Tennessee Market Highlights - The University of Tennessee

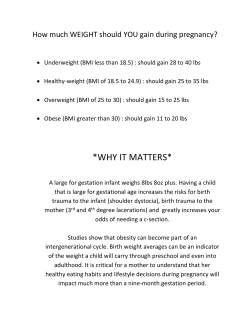

Tennessee Market Highlights Trends for the Week Compared to a Week Ago Slaughter Cows Steady Slaughter Bulls $1 to $3 higher Feeder Steers Steady to $4 higher Feeder Heifers $1 to $4 higher Feeder Cattle Index Wednesday’s index: 217.37 Fed Cattle The 5-area live price of $159.17 is up $0.26. The dressed price is up $1.76 at $253.90. Corn July closed at $9.64 a bushel, down 6 cents a bushel since last Friday. Wheat July closed at $4.74 a bushel, down 14 cents a bushel since last Friday. Cotton July closed at 66.61 cents per lb, up 0.27 cents per lb since last Friday. Number: 18 Livestock Comments by Dr. Andrew P. Griffith FED CATTLE: Fed cattle traded steady to $2 higher on a live basis compared to a week ago. Prices on a live basis were $158 to $160 while dressed prices were between $253 and $255. The 5-area weighted average prices thru Thursday were $159.17 live, up $0.26 from last week and $253.90 dressed, up $1.76 from a week ago. A year ago prices were $147.79 live and $236.38 dressed. Packers and feeders were reluctant to compromise as they played a game of tug of war. Feedlot managers have closeouts that are bleeding red ink while cutout prices are faltering and squeezing packer margins. The June live cattle contract is now the nearby futures contract, but the June contract is trading at $10 plus discount to cash prices in both the South and North. Complete convergence of the cash and futures is not likely to occur at all while significant partial convergence is not expected to occur until June arrives. The cash price is likely to weaken into the summer, but the live cattle contract is also likely to find some support and push towards the cash price by the first of June. July closed at $3.63 a bushel, down 6 cents a bushel since last Friday. Soybeans May 1, 2015 BEEF CUTOUT: At midday Friday, the Choice cutout was $254.50 down $2.40 from Thursday and down $4.28 from last Friday. The Select cutout was $242.38 down $1.67 from Thursday and down $6.90 from last Friday. The Choice Select spread was $12.11 compared to $9.49 a week ago. The unofficial start of summer does not kick off until Memorial Day weekend but, grilling season has already started for many consumers. This is evident through the Choice Select spread which has widened by about $9 since the first week of April. Restaurants and food service folks have been shifting their purchases from Select grade cuts to Choice grade product more suitable for grilling. The desire to purchase Choice grade beef relative to Select grade beef is expected to continue throughout the grilling season. The Choice Select spread is expected to continue widening the next sev- eral weeks before experiencing some resistance. Steak cuts such as the ribeye and loin along with ground product will drive the beef market through the summer. The one big question is if consumers will defect from beef due to high retail prices. There has been little indication that consumers will look past the beef counter. A second question is how the highly pathogenic avian influenza outbreak in the chicken flock will impact beef prices. It could go either way at this point. TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were steady to $4 higher. Heifers were $1 to $4 higher. Slaughter cows were steady while bulls were $1 to $3 higher. Average receipts per sale were 718 head on 10 sales compared to 640 head on 10 sales last week and 550 head on 12 sales last year. OUTLOOK: Last week’s cattle on feed report was a little bearish in terms of the number of cattle on feed as numbers were even with a year ago but higher than what many analysts had expected. There is not necessarily a lot to say about the report, but the report does confirm what many in the industry suspected with regards to growing calves outside the feedlot. Placements of cattle on feed was down for cattle weighing less than 800 pounds, but cattle placed on feed weighing 800 pounds and up increased 16.1 percent from one year ago. Many producers continue to hold cattle longer on pasture as the market price of yearling feeder cattle supports the notion to continue adding weight. Thus, cowcalf, stocker and backgrounding operations are holding cattle to heavier weights. Similarly, feedlot operators are holding cattle to heavier weights because the market continues to pay for the additional weight. This may or may not be an issue going forward, but the large number of heavier cattle on (Continued on page 2) Livestock Comments by Dr. Andrew Griffith 50.18. August live cattle closed at $148.10. Support is at $146.85, then $144.85. Resistance is at $149.25, then $149.73. The RSI is 51.70. October live cattle closed at $149.68. Support is at $149.58, then $146.80. Resistance is at $149.78, then $150.60. The RSI is 50.94. May feeders closed at $212.98. Support is at $211.01, then $207.48. Resistance is at $214.53 then $218.06. The RSI is 53.26. August feeders closed at $214.70. Support is at $213.90, then $213.88. Resistance is at $214.80 then $215.68. The RSI is 53.64. September feeders closed at $213.93. Support is at $213.78, then $213.03. Resistance is at $213.98 then $214.70. The RSI is 54.05. Friday’s closing prices were as follows: Live/fed cattle –June $149.18 -0.53; August $147.83 -0.28; October $149.60 -0.08; Feeder cattle - May $213.63 +0.65; August $215.08 +0.38; September $214.70 +0.78. October $213.78 +0.53; May corn closed at $3.60 down $0.03 from Thursday. (Continued from page 1) feed could put pressure on live cattle prices as the market approaches some of the largest slaughter weeks in the month of June. One aspect of the market that supports prices is that the dressed weight of cattle is generally declining at the same time slaughter is peaking. However, slaughter weights are holding their own which will put more beef product on the market which will pressure beef prices and then cattle prices. The market price is expected to continue rewarding putting weight on calves and feeder cattle the next several months, but producers should consider adding value to those animals by providing a complete health program as well as preparing those animals to enter the feedlot. The idea of adding value to calves is often overlooked by small producers, but it is not overlooked by order buyers and feedlot managers. Making a change to the operation always comes with some degree of resistance, but the time to attempt making a change is when times are good because it provides a greater margin for error. Such changes can and will mean the difference in profits and losses when prices falter and costs escalate. Milk Futures Month May Jun Jul Aug Sep TECHNICALLY SPEAKING: Based on Thursday’s closing prices, June live cattle closed at $149.70. Support is at $148.12, then $144.94. Resistance is at $151.29 then $154.47. The RSI is Average Daily Slaughter Thursday April 30, 2015 Class III Close Class IV Close 16.22 14.20 16.34 14.85 16.45 15.26 16.72 15.53 17.10 15.92 USDA Box Beef Cutout Value Cattle Hogs Choice 1-3 600-900 lbs ———— Number of head ———— This week (4 days) 112,500 Last week (4 days) 108,750 Year ago (4 days) 118,750 This week as percentage of Week ago (%) 103% Year ago (%) 95% 427,250 429,500 395,500 Select 1-3 600-900 lbs ———————— $/cwt —-——————— Thursday Last Week Year ago Change from week ago Change from year ago 99% 108% 256.90 260.01 233.10 -3.11 +23.80 244.05 251.04 222.29 -6.99 +21.76 Crop Comments by Dr. Aaron Smith Overview Cotton was up; corn, soybeans, and wheat were down for the week. In April, July corn futures decreased 21 cents from $3.85/bu to $3.64/bu; July soybeans decreased 5 cents from $9.77/bu to $9.72/bu; July wheat decreased 41 cents from $5.15/bu to $4.74/bu; and July cotton increased 4.67 cents from 63.21 cents/lb to 67.88 cents/lb. For soybeans, wheat, and corn, large global stocks, a record South American harvest, and a high US dollar have contributed to lower prices. Cotton futures, the lone bright spot this past month, benefitted from strong export sales and reduced estimated domestic acreage, as indicated by the USDA’s Prospective Plantings report. Moving forward, a weaker-to-flat US dollar should help export sales. On the downside, concerns over feed use may persist if we see an increase in the number of cases of H5N2 bird flu. As we move through May we will likely see harvest futures trade in established ranges: Dec corn-$3.70 to $4.20; Nov soybeans-$9.30 to $9.80; July wheat-$4.60 to $5.20; and Dec cotton- 62 to 68 cents. Any rallies in grain and oilseed markets should be viewed as opportunities to price additional production as, baring a weather event, substantial price improvements remain unlikely in the current marketing environment. Nationally, corn planting progress is ahead of 2014 but slightly behind the five year average; however, Monday’s report release should show further improvement due to favorable planting conditions in many Corn Belt states. Due to wet weather, Tennessee continues to remain well behind typical planting progress. Tennessee producers may shift acreage to cotton, soybeans, or sorghum 2 Crop Comments by Dr. Aaron Smith if wet conditions persist. Note: This week, the CME implemented new daily price limits effective May 1st. The new price limits (and expanded limits) are: corn: $0.30 ($0.45), soybeans: $0.70 ($1.05); and wheat $0.40 ($0.60). Corn July 2015 corn futures closed at $3.63 down 6 cents a bushel since last week. This week July 2015 corn futures prices traded between $3.60 and $3.70. Across Tennessee average basis (cash price- nearby future price) strengthened at Northwest Barge Points, Memphis, Northwest, Lower-middle, and Upper-middle Tennessee. Overall, average basis for the week ranged from 10 under to 39 over the July futures contract with an average of 12 over at the end of the week. Ethanol production for the week ending April 24th was 921,000 barrels per day down 9,000 barrels per day from last week. Ending ethanol stocks were 20.797 million barrels down 545,000 barrels from last week. Corn net sales reported by exporters from April 17th to 23rd were above expectations with net sales of 32.8 million bushels for the 2014/15 marketing year and 4.5 million bushels for the 2015/16 marketing year. Exports for the same time period were up from last week at 50 million bushels. Corn export sales and commitments were 88% of the USDA estimated total annual exports for the 2014/15 marketing year (September 1 to August 31) compared to a 5-year average of 91%. Jul/Sep and Jul/Dec future spreads were 6 cents and 17 cents, respectively. September 2015 futures closed at $3.69 down 8 cents from last week. September 2015 cash forward contracts averaged $3.64 with a range of $3.39 to $3.94. Nationally, this week’s Crop Progress report estimated corn planted at 19% compared to 9% last week, 17% last year, and a 5-year average of 25%; and corn emerged at 2% compared to 3% last year and a 5-year average of 6%. In Tennessee, corn planted was estimated at 17% compared to 6% last week, 48% last year, and a 5-year average of 60%; and corn emerged at 3% compared to 10% last year and a 5-year average of 30%. Downside price protection could be obtained by purchasing a $3.70 September 2015 Put Option costing 22 cents establishing a $3.48 futures floor. Soybeans July 2015 soybean futures closed at $9.64 down 6 cents since last week. This week July 2015 soybean futures traded between $9.61 and $9.95. July soybean to corn price ratio was 2.66 at the end of the week. For the week, average soybean basis strengthened at Memphis, Northwest Barge Points, Northwest, Upper-middle, and Lower-middle Tennessee. Basis ranged from 10 under to 32 over the July futures contract at elevators and barge points. Average basis at the end of the week was 14 over the July futures contract. Net sales reported by exporters were within expectations with net sales of 15.9 million bushels for the 2014/15 marketing year and net sales reductions of 4.4 million bushels for the 2015/16 marketing year. Exports for the same period were up from last 3 (Continued on page 4) Crop Comments by Dr. Aaron Smith week at 9.7 million bushels. Soybean export sales and commitments were 101% of the USDA estimated total annual exports for the 2014/15 marketing year (September 1 to August 31), compared to a 5-year average of 98%. August 2015 soybean futures closed at $9.59 down 7 cents since last week. Jul/Aug and Jul/Nov future spreads were -5 cent and -24 cents, respectively. November 2015 futures closed at $9.40 down 12 cents from last week. Nov/Sep 2015 soybean to corn price ratio was 2.55. October/November 2015 cash forward contracts averaged $9.46 with a range of $9.20 to $9.72 at elevators and barge points. Nationally, this week’s Crop Progress report estimated soybeans planted at 2% compared to 3% last year and a 5-year average of 4%. In Tennessee, soybeans planted were estimated at 1% compared to 2% last year and a 5-year average of 3%. Downside price protection could be achieved by purchasing a $9.60 November 2015 Put Option which would cost 62 cents and set an $8.98 futures floor. Cotton July 2015 cotton futures closed at 66.61 up 0.27 cents since last week. July 2015 cotton futures traded between 65.6 and 68.13 cents this week. Adjusted world price (AWP) increased 3.14 cents to 51.7 cents per pound. Net sales reported by exporters were down from last week with net sales of 124,200 bales for the 2014/15 marketing year and net sales of 42,900 bales for the 2015/16 marketing year. Exports for the same period were down from last week at 285,300 bales. Upland cotton export sales were 103% of the USDA estimated total annual exports for the 2014/15 marketing year (August 1 to July 31), compared to a 5-year average of 100%. October 2015 cotton futures closed at 66.3 up 0.69 cents since last week. Jul/Oct and Jul/Dec futures spread were -0.31 cents and -0.16 cents, respectively. December 2015 cotton futures closed at 66.45 up 0.83 cents since last week. Nationally, this week’s Crop Progress report estimated cotton planted at 10% compared to 8% last week, 12% last year, and a 5-year average of 16%. In Tennessee, cotton planted was estimated at 3% compared to 3% last year and a 5-year average of 2%. Downside price protection could be obtained by purchasing a 67 cent December 2015 Put Option costing 3.68 cents establishing a 63.32 cent futures floor. Wheat July 2015 wheat futures closed at $4.74 down 14 cents since last week. July wheat futures traded between $4.64 and $4.90 this week. July wheat to corn price ratio was 1.31. In Memphis, old crop cash wheat traded between $4.27 and $4.37 last week. Net sales reported by exporters were below expectations with net cancellations of 16.5 million bushels for the 2014/15 marketing year (Continued on page 5) 4 Crop Comments by Dr. Aaron Smith and net sales of 31.3 million bushels for the 2015/16 marketing year. Exports for the same period were up from last week at 22.3 million bushels. Wheat export sales were 97% of the USDA estimated total annual exports for the 2014/15 marketing year (June 1 to May 31), compared to a 5-year average of 102%. Nationally, this week’s Crop Progress report estimated winter wheat condition at 42% good to excellent and 20% poor to very poor; winter wheat headed was estimated at 28% compared to 16% last week, 17% last year, and a 5-year average of 24%; spring wheat planted was estimated at 55% compared to 36% last week, 17% last year, and a 5-year average of 19%; and spring wheat emerged was estimated at 9% compared to 4% last year and a 5-year average of 9%. In Tennessee, winter wheat condition was estimated at 79% good to excellent and 2% poor to very poor; winter wheat jointing was estimated at 81% compared to 66% last week, 73% last year, and a 5-year average of 89%; and winter wheat headed was estimated at 13% compared to 1% last week, 18% last year and a 5-year average of 38%. June/July 2015 cash forward contracts averaged $4.65 with a range of $4.13 to $4.90 at elevators and barge points. September 2015 wheat futures closed at $4.82 down 16 cents since last week. Jul/Sept and Jul/Jul future spreads were 8 cents and 59 cents, respectively. July 2016 wheat futures closed at $5.33 down 10 cents since last week. Downside price protection could be obtained by purchasing a $5.40 July 2016 Put Option costing 56 cents establishing a $4.84 futures floor. Additional Information: If you would like further information or clarification on topics discussed in the crop comments section or would like to be added to our free email list please contact me at [email protected]. 5 Futures Settlement Prices: Crops & Livestock Friday, April 24, 2015 — Thursday, April 30, 2015 Friday Monday Tuesday 9.69 9.73 9.77 9.70 9.73 9.77 9.66 9.68 9.71 9.56 9.56 9.59 9.52 9.52 9.53 9.59 9.58 9.59 Commodity Soybeans ($/bushel) Contract Month May Jul Aug Sep Nov Jan Wednesday 9.88 9.88 9.82 9.68 9.61 9.67 Thursday 9.78 9.76 9.71 9.58 9.52 9.58 Corn ($/bushel) May Jul Sep Dec Mar May 3.64 3.69 3.77 3.88 3.99 4.07 3.60 3.64 3.72 3.83 3.94 4.02 3.61 3.64 3.71 3.82 3.93 4.01 3.63 3.67 3.74 3.85 3.97 4.04 3.62 3.66 3.72 3.83 3.94 4.02 Wheat ($/bushel) May Jul Sep Dec Mar 4.86 4.88 4.98 5.15 5.30 4.70 4.73 4.82 5.00 5.16 4.71 4.76 4.85 5.03 5.20 4.77 4.83 4.93 5.11 5.28 4.67 4.74 4.83 5.02 5.20 Soybean Meal ($/ton) May Jul Aug Sep Oct Dec 314 313 312 310 308 309 315 314 312 311 309 309 318 317 315 314 311 311 324 322 320 318 314 314 318 316 314 313 310 310 Cotton (¢/lb) May Jul Oct Dec Mar 66.50 66.34 65.61 65.62 65.27 66.39 66.23 65.76 65.63 65.21 66.62 66.39 65.77 65.85 65.48 67.32 67.09 66.51 66.27 65.78 68.12 67.88 66.83 66.64 66.11 Live Cattle ($/cwt) Apr Jun Aug Oct Dec 161.17 151.20 149.72 151.22 152.00 160.47 150.27 148.35 150.05 150.97 161.00 151.12 148.80 150.47 151.40 160.80 150.90 149.15 150.60 151.30 159.50 149.70 148.10 149.67 150.47 Feeder Cattle ($/cwt) Apr May Aug Sep Oct Nov 214.85 214.07 215.67 214.70 213.87 212.95 214.90 211.40 213.17 212.22 211.32 210.65 215.97 212.35 213.87 213.02 212.10 210.87 216.52 213.05 214.70 213.95 213.07 212.15 217.55 212.97 214.70 213.92 213.25 212.07 Market Hogs ($/cwt) May Jun Jul Aug Oct 71.95 79.45 80.75 80.75 71.87 72.27 79.40 80.72 80.77 71.67 73.75 79.90 81.20 81.27 71.77 75.32 81.20 82.47 82.57 72.50 76.95 81.42 82.52 82.37 71.87 6 Prices on Tennessee Reported Livestock Auctions for the week ending May 1, 2015 Low This Week High Weighted Average Last Week Weighted Average Year Ago Weighted Average —————————————————————— $/cwt —————————————————————— Steers: Medium/Large Frame #1-2 300-400 lbs 267.00 365.00 309.61 310.24 236.72 400-500 lbs 250.00 315.00 276.75 276.25 223.47 500-600 lbs 233.00 275.00 254.26 250.33 204.94 600-700 lbs 205.00 243.00 226.93 224.87 186.22 700-800 lbs 191.00 221.00 209.80 202.47 170.43 300-400 lbs 200.00 325.00 275.50 282.53 201.05 400-500 lbs 222.50 260.00 250.27 257.86 204.82 500-600 lbs 227.00 250.00 241.70 230.32 ——— 600-700 lbs ——— ——— ——— ——— ——— Steers: Small Frame #1-2 Steers: Medium/Large Frame #3 300-400 lbs 250.00 330.00 286.10 282.71 215.61 400-500 lbs 226.00 290.00 252.06 251.75 194.10 500-600 lbs 221.00 255.00 234.02 234.66 181.79 600-700 lbs 195.00 230.00 213.91 213.01 170.68 700-800 lbs ——— ——— ——— ——— ——— 300-400 lbs 232.50 250.00 244.96 ——— 149.01 500-600 lbs ——— ——— ——— 188.86 ——— 700-800 lbs 159.00 164.50 161.18 ——— ——— Breakers 75-80% 103.00 117.00 110.22 109.32 97.35 Boners 80-85% 103.50 118.00 111.70 111.92 98.10 Lean 85-90% 90.00 111.50 102.56 102.94 85.24 Bulls YG 1 130.50 150.00 139.70 136.81 115.72 Holstein Steers Slaughter Cows & Bulls Heifers: Medium/Large Frame #1-2 300-400 lbs 245.00 317.50 275.30 276.40 212.28 400-500 lbs 226.00 272.50 246.77 249.13 200.79 500-600 lbs 210.00 244.00 227.29 225.20 186.08 600-700 lbs 182.00 220.00 205.75 203.12 171.67 300-400 lbs 230.00 257.50 244.58 251.26 180.36 400-500 lbs 201.00 240.00 223.06 220.16 171.50 500-600 lbs 209.00 224.00 215.41 212.33 166.22 185.04 ——— Heifers: Small Frame #1-2 600-700 lbs Heifers: Medium/Large Frame #3 300-400 lbs 220.00 282.00 255.82 257.20 193.60 400-500 lbs 216.00 252.50 234.85 231.33 181.56 500-600 lbs 200.00 238.00 215.63 208.51 170.81 600-700 lbs 172.50 205.00 190.07 190.44 150.83 Cattle Receipts (# sales): This week: 7,181 (10) Week ago: 6,400 (10) 7 Year ago: 6,600 (12) Tennessee 500-600 lbs. M-1 Steer Prices Tennessee 700-800 lbs. M-1 Steer Prices 2014, 2015 and 5-year average 2014, 2015 and 5-year average 270 250 230 210 190 170 150 130 110 225 205 185 165 145 125 105 85 2009/2013 Avg 2014 200 9/20 13 Avg 2015 201 4 201 5 5-Area Finished Cattle Prices Tennessee Slaughter Cow Prices 2014, 2 015 and 5-year average Breakers 75-80% 2014, 2015 and 5-year average 175 165 155 145 135 125 115 105 95 85 115 105 95 85 75 65 55 45 35 2009/2013 Avg 2014 200 9/20 13 Avg 2015 201 4 201 5 Prices Paid to Farmers by Elevators Friday, April 24, 2015 — Thursday, April 30, 2015 Friday Low High Monday Low Tuesday High Low High Wednesday Low High Thursday Low High ————–-——–——————————————— $/bushel ———————————————————–——— No. 2 Yellow Soybeans Memphis 9.94-9.99 9.98-10.03 10.02-10.07 10.13-10.18 10.03-10.08 N.W. B.P. 9.69-9.94 9.73-9.98 9.77-10.02 9.88-10.13 9.78-10.03 N.W. TN 9.65-9.69 9.68-9.73 9.77-9.78 9.88-9.90 9.78-9.81 Upper Md. 9.84-9.84 9.88-9.88 9.92-9.92 10.03-10.03 9.93-9.93 Lower Md. 9.59-9.90 9.63-9.93 9.67-9.98 9.78-10.09 9.68-9.99 Memphis 3.87-3.89 3.83-3.85 3.86-3.86 3.88-3.88 3.87-3.87 N.W. B.P. 3.64-3.86 3.60-3.85 3.61-3.86 3.63-3.88 3.62-3.87 N.W. TN 3.57-3.79 3.54-3.75 3.58-3.76 3.61-3.78 3.60-3.77 Upper Md. 3.67-3.76 3.63-3.72 3.64-3.73 3.66-3.75 3.65-3.74 Lower Md. 3.89-3.90 3.86-4.00 3.86-4.01 3.89-4.03 3.88-4.02 4.46-4.46 4.30-4.30 4.31-4.31 4.37-4.37 4.27-4.27 Yellow Corn Wheat Memphis 8 Video Board Sale and Graded Sales Tennessee Sheep and Goat Auction BLUE GRASS STOCKYARDS—April 29, 2015 20 bbwf steers, avg. wt. 600 lbs., $244.00 45 bbwf heifers, avg. wt. 600 lbs., $234.00 75 bbwf-fancy steers, avg. wt. 650 lbs., $250.00 60 bbwf-mixed steers, avg. wt. 835 lbs., $204.50 57 bbwf-mixed steers, avg. wt. 935 lbs., $189.00 105 Holstein steers, avg. wt. 970 lbs., $160.50 4/27/15 Tennessee Livestock Producers Graded Goat and Sheep Sale, Columbia, TN Receipts: 445 (257 Goats; 188 Sheep) Last Sale 336 Next Sale May 11, 2015. (2nd and 4th Monday of each month) Goats sold per hundred weight (cwt) unless otherwise noted, weights, actual or estimated. Slaughter Classes: Kids Selection 1 25-35 lbs 215.00-232.00 36-50 lbs 202.00-265.00 51-65 lbs 260.00-270.00 66-80 lbs 248.00 Video Board Sale and Graded Sales 4/29/15 Brownings Livestock Market, Lafayette, TN Receipts: 1,901 (1,719 Feeders) For complete report: http://www.ams.usda.gov/mnreports/nv_ls180.txt Selection 2 25-35 lbs 202.00-206.00 36-50 lbs 230.00-265.00 51-65 lbs 253.00-261.00 66-80 lbs 192.00 81-100 lbs 160.00 Selection 3 25-35 lbs 200.00 36-50 lbs 201.00-211.00 51-65 lbs 182.00-208.00 66-80 lbs 155.00 Yearlings Selection 2-3: 50-130 lbs 153.00-164.00 Slaughter Bucks/Billies: All wgts 122.00-153.00 Slaughter Nannies/Does: All wgts 115.00-152.00 Kids Feeders Selection 3: 24-50 lbs 175.00-205.00 SHEEP: Slaughter Lambs-Includes all breeds, sold per hundred weight (cwt). Choice and Prime 40-60 lbs 200.00-212.00 Good 216.00-225.00 Choice and Prime 61-80 lbs 194.00-199.00 Good 139.00-155.00 Choice and Prime 81-100 lbs 152.00-174.00 Good 132.00 Choice and Prime 100-120 lbs 155.00 Good 132.00 Choice and Prime 120-140 lbs Slaughter Ewes Utility and Good: All wgts 73.00-119.00 Slaughter Rams: All Wgts 72.00-78.00 9 Beef Industry News - Featured Article from PORKNetwork Antibiotic use deserves serious conversation, not scare tactics The recent release of the Food and Drug Administration’s report on antibiotic sales brought a round of calls from certain advocacy groups to ban the use of antibiotics in animal agriculture. These advocates remind me of another crowd: the antivaccination movement. Both the groups pushing for an antibiotic-free animal agriculture and the “anti-vaxxers” ignore established science on their respective issues in a way that leads to diminished human and animal welfare. We certainly should have a debate about the judicious use of antibiotics in agriculture, but jumping to an outright ban defies science and common sense, will cause more animal suffering, and may have adverse effects on public health. While those pushing for an outright ban are on the fringe, concerns about antibiotic-resistant bacteria in agriculture are starting to hit the mainstream. In American Humane Association’s 2014 Humane Heartland Farm Animal Welfare Survey, more than half of the respondents indicated that they seek out food labeled “Antibiotic Free,” second only behind “Humanely Raised.” Opponents of antibiotics frequently point to Centers for Disease Control and Prevention estimates that at least two million Americans become infected with bacteria that are resistant to antibiotics every year. Reports indicate that the most resistant infections reside in human hospital settings. However, there is no evidence that antibiotics used in animal agriculture have decreased the effectiveness of antibiotics in humans. According to Dr. Stephanie Doores of Pennsylvania State University, “People would be more likely to die from a bee sting than for their antibiotic treatment to fail because of macrolide-resistant bacteria in meat or poultry.”; A look across the world to Denmark is also instructive. Despite a complete ban on antibiotic use for growth promotion instituted in 2000, there is very little evidence that it led to any positive impacts onhuman health or a decline in antibiotic resistant bacteria. In fact, it has resulted in a significant increase in the therapeutic use of antibiotics in animals, due to animals getting sick. when given to a child with strep throat, antibiotics relieve the pain and distress of sick animals while helping them to recover. One of the Five Freedoms upon which the American Humane Certified program is based is the freedom “from pain, injury and disease.” An outright ban would be inhumane to sick animals, and would violate one of the Five Freedoms that serves as the internationally accepted social contract with animals. Additionally, what is not often discussed is that use of antibiotics in farm animals provides for a safer food supply, and that the FDA has long required withdrawal periods for such use. As noted by Dr. Christine Hoang, assistant director of the American Veterinary Medical Association, in her 2010 testimony to the House Committee on Energy and Commerce, Subcommittee on Health: “For food animals, drugs additionally contribute to the public health by mitigating disease and thereby reducing the numbers of bacteria entering the food supply. Studies show that a reduction in the incidence of food animal illness will reduce bacterial contamination on meat, thereby reducing the risk of human illness.” Because it is an issue of concern for the public, antibiotic use in agriculture demands a healthy and robust discussion. But veterinarians, public health professionals and scientists should be determining what the appropriate use of antibiotics is. And such a discussion needs to include outcomes for the sick animal, as it’s simply not humane to leave an animal to suffer needlessly. Recent moves by Chick-fil-A and McDonald’s demonstrate that the issue is becoming more urgent. Let’s set aside the scare tactics and pressure campaigns and have a real, honest conversation about safe and proper antibiotic use that’s driven by science. Agriculture, researchers and humane organizations must work together to educate the public and food companies about proper antibiotic use, or else the dialogue will be led by misinformation. In working together, we can develop policies that improve animal health and welfare, safeguard our abundant food supply and protect public health. Better science is needed to advance a better understanding of human and animal health, and define what it is to be humane. Science – and common sense – tell us that antibiotics can and do help improve well-being, decrease mortality rates of farm animals, and prevent unnecessary suffering. Just as they do Department of Agricultural and Resource Economics 314 Morgan Hall • 2621 Morgan Circle http://economics.ag.utk.edu/ USDA / Tennessee Department of Agriculture Market News Service http://economics.ag.utk.edu/curmkt.html http://www.tennessee.gov/agriculture/marketing/marketnews.html 10 1-800-342-8206

© Copyright 2026