IPO Note: Zaheen Spinning Ltd (ZSL) Date: March 25, 2015

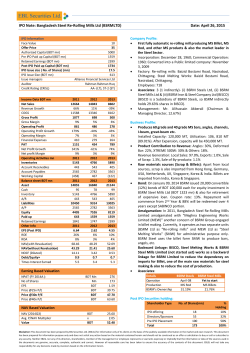

IPO Note: Zaheen Spinning Ltd (ZSL) IPO Information Face Value Offer Price Authorized Capital (BDT mn) Pre IPO Paid up Capital (BDT mn) Retained Earnings (BDT mn) Post IPO Paid up Capital (BDT mn) IPO Issue size ( No. of Shares) (mn) IPO Issue Size (BDT mn) Issue managers Auditor Credit Rating (CRAB) Income Data BDT mn Net Sales COGS Gross Profit Operating Profit Financial Expenses PAT Operating Activities mn Inventories Account Receivables Account Payables Working Capital Balance sheet BDT mn Asset Liabilities Equity Paid up Margins Gross Margin Operating Margin Net profit Margin Return ROE ROA Growth Revenue Growth Operating Profit Growth Net Profit Growth Per Share BDT EPS (Post IPO) NAV (Diluted) NOCF (Diluted) Debt & Cash BDT mn Total Debt Long Term Debt Times Interest Earned Debt/Equity× Date: March 25, 2015 10 10 1000 528 108 648 12 120 MTB Capital Ltd Mohammad Ata Karim & Co. BBB3 (LT), ST-3 (ST) 2012 400 337 62 51 33 14 2012 204 16 3 126 2012 551 180 372 93 2012 16% 13% 3% 2012 4% 2% 2012 6% 8% -31% 2012 0.21 6.56 0.44 2012 174 84 1.6 0.5 2013 456 384 79 55 22 29 2013 227 24 2 320 2013 706 100 607 528 2013 16% 12% 6% 2013 5% 4% 2013 14% 8% 117% 2013 0.45 10.00 0.89 2013 93 75 2.7 0.2 2014A 714 600 114 97 10 86 2014Q2 159 50 2 381 2014Q2 762 97 665 528 2014A 16& 14% 12% 2014A 16% 14% 2014A 57% 76% 197% 2014A 1.32 12.30 1.39 2014A 84 66 10.9 0.1 BDT Mn Mn BDT BDT BDT 86 65 1.32 26.40 33.00 BDT 12.30 2.00 24.60 Company Profile: 100% export oriented company producing 100% cotton yarn of different counts Incorporation: July 22, 2007 Commercial Operation: February 15, 2010 Converted into a Public limited company: August 14, 2012 Factory: Jhawgara, Araihazar & Narayanganj, Bangladesh Employees: 498. Management: Farida Khanam (Chairman, 7.59%), A.M. Badruzzaman Khashroo (Managing Director, 18.02%) Business Profile: Producing 100% cotton yarn from different counts, normal or high bulk Installed Capacity: 4,105,200 lbs., Utilization: 95.59% (3924291 lbs.) Market Share: Bhai Bhai Spinning (19%), Raya Spinning (9%), Intimate Spinning (10%), R.K Spinning (6%), Pakiza Spinning Mills Ltd (17%). Raw materials sources (Cotton): India. Expansion Project: Cost: BDT 854 mn Estimated Revenue: BDT 6050 mn Project Capacity: 20, 694 ring spindles Employment Generation: 446 persons Project Life: 10 years Project Financing: Loan from MTB at 16% rate of interest Project IRR: 53% Post IPO Securities holding: Shareholder Type IPO offering Directors/Sponsors Pre IPO Placement Total No. of Shares(mn) 12 33 20 65 % Holding 18% 51% 31% 100% IPO Fund Utilization Plan: Particulars Expansion Project IPO Expenses TOTAL Amount 108 mn 12 mn 120 mn % 90 10 100 *Total Project Cost: BDT 854 mn, Plant & Machinery Cost: BDT 108 mn Bangladesh Textile Industry Overview: Bangladesh RMG Exports compared to Total Exports: Earning Based Valuation NPAT (FY 2014A ): No of Shares EPS Price @ 20x P/E Price @ 25x P/E NAV Based Valuation NAV (2014 Q3): P/ NAV Multiplier Value BDT The RMG sector of Bangladesh provides 4 mn direct jobs (80% of them are women), contributes 15% of the GDP, 5% of National Income and fetched BDT 24,492 mn (81%) of Bangladesh’s total exports (2013-14) (BGMEA). After China & EU, Bangladesh is the largest exporter in RMG in the $1.1 trillion Global Apparel Market (2013).It Disclaimer: This document has been prepared by EBL Securities Ltd. (EBLSL) for information only of its clients on the basis of the publicly available information in the market and own research. This document has been prepared for information purpose only and does not solicit any action based on the material contained herein and should not be construed as an offer or solicitation to buy or sell or subscribe to any security. Neither EBLSL nor any of its directors, shareholders, member of the management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the documents are genuine, accurate, complete, authentic and correct. However all reasonable care has been taken to ensure the accuracy of the contents of this document. EBLSL will not take any responsibility for any decisions made by investors based on the information herein. IPO Note: Zaheen Spinning Ltd (ZSL) Date: March 25, 2015 has 5,000 factories, compared with 2,500 in Indonesia and 2,000 in Vietnam. Factors behind growth: cheap labor cost, cheap resources, supplier capacity and also the government’s supportive measures. Bangladesh’s current demand supply gap is about 50% on cotton based products and around 25% for non-cotton based products. Therefore, Bangladesh has a huge untapped demand for fabric production. Though there is a demand and supply gap in this industry, new firms are quite discouraged to enter due to high startup costs and lack of expertise. As a consequence of electricity crisis, the textile production capacity has been reduced by up to 30% Recent Disasters: Last few years some tragic events i.e., Tazrin, Rana plaza etc., brought forward the compliance issues of the garments factories. USA restricted the GSP facility while European Union (EU) is considering the fulfillment of compliance issues seriously. This compressed in the demand scenario as international buyers were reluctant to place orders at that time. To eliminate this problem, 150 European brands, retailers and companies formed an accord to ensure work-place safety in the country's apparel units industry for a period of 5 years. Government Incentives: Various initiatives like, tax benefits, Export Development Fund (EDF) facility, Cash benefit etc., have been taken to stimulate the export. Recently, the government has reduced tax at source to 0.30% from the existing 0.80% until June 2015 and also provides 5% cash subsidy for exporters A comparison between some listed companies in the Textile Sector are shown below: Paid up Cap (mn) MATINSPINN 975 TALLUSPIN 812 Rev (mn) NPAT (mn) EPS NAV 2058 1297 391 -40.6 4.02 -0.50 28.69 15.94 MHSML ZSL METROSPIN 1325 714 895 219 86 26 2.82 1.32 1 0.44 15.99 12.30 17.33 Companies 781 648 605 ZSL is exposed to Exchange Rate Risk as it procures Raw Materials from India. The company has no dividend history. Financial Review: (2013) Turnover increased by 14%. Cost of Goods sold was 84% of sales consistent as in the previous year. Operating expenses were 4% of Sales compared to 3% in the previous year Investment in PPE was BDT 58 mn, 142% more than previous year’s investment (BDT 24 mn) NPAT stands at BDT 29 mn, a 117% increase from previous year. ROA & ROE both increased compared to previous year. Interest on Loan was 23%, which was 19% in 2012. Short Term Loan decreased from BDT 90 mn to 18 mn while Long Term Loan decreased from BDT 84 mn to 75 mn reducing the Debt Equity ratio to 0.2 times from 0.5 times in 2012 EPS (Post IPO) stands at BDT 0.45 which was BDT 0.21 in the previous year Financial Review: (2014A) NPAT stands at BDT 86 mn, 197% more than the previous year. Annualized EPS stands at BDT 1.32 compared to BDT 0.45 in the previous year. Concluding Remarks: Dividend of SDL is still pending. If the current economic situation continues and the blockade goes on, the textile sector’s production is going to have an adverse impact on its profitability in the upcoming time period. NPAT & EPS (Post IPO) Trend- last 6 years (BDT mn): Investment Positives: ZSL’s Expansion of business activities is likely to result in higher production and hence higher turnover & profitability. Declining trend of cotton prices in the global market may have a positive impact as COGS will be reduced to some extent. To support the local manufacturers in the RMG industry, the government reduced the tax rate to 15%. (Source: Bangladesh Tax Handbook FY 2013-2014). 5 year CAGR- Sales: 42%, NPAT: 81%. Operating Cash Flow shows an increasing trend last 3 years. Investment Negatives: ZSL is exposed to raw material supply risk as the company imports Yarn & Chemicals from international market. Shortage of Gas & Power Supply, political & Labor unrest and any change in national policies may affect its productivity/ performance significantly. EBL Securities Ltd. Research Team: M. Shahryar Head of Faiz Research Farah Tasneem Research Associate Shahriar Azad Research Shashi Associate [email protected] [email protected] [email protected] Disclaimer: This document has been prepared by EBL Securities Ltd. (EBLSL) for information only of its clients on the basis of the publicly available information in the market and own research. This document has been prepared for information purpose only and does not solicit any action based on the material contained herein and should not be construed as an offer or solicitation to buy or sell or subscribe to any security. Neither EBLSL nor any of its directors, shareholders, member of the management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the documents are genuine, accurate, complete, authentic and correct. However all reasonable care has been taken to ensure the accuracy of the contents of this document. EBLSL will not take any responsibility for any decisions made by investors based on the information herein.

© Copyright 2026