trade related guarantees - BNP Paribas Corporate & Investment

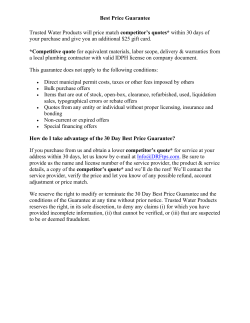

TRADE RELATED GUARANTEES Whether you are an importer or an exporter, trade related guarantees will help you to: • Secure the steps of your commercial contract from the submission of the tender to final acceptance, • Reduce the risks linked to performance and/or payment of your international transactions. Principle In commercial contracts (export/import), some milestones require a third party, typically a financial institution, to provide a guarantee, which is a form of surety against a possible default of the other party. THE CALL FOR TENDERS Submission of tenders Tenders opening THE CONTRACT Last delivery Contract signature Last deliveries provisional acceptance Final acceptance BID BOND ADVANCE PAYMENT BOND A bank guarantee is an irrevocable bank commitment by signature, by order of one of its customers (the applicant), to pay a certain sum of money to a beneficiary, upon receipt of a complying demand from him informing the bank that the customer failed to fulfil their contractual obligations. In other words, the bank guarantee is a security given by the bank to protect the beneficiary against the applicant’s default. The bank only commits to pay, in whole or in part, in one or in several drawings, the amount stated in the guarantee. This means that the bank will not, and is not liable to deliver the goods or to assume responsibility for carrying out a project. Depending on the country or applicable laws, guarantees, standby letters of credit (SBLC) or other types of text may be used. PERFORMANCE BOND RETENTION MONEY BOND Types of guarantees n Bid Guarantee/Bond This type of bond is intended to guarantee the genuineness of the bidder. The purchaser/importer will be indemnified: if the bidder withdraws their bid during its validity; if a successful bidder refuses to sign a contract or upon signature of the contract; If after signing the contract, the bidder does not provide the guarantees required by the purchaser in the invitation to tender. n Advance Payment Guarantee/Bond This is a guarantee for the purchaser/importer covering the reimbursement of the down payment(s) paid by the latter in case the supplier/exporter would not respect his delivery or performance obligations and would refuse to reimburse the down payment(s). One guarantee may cover progress payments. n Performance Guarantee/Bond This type of guarantee is aimed to reassure the purchaser about the technical capacity of the supplier to fulfil their contractual obligations. The bank commits to pay to the purchaser a certain sum of money, if the exporter fails to perform or performs imperfectly. n Retention Money Guarantee/Bond This guarantee is designed to avoid deduction by the purchaser/importer of the last term of payment in a contract in case the equipment delivered or work performed does not conform to the contract specifications. This Guarantee enables the seller/exporter to receive full payment before final acceptance. n Payment Guarantee With this type of undertaking acting on the importer’s order, the issuing bank guarantees the payments made by the importer to the exporter under the terms of the contract. A payment guarantee can cover either the partial or full amount of a single transaction or business flow. Our trade experts will assist and advise you in adapting the right solution to your needs. Standby Letter of Credit (SBLC) The Standby Letter of Credit is a bank guarantee, payable on first demand against presentation of specified documents. The SBLC simply requires a declaration from the beneficiary stating the applicant’s default by virtue of the underlying transaction. 1. Commercial Like any other bank guarantee, the Standby Letter of Credit may have multiple purposes: tender guarantee, advance payment guarantee, performance guarantee, retention money guarantee or payment guarantee. SBLCs can be made subject to two different sets of rules approved by the International Chamber of Commerce (ICC): lthe Uniform Customs and Practices for Documentary Credits, 2007 revision, ICC Publication N° 600 (“UCP 600”); l the International Standby Practices, ICC Publication N° 590 (“ISP 98”). Both publications co-exist with each other and have the advantage of providing a common understanding in the different countries where Standby Letters of Credit are used. Key Advantages of Our Offer nBNP Paribas` strength as a global player. nCommitments are guaranteed by the BNP Paribas Group’s signature. nSubmission of the undertakings to universally recognised rules ensures that the documents are objectively examined should a default arises. nSupport from our Trade experts when drafting and negotiating your commitments ensures that your interests are protected throughout all stages of the contract. nThrough our dedicated e-platform Connexis Trade, you will be able to manage the issuance of your guarantees online in real time. contract IMPORTER / EXPORTER EXPORTER / IMPORTER 2. Request of SBLC opening Our experts will help you make the best choices for your transactions. 4. SBLC notification ISSUING BANK ADVISING / CONFIRMING BANK For further additional information, please contact: Your BNP Paribas Trade Center 3. SBLC issuance The information contained in this document is correct as at the date of printing. It is distributed for information purposes only, it does not constitute a prospectus and is not and should not be construed as an offer document or an offer or solicitation to buy or sell any product or solution, to subscribe any service or to enter into any transaction described in that document. This document does not and is not intended to constitute any investment or financial advice, and nothing contained herein shall be construed as an inducement or recommendation of any form whatsoever. Recipient should contain independant legal, financial and other professional advice as regards its decision to buy or sell any product or solution, to subscribe any service or to enter into any transaction described herein. BNP Paribas will not be responsible for the consequences of any use of or reliance upon any information contained herein or for any omission or error. This document is distributed to selected recipients only. It may not be reproduced or disclosed (in whole or in part) to any other person nor be quoted or referred to in any document without the prior written permission of BNP Paribas. © 2014 BNP Paribas. All rights reserved.

© Copyright 2026