation or warranty is made that any indicative performance or return indicated will be achieved in the future. This document is not an official confirmation of terms, and any transaction that may be concluded pursuant to this document shall be in terms of and confirmed by the signing of appropriate documentation, on terms to be agreed between the parties. The information in the document is also subject to change without notice. SBSA, or an associated company, may have effected or may effect transactions for its own account in any investment outlined in the document or any investment related to such an investment. Prospective investors should obtain independent advice in respect of any product detailed in this document, as SBSA provides no investment, tax or legal advice and makes no representation or warranty about the suitability of a product for a particular client or circumstance. Transactions described in this material may give rise to substantial risk and are not suitable for all investors. SBSA will only provide investment advice if specifically agreed to by SBSA in appropriate documentation, signed by SBSA. This information is to be used at your own risks, and SBSA makes no representation with regards to the correctness of the information herein. 6 Authorised financial services and registered credit provider (NCRCP15) The Standard Bank of South Africa Limited (Registered Bank) Reg. No. 1962/000738/06 SBSA 182806-7/14

© Copyright 2026