Sanlam Tech Guide

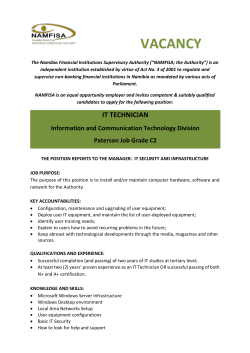

Technical Guide 2015 Contents 1. Xelus – Structure & Background………………………………………..…..……..1 2. Sanlam – Comprehensive & Standard Gap Cover….……….…………..…...2 3. Supplementary Benefits…..……………………………………………………..….3 4. Terms & Conditions ………………………………………………………………….4 5. Waiting Periods & Underwriting …………………………...………………………4 6. Exclusions.……………………………………..……………………………..………..5 7. Application Procedure……………...………………………………………………6 8. Claim Procedure……………………..…………………………...…………….6 & 7 9. Contact Details……………………………………………………………………….8 1. Structure & Background Below is an organogram of Sanlam/Xelus administration link: Administrator Xelus is registered with the Financial Services Board as an underwriting manager (“UMA”) and we distribute our products exclusively via independent intermediaries. In terms of a binder agreement, governed by the Binder Regulations of the Short Term Insurance Act, Centriq fully underwrites all our insurance products. We have invested in our staff and systems to ensure efficient and prompt service levels. All administrative functions are undertaken by Xelus (i.e. premiums, claims, underwriting etc.) In 2013, Centriq achieved turnover is excess of R2 billion and holds a very healthy solvency ratio of 54%. Centriq is a wholly owned subsidiary of Santam, the largest short term insurance company in South Africa 2. Comprehensive & Basic Gap Cover Sanlam offers two product solutions, namely Comprehensive Gap Cover and Standard Gap Cover. These products are outlined below: In – Hospital Treatment 2015 Benefits Sanlam Standard Gap Cover Tariff Shortfalls Up to 500% of scheme tariff Up to 500% of scheme tariff Co-Payments Unlimited No benefit Deductibles Unlimited No benefit R33,000 pre event/condition R13,000 per event/condition R275,000 pbpa Formulary on Biologicals: No List of Defined Conditions: No Includes pre-existing cancer: No No benefit Sub Limits Oncology Co-Payments Out- of Hospital Treatment Sanlam Comprehensive Gap Cover Out – Patient Treatment Co-Payments – MRI/CT scans (unlimited) 500% Tariff Cover Oncology, Dialysis, Surgical Wisdom Extraction, Scopes & Home Births (unlimited) Emergency Casualty Benefit (accidental only) Up to R7500 per event (max R15000 pa) Emergency Casualty Benefit (accidental only) Up to R5000 per event (max R10000 pa) Important Notes: 1. In- Hospital Cover All in-patient shortfall types are covered (i.e. Tariffs, co-payments, deductibles and sub-limits). The benefit restrictions are 5x scheme tariff shortfalls and R33, 000 per event /condition where any type of limit or sub-limit is applied. There is no rand limit on co-payments and/or deductibles. 2. Oncology Cover Co-payments that are applied once a pre-defined threshold is reached are covered up to a maximum of 20% of treatment cost. The annual limit is R275, 000 pb per treatment cycle. 3. Out-of-hospital Tariff Shortfalls Over and above oncology and dialysis, this also provides tariff shortfall cover on procedures that traditionally are performed in a hospital or day clinic (scopes/wisdoms/births) but if performed on an out-patient basis will not attract a co-payment/deductible from the medical scheme. The benefit is this designed to assist medical schemes in managing overall costs by using appropriate facilities. Sanlam Comprehensive Gap Cover will cover the tariff shortfalls in such instances. 3. Supplementary Benefits The Benefit Extender is automatically included within the Sanlam Gap and does not require any benefit choice or additional premium. The intention is to provide financial protection in areas where indirect medical costs are incurred as a result of the major events listed below: 2015 Benefits Supplementary Benefits Additional Cover & Lump Sum Benefits Sanlam Comprehensive Gap Cover Sanlam Standard Gap Cover Hospital Cash Benefit Day 7 to 13 R550pd Day 14 to 21 R1100pd Day 21 to 30 R1650pd Hospital Cash Benefit Day 7 to 13 R275pd Day 14 to 21 R550pd Day 21 to 30 R825pd Premature Birth (in 34th week or earlier) R11,000 per event Premature Birth (in 34th week or earlier) R8,250 per event Death/Permanent Disability Illness : R11,000 pb Accidental : R22,000 pb Death/Permanent Disability Illness : R8,250 pb Accidental : R16,500 pb Dental Reconstruction (Trauma & Oncology) Up to R33,000 per event / condition Medical Scheme Contribution Waiver 6 months – max R3300 pm (principal member only) Medical Scheme Contribution Waiver 6 months – max R3300 pm (principal member only) RAF Claims End to end legal assistance in RAF Claims (% RAF Benefit Allocation to Claimant) RAF Claims End to end legal assistance in RAF Claims (% RAF Benefit Allocation to Claimant) Important Notes: 1. The family booster and hospital booster pay out on a per event basis, e.g. if twins are born in the 32nd week, only one benefit payment is made. 2. The dental reconstruction booster will pay out up to R33, 000 per event / condition. It applies to reconstruction necessitated by oncology treatment and/or a trauma (e.g. car accident) that occurs after commencement of the policy. 3. The medical scheme contribution waiver only covers the principal member of the Sanlam policy. 4. Terms & Conditions The following Terms important to note: & Conditions are Maximum entry age for individuals is 60 Maximum entry age for groups >20 is 65. Waiting periods will be applied – see member schedule or marketing offer Cover applies to the member, spouse, children (up to 26) and special dependants covered under the medical scheme A spouse dependant on the medical scheme can be the Sanlam Gap Cover Principal member Please refer to your policy document for all conditions of cover Important Notes: 1. The cover is applicable to the principal member, their spouse, children (up to age 26) and special dependants that are covered on one registered medical scheme benefit option. 2. It is possible for a spouse dependant under the medical scheme to take up cover as the Sanlam Gap Cover principal member. The same beneficiaries will be covered (the family must all be on one registered medical scheme benefit option). 5. Underwriting & Waiting Periods Medical Underwriting Medical underwriting will be applied to all individual applicants. The medical questionnaire completed on the application form will be taken into account for Medical Underwriting. Based on the completion of the above mentioned questionnaire the relevant application will either be accepted or declined. Non-disclosure of any medically relevant condition or past/future procedure which could result in hospitalisation and/or surgery will be excluded from cover. Waiting Periods Standard waiting periods outlined below will be applied to all accepted policies” 3 months on all benefits 12 months on all pre-existing conditions 12 months on all claims relating to pregnancy, birth or confinement 6. Exclusions A full list of the exclusion is contained within Section D of the master policy document. The pertinent areas that are worth noting in the exclusions are: Treatment for obesity which will include bariatric surgery Treatment for cosmetic surgery is excluded unless necessitated by trauma or as a result of oncology treatment Any co-payment that is not a defined rand amount (i.e. it is applied as a percentage) Please note that this excludes the oncology co-payment cover. Any penalty, co-payment or limit applied by the medical scheme for non-adherence to the benefit rules or authorisation procedures. Dentistry is limited to basic dental procedures. The in- hospital basic dentistry that is covered includes: o Fillings (e.g. young children admitted to a day clinic) o Extractions (e.g. young children admitted to a day clinic) Surgical extractions (e.g. impacted wisdom teeth) o Root Canal Treatment o Non-elective surgery (e.g. periodontitis) “Balance Billing” ¹ - separate provider fees that are non- refundable by the member’s medical scheme. This occurs where the provider charges the scheme tariff for the billable items on a procedure and then adds a separate fee over and above the tariff items. Usually schemes ignore this additional fee and it does not appear on their claims remittance, or, if it does appear, then it shows as a zero paid item. Claims older than 6 months. o ¹ if balance billing is undertaken where the additional fee (over and above the tariff items charged) is shown on a separate statement, this practice is called “split billing” and is considered to be illegal. 7. Application Procedure Application forms 1. Xelus requires each applicant to complete an individual application form (online or PDF e-Form) 2. On completion of our online application both the member and broker will receive a confirmation email along with the relevant disclosure document. 3. Once Xelus receives these application forms, members will be loaded on the system. 4. On acceptance, policy documents will be sent via email to each member. 5. Should application be declined, notice thereof will be sent to the member via email. We can load a 2nd email address on our system so that intermediaries are copied when these policy documents are issued. 8. Claim Procedure Members can request a claim form from our consultants, or by clicking here. There is an option for members to sign an authority for Xelus to obtain the relevant claims information on their behalf. For Discovery and Momentum – members must sign the relevant authority form from their medical scheme (these are available from our office or click on the relative web link at the base of our claim form). In doing so, we will be able to obtain the outstanding supporting documentation on their behalf. If members do not sign the authority form, the following supporting documents are required: 1. Claims Transaction History Report 2. Relevant Doctors Accounts 3. Hospital Account (first one – four pages showing admission & discharge times and ICD codes 4. Current medical scheme membership certificate (copy of the membership card is not accepted) 9. Claim Procedure continued The biggest delay in processing claims results from our outstanding documentation. If you are assisting a client with a claim please emphasise that all material above is require otherwise claims will not be processed. Claims are processed continuously as and when received by Xelus and payments are made on a daily basis. An email and sms notification is issued to the member when: The claim is captured, Requesting outstanding documentation (assuming they have not signed the authority form) Authorising the claim Important Notes EFT payments can only be made to the principal member – by law we may not pay service providers. 10. Contact Details Office Number 0861 11 11 67 Administrative Queries General Admin, Escalated Queries and Commission Megan Steyn │E-mail: [email protected] Operations (Clients are allocated to one administrator who undertakes all related tasks for that clients – billing, claims and applications) Arno Strauss │E-mail: [email protected] Corlea Kruger │E-mail: [email protected] Laura Hill │072-455-7162│mail: [email protected] Verner Strauss │E-mail: [email protected] Mia Louw │E-mail: [email protected] Michelle van Rooyen │E-mail: [email protected] Marketing / Presentations / Training

© Copyright 2026