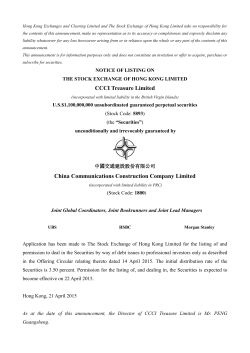

Annual Report 2014