breaking the ice and building relationships

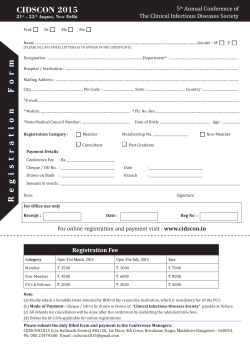

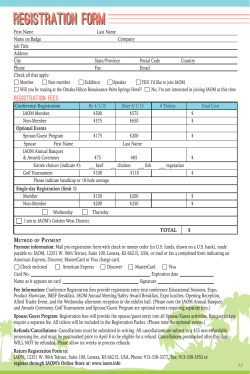

BREAKING THE ICE AND BUILDING RELATIONSHIPS What is a personal brand and how does one achieve it? What role does networking play in achieving the desired career? This interactive session allows you to experiment with networking tools as you meet with your peers and colleagues over networking drinks and canapés. At the end of this event, participants will develop new networking skills and gain tips on how to promote your professional brand, as well as making new contacts within the tax profession. The evening will be facilitated by Kasia OrlowskaMeinen, a Perth based leadership trainer and executive coach helping professionals improve their performance, ability to influence and inspire others to live and lead authentically. Kasia is a graduate of Coaches Training Institute in London, an accredited coach of 360 Leadership Profiles and holds a Bachelor of Education (TESOL). As a coach and a trainer Kasia has engaged with Corporate and Public Sector clients to design and deliver programs on developing leadership skills, building high performing teams, performance management process, effective communication and crosscultural awareness and delivered strategic planning and engagement planning sessions for her corporate clients. When: Tuesday, 16 June 2015 Venue: BDO, 38 Station Street, Subiaco WA Time: 5.30pm–7.30pm Cost: Member $30 / Non-member $35 Supported by: REGISTRATION FORM Please photocopy the blank form for additional delegates. All prices quoted include GST. ABN 45 008 392 372 Register Online Save time, register online at taxinstitute.com.au Mail GPO Box 1694 Sydney, NSW 2001 Fax 02 8223 0077 PLEASE PRINT IN BLOCK LETTERS. Breaking the Ice and Building Relationships 6150610M1 Registration Member $30 Non-member $35 Dietary requirements: Promotional code: Date of issue: 23 April 2015 Delegate contact details Title: (Dr/Mr/Mrs/Miss/Ms/Other) Company: First name: Last name: Position: Member no: Tel: Postal address: Mobile: Suburb: Email: State:Postcode: Fax: Please tick this box if you do not wish your name to be included on the delegate list provided to all attendees for networking purposes. Payment method Please note: all registration payments must be made prior to the event, unless other arrangements have been made with The Tax Institute. I enclose a cheque* for Card no. $ *Please make cheque payable to The Tax Institute in Australian dollars. Please charge my credit card $ Visa MasterCard / / Expiry date: Cardholder’s signature: Card type: AMEX / Diners Cardholder’s name: For event enquiries, please contact Catherine Bower on 08 9322 2004 or email [email protected] Replacements Please note: registrations for the event are not interchangeable but replacements are acceptable. Please notify us at least two days prior if you intend on sending a replacement. CPD hours will be allocated to the designated attendee. If the replacement is not a member, the non-member registration fee will apply. Cancellations The Tax Institute must receive cancellations in writing five working days prior to the seminar. No refund will be given for cancellations received within five working days of the event. A replacement may be nominated. Further details on The Tax Institute’s cancellation policy can be found at taxinstitute.com.au Membership and education program promotion I am interested in becoming a member of The Tax Institute, please send me further details. I am interested in learning more about The Tax Institute’s education program, please contact me. Marketing and business alliance partner exclusions I no longer wish to provide my contact details to The Tax Institute’s contracted business partners. I no longer wish to receive marketing correspondence from The Tax Institute. 0077WA_04/15 We take your privacy seriously, and our policy can be viewed at taxinstitute.com.au/go/footer/privacy

© Copyright 2026