Keys to Wind Park Bankability

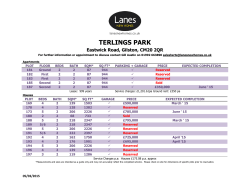

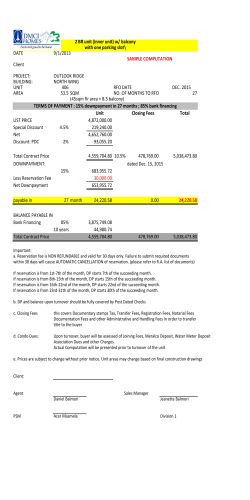

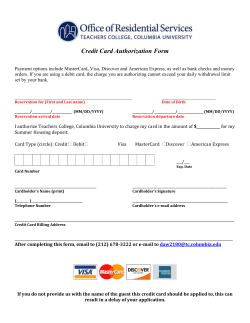

Keys to Wind Park Bankability Vaasa Wind Exchange & Solar 2015 Dr. Hans Bergmann Managing Partner at Bergmann Attorneys at Law 17.3.2015 1 Our firm Industry-focused Legal Solutions Advising international businesses in Finland since 1992 • Focus on key sectors • – Construction – Energy – Infrastructure 3 Energy and Environment practice • Special focus on renewable energy and cleantech › Bergmann Attorneys at Law has advised international investors and wind power operators in relation to (potential) acquisitions of wind parks of more than 400 MW in Finland. › In addition, we assist our clients in the development and construction stages of wind park projects. 4 2 Bankability The Finnish wind power market Pros • • • • • New market with great potential and opportunities Feed-in tariff Economically and politically stable country Government active in taking measures to promote wind energy and removing obstacles Offshore demonstration project: know-how Cons Challenges in permitting practice and neighborhood acceptance • Limited know-how affects project development quality and qualification for project finance • Seller’s market • Sales processes started early in the development process, while many development risks still open • 6 Feed-in tariff • Guaranteed target price for production – until 2015: EUR 105.30 / MWh – from 2016: EUR 83.50 / MWh Paid for 12 years • Granted only up to total capacity of 2,500 MVA • Reservation • – Originally no advance reservation – Now quota reservation possible – Reservation valid for two years 7 Changes in the investment climate Cumulative capacity in FIT scheme 2 500,00 2 000,00 1 500,00 1 090,00 MVA in scheme Incl. reservations 1 000,00 840,00 710,00 500,00 380,00 190,00 20,00 0,00 2011 • 2012 2013 2014 until now Future subsidy scheme? 8 Key elements of bankability 1. 2. 3. 4. 5. Quality of the project Finance aspects Project parties and contractual arrangements Due diligence Security package 9 Due Diligence • Key objects: – – – – – • Permits and statements secured for construction and operation Grid connection and capacity reservation Sufficiency of land rights Project participants Coordination of project contracts to secure project implementation Implementation of results into project agreements 10 Security package • Key security interests: – – – – – – • Charge over the shares of the project company Charges over project company's assets (‘floating charge’) Charge over project accounts Charge over land/leaseholds Assignment of project contracts and rights Assignment of insurances Direct agreements between lenders and key contractual partners (e.g. O&M) 11 Thank you! Visit our stand 6D. Bergmann Attorneys at Law Eteläranta 4 B 9 00130 Helsinki Finland Tel. +358 9 6962 070 Fax +358 9 6962 0710 [email protected]

© Copyright 2026