Our Annual Report - Devils Lake Economic Development

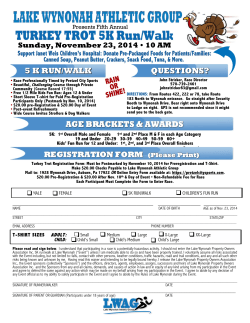

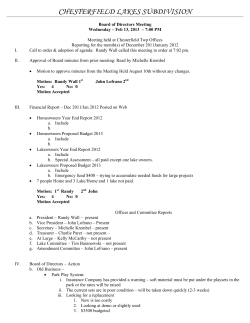

table of contents Letter from the Executive Director.......................................................................................................................1 Public vs. Private Investment..............................................................................................................................2 Sales Tax Collections..........................................................................................................................................3 Devils Lake Community Profile...........................................................................................................................4 Facade Improvement Program............................................................................................................................5 Flex PACE/PACE Program.................................................................................................................................6 Multi-Family Housing Program............................................................................................................................7 Mini-Grant Program.............................................................................................................................................8 Renaissance Zone Program................................................................................................................................9 TrainND Program..............................................................................................................................................10 Ongoing Efforts.................................................................................................................................................11 Board of Directors.............................................................................................................................................12 Forward Devils Lake Members..........................................................................................................................13 Individual Members...........................................................................................................................................14 how do you describe ONE YEAR? One year has more descriptions than most of us have considered. In rudimentary terms one year has 365 days, 8,760 hours, or 525,600 minutes. From a global perspective one year can be defined by the amount of change that has taken place in our community. During the 365 days of 2014, Forward Devils Lake approved four Façade Improvement projects, one Mini Grant, eight Multi-Family Housing projects, and three Flex Funding projects; a total investment of $580k into Devils Lake. In addition to the programs that Forward Devils Lake offers there were ten other projects on FDL’s agenda. Looking at what the 8,760 hours in 2015 will bring. FDL will be focusing on housing and daycare while continuing to promote the programs that are offered. Daycare and housing are essential to workforce development. We will continue efforts with American Dakota Refinery with hopes that there will be 100 new families relocating to the Lake Region in the near future. If Devils Lake did not have the dedicated and successful business leaders that we do, we would not be discussing the forward projection that next year brings. For that I would like to thank each person that has supported Forward Devils Lake over the years. You are supporting what our mission stands for; to foster and develop existing and new business and industry in the Lake Region. It is because of you that we are successful. We are eager to experience the next 525,600 minutes with you. Let’s make 2015 worth talking about! Rachel Lindstrom, MBA Executive Director FORWARD DEVILS LAKE 2014 ANNUAL REPORT 1 public vs. private investment 2010-2014 City of Devils Lake Building Permits $100,136,116 sales tax collections 2010-2014 $3,500,000 Forward Devils Lake Investment $2,992,784 $3,000,000 $2,500,000 2 $3,105,882 $3,097,986 $2,999,144 $1,000,000 $2,831,977 $1,500,000 $2,705,601 $2,000,000 2010 2011 2012 2013 2014 FORWARD DEVILS LAKE 2014 ANNUAL REPORT 3 devils lake community profile 4 facade improvement program Population.......................................................................................7,256 Median Age..........................................................................................40 Total Housing Units.........................................................................3,515 Occupied Housing Units........................................................85.4% Education (Age 25+) No High School Diploma........................................................11.8% High School Diploma or Equivalency.....................................28.5% Some College, No Degree.....................................................25.4% Associate’s Degree................................................................13.3% Bachelor’s Degree.................................................................16.5% Graduate/Professional Degree................................................4.5% Income Median Household..............................................................$48,604 Per Capita...........................................................................$43,229 Individuals Below Poverty Level............................................12.1% Employment Status (Age 16+) Employed...............................................................................70.6% Unemployed.............................................................................3.9% Government Workers.............................................................24.2% Work at Home..........................................................................9.6% Commuting Time........................................................................11.7 min Occupation Management, Professional & Related...................................32.3% Service...................................................................................20.2% Sales & Office........................................................................25.3% Construction, Extraction & Maintenance................................10.8% Production, Transp. & Material Moving..................................11.4% largest employers average wages 1. Devils Lake Public Schools 2. Lake Region State College 3. Lake Region Lutheran Home 4. Leevers Foods 5. Mercy Hospital 6. Summers Manufacturing 7. Nondisclosable 8. The Mentor Network 9. Good Samaritan Center 10. City of Devils Lake 1. Williams County......................................................................$80,704 2. McKenzie County...................................................................$73,528 3. Oliver County..........................................................................$72,956 4. Dunn County..........................................................................$72,592 5. Slope County..........................................................................$69,836 6. Mountrail County....................................................................$68,848 7. Stark County...........................................................................$66,144 8. Mercer County........................................................................$61,360 9. Divide County..........................................................................$57,668 10. Burke County........................................................................$53,716 Statewide............................................................................$48,672 Ramsey County..................................................................$35,308 *2009 American Community Survey 5-year Estimates, U.S. Census Bureau, except as noted. Facade Improvement Program Guidelines • • • • • • • • • • • $5,000, $7,500 or $10,000 interest free loan Loans to be paid back minimum $100, $150, or $200 depending on the loan amount per month until paid in full Payback is 50 months Loan money received is put back into the fund to keep it revolving Fund will be administrated out of the Forward Devils Lake Office There will be an application process which will include proposed drawings, before pictures, building permits, etc. before loan is approved for the business Check with City Building Authority Check with Devils Lake Historic Preservation Commission Materials must be purchased locally if possible Money to be disbursed on completed and agreed upon plans Available to any business within City Limits FORWARD DEVILS LAKE 2014 ANNUAL REPORT 5 Flex pace program multi-family housing program The PACE family of programs at BND is designed to encourage specific types of economic activity within the state of North Dakota. In general terms, PACE provides an interest buy down that can reduce the borrower’s rate of interest by as much as 5%. The Flex PACE feature of the PACE program provides interest buy down to borrowers that do not fit into the traditional definition of a PACE qualifying business. Under Flex PACE, the community determines eligibility and accountability standards. Flex PACE allows communities the ability to provide assistance to borrowers with a business focus or need outside of the current requirements of PACE, such as jobs retention, technology creation with no new jobs, retail, smaller tourist businesses and essential community services. Jobs Qualification - Job creation is not a requirement of Flex PACE, but jobs will be tracked for informational purposes. Flex PACE Funding - The cumulative amount of PACE funds available per biennium under Flex PACE to a North Dakota community or an individual borrower will be determined by the Bank’s Investment Committee. BND will provide up to $100,000 of Flex PACE funds for regular projects and up to $300,000 for Licensed Child Care Projects. pace program Borrower - The borrower can be any person or entity whose business is in manufacturing, processing, value-added processing and targeted service industries. Targeted service industries are businesses involved in data processing, telemarketing, telecommunications, major tourist attractions, holding companies involved in leasing assets to entities otherwise defined as a PACE qualified business, and all other service companies and wholesalers that generate 75% or more of their sales outside of the state of North Dakota. A holding company may qualify provided the benefit of the PACE buydown flows through to the lessee. The lessee will be responsible for satisfying the job creation requirements of the program. If no less than 40% of the space is used by the PACE qualified business, the entire requested loan amount for the facility will be deemed as a PACE qualified project, subject to all other requirements of the program. Loan Limit - There are no maximum loan parameters for borrowing under this program. Use of Proceeds - The proceeds of a loan may be used to purchase real property, equipment and certain working capital requirements. The program cannot be used to refinance any existing debt or for relocation within North Dakota. Job Creation - The borrower shall demonstrate that within one year there will be a minimum of one job created and retained for every $100,000 of total loan proceeds. Otherwise, the interest buydown will be prorated to reflect any partial fulfillment. 6 Multi Family Housing Incentive Program • • • • • • • • • The fourth round of incentive has allocated $250,000 from the growth fund to participate in the FLEX Pace Buy Down program through the Bank (Interest Rate Buy-Down) The max any developer would receive from FDL would be $50,000 (Loan) Bank of ND would contribute $100,000 per project (Grant) Total available buy down per developer is $150,000 The local share would be paid back to FDL after the original loan is paid Payback of FDL money is over 5 years at 0% FDL would have a second mortgage or lien Development must be within City Limits Total development must be 4 units or larger FORWARD DEVILS LAKE 2014 ANNUAL REPORT 7 mini-grant program renaissance zone program FDL offers small grants to primary sector businesses (which includes tourism) that have their headquarters in the Lake Region. Mini-grants can be utilized for research and development, business plans, marketing plans, feasibility studies, marketing tasks and patent fees. Project requests not directly benefiting a for-profit business will be referred directly to the Growth Fund and Devils Lake City Commission. The Renaissance Zone is a development program to help rebuild Devils Lake downtown area in an effort to maintain historic attractiveness. Tax Incentives Income Tax Exemptions & Credits • An individual taxpayer who purchases or rehabilitates a single family residential property for their primary place of residence is exempt from up to $10,000 of personal income tax liability. • Any taxpayer that purchases, leases, or rehabilitates residential or commercial property for any business or investment purpose is exempt from any tax on income derived from the business or investment location. Property Tax Exemptions • A partial or complete exemption from ad valorem taxation on single-family residential property for five years, excluding the land value, if the property was purchased or rehabilitated by an individual for the individual’s primary place of residence. 8 FORWARD DEVILS LAKE 2014 ANNUAL REPORT 9 train nd program ongoing efforts Forward Devils Lake and TrainND have collaborated over the past six years to provide Professional Development and Computer Training to Forward Devils Lake members, and non-members in the Lake Region. As a benefit of membership, Forward Devils Lake members are complimentary or reduced price, and non-members pay a nominal fee. City of Devils Lake Commission Meetings Ramsey County Commission Meeting Devils Lake Regional Partnership North Dakota Department of Commerce Economic Development of North Dakota Rotary Club Devils Lake Chamber of Commerce Devils Lake Convention & Visitors Bureau Lake Region State College Devils Lake Regional Airport UAV Developments Wind Farm Developments Greater North Dakota Chamber Military Affairs Committee Lake Region Technology Entrepreneur Center TrainND Marketplace for Kids Devils Lake Centers Devils Lake Industrial Park Renaissance Zone Committee Relocation Committee Community Development Corporation Beautification Committee Since 2009 there have been 537 individuals that have participated in the various trainings. Many have attended more than once for a total of 775 participants and 139 businesses. The program has had an overall satisfaction rating of 99%. In addition to the various computer trainings, other training topics have included: Communication, Conflict Resolution, Customer Service, Generations, How to Solve Problems So They Stay Solved, Leadership, Management, and Team Building to list a few. 12 FORWARD DEVILS LAKE 2014 ANNUAL REPORT 13 2014 board of directors Guy DeSautel – President John Nord – Vice President Wade Schwan – Past President Jay Klemestrud Richard Volk Tom LaMotte Tom Wade Brett Johnston Al Freidig Barry Gage Dave Dircks Fran Leiphon Tim Greene Shannon Teigen Renard Bergstrom Mayor Richard Johnson – City Representative Myrna Heisler – County Representative Terry Johnston – City Administrator 14 2014 forward devils lake members Altru Clinic - Lake Region American Bank Center AmeriPride Linen & Apparel Services Bergstrom Auto Management Bremer Bank Britsch and Associates Citizens Community Credit Union Construction Engineers Devils Lake Glass & Paint Co., Inc. Devils Lake Public Schools Edward Jones Farmers Union Oil Company of DL Fireside Inn & Suites First Financial Center Gilbertson’s Funeral Home H. E. Everson Highway Two Storage Hoiberg’s Office & Printing Center Holiday Inn Express I.F. LaFleur & Sons, Inc. Jerome Wholesale, Inc. Job Service of North Dakota Klemetsrud Plumbing & Heating Co. Lake Region Corporation Lake Region Grain Corp. Lake Region Sheet Metal, Inc. Lake Region State College Leevers Foods, Inc. - South Leevers Foods, INC. Mercy Hospital Metroplains Montana-Dakota Utilities Nodak Electric Cooperative, Inc. North Central Granite North Central Planning Council North Dakota Telephone Company Northern Plains Railroad Otter Tail Power Company Ramsey National Bank & Trust Co. Real Estate “7” Schwan Wholesale Co., Inc. Slumberland St. Michael Furniture Summers Manufacturing Co. Tecta America Dakotas, LLC Traynor Law Firm US Bank Corp. Vocational Rehabilitation Consulting Ihry Insurance Western State Bank White House Cafe Wired Cellular Woodland Resort, Inc. INDIVIDUALS Dale Dinger Ray & Bev Horne Richard Kunkel Chuck Soderstrom Mike Connor Rodger Haugen PO Box 879, 208 Highway 2 West Devils Lake ND 58301 701.662.4933 devilslakend.com

© Copyright 2026