MATHEMATIZATION IN ECONOMICS Instituto de

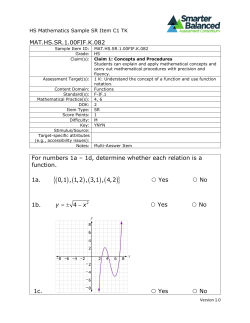

Energeia Vol. 7, no. 1, 2015, pp. 85–95 ISSN 1666-5732 MATHEMATIZATION IN ECONOMICS A DOLFO G ARC´I A DE LA S IENRA Instituto de Filosof´ıa Universidad Veracruzana [email protected] RESUMEN : Para ejemplificar el inicio del proceso de matematizaci´ on de la teor´ıa econ´omica, en este art´ıculo me propongo hacer una reconstrucci´on racional, desde un ventajoso si bien anacr´onico punto de vista, de las condiciones que hubiera tenido que satisfacer Jevons para producir una medici´on fundamental de la utilidad como e´ l la entend´ıa, mediante el tipo de experimento que describe en los textos relevantes (Jevons 1866, 1871). PALABRAS CLAVE : Experimento de Jevons ⋅ medici´ on de la utilidad ⋅ utilidad marginal ⋅ matematizaci´on ⋅ medici´on fundamental ABSTRACT: In order to illustrate the beginning of mathematization of economic theory, in this paper I propose to provide a rational reconstruction, from an anachronistic albeit advantageous point of view, of the conditions that Jevons would have had to satisfy in order to produce a rigorous fundamental measurement of utility, by means of the experiment that he describes in the relevant texts (Jevons 1866, 1871). KEYWORDS : Jevons’ Experiment ⋅ Measurement of Utility ⋅ Marginal Utility ⋅ Mathematization ⋅ Fundamental Measurement 1. Introduction What is the nature of a mathematical economic theory? By ‘mathematized economics’ it is understood, nowadays, mathematical economics roughly as defined, say, by the series Handbook of Mathematical Economics edited by Arrow and Intriliga85 ADOLFO GARC´I A DE LA SIENRA 86 tor (1981). In the Historical Introduction to the series (which contains a brief, albeit quite complete history of the mathematization of economics), these authors say: Indeed, while the field of “mathematical economics” could be defined . . . as one that “includes various applications of mathematical concepts and techniques to economics, particularly economic theory”, an alternative approach to define the field would be to enumerate its parts. Pragmatically, our definition of the field in this sense is provided by the Table of Contents of the Handbook. We recognize, however, that this definition is not truly complete; considerations of space limitations and priorities have caused the omission of some very active fields of mathematical economics (Arrow and Intriligator 1981, vol. 1, p. 1). Standard textbooks on mathematical economics also provide a good idea of the field. Outstanding among these are those of Takayama (1985) and Nikaido (1968). The main mathematical techniques used in mathematical economics are, of course, linear algebra and calculus. But also convex analysis, mathematical programming (both linear and nonlinear), control theory, measure theory, probability and statistics, and a whole array of fixed-point theorems. Beside the classical topic of calculus-based marginalism, and the set-theoretic/ linear models of the period 1948– 1960, the main topics treated with these methods, enlisted by Arrow and Intriligator (1981), are eleven: (1) Uncertainty and information. (2) Global analysis. (3) Duality theory. (4) Aggregate demand functions. (5) Core of an economy and markets with a continuum of traders. (6) Temporary equilibrium. (7) Computation of equilibrium prices. (8) Social choice theory. (9) Optimal taxation. (10) Optimal growth theory. (11) Organization theory. MATHEMATIZATION IN ECONOMICS 87 Moreover, since the work of Leontief (1941), Georgescu-Roegen (1950), Burgess Cameron (1952), and Morishima and Seton (1961), the labor theory of value has also been mathematized in terms as rigorous as those of the aforementioned theories.1 Hence, the labor theory of value must be considered also as a province in mathematical economics. Sraffa’s economic theory, in contradistinction, has never received such a strict mathematical formulation, and its followers are enmeshed in disputes about the use of non-constructive mathematical methods in the demonstration of its main results.2 Other economic theories, like those of Keynes or the institutionalists, are far from being formulated in a strict mathematical fashion, and so are far from being considered as parts of mathematical economics. Mathematical economics gives rise to several philosophical questions. The first one is whether mathematically formulated economic theories are the result of the “mathematization” of a previously given, non-mathematical economic theory, or whether they are innately mathematical; whether they are born with their mathematical structure “built in”. Another one is What conditions within the historical development of mathematics have made possible the rise of mathematical economics? Has mathematical economics reached out to given, established mathematical theories, or has she given rise to new branches of mathematics? A logical question that arises is What is the logical structure of a mathematical economic theory? Is it a set of sentences formulated in first-order logic? Is it really possible to formulate mathematical economic theories in first-order logic? If the answer is negative, is there a “canonical way” of describing their logical structure? What is, indeed, the conception of the axiomatic method behind the work of the mathematical economists in formulating their theories? Other questions are epistemological. What is the structure of explanation in mathematical economics? What empirical claims can be made using a mathematical economic theory? Does the explanatory power of a previously non-mathematical theory increases once it receives a mathematical formulation? Why is it precisely that it has been deemed necessary or useful to mathematize economics? In responding to these questions, the role of fundamental measurement (in the sense of Krantz et al. 2007) must be taken into account. 1 2 For a history of the mathematization of the labor theory of value, see Garc´ıa de la Sienra 1992, §2.3. Cf., for instance, Vela Velupillai 2008. ADOLFO GARC´I A DE LA SIENRA 88 2. The Rise of Mathematical Economics It is fair to say that mathematical economics arose with the introduction of calculus in economics, due mainly to William Stanley Jevons (1871), Carl Menger (1871) and Leon Walras (1874). This marks the appearance of the idea of utility as a numerical magnitude and to the related idea of marginal utility, which gave the new theory its name: marginalism. Marginalism provides the most important historical example of a mathematical economic theory. In a paper read before the Royal Statistical Society in 1862, Jevons makes clear that economics “has of necessity always been mathematical” because it is “concerned with quantities”, but this does not mean that the theory has received a “strict and general statement”: The following paper briefly describes the nature of a Theory of Economy which will reduce the main problem of this science to a mathematical form. Economy, indeed, being concerned with quantities, has always of necessity been mathematical in its subject, but the strict and general statement, and the easy comprehension of its quantitative laws has been prevented by a neglect of those powerful methods of expression which have been applied to most other sciences with so much success. (Jevons 1866, §1) This suggests that economics is inherently mathematical but that not all economic theories receive a rigorous mathematical formulation. I shall briefly try to show now how the concept of utility was the result of a certain “mathematization” carried out by Jevons. To mathematize an economic magnitude means to provide a metrization of it, in the sense of Garc´ıa de la Sienra (2013). Metrization gives rise to some mathematical object, usually a function of a certain sort. Jevons’ theory begins with the metrization of certain types of sensations of pleasure and pain, namely those that “arise periodically from the ordinary wants and desires of body or mind, and from the painful exertion we are continually prompted to undergo that we may satisfy our wants” (Jevons 1866, §2). The very starting point of marginalism is the metrization of a magnitude capable of more or less, of a certain comparison relation: We always treat feelings as being capable of more or less, and I now hold that they are quantities capable of scientific treatment. [. . . ] Our estimation of the comparative amounts of feeling is performed in the act of choice or volition. Our choice of one course out of two or more proves that, in our estimation, this course promises the greatest balance of pleasure. When there is a large overbalancing force on one side, indeed, the estimation of the amount of this balance is no doubt very rude; but all the critical points of the theory MATHEMATIZATION IN ECONOMICS 89 will depend on that nice estimation of the opposing motives which we make when these are nearly equal, and we hesitate between them. (Jevons 1866, §3) In the previous paragraph Jevons introduces a relation of comparison among feelings, and also anticipates a sort of “revealed preference”, but in the next one he is quite accurate regarding the magnitudes he wants to measure: feelings have two dimensions, intension and duration. A pleasure or a pain may be either weak or intense in any indivisible moment; it may also last a long or a short time. If the intensity remain uniform, the quantity of feeling generated is found by multiplying the units of intensity into the units of duration. But if the intensity, as is usually the case, varies as some function of the time, the quantity of feeling is got by infinitesimal summation or integration. Assuming that the agent has perfect memory, so that he can compare any two feelings as to their intension, let F be the set of feelings and ≿ the comparison relation among them, so that x ≿ x′ iff the agent finds feeling x more intense ADOLFO GARC´I A DE LA SIENRA 90 (pleasant) than feeling x′ . Now, a necessary condition for the metrization of relation ≿ is that the structure ⟨F, ≿⟩ be a weak order. The condition is also sufficient if F is at most countable, but the metrization might not exist if F is uncountable. Moreover, any metrization g∶F → R need not be continuous, something which Jevons needs in order to map F into the set of real numbers.3 Jevons wants to consider a time interval T = [0, τ ] during which the agent is enjoying some good; for instance, drinking water. The intensity of the sensation may be constant along this interval, but it may also vary in many ways. Actually, Jevons requires another function u relating each instant t ∈ [0, τ ] with a certain level of intensity; i.e. with a number in R. This is just the composition u = g ○ f , as depicted in figure 2. Moreover, in order to define the concept of quantity of feeling, Jevons needs u to be continuous almost everywhere, as this amount at time t is defined as the integral U (t) = ∫ t u(z) dz. 0 Clearly, while u(t) ≥ 0, U (t) increases with time. The marginalist idea, of course, is that U grows with time up to a point but: if the agent keeps consuming the good, there will be a satiation point t∗ in which u becomes negative and forces U to start decreasing. Clearly, at point t∗ , U reaches a maximum, which is precisely when u crosses the horizontal axis, that is when u(t) = 0. Thus, u is nothing but the marginal utility, and it is seen that the condition dU ∗ (t ) = u(t∗ ) = 0 dt is exactly right. As Jevons puts it, 3 The existence of all types of metrizations in science, especially economics, is the topic of Krantz et al. 2007. MATHEMATIZATION IN ECONOMICS 91 Amount of utility [the level of U ] corresponds to amount of pleasure produced. But the continued uniform application of a useful object to the senses or the desires, will not commonly produce uniform amounts of pleasure. Every appetite or sense is more or less rapidly satiated. A certain quantity of an object received, a further quantity is indifferent to us, or may even excite disgust. Every successive application will commonly excite the feelings less intensely than the previous application. The utility of the last supply of an object, then, usually decreases in some proportion, or as some function of the whole quantity received. This variation theoretically existing even in the smallest quantities, we must recede to infinitesimals, and what we shall call the coefficient of utility, is the ratio between the last increment or infinitely small supply of the object, and the increment of pleasure which it occasions, both, of course, estimated in their appropriate units. (§8) If “time” is interpreted as amounts of the good consumed (or as the time during which the good is consumed), u(t) can be interpreted as the coefficient of utility at t. Then the fundamental law of Jevon’s theory can be formulated thus: The coefficient of utility [our u] is, then, some generally diminishing function of the whole quantity of the object consumed. Here is the most important law of the whole theory. (§9) This rational reconstruction of Jevons’ ideas gives us a glimpse of the role of metrization in mathematical economics but does not tell us anything about the way these theories can be applied (if they can be applied at all) to make empirical claims and make explanations. This is the topic of the final section, but this topic cannot be dealt with unless a disquisition about the logical structure of such theories is introduced before. 3. The Logical Structure of Mathematical Economic Theories Perhaps the clearest example of a mathematical economic theory is the theory of value as presented by Gerard Debreu in his classic Theory of Value (1959). Along the lines of Bourbaki’s mathematics, based mainly on the set-theoretic concept of structure (cf. Weintraub 2002, ch. 4), Debreu formulated his theory of value following a logical methodology which was going to be further elaborated at Stanford by J. C. C. McKinsey, and mainly by Patrick Suppes, to produce one of the most influential views in the philosophy of science. The application of this methodology in economics was pursued at the Institute for Mathematical Studies in the Social Sciences (IMSSS) of Stanford University. Instead of identifying scientific theories as sets of sentences formulated in some formal language (as Rudolf Carnap among others proposed to do), Suppes proposes to identify the theory through an extrinsic characterization of its models, using the ADOLFO GARC´I A DE LA SIENRA 92 language of informal set theory. Here the relevant notion of model is precisely the one that Bourbaki (1968) defined under the label ‘mathematical structure’. These structures are introduced by Suppes through the definition of a set-theoretic predicate, like ‘A is a topological space’ or ‘A is a game’.4 In order to illustrate this method, let us try to reconstruct Jevons’ theory as formulated in the previous section. Since the theory intends to describe the behavior or actions of a consumer, we need first a conceptual apparatus describing such behavior. It is usual to adopt a choice correspondence η for this effect. In the present case, the correspondence or function must describe the amount of the good selected by the agent over the set of all the possible amounts; i.e., η is a function from the family of all subintervals S = [0, t] of T into T . For any such set S, η(S) is the amount actually chosen by the agent. The “most important law of the theory” is actually a description of the utility function: It says that u is strictly quasi-concave (or ≿ strictly convex). The law is in fact the assertion that utility begins to decrease after a certain amount of the good has been consumed. An implicit presupposition of Jevons is the agent is “rational”; i.e. that she chooses that point in S that maximizes her utility. More precisely: ∀S U [η(S)] = m´ax U (t). t∈S In particular, η(T ) is the point where U reaches its maximum; i.e. where u(t) = 0. Hence, we can formulate the theory as follows. D EFINITION 1 J is a Jevonian consumer iff there exist T , 7, η and u such that (0) J = ⟨T, 7, η, u⟩. (1) T is a closed interval [0, τ ] of real numbers. (2) 7 is the set of all closed subintervals of T of the form [0, t], 0 ≤ t ≤ τ . (3) η∶7 → T is a function that assigns to each element S ∈ 7 a point η(S) of S. (5) u∶T → R is a quasi-concave, real-valued continuous function. (6) ∀S U [η(S)] = m´axt∈S U (t) (fundamental law). 4 For a rigorous formulation of Suppes’ notion of set-theoretic predicate, see Da Costa and Chuaqui (1988). MATHEMATIZATION IN ECONOMICS 93 4. Explanation Through the Application of Mathematical Economic Theories To explain in economics is to “apply” successfully the conceptual apparatus of some economic theory to empirical data; i.e. to find specific functions, out of empirical data about the object of the application (e.g. a consumer), that not only satisfy the characterizations of the theory, but above all the fundamental law. Yet, as I try to explain in Garc´ıa de la Sienra (2009), the production of empirical claims by means of mathematical economic theories is not straightforward, but requires several mediating steps. First of all, it requires a pre-theoretical identification of the phenomenon to be explained. This explanandum must be described in appropriate terms, the nontheoretical terms of the theory. In the present example, T , 7, and η, in order to get a partial potential model C = ⟨T, 7, η⟩, specifying the time interval T , and the choice function η; all these out of empirical observations. To explain C consists of finding a u of the appropriate sort that satisfies the fundamental law. The utility function obtained by integration out of u is peculiar to each kind of object, and more or less to each individual. Thus, the appetite for dry bread is much more rapidly satisfied than that for wine, for clothes, for handsome furniture, for works of art, or, finally, for money. And every one has his own peculiar tastes in which he is nearly insatiable. (§10) Hence, C is to be specified depending upon the agent and the kind of object under consideration. Since u is a Jevons-theoretical function, its determination will make essential use of the fundamental law. The key is to find the specific form of u and to infer out of it the behavior of the agent, inducing a “theoretical” behavior in the form of a model C′ of the same similarity type as C. The explanation (prediction or retrodiction) is “perfect” if C′ is identical to C, but usually, they will be only “similar”, in the best case. This means that the distance between η and η ′ will not be “too large”. 5. Conclusions The first conclusion is that, usually, mathematically formulated economic theories are the result of the “mathematization” if not of a previously given, nonmathematical economic theory, at least of some crucial ideas (like marginal utility in the case of Jevons). Mathematical economics was made possible in the nineteenth century thanks to the availability of calculus. Twentieth century theories were made possible by the rise of set-theory, topology, the development of convex analysis and 94 ADOLFO GARC´I A DE LA SIENRA fixed-point theorems, and both linear and nonlinear programming. It is fair to say, I think, that mathematical economics has reached out to given, established mathematical theories, and I really do not recall any case in which it gave rise to a new mathematical method or theory. It is clear that no real-life scientific theory can be formulated as a set of sentences formulated in first-order logic. I have tried to make a case for a “canonical way” of describing their logical structure. The conception of the axiomatic method behind the work of the mathematical economists in formulating their theories is basically the one developed by Suppes at Stanford University. Once the theory has been rationally reconstructed following Stanford’s methodology, it is possible to raise in precise terms the question of its empirical claim. I have explained the structure of explanation in mathematical economics basically in terms of an imbedding of empirically-determined structures into the non-theoretical structures stemming from the theoretical part. There is no doubt that the explanatory power of a previously non-mathematical theory increases once it receives a mathematical formulation, if only because it becomes more precise. It has been deemed necessary or useful to mathematize economics because the topic itself requires it (as Jevons claimed), mainly because some propositions cannot be even formulated, or some concepts defined, in terms of ordinary language alone. Referencias Arrow, K. J. and M. D. Intriligator, 1981, Handbook of Mathematical Economics, 3 vols., Elsevier, Amsterdam. Bourbaki, N., 1968, Theory of Sets, Addison-Wesley, Redding, Mass. Cameron, B., 1952, “The Labour Theory of Value in Leontief Models”, The Economic Journal, no. 62, pp. 191–197. Crangle, C., A. Garc´ıa de la Sienra y H. Longino (comps.), 2013, Essays in Honor of Patrick Suppes on the Occasion of his 90th Birthday, CSLI, Stanford (forthcoming). Da Costa, N. C. A. and R. Chuaqui, 1988, “On Suppes’ Set-Theoretical Predicates”, Erkenntnis, vol. 29, pp. 95–112. Debreu, G., 2002, Theory of Value. An Axiomatic Analysis of Economic Equilibrium, Yale University Press, New Haven and London. Garc´ıa de la Sienra, A., 2013, “Representational Measurement in Economics”, in Crangle, Garc´ıa de la Sienra and Longino 2013, forthcoming. , 2009, “La aplicaci´on a la Econom´ıa de la concepci´on estructuralista de las teor´ıas”, in Garc´ıa-Bermejo 2009, pp. 355-366. Garc´ıa-Bermejo, J. C. (ed.), 2013, Sobre la Econom´ıa y sus m´etodos, Editorial Trotta, Madrid. Enciclopedia Iberoamericana de Filosof´ıa, vol. 30. MATHEMATIZATION IN ECONOMICS 95 , 1992, The Logical Foundations of the Marxian Theory of Value, Kluwer, Dordrecht. Georgescu-Roegen, N., 1950, “Leontief’s System in the Light of Recent Results”, Review of Economics and Statistics, no. 32, pp. 214–222. Jevons, W. S., 1866, “Brief Account of a General Mathematical Theory of Political Economy”, Journal of the Royal Statistical Society, London, XXIX, pp. 282–287. , 1871, The Theory of Political Economy, MacMillan, London. Krantz, D. H., R. D. Luce, P. Suppes, and A. Tversky, 2007, Foundations of Measurement, 3 vols., Dover, Mineola, NY, 2007. Leontief, W. W., 1941, The Structure of the American Economy 1919–1929, Harvard University Press, Cambridge, Mass. Menger, C., 1871, Grunds¨atze der Volkswirtschaftslehre, Braum¨uller, Vienna. Morishima, M. and Seton, F., 1961, “Aggregation in Leontief Matrices and the Labor Theory of Value”, Econometrica, vol. 29, no. 2, pp. 203–220. Nikaido, H., 1968, Convex Structures and Economic Theory, Academic Press, New York. Takayama, A., 1985, Mathematical Economics, Cambridge University Press, Cambridge. Vela Velupillai, K., 2008, “Sraffa’s Mathematical Economics: a Constructive Interpretation”, Journal of Economic Methodology, vol. 15, no. 4, pp. 325–342. ´ ements d’´economie politique pure, L. Corbaz et Cie., Laussane. Walras, L., 1874, El´ Weintraub, E. R., 2002, How Economics Became a Mathematical Science, Duke University Press, Durham and London.

© Copyright 2026