CBI Product Factsheet: Soap in France

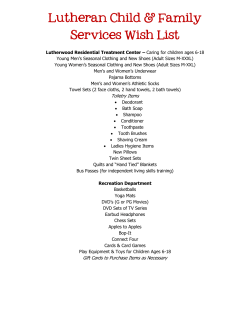

CBI Product Factsheet: Soap in France ‘Practical market insights concerning your product’ Exporters from developing countries (DCs) can profit from the growing soap supplies from DCs to France. They may be able to supply the French mid-high-end market by promoting their unique identity and story. Moreover, France’s role as a trade hub seems to be growing, indicating that this country can also be used as an intermediary to reach other markets in Western Europe. Although this factsheet focuses on the French market, most of the information also applies to other mature European markets. A mature market is a market where a product’s life cycle has passed both the emergence and growth phases. Sales and earnings increase more slowly in mature markets than in emerging markets. Mature market consumers are more experienced through years of intense marketing efforts and an expanding number of choices. Whereas any segment can be targeted, most opportunities are currently in the higher market segments. Design, hand-made products and branding are of utmost importance when targeting these segments. Mature European markets include Austria, Belgium, Denmark, Finland, France, Germany, Luxembourg, the Netherlands, Norway, Sweden, Switzerland and the United Kingdom. Product Definition Product Soap Theme Pampering/wellness/spa Refer to Trendmapping for more information on this theme. HS codes 3401 11: Soap & organic surface-active products in bars or cakes, etc, for toilet use 3401 19: Soap & organic surface-active products in bars or cakes, etc, not for toilet use 3401 20: Soap in other forms PRODCOM codes 20.41.31.20: Soap and organic surface-active products in bars, etc., n.e.c.(not elsewhere classified) 20.41.31.50: Soap in the form of flakes, wafers, granules or powders 20.41.31.80: Soaps in forms excluding bars, cakes or moulded shapes, paper, wadding, felt and non-wovens impregnated or coated with soap/detergent, flakes, granules or powders Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France Product Specification Product specifications Soap as a consumer product in Home Soap started off in the form of a simple bar of soap for washing the hands and clothes. It performed an antibacterial function and as such became a mere commodity. This type of soap still exists and finds its place in the lower end of the body care/hygiene market. This application is not discussed in this product factsheet. Soap then became part of the growing body care market, resulting in the luxury segment of wellness and spa treatment, also increasingly at home. In so doing, soap increasingly became a suitable gift, and the product features and its packaging were adapted to this new need. Finally, soap is moving into the home: as consumers are creating a much more personal ambience in the home (scent and look of soap can create atmosphere of calm and relaxation), soaps became part of the market that may be labelled ‘the fragrance market’. In the course of this transformation from a basic, functional commodity to an emotionallycharged body and home-care product and gift, soap developed a premium side. Quality Quality is first and foremost related to the fact that it comes in contact with the skin, and as such, needs to comply with health regulations (refer to ‘Legal requirements’); the product must also be non-allergic and generally safe to use. Obviously, as soap, a basic quality requirement is that it cleans the skin, textiles or the dishes. For extra convenience, soap now comes in solid or liquid forms. Having developed into a body and home care item and a gift, with possibilities for premium marketing, soap needs to offer additional attributes that contribute to consumer needs involving ‘giving’, ‘wellness/pampering’ and ‘ambience at home’. The smell and colour of soap are the most important determinants of quality. Extra features include: o Natural (vegetable as opposed to chemical) ingredients (e.g. Aloe Vera, Shea Butter, Jojoba…), providing fragrances that can relax or invigorate or just create an atmosphere in the home and any of the rooms o Biodegradable and environment-friendly ingredients and packaging o ‘Origin’ or ‘Provenance’ (e.g. soap from Aleppo, Syria, or the French Provence) o Hand-made (as opposed to industrial), and as such rough and uneven in shape or form o Contributing to the atmosphere at home (which is often achieved by embossing or stamping texts on the soap itself): e.g. nostalgic, exotic, rustic, romantic, pure. o Part of a Spa or gift offer There is a marked tendency for more natural and authentic in the higher segment. Interestingly, ‘green’ values are very much part and parcel of the soaps fulfilling the needs to give and pamper. In this, the fragrance market is a forerunner in the Home market. Labelling Your label on the outer box should include information concerning the product such as fragrance, the ingredients, quantity, size, volume, producer (logo), consignee, country of origin and caution signs. Information on the carton should correspond to the packing list sent to the importer. On the product label, EAN/Barcodes are widely used within Europe. With the widespread practice of e-marketing of soaps and fragrances, individual packing and labelling is a firm requirement. Please note, your buyer will specify what information they need on product labels or on the item itself (logos, 'made in…'). This forms part of the order specs. All labelling must be in English. Packing and Soap should be packed in agreement with the importer’s instructions. Every packaging of product importer will have their own specific requirements related to the use of packaging materials, the filling of cartons, palletisation, and the stowing of containers. Always ask for the importer’s specifications as part of the order specifications. The balance is between using maximum protection and avoiding shipping ‘air’ or excess materials (waste removal is a cost to buyers). Proper packing of soap can minimise the risk of damage as a result of fluctuations in temperature, humidity and shocks. Soap packaging therefore usually consists of inner and outer cardboard boxes, with appropriate materials to protect the products inside the inner boxes (this may involve materials such as bubble wrap or paper, depending on the preferences of the buyer). Packaging needs to be of easy-to-handle dimensions and weight. Standards here are often related to labour regulations at the point of destination and will have to be specified by the buyer. Cartons are usually palletised for air or sea transport and exporters are requested to maximise pallet space. At retail level, soap sold as a gift or luxury body or home care will carry information about the ingredients, the process or about any additional features that are underpinning the premium marketing. Online, the message is conveyed with the help of succinct texts, but in brick-and-mortar outlets1, small labels or forms of packaging will express the exclusivity of the product. However, there is a strong tendency to reduce the amount of packaging, both to allow the consumer a better sense of the natural qualities of the soap and to reduce the environmental footprint. In the case of liquid soaps, retailers may offer refillable packaging to their customer and may, therefore, order in bulk or temporary packaging. The exporter is not always responsible for attractive consumer packaging as it is usually designed by the importer to Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France reflect the brand identity. As a further selling point in the fragrance industry, gift packs or complete spa packs are offered (see illustration under ‘mid-market’). The exporter may or may not be asked to supply the packaging for this, again depending on the importers’ preferences and the exporters’ options. Illustration Low end Mid end High end Source: Poundland Online-cosmetics Maison du Savon Fiorira un Giardino L’Occitane Lush Legislative requirements Product safety and Liability The General product safety Directive (GPSD), which applies to all consumer products, states that all products marketed in the EU should be safe. The purpose of the legislation is to ensure consumer safety. The Liability Directive states that the EU importer is liable for the products introduced into the European market. The EU importer, however, can in principle pass on a claim to the producer/exporter. Packaging Packaging and packaging waste EU packaging legislation restricts the use of certain heavy metals, among other requirements. Considerations for action Consider implementing a management system or code of conduct in order to demonstrate to your buyer that you have taken appropriate safety measures. Make sure your products are safe to avoid product liability claims for defective products. Reduce the amount and diversity of your packing materials by: partitioning inside the cartons with the help of folded cardboard, matching inner boxes and outer cartons better and standardising the sizes of each, considering packing and logistical requirements at the design stage of the products asking your buyer for alternatives Consider using biodegradable materials which may form a market opportunity or even a demand from your buyer. Chemical substances The Cosmetics Directive soon to be replaced by the Cosmetics Regulation specifies requirements (physic-chemical, microbiological & toxicological) for substances/ingredients to be included in each Cosmetic Product Safety report. Be aware of the EU legislation on cosmetic products. Products that do not meet this legislation are not allowed on the EU market. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France Non-legislative requirements Sustainability Consumers are increasingly aware of social and environmental circumstances during production. As a consequence, requirements regarding sustainability and certification are increasingly important to buyers. Considerations for action Think about sustainable production methods and consider certification because it adds value to your products. This is useful when targeting the higher market segments. Implementing a management system (or using sustainably produced materials) may be a competitive advantage. Codes of conduct EU buyers may expect you to comply with their supplier codes of conduct. This can be the importer’s own code of conduct or a code of conduct as a part of an initiative in which the importer is participating (e.g. BSCI). The following are examples of initiatives regarding sustainability, possibly relevant if you want to export to the EU: The Business Social Compliance Initiative (BSCI) has been developed by European retailers to improve social conditions in sourcing countries. Suppliers of BSCI participants are expected to comply with the BSCI Code of conduct. To prove compliance, your production process can be audited at the request of the importer. Once a company is audited, it will be included in a database which can be used by all BSCI participants. As more and more European importers participate in BSCI, you can expect that complying with the BSCI code of conduct will be seen as a basic requirement. Because it can harm your position on the market if you are far from complying with this initiative, you are advised to anticipate by performing a self-assessment, which is available on the BSCI website. ISO 14001 Certification scheme which provides generic requirements for an organisation's environmental policy. SA 8000 Certification standard by Social Accountability International (SAI) for the improvement of working conditions. This standard can be used to reduce the cost of waste management, distribution costs and improve corporate image. Therefore, consider ISO 14001 certification which may form a market opportunity or even a demand from your buyer. Consider SAI certification which may form a market opportunity or even a demand from your buyer. Besides social and environmental aspects of production, Fairtrade certification also covers a fair wage to labourers involved in the production of soap. Acquire Fairtrade certification to enter the fairtrade segment. Compliance with fairtrade norms will also make it easier to acquire other social and environmental norms, as it is the most integrated system for sustainability. The Cosmos Standard has been developed at the European level by BDIH (Germany), BIOFORUM (Belgium), COSMEBIO & ECOCERT (France), ICEA (Italy) and SOIL ASSOCIATION (UK) in order to define minimum requirements and common definitions for organic and/or natural cosmetics. Consider acquiring these standards to distinguish yourself from your competitors. Ask your buyer which of these two standards he prefers. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France The NaTrue standards are applied by an association of large organic and natural cosmetic producers. Trade and Macro-Economic Statistics Figure 1: Apparent consumption of soap, value in € million 300 Figure 2: Production of soap, value in € million 120 100 250 80 200 France 60 France 150 Europe average Europe average 40 100 20 50 0 0 2007 2008 2009 2010 2011 Source: Eurostat Prodcom 2013 The market is recovering after a dip in 2008-2010 Apparent consumption of soap in France amounted to € 184 million in 2011, accounting for 18.5% of total European consumption. European average consumption experienced growth in the period 2007-2011. Spending on body care continued, despite the European crisis, and the market for soap is expected to continue to grow. The French market showed an average annual decrease of 4.5% in the period 2007-2011. This decrease is likely the result of the economic crisis between 2008 and 2010 (refer to CBI Tradewatch for Home Decoration). Soap is related to giving, pampering and ambience at home and is regarded as a premium product; expenditure on soap therefore could have been affected by the crisis. However, the French market has been recovering since 2010 and remains a significant market compared to European averages. European production is highly concentrated in three main producing countries: France and its main competitors Italy and Germany. Together they account for more than half of European production. This 2007 2008 2009 2010 2011 Source: Eurostat Prodcom 2013 Considerations for action In your strategic choice of countries in which you market your products, France, Germany and Italy deserve to be given priority as their production power will largely reflect market demand. Trade fairs in these countries may be more useful than others (especially Maison et Objet and Ambiente trade fair). The fact that production is high in these countries too means that manufacturers may be looking for suppliers of new ingredients and ‘stories’. This may open up new opportunities for partnerships based on raw or semi-finished materials. Consider combining different products in your range (soaps with scented candles, perfumes and room fragrances). This may take any form, from informal collaborations with colleagues in related product categories to business mergers or product extension. Soaps related to giving, wellbeing and home ambience are products sold in the premium segment, where small players with a differentiating offer may well find a profitable niche, across the various mature markets in the EU. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France explains the relatively low European soap production on average. Also in these countries the fragrance industry (besides soaps and diffusers including scented candles, perfumes and eau de toilette, and home fragrances) has matured and has been taken to premium levels. French production represents 8% of total European production and was worth €96 million in 2011 after showing an average annual increase of 4.2% during 2007-2011. Production is expected to remain relatively stable in the coming years. Figure 3: Consumer confidence indicator, France compared to EU27, 2008-February 2013 0,0 jan-08 Figure 4: GDP in France, % change on previous year 2,5% jan-09 jan-10 jan-11 jan-12 jan-13 -5,0 2,0% -10,0 -15,0 1,5% France 1,0% EU 27 average EU27 -20,0 France -25,0 -30,0 0,5% -35,0 0,0% -40,0 2010 Source: Eurostat (2013) Economic indicators vary Consumer confidence and GDP expectancy are important indicators for the French home decoration market and for soap as an element of that. French consumer confidence develops at almost the same pace as EU 27 consumer confidence (see Figure 3). As a whole, the French consumer is a little bit gloomier than the average EU citizen and this may have a negative impact on consumption patterns for home products, perhaps including soap, although research confirms that spending on body care remains one of the priorities in EU consumer spending. France’s GDP is forecast to increase again at a strong rate towards 2014. This could suggest that consumption of luxury products, also soap, is likely to rise. However, because France is a mature market, growth in consumption will be moderate only. 2011 2012 2013 2014 Source: Eurostat (2013) Considerations for action Monitor consumer confidence and GDP, because when these turn positive, expenditure on soap products is expected to increase. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France Figure 5: French imports of soap intra-EU and DCs, value in € million Figure 6: French main soap suppliers, value in € million 70 300 60 250 50 Germany 200 Intra-EU/EFTA 150 DCs 100 Italy 40 Belgium 30 Israel 20 50 United Kingdom 10 0 0 2007 2008 2009 2010 2011 2012 2008 Source: Eurostat (2013) Decline in Intra-European trade while imports from DCs are growing France is Europe’s largest importer of soap and imported € 206 million worth of soap in 2012, of which 11% was sourced in DCs. Imports from DCs increased by 9% annually on average between 2007 and 2012. Various DCs witnessed their supplies to France increase, including Israel, Malaysia, China and Indonesia. With a growing demand for unique products with a story, this trend is expected to continue, if DCs are able to supply these niches. DC exporters are threatened by German and Italian suppliers, which witnessed a major increase in their supplies to France. Germany and Italy are important soap producers from which France can benefit as transportation time and costs are much lower than for DCs. However, a positive note is the fact that DC supplies are increasing simultaneously. There is consolidation in the production of industrially-made soap for the lower and middle markets. This will most likely continue as France in particular houses a number of related industries, all forming part of the fragrance industry: scented candles, home fragrances and cosmetics. As such, ingredients flows and manufacturing technologies are concentrated, offering competitive advantages over other production locations in other countries. Moreover, France and Italy are most well known with high-quality (natural) ingredients and intensive marketing (branding). As this will continue to be their competitive advantage, it offers few 2010 2012 Source: Eurostat (2013) Considerations for action The growth trend in imports of soap from DCs is driven by the market’s need for product innovation and new stories. DC suppliers offering new directions (esp. new ingredients) may well find rewarding new market niches. In an industry that places high demands on quality (see ‘Product Specification’), DC suppliers need to develop a high level of service (in order to become an option for an EU importer). Invest in long-term relationships with your buyers, giving them less incentive to switch to a competitor. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France opportunities for other producers/exporters. However, an increasing demand in the premium segments in new ‘stories’ in soaps, based on new, exotic and natural ingredients, will be likely to drive a growing demand for DC-produced soaps. Figure 7: Total French exports of soap, value in € million Source: Eurostat (2013) Exports on the rise French exports of soap increased by 3.4% annually between 2007 and 2012, to a value of € 129 million. The main destinations include surrounding countries Germany, the UK, Belgium and Italy. Due to the expected stability in French production, exports are also expected to remain rather stable. Figure 8: Top 5 export destination of French soap, value in € million value in € million Source: Eurostat (2013) Considerations for action As France mainly supplies to surrounding countries it could also be used as an entry point to reach other markets in Western Europe. Be aware of your EU buyer’s markets and its requirements. This way, you can develop new ideas also for the buyer’s other EU markets. Market Trends Soap benefits from the ‘slow bathing trend’ Soap no longer only functions as an ‘antiseptic bar and physical cleaner’, it fits in with the ‘slow bathing’ trend (refer to CBI Trendmapping for Home Decoration and Textiles) and the greater attention that is paid to body care and physical/mental wellbeing. Soap brings physical and mental freshness: it is able to create atmosphere, a feeling of wellness both in the body and in areas of the home. This means that soap needs to look and smell attractive. A result is that soap is no longer just a bar, but it can come in different shapes (chunks, blocks, balls) Considerations for action Consider investing in product development or a partnership with a French producer. Co-creations by producers, retailers and marketers can increase your opportunities on the market. Follow the trends on product design for soap and offer your product in different shapes, colours and exotic fragrances. Know you market: the main distributers and brands, trade fairs, consumer needs, and apply your knowledge to drive innovation in production, market development, pricing strategies, investment in packaging and communication etc. Much differentiation in the soap industry is Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France colours and exotic fragrances: it has to be attractive to the eye, including the colour. Soap has become more of a way of showing one’s identity (‘I have travelled far’, or ‘I am green’) as well as being able to create or cater for a particular mood that can help the consumer relax, feel invigorated or ‘wander off’ to imaginary destinations. Based on the decorations (patterns or statements can be stamped on soaps to suggest an origin) or fragrances, soaps can bring exotic touches to the home, especially if it tells a story or illustrates a specific identity (e.g. natural, organic, handmade). Because of their contribution to one’s wellbeing in the body or home, soaps have become perfect gifts, able to express a number of values (from an appeal to the senses to environmental and physical health). related to ‘origin’: ingredients that are new to the consumer and which have a specific appeal. Try to distinguish your product and promotion strategy by offering this type of new ‘story’ (a local ingredient, a traditional production method or packaging ideas). If you work your own context into your soap product and marketing, you can offer relevant benefits to the French buyer looking for differentiation. The big trend in soap in the higher segments is ‘natural over chemical ingredients’. Source and use natural ingredients, such as oils, spices or minerals and communicate this to the buyer. Green values are important in the fragrance business. Certification (fair trade, organic) can also be used to further enhance your product. But sustainable materials and production, more effective packing and transport, and biodegradable end products can be aspects for you to work on, to become greener too. Please refer to CBI Trendmapping for Home Decoration & Textiles for more information on general trends in home decoration, and the pampering/wellness/spa theme specifically. Market channels and segments Please refer to CBI Market Channels and Segments for Home Decoration, because soap channels and segments do not differ significantly from this general overview. The following considerations for action should be taken into account for the soap market: In Europe, soap has become a true lifestyle product, and has crossed the boundaries of several traditional categories. Soap combines elements from the health and body care markets, from the gift market, and from the home fragrance market. In these different segments, soap has developed lower, middle and higher segments (see ‘Product Specifications, soaps as a consumer product in Home’). In other words: the market for soaps in Europe, including France, has become broader and deeper. As a functional mass product, soap is part of the hygiene market, and is found in chemists, supermarkets and other convenience stores. Considerations for action Look around for opportunities to extend your offer. This can be done by developing gift packs, with nice local materials (woven baskets, soap-related accessories etc) and/or by offering related product groups such as scented candles, home fragrances or diffusers. Options could be to outsource to or form collaborations with companies that are specialised in these product groups. A complete offer like this, could offer competitive advantages in the market. Consider targeting online retailers, in order to reach a broader range of customers. This means, however, supplying small batches and fast delivery. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Soap in France Soap has entered the up-market fragrances market, where specialists such as Yves Rocher (France), Lush (UK), and Sabon (Israel) offering ‘fresh, hand-made cosmetics’ are found. This market also features more general distributors, marketing home and living concepts (lifestyle concepts), with a wide array of product categories, such as: home care, potpourri, soaps, scented candles, home fragrances, bathroom textiles, recycled products (e.g. Amélie et Mélanie, France). In the traditional home decoration market, players now also offer decoration and fragrances, including soap. The traditional gift market has also discovered soap as an ideal personal or corporate gift. Quite contrary to what is observed in the home decoration market as a whole, ecommerce has a strong presence in the fragrance market; a great deal of soap is sold on-line. Market competitiveness Please refer to CBI Market Competitiveness for home decorations, because soap competitiveness does not differ significantly from this general overview. Useful Sources Trade fairs are still the most important way to meet new clients within the home accessory sector. Therefore, your best options for meeting potential French buyers are: Maison et Objet - http://www.maison-objet.com/ Ambiente - http://ambiente.messefrankfurt.com Tendence - http://tendence-lifestyle.messefrankfurt.com This survey was compiled for CBI by ProFound – Advisers In Development in collaboration with CBI sector expert Kees Bronk (GO - Good Oppertunity) Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer

© Copyright 2026

![Why soap? BON [Bio Organic & Natural]](http://cdn1.abcdocz.com/store/data/000106730_2-cde21536cdc133b31075d52c0ad2db16-250x500.png)