CBI Product Factsheet: Rose geranium oil for cosmetics in Europe

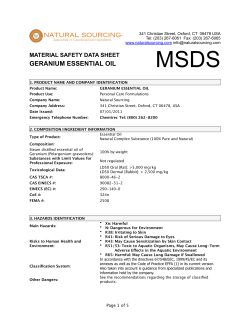

CBI Product Factsheet: Rose geranium oil for cosmetics in Europe ‘Practical market insights into your product’ Decreasing supplies of high quality rose geranium oil and an increasing demand is leading to greater opportunities for DC exporters to produce this fragrant essential oil. Originally cultivated in Europe to substitute rose oil, rose geranium oil is currently produced outside of Europe to benefit from lower labour costs and warmer climates. Product definition There are hundreds of varieties of rose geranium; the most common type for essential oil production is the Pelargonium graveolens. In addition, the P. capitatum, P. asperum, and the P. radens are also claimed to be sources of rose geranium oil. The cultivated species of rose geranium, called Pelargonium graveolens, is a probable cross between Pelargonium graveolens, P. capitatum and/or P. radens. The plant is often called a geranium because it falls under the same plant family as the Geranium species: Geraniaceae. Rose geranium Originally native to South Africa, Zimbabwe and Mozambique, the plant is now also cultivated in other parts of Africa, Europe, Asia and North America. However, production of the essential oil is limited to China, Egypt, Algeria, Morocco, Madagascar, South Africa and Réunion Island. Rose geranium oil is obtained through the steam distillation of the stems, leaves and flowers of the plant. The oil is a clear, colourless liquid and has a rose-like odour. Historically, the oil was produced to replace the more expensive rose oil. Currently, rose geranium oil is mostly used in cosmetics (fragrances and skin care products) and to a lesser extent in the flavour and aromatherapy industries. Classification of rose geranium oil: Chemical Abstract Service (CAS) numbers: 90082-51-2 and 8000-46-2 Harmonised System (HS): within the EU / EFTA, rose geranium oil does not have a separate HS code. Instead it would be classified under: o 3301.29: essential oils other than citrus and mint oils Cosing, the European Commission database with information on cosmetic substances and ingredients, lists several derivatives of rose geranium under their INCI names. Examples include: o INCI name: Pelargonium graveolens oil, with masking and perfuming properties. o INCI name: Pelargonium graveolens flower/leaf/stem extract, with masking and skin conditioning properties. UN number: 3082, Class 9, Packaging Group III Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer Rose geranium oil CBI Product factsheet: Rose geranium oil for cosmetics in Europe Product specification Quality Considerations for action: Steam distilled rose geranium oil consists of Work together with a local university the alcohols citronellol, geraniol and linalool department or laboratory to determine the (55-65%), esters (15%) and ketones such as composition of your rose geranium oil. isomenthone (1-8%). These proportions only Information on the chemical profile of the oil vary slightly when other extraction by (accredited) laboratories is important to techniques such as solvent extraction or buyers and should be part of your Product supercritical CO2 extraction are used. The Factsheet and specifications. For an example, proportions of each of these constituents check this product specification of affect the aroma of the specific geranium oil. sandalwood. The compounds citronellol and geraniol give Minimise the time between harvesting and the oil its rose-like odour. distillation to prevent quality deterioration. For the perfumery and fragrance industries Use the extraction method (temperature, the most desirable ratio of citronellol:geraniol pressure, time) consistent with the buyer’s is close to 1:1. preferences and specifications. Bourbon geranium oil from Réunion Island is Prevent dilution, adulteration and regarded as the best in terms of quality. contamination by foreign materials (e.g. Bourbon oil was named after the island, since monoterpene alcohols and esters or copper it was formerly called Bourbon Island. The chlorophyll for colour) to preserve you plant variety is cultivated in other regions reputation. Importers regularly analyse such as Rwanda. However, oil from that products for adulteration. specific variety that is not produced on Check the quality standards that the Réunion Island itself it cannot be called International Organisation for Standardisation Bourbon geranium oil. It is referred to as the has set for geranium oil (Pelargonium Bourbon variety instead. supplements) in ISO 4731:2012, which can Geranium oil from China is more variable in be purchased for around € 53. These are the quality as a result of the differences in international standards, but individual buyers variants due to particular cultivation and may set their own standards. distillation methods. Always ensure that you can offer a Distillation of very young shoots of rose geranium is standardised known to product with a well-defined result in an oil high in geraniol. specification. Standardise your product’s Buyers require a product of a consistent quality by blending extracts from different quality. They prefer a large volume with a crops (e.g. early and late crops, or different consistent quality level to smaller batches of slopes/areas) and by closely monitoring different qualities. cultivation and harvesting practices. Labelling Facilitate the traceability of individual batches with markings and a registration system, whether they are produced by blending or not. Use the English language for labelling unless your buyer has indicated otherwise. Labels must include the following: o Product name/INCI name o Batch code o Place of origin o Name and address of exporter o Date of manufacture o Best before date o Net weight o Recommended storage conditions o Organic: Name/code of the inspection body and certification number. Ensure the buyer can access the following documentation: o Technical Data Sheet (TDS) or Specification, including CAS number, check this example of a TDS of frankincense oil o Certificates of analysis to support the claims in the specifications, check this example of a certificate of analysis of peppermint essential oil o Safety Data Sheet (SDS), check this example of an MSDS of carrot seed oil o GMO certificate (if requested) Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer Hazard labels CBI Product factsheet: Rose geranium oil for cosmetics in Europe o Certificate of origin o Product information sheet o Allergen declaration, check this example for rose geranium Rose geranium essential oil is classified as a hazardous material; include the relevant hazard symbols (as shown on the right) to show that the product is hazardous to the environment (N), harmful (Xn) and a miscellaneous dangerous substance (Class 9). Also include the risk phrases with the following numbers: R38-41-43-51/5365, and the safety phrases with the following numbers: S24-26-37-39-6162. EU Directive 2001/59/EC elaborates on these and other risk and safety phrases. Packaging Always consult with your buyer for specific packaging requirements. Use UN approved packaging, as specified by your buyer. For more information, check the details provided by the European Federation of Essential Oils on the transport of dangerous goods. Ensure the preservation of the quality of rose geranium oil by: o Using containers of a material that does not react with constituents of the oil (e.g. lacquered or lined steel, aluminium). o Cleaning and drying the containers before filling them with oil. o Filling the headspace in the container with a gas that does not react with constituents of the oil (e.g. nitrogen or carbon dioxide). Facilitate the re-use or recycling of packaging materials by, for example, using containers of recyclable material (e.g. metal). Store the containers in a dry, cool place to prevent quality deterioration. Organic oils should remain physically separated from conventional oils. Food grade containers Legislative requirements Considerations for action: EU Cosmetics Regulation: The Cosmetics Familiarise yourself with EU legislation on Regulation includes, amongst others, Cosmetic ingredients and products. If you requirements (physic-chemical, microbiological & can provide all the information needed in the toxicological) for substances/ingredients to be product information file, you can offer your included in each Cosmetic Product Safety report buyer a better package. Also ask your buyer and Product Information File. Cosmetics for advice on legislative requirements. For manufacturers and ingredient producers more information on product safety reports, increasingly place the responsibility for check EU Regulation 1223/2009. compliance on their suppliers. Familiarise yourself with UN GHS and the EC Globally Harmonised System for the 1271/2008, which is aligned with this classification, packaging and labelling of legislation. chemicals: The EU sets requirements for the packaging of chemical substances, as well as the required symbols and phrases warning users and providing safety advice that should be used on the labels. CLP: The classification, labelling and packaging of substances and mixtures (EC 1271/2008) is based on international legislation – the Globally Harmonised System (GHS) REACH may be relevant in case of chemical modification of the oil. Basic extracts would generally not fall under REACH legislation. However, the burden of proof rests with the manufacturer/importer who wishes to use this exemption. Familiarise yourself with the EC Regulation 1272/2008 on the classification, packaging and labelling of chemicals. You can access such information through the European chemical Substances Information System (ESIS). Familiarise yourself with REACH regulation. The European Chemicals Agency (ECHA) offers guidance on exemptions. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe Product Liability Directive: This directive states that the EU importer is liable for the products put on the European market. In principle the EU importer can, however, pass on a claim to the producer/exporter depending on contracting arrangements. Be aware that EU importers can pass on a claim for defective products to exporters. Packaging and packaging waste: Among other requirements, EU packaging legislation restricts the use of certain heavy metals. Make sure you comply with the EU legislation on packaging. Non-legislative requirements Good Manufacturing Practices: GMP is not obligatory for producers of cosmetics ingredients, but compliance can provide a competitive advantage on the European market. See the GMP Guide for cosmetic ingredients. Quality safety management: ISO 9001:2008 sets out the criteria for a quality management system. The standard is based on several quality management principles including a strong customer focus, the motivation and support of top management, the process approach and continuous improvement. Considerations for action: The European Federation for Cosmetic Ingredients (EFfCI) provides a guide that defines specific GMP principles for cosmetic ingredient manufacturers. Moreover, ISO Good Manufacturing Practices for Cosmetics (ISO 22716:2007) includes a chapter on how manufacturers should deal with raw materials. Making it easier for your buyer to comply will provide you with a competitive advantage. International Fragrance Association (IFRA): IFRA Standards form the basis for the globally accepted and recognised risk management system for the safe use of fragrance ingredients and are part of the IFRA Code of Practice. Since rose geranium oil is used as a fragrance in the cosmetic industry, check the IFRA Code of Practice on the association’s risk management system. Regulation (EC) 834/2007 on organic agriculture: Standards for organic cosmetics mentioned below require certain thresholds of organically certified organic ingredients to be used in certified cosmetics products. Organic ingredients need to comply with requirements regarding the production and labelling for organic products as established by the EU. This regulation legally only applies to food products, but standards for organic cosmetics are based on this regulation. If you choose to obtain a certificate for organic production, find out more about Organic production and labelling. French buyers prefer certificates issued by Ecocert Supplier Ethical Data Exchange (SEDEX): SEDEX offers an online database that allows members to share information on Labour Standards, Health & Safety, The Environment and Business Ethics depending on the particular industry and role in supply chain. Use SEDEX information to familiarise yourself with responsible business practices. Share your company’s information on ethical and responsible practices, such as selfassessments, audits and certifications efficiently with your buyers on the online database of SEDEX. Find out more information on the standards of Cosmos and NATRUE. Prepare and publish a code of conduct that defines your social and environmental responsibility as an employer and supplier. Cosmos and NATRUE standards: These standards, and other standards of national certification bodies, specify what cosmetic products need to comply with to be certified natural and organic. Although not directly applicable to ingredient producers, it is important to be aware of these standards in terms of permitted processes and additives. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe Documentation: Buyers need well -structured product and company documentation. Buyers generally require detailed specifications supported by certificates of analysis and Safety Data Sheets (SDS). Representative samples: Your sampling method should result in lot samples that represent what you can deliver in terms of quantities, quality and lead time as specified by the buyer and in your technical data sheet. Delivery terms: Pay attention to strict compliance with delivery terms as agreed upon with your buyer. Website: European buyers look for credible suppliers. You can improve the perceived credibility of your company by developing your website accordingly. For your own internal purposes, it is advisable to prepare a more detailed dossier with all the technical data from both primary and secondary research. Preparing a Safety Data Sheet (SDS) can pose technical challenges, especially for new ingredients. Consider seeking qualified advice. Check websites of European companies for examples of an SDS, e.g. The Soap Kitchen or Eramex. Buyers will appreciate a commercially oriented Product Data Sheet with photos, information on origin and bibliographic references, where available. Familiarise yourself with international delivery terms. Ensure that your customers receive a copy of your terms and conditions of sale before agreeing to the sales contract. See the websites of Earthoil, Azelis and Seatons for examples of terms and conditions. The Synthite website is a good example of a website that enhances the credibility of a company. This website has a professional image with clear and relevant information on the company and its product range. Trade and Macro-Economic Statistics (!) No specific trade statistics are available for rose geranium oil. They are included in the trade data on ‘essential oils, non-deterpenated, other than those of citrus fruit, mint, niaouli and ylang-ylang’. Supply of the different varieties of rose geranium oil World market demand for the various geranium oils is estimated at 400 tonnes per year. Of that, the market for rose geranium oil is about 100 tonnes. High-quality rose geranium oil – the Bourbon oil variety – is mainly produced in Réunion Island (10 tonnes), Algeria and Morocco (together 10 tonnes), South Africa and Madagascar (a few tonnes each). Supplies from Réunion Island have been decreasing. Several African countries (Rwanda and the Congo) are starting to produce oil to fill in this gap in the supply. It is estimated that Rwanda, which currently produces 1.5 tonnes, will reach a production of 10 tonnes of organic oil by 2016-17. Both China and Egypt produce significant quantities of lower quality rose geranium oil. Production in China is increasingly for domestic consumption, resulting in annual exports of around 20 tonnes. Egypt produces close to 60 tonnes per year, mostly destined for exports to the EU. Rose geranium oil has historically been produced in Europe. However, production is currently too expensive since it is labour intensive and measures need to be taken to protect the plants from frost. As a result, Considerations for action: Make use of the apparent limit in the supply of good quality rose geranium oil by starting or increasing production. Ensure that you can deliver sufficient quantities of the oil. Keep a close watch on the future production of rose geranium oil in countries such as Rwanda and Congo. You may request such information from your buyers. These countries are currently starting production and may become important competitors in the future. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe most demand for rose geranium oil is met by imports. Western European countries (France, the UK, Spain, Italy and the Netherlands) as well as Russia are estimated to be the largest importers of rose geranium oil. France imports most of the rose geranium oil from Réunion Island (10 tonnes) and is considered to be the largest importer. Demand for rose geranium oil is mostly for use as an ingredient in perfume. In addition, rose geranium oil is used in the flavour industry and for aromatherapy. For use in perfumes, the Bourbon variety is the preferred oil. Both the global personal care industry and the fragrance market are expected to grow, creating more demand for products such as rose geranium oil, which are used in a wide variety of perfumes and cosmetic products. In 2012, the global personal care industry was predicted to reach € 487 billion by 2017, with an annual growth of 3.4 %. The global fragrance market grew even further, growing annually by 10.9% and reaching € 17.9 billion ($ 23.7 billion) in 2011. It is forecasted to reach over € 24.8 billion ($ 33 billion) by 2015. Focus your exports on the cosmetic industries in the UK, Spain, Italy, the Netherlands and France. Benefit from the increase in demand for cosmetic products and fragrances by focusing your exports on these segments. Please refer to CBI Tradewatch for natural ingredients for cosmetics for more trade statistics. Market trends Considerations for action: Natural ingredients: in Europe there is In your promotional material, emphasise the increasing consumer interest for natural potential of the use of rose geranium oil in ingredients in cosmetics, and the global the growing market for natural cosmetics and natural cosmetics sector is estimated to grow specifically fragrances. Ensure that you can annually by 5-9%. The global fragrance supply oil at a commercial price. industry generally prefers natural products to In your promotional material, emphasise the synthetic ingredients. However, sufficient potential of rose geranium for use in antisupplies at a commercially viable price need aging products, which may be less known to to be guaranteed. your buyers. Refer to Cosing for the properties of the specific derivatives of rose geranium. Ethical products: a growing interest in Check your opportunities for obtaining ethically sourced and sustainable products certification for ethical sourcing. Please refer provides an opportunity for fair trade and to the section on market segments for more organically certified rose geranium oil. In information. addition, consumers are interested in the In addition to certification, focus on the story story behind ethical certification. In their behind your rose geranium oil in your marketing, cosmetics producers actively promotional material. It is an advantage to communicate the best stories for their help cosmetics producers communicate these ingredients to improve the connection with stories, for example by providing pictures. the consumer. Communication takes place If your geranium oil is produced sustainably, using images, with short stories about the include this fact in your promotional material. product, or using the producer’s corporate Please refer to CBI Trendmapping for more image. market trends. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe Market Channels and Segments Market channels Figure 1: Major market channels for rose geranium oil Developing country European market Domestic processors Segments Cosmetic producers Traders (importers, agents, brokers) Farmers EU ingredient distributors Please refer to CBI Market channels and Segments for more information Rose geranium oil exported as oils or Considerations for action: extracts Rose geranium oil for the use in cosmetics is Benefit from the experience and knowledge exported in the form of oil. As such, it of specialised European importers and agents generally does not need further refining or instead of approaching end users directly. processing before it can be used in cosmetic Especially for exporting specialised products products. traders are the most suitable distribution Rose geranium oil can be sold directly to channels. cosmetics producers, or more commonly through one or more traders, such as agents, importers or brokers. Speciality oils and certified organic or Fairtrade oils usually have relatively short trade channels. This is because they are often traded by specialised traders. Market segments Table 1: Major cosmetic segments and applications for rose geranium oil Segment Sub-segment Benefits of applying rose geranium oil Fragrances Perfume, eau de toilette Fragrance Skin care Facial skin care, body care, moisturiser, anti-aging, lip balm Skin conditioning properties Fragrance Hair care Shampoo Fragrance Toiletries Soap, luxury bath essences Fragrance Best opportunities in fragrance and Considerations for action: skincare Rose geranium oil is mostly used in Emphasise the potential of using rose perfumes, as a middle note. It is used in geranium oil in perfumery. different ratios in fragrances, but rarely as the sole fragrance. Rather, it is supported by other scents. In the fragrance and skin care segments, Cosing lists the properties registered for rose consumers tend to be more willing to pay a geranium oil and several other derivatives; higher price. Therefore, the high price of rose use these in your promotional material. geranium oil is less of an issue. Producers in these segments place more value on Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe consistently good quality oil. Rose geranium oil is also used in hair care and toiletries, such as soap and luxury bath products. Please note that the applications in these segments are limited as a result of the high price of the oil. There is a market for fairly traded rose geranium oil. This oil does not necessarily need to be certified. Consumers and cosmetics producers are increasingly interested in the story behind ethically sourced and processed final products. Whether fair trade certification is necessary depends on your buyer’s preferences. They may require certification as an assurance for fairly traded products. There is a demand for organically certified rose geranium oil, but availability is rather low. The global organic geranium oil market is estimated to be around 7-10% of the total market and valued at € 9.8 billion (US$ 13 billion). Please note that the potential for organic certification depends on your prospective buyer. It is important to focus on the story behind ethical certification. In your promotional material, emphasise the social benefits to local communities of your production. If you want to obtain Fairtrade certification, check the requirements of the Fairtrade standard. Always discuss these opportunities with your buyers. Discuss the opportunities for organically certified rose geranium oil with your buyers. Prices Price and yield of rose geranium oil Bourbon rose geranium oil is regarded to have the best quality and fetches the highest price. Even though oils from South Africa or Algeria and Morocco are similar in quality, they can fetch a slightly lower price. Chinese and Egyptian oils are located at the bottom of the price range as these oils are of lower quality and show major variations in odour. The Bourbon variety rose geranium oil is priced at € 200-220 per kg for conventional oils and around € 250 per kg for high-quality, organically certified oils. Egyptian and Chinese oils (not of the Bourbon variety) are priced at around € 125 per kg. These prices are rather volatile. The yield of rose geranium oil is in the region of 0.30-0.50 %. For 1 kg of rose geranium oil, around 300-500 kg of plant material is needed. Oil yield is about 30-50 kg per year per ha of cultivated rose geranium. Considerations for action: Monitor harvests in major production countries to anticipate price developments for your specific rose geranium oil. You may request such information from importers. Ensure that your prices reflect the quality of your product. Different composition of the oil results in different quality, you should change your price accordingly. Distil close to the harvesting location in order to preserve quality and to save costs on transporting large amounts of raw material to distillation sites. Optimise the yield of rose geranium cultivation and distillation to lower your cost price: o Cut rose geranium plants at 15 cm above ground to allow the re-establishment of new leaves. As such, plants can be harvested 3-4 times per year. Ensure that the first harvest is 6-8 months after plantation to allow the plant to grow to the right size. o Harvest the leaves and young shoots of rose geranium as these contain the most oil. o Only harvest plants after 1 or 2 dry days as humidity during harvesting can result in a lower oil yield. Also stop irrigation before harvesting to increase the oil yield. o The distillation still needs to be packed tightly to increase oil recovery. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe The following price breakdown shows which costs and margins are applied to rose geranium oil before it reaches the end user. Figure 2: Price breakdown for rose geranium oil, mark-ups in % Export Source: ProFound, 2013 Air cargo Import +2-4% +5% Sales +30% If agents are involved, they typically receive a commission of a few (2-5) percent. However, their actual profit margin strongly depends on volumes sold and gross margin. They will normally lower their gross margin for big volumes. Considerations for action: Agents are particularly interesting if you do not have a strong sales network. However, once you have established a trade relationship through an agent, you cannot establish a direct relationship with the buyer anymore. The sales network of the agent is protected by law. Importers add a margin of up to 25-100% to You can add value by improving the quality of the product depending on the activities your production. Prevent contamination with undertaken, such as testing and stocking. foreign materials and minimise time between harvesting and distillation. Market competitiveness Advantages for the cultivation of rose geranium in DCs Cultivation, hand weeding and harvesting of rose geranium is labour intensive. Therefore, countries with low labour costs have a competitive advantage over European countries where production is more expensive. Warm climates have been shown to increase the herbage growth and total essential oil yield of rose geranium (Pelargonium graveolens). In addition, rose geranium is not resistant to frost. Therefore, subtropical regions have an advantage over temperate regions, such as several European countries. The summer season is generally the best season for geranium oil production, as oil content increases in summer. Réunion Island is part of the EU as it is an overseas department of France. As such, it has the same status in the EU as France itself and thus has no limitations on exports. This gives exporters from Réunion Island a competitive advantage over exporters from other countries. As the distillation of rose geranium requires limited know-how, technological barriers to enter the markets for rose geranium oil are relatively low. However, steam distillation requires significant investments. Considerations for action: Rose geranium oil faces competition from For more information on the cultivation of rose geranium, check the information available on websites such as Plants For a Future or BioAfrica. If you are based in a country with a warm climate and low labour costs, you can produce rose geranium oil at lower production costs. If you are based on Réunion Island, take advantage of the unlimited exports to the EU. Producers of rose geranium oil can cooperate to share the investment in distillation equipment. Additionally, when you master steam distillation of one essential oil, the same machinery can be used to distil other plants for essential oils. In your promotional material, make sure to Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product factsheet: Rose geranium oil for cosmetics in Europe cheaper synthetic oil. This is predominately used in low-budget soaps and perfumes. differentiate your natural rose geranium oil from competing synthetics. For instance, focus on origin and ethical and sustainable sourcing of the product. Direct your sales to producers of high-end cosmetics. Please refer to CBI Market Competitiveness for more information. Useful sources Trade fairs Visiting and especially participating in trade fairs is highly recommended as one of the most efficient methods for testing market receptivity, obtaining market information and finding prospective business partners. The most relevant trade fairs in Europe for exporters of rose geranium oil are: In-Cosmetics (http://www.in-cosmetics.com/) in Paris, France Beyond Beauty (http://www.beyondbeautyparis.com) in Paris, France SANA (http://www.sana.it/en) in Bologna, Italy Vivaness (http://www.biofach.de) in Nuremberg, Germany (for organic producers) This survey was compiled for CBI by ProFound – Advisers In Development in collaboration with Sector Expert Andrew Jones Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer

© Copyright 2026