CBI Product Factsheet: Christmas Articles in Slovakia

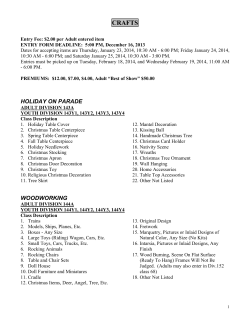

CBI Product Factsheet: Christmas Articles in Slovakia ‘Practical market insights into your product’ Slovakia is an interesting market for DC exporters to focus on, as its imports of Christmas articles, as well as the share of DC in imports, increased considerably in the last few years. Options for you to enter the Slovakian market for Christmas articles are via existing European importers/wholesalers. It is a mid-market that is price-sensitive and already quite dominated by articles originating from China, and, therefore, you need to be able to compete on price and volume. If you can offer higher quality or more unique products, the higher market segments are available, but as yet quite scarce. ‘Hand-made’ looks may offer market opportunities for you as well. Although this fact sheet focuses on the Slovakian market, most of the information also applies to other emerging (Eastern) European markets. Emerging markets are markets in the process of rapid economic growth and, therefore, not yet saturated. Consumers still mostly buy value-for-money products because they do not have sufficient income to spend on more expensive and/or non-essential products for the home. However, emerging Eastern European markets commonly have an up and coming middle class which has enjoyed an increase in disposable income over the past two decades. Therefore, opportunities exist increasingly in finding new value-added segments, where design, hand-made, and branding are increasingly more important. The challenge to DC exporters is to find distribution partners who are willing to take on the pioneering role of opening up those segments. This can be risky and requires serious marketing efforts. Emerging Eastern European markets include Bulgaria, Romania, Hungary, the Czech Republic, Estonia, Latvia, Lithuania, Poland, Slovakia and Slovenia. Product Definition Product Christmas articles Theme Celebrating Refer to Trend Mapping for more information on this theme. HS codes 9505 10 10: Christmas articles made of glass (excl. Electric lighting sets). 9505 10 90: Christmas articles (excl. glass, candles and electric lighting sets, natural christmas trees and christmas tree stands). PRODCOM codes 32.99.51.30: Articles for Christmas festivities (excluding electric garlands, natural Christmas trees, Christmas tree stands, candles, statuettes, statues and the like used for decorating places of worship) Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia o o Christmas articles may consist of Christmas baubles, tree toppers, figurines made of glass, wood, ceramics, textile, etc. and other Christmas (table) decorations. As Christmas articles come in various styles, production methods and materials differ greatly, ranging from wood, plastic, cotton, etc. Product Specification Product specifications Product Categories and Consumer Needs Christmas brings forward a number of consumer needs that are also important for Home Decoration as a whole. Consumers see this part of the year as an important shopping moment, and sales in home decoration reach their annual peak between August and December. Christmas shopping can be quite impulsive. During this time the consumer tends to drop his or her price sensitivity. As a result, a few clear needs can be seen as underlying Christmas sales in our industry.. Decorating is an important buying motive at this time of the year. The consumer has a tendency to decorate both the inside and the outside of the home with accessories expressing the sentiment of the season, ranging from sheer joy to a sense of spirituality. Also, Christmas, for many, is related to giving: presents are exchanged within a family setting and/or the circle of close friends. Along the same lines, the sharing of good will and positive feelings amongst the inner circle takes place in the form of lavish dining. Christmas items within home decoration can, therefore, be classified as: specific shopping goods rather than everyday commodities decorative accessories bringing forward the typical associations and character of Christmas gifts goods related to cooking and eating. This fact sheet will discuss decorative accessories for the home, and mostly those for inside. Christmas Decoration – main product groups This fact sheet focuses on those product groups that contribute to the decoration of the home – especially the living room – during Christmas, with a low-tech, hand-made and natural character. Christmas tree decoration receives the main focus, which includes articles like baubles, bells, angels, figurines, etc. In line with technological developments in society as a whole, Christmas has become increasingly hi-tech, 3D, mechanised, animated and ‘plugged in’. This report will not touch upon this group. Lighting is of vital importance to express the joy of Christmas – it incorporates Christmas tree lights and the increasing tendency to decorate the outside of the home with lighting too, as well as candle lighting to create atmosphere. Both product groups are outside the scope of this report (for candles, refer to Product Fact Sheet ‘Candles’ (2012)). Dinnerware is a prime product group for Christmas, too, and consumers consider this an occasion for lavishly decking out the table. For ceramic tableware and glassware, as well as cutlery, refer to Product Fact Sheets 2012. The greeting card industry also reaches its peak during Christmas, although the electronic media are increasingly playing a role. This will also not be dealt with in this report. Christmas Decoration As mentioned in Trend Mapping, the driver behind Christmas decoration is the consumer’s need to create an – themes and motives ambience, a feeling of cosiness in the home, a warm and inviting atmosphere, with a touch of spirituality. This ambience is created through a number of influences: o Religion/spiritual (e.g. angels, bells, nativities) o Santa Clause / Father Christmas story (reindeers, sleigh, socks) o Winter season (snowflakes, snow on trees, starry nights) o All that contributes to a sense of going back to the innocence of one’s childhood or to peace and tranquillity generally (novels by Dickens, a famous British writer, or Disney) o Romance (consumers want to huddle up with their close ones during the festive season – so hearts and other love tokens are very much part of the Christmas vocabulary) To stay within these themes is important for DC exporters, but to add to it is equally important as consumer want to see familiar themes in a new translation every Christmas, to allow them to shop, give and decorate again to their heart’s content. Quality Christmas items are seasonal and trendy: in most cases, consumers want to ‘update’ their Christmas ‘look’ every year, and much of the collection of Christmas accessories is, therefore, replaced by the latest on offer. Durability is, therefore, a less prominent quality norm than usually in home decoration. Also, because of the emphasis on atmosphere in the home, the product quality of individual items receives less focus than how such items fit into the theme. As a consumer event, Christmas is a mass market and essentially a mid-market in terms of its consumer values. This means that prices and designs need to be accessible for the majority of consumers. As consumers want choice, Christmas articles come in different sizes, shapes, colours and materials, but within the themes and styles described above; they are often offered in convenient collections and sets, to reduce consumers’ choice anxiety. In the more premium niches, product and aesthetic quality are both of prime importance. This concerns mainly Western European or US brands for the Slovakian retailer and consumer. Labelling Your label on the outer box should include information concerning the product such as the material, quantity, size, volume, producer (logo), consignee, country of origin and caution signs. Moreover, it should show the number of pieces, bale/box identification and total number of bales or boxes, and net and gross weight. Information on the carton should correspond to the packing list sent to the importer. On the product label, EAN/Barcodes are widely used within Europe. o For all glassware and porcelain articles it is strongly recommended that you label all boxes with warning notices Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia such as “FRAGILE!” or “Handle with care!”. Fragile! This side up! Please note, your buyer will specify what information they need on product labels or on the item itself (logos, 'made in..'). All labelling must be in English. Packaging product Christmas articles should be packed in accordance with the importer’s instructions. Every importer will have their own specific requirements related to the use of packaging materials, the filling of cartons, palletisation, and the stowing of containers. Always ask for the importer’s specifications as part of the order specifications. The balance is between using maximum protection and avoiding excess materials (waste removal is a cost to buyers) or shipping ‘air’. Proper packing minimises the risk of damage due to fluctuations in humidity and especially shocks. Packaging usually consists of plastic wrapping to protect the fabric from water and staining. Packaging dimensions and weight should make it easy to handle. Ideally, it should be possible to place the boxes or bales together on pallets. At retail level, Christmas articles are often sold as loose items, allowing consumers to create their own collection, although often within one theme or style. Consumer packaging is, therefore, not very relevant, and seasonal wrapping is done at point of sale. In the lower segments, ‘more for less’ is an important selling point, and here prepackaged sets are offered. The retailer wants to add their branding to the final gift at point of sale, and sometimes the supplier is asked to print tags or labels, although it is usually part of the retailer’s own marketing communication and produced in Europe. Illustration Low-end: ‘value for money’ Mid-end: ‘atmosphere and mass appeal’ Sources: Awad Sashe Interiermagazine Seletti Nativity Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer High-end: ‘craftsmanship and brand’ CBI Product Factsheet: Christmas Articles in Slovakia Legislative requirements Product safety and Liability The General product safety Directive (GPSD), which applies to all consumer products, states that all products marketed in the EU should be safe. The purpose of the legislation is to ensure consumer safety. The Liability Directive states that the EU importer is liable for the products put on the European market. The EU importer, however, can in principle pass on a claim to the producer/exporter. Packaging Packaging and packaging waste EU packaging legislation restricts the use of certain heavy metals, among other requirements. Considerations for action Consider implementing a management system or code of conduct in order to show to your buyer that you have taken appropriate safety measures. Make sure your products are safe to avoid product liability claims for defective products. Reduce the amount and diversity of your packing materials by: partitioning inside the cartons with the help of folded cardboard, matching inner boxes and outer cartons better and standardising the sizes of each, by considering packing and logistical requirements at the design stage of the products asking your buyer for alternatives Consider using biodegradable materials which may form a market opportunity or even a demand from your buyer. Wood packaging materials used for transport The EU sets requirements for wood packaging materials (WPM) such as packing cases, boxes, crates, drums, pallets, box pallets and dunnage (wood used to wedge and support non-wood cargo). Wood preservatives The EU has restricted the use of arsenic and creosotes as wood preservatives. Although these preservatives are not very commonly used anymore (especially not in consumer goods), you have to make sure that your products do not contain these hazardous substances. CITES The Convention on International Trade in Endangered Species (CITES) lays down provisions for international trade of endangered species. The EU has set additional import restrictions. Avoid wooden crating and packing. They are increasingly banned by importers because of the high cost of disposal, and because they are often unsustainable and costly. Investigate and source alternative packing materials that are economical and sustainable. If you do need to export products wrapped with or supported by wood packaging materials during transport, you have to make sure that your WPM complies with requirements. As wood treated with creosote or arsenic compounds may not be placed on the EU market, use safer alternatives for wood preservation (such as using heat or vacuum treatments). Link up with companies that are specialised in wood preservation. Before exporting your products to the EU, you should check with the CITES management authority of destination or with your importer, whether there is any restriction that may impact the import into the EU. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia Non-legislative requirements Sustainability Consumers are increasingly aware of social and environmental circumstances during production. As a consequence, requirements regarding sustainability and certification are increasingly important to buyers. Considerations for action Think about sustainable production methods and consider certification because this adds value to your products. This is useful when targeting the higher market segments. Implementing a management system (or using sustainably produced materials may give a competitive advantage. Codes of conduct EU buyers may expect you to comply with their supplier codes of conduct. This can be the importer’s own code of conduct or a code of conduct as part of an initiative in which the importer is participating (e.g. BSCI). The following are examples of initiatives regarding sustainability, which may possibly be relevant if you want to export to the EU: The Business Social Compliance Initiative (BSCI) has been developed by European retailers to improve social conditions in sourcing countries. Suppliers of BSCI participants are expected to comply with the BSCI Code of conduct. To prove compliance, your production process can be audited at the request of the importer. Once a company is audited, it will be included in a database which can be used by all BSCI participants. Since more and more European importers are participating in BSCI, you can expect that complying with the BSCI code of conduct will be seen as a basic requirement. Because it can harm your position on the market if you are far from complying with this initiative, you are advised to anticipate by performing a selfassessment, which is available at the website of BSCI. ISO 14001 Certification scheme which provides generic requirements for an organisation's environmental policy. SA 8000 Certification standard by Social Accountability International (SAI) for the improvement of working conditions. This standard can be used to reduce the cost of waste management, reduce distribution costs and improve your corporate image. Therefore, consider ISO 14001 certification which may form a market opportunity or even a demand from your buyer. Consider SAI certification which may form a market opportunity or even a demand from your buyer. Besides the social and environmental aspect of production, Fair Trade certification also covers a fair wage to labourers involved in the production of Christmas articles. Acquire Fair Trade certification to enter the fair trade segment. Compliance with fair trade norms will also make it easier to acquire other social and environmental norms, as it is the most integrated system for sustainability. FSC certification assures environmentally appropriate use of the forest. FSC or similar norms for the sustainable management of wood or other raw materials will increasingly adopt a legal character or become a way to influence consumer choice. Exporters should build such values into their offer, even at the stage when they are optional in the trade, to anticipate future demand. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia Trade and Macro-Economic Statistics Production and consumption Production and consumption data is not available. Figure 1: Consumer confidence indicator, Slovakia compared to EU27, 2008-February 2013 Figure 2: GDP in Slovakia, % change on previous year 4,5% 4,0% 3,5% 3,0% 2,5% Slovakia 2,0% EU 27 average 1,5% 1,0% 0,5% 0,0% 2010 Source: Eurostat (2013) GDP looks relatively favourable Consumer confidence in Slovakia has consistently been below EU average and remains negative at this moment. This may well indicate that the consumer, on average, is cautious about spending. Compared to the EU average, Slovakia does well on the GDP indicator. What is more, GDP is forecast to increase at a stronger rate towards 2014. This may indicate that Slovakian citizens are building up increasing disposable incomes for purchases in, for example, home decoration, including Christmas articles. Consumers in the emerging European markets like Slovakia are not yet so exposed, and have much less experience in the buying of high quality Christmas articles than consumers in mature markets. The offers available in retail in these markets are still predominantly inexpensive, with relatively low design quality. Middle class consumers are developing their home decoration tastes under the influence of rising incomes, Western tourists and the Internet. This is especially so in the urban centres and amongst younger consumers – typical ‘early adopters1’. Therefore, the middle-high market is expected to grow in the coming years. 2011 2012 2013 2014 Source: Eurostat (2013) Considerations for action As Slovakia is an emerging country, consumer purchases depend on the economic outlook. Greater shares of income may be allocated to purchases for the home if GDP remains positive. Consumer confidence being low, consumers may either replace their Christmas decorations a bit more slowly than normal or be more selective when it comes to buying new ones. This means that ‘good value for money’ (much for less) and trendiness may be good values to look for by exporters entering this market right now. At the same time, in line with EU consumerism as a whole, consumers may want to pamper themselves, their relatives and friends during Christmas to make up for lower consumption at other times of the year. More than ever, perhaps, suppliers in the Christmas market must, therefore, create collections that help consumers create a special atmosphere in the home. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia Figure 3: Slovakian imports of Christmas articles, value in € million 5,0 4,5 4,0 Intra-EU/EFTA 3,5 DCs 3,0 China 2,5 Czech Republic 2,0 Germany 1,5 Austria 1,0 Poland 0,5 0,0 2008 2010 2012 Source: Eurostat (2013) The Slovakian market for Christmas articles is a growing market and will offer opportunities for DC exporters in the longer run Slovakia’s imports of Christmas articles increased considerably between 2007 and 2012, amounting to € 9 million in 2012, of which 50.1% was sourced in DCs. Imports from DCs increased by 17% annually on average between 2008 and 2012. DCs are mainly represented by China which accounts for almost all imports sourced in DCs. The other DC supplier of Christmas articles to Slovakia is Thailand. However, this counts for only a small quantity. Considerations for action The Slovakian market for Christmas accessories is a growing market and will offer opportunities for more players. DC exporters are advised to monitor this emerging European market and others, such as Poland. Growth can be expected from a widening of the mid-market, as more people in the lower and middle classes may have more disposable income to spend on home products. DC exporters are advised to embrace the mid-market values as described under ‘Product Specification’. Part of the growth will also come from new segments opening up, which has already been seen in the more mature European markets for Christmas articles (refer to Product Fact Sheet Christmas Articles in Germany). Such segments are more premium and offer new directions based on natural materials, fair trade, ‘design’, craftsmanship and brand, and may hold options for DC exporters. Monitor developments in China, which, with its growing costs of production, higher demands on sustainability, and a growing internal market, may open the door for a wider share into the Slovakian market for Christmas articles. Supplies of Christmas articles into Slovakia are dominated by Western European traders. DC exporters are advised to source such traders among German, Dutch and French distributors, for instance, through trade fairs such as Christmas World and Ambiente (Germany). Invest in long-term relationships with your existing buyers, giving them less incentive Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia to switch to a competitor. Slovakia as an entry point to reach other Eastern European markets Slovakian exports of Christmas articles increased by an impressive 10.7% annually on average between 2008 and 2012, to a value of € 7 million. It is expected that the increase will continue in the coming years. The main export destinations include surrounding European countries such as the Czech Republic, Hungary and Poland. Considerations for action Figure 4: Total Slovakian exports of Christmas articles, value in € million value in € million 14 After Poland and the Czech Republic, Slovakia is the third largest exporter of Christmas articles in Eastern Europe. Therefore, consider it as a possible entry point to reach surrounding markets. Global chains such as IKEA, Carrefour, Metro and Zara are also servicing the region, and may as such be special targets for DC suppliers who want to look at Slovakia and other European emerging markets for Christmas items such as Poland, Hungary or the Czech Republic. Be aware of your EU buyer’s markets and their requirements. This way, you can also develop new ideas for the buyer’s other EU markets. Figure 5: Top 5 export destination of Slovakian Christmas articles, value in € million value in € million 6 12 10 5 Czech Republic 4 Hungary 3 Poland 2 Germany 8 6 4 1 2 Austria 0 0 2008 2010 2012 Source: Eurostat (2013) 2008 2010 2012 Source: Eurostat (2013) Market Trends With rising disposable incomes and the entry of retailers in upper-mid and premium segments, demand for Christmas accessories will slowly increase and become more diversified offering opportunities for DC suppliers in the future. The market for Christmas items is already quite universal in its mass appeal, its emphasis on a limited set of atmospheres and styles (refer to ‘Product Specifications’). Where emerging markets such as Slovakia deviate –more attention to the religious and less to ethnic or handmade influences – this can be expected to converge even more in the coming years. A major factor is the increasing presence and Considerations for action In targeting the middle segments of the EU market for Christmas decorations, DC exporters are advised to work from the accepted look and feel, e.g. from the Christmas tree as the centre piece, and green, red, silver and gold as the eternal colours of Christmas; balls, stars and angels, etc. Such basic premises will not change, as they are part of the consumer’s identification with the Christmas season. The almost total annual renewal of collections demands supreme innovation skills from suppliers. This innovation can take the form of ‘restyling’, or adding new colours and decorations to existing forms or items. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia marketing power of Western European or global players such as Carrefour, IKEA or Metro driving the available Christmas concepts even more towards a unified look and feel. Magazines, internet blogs, TV and other influences on consumer behaviour will further stimulate consumers’ awareness of and desire for what is available throughout Europe. Slowly, with rising disposable incomes and the entry of retailers into the upper-mid and premium segments, the landscape of Slovakian Christmas accessories will become more diversified. The emergence of consumer needs, based on such typical home decoration values as: ‘natural’, ‘handmade’, ‘designer’ and ‘green’ and their related price differentials, will then be seen. The malls in the major urban centres of Slovakia already see the emergence of brands using added value in fashion and beauty, but not yet in home decoration. Convenience is an important trend in this market. Importers have a preference for ‘one-stop-shopping’: finding everything at one supplier, such as a tree, its decorations and the lighting, but perhaps also nonChristmas-related home decorations. With so much pressure on costs and efficiency, importers also look for exporters offering complete concepts, as well as great variety and flexibility in product development. A growing trend for on-line retailing is also witnessed in the market for Christmas accessories. In Slovakia, this takes the form of retailers with additional on-line platforms as well as wholesalers with on-line facilities for retailers. Professional buyers in Slovakia and other ‘new’ markets - in Eastern Europe or the Baltic states – appreciate branded products perhaps a bit more than elsewhere in Europe, as brands are considered providing status to the collection and to the consumer, and are seen as offering superior quality and service. New entrants into the EU market for Christmas decorations may differentiate on materials (new, local materials) or material combinations rather than ethnicity. Barring a few exceptions (Bubo Style or Rainforest), ethnic styles are unpopular in Slovakia. DC exporters who are already marketing in mid markets in home decoration, may find it relatively easy to develop the festive market, too, as they are already used to manufacturing nostalgic or romantic products. The German Christmas World trade fair may be a good platform for promotion. DC exporters wishing to enter the market for Christmas accessories need to offer opportunities for ‘one-stop-shopping’ – a broad set of categories, materials and techniques and great flexibility in product development. If you can also fill in the buyer’s non-festive collections, your position may even be stronger. Monitor the market for Christmas items in the mature EU markets in order to improve your insights into consumer needs, styles and the players in distribution. DC exporters can do so by visiting trade fairs, reading international Home magazines, and tracking the websites of a number of important players in home decoration in mid and premium markets. To help the importer build and maintain a brand (e.g. Black Box Trees by Edelman; Dansk by Lennox), suppliers offering background stories (e.g. about production and producers) and excellent service (e.g. extra spare parts, pre-stocking) will add a meaningful contribution. DC exporters with strong identities, based on special techniques and materials, or with an ability to create atmosphere, may approach distributors in Western Europe about pioneering their possible entry into prospective upper markets for Christmas articles in Slovakia and other emerging European markets. Please refer to CBI Trend Mapping for Home Decoration and Textiles for more information on general trends in home decoration, and specifically the celebrating theme. Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia Market Channels and Segments Please refer to CBI Market Channels and Segments for Home Decoration, because Christmas articles channels and segments do not differ significantly from this general overview. The following considerations for action should be taken into account for the Christmas articles market: The market for Christmas decorations is a mid-market in terms of its mass appeal of competitively-priced goods with accessible designs in a number of set styles and ‘atmospheres’. In line with the mid-market consumer’s need for convenience, Christmas accessories can be found almost anywhere. In Slovakia, supermarkets and hypermarkets owned by international or national groups are important outlets for price-sensitive Christmas shopping. Malls and department stores sell Christmas items with a little more differentiation at a slightly higher price, including branded offers. As yet, this segment is limited in size. A special character of the Christmas market is its seasonality. Exporters opting for this segment must be aware that, as opposed to, say, tableware or storage, Christmas sales have a limited time slot in the sales calendar. Considerations for action Know your market including the main distributers and brands, the trade fairs, and consumer needs, and apply your knowledge to drive innovation in production, market development, pricing strategies, investment in packaging and communication, etc. E-commerce is also prevalent in Slovakia, sometimes complementing brick-andmortar retail. Both business-to-consumer or wholesale platforms can be found. Examples are Kvetyonline, Topdecor and Dekomark. Slovakia has a lively culture of ‘making your own’: consumers are encouraged to make their own Christmas decorations and Christmas gifts. This is fed by suppliers of raw materials (anything from ribbons to twigs), retailers and sites for hobby and DIY activities, and supported by magazines and TV. Part of this trend feeds into the recycling theme, as retro or just last year’s Christmas items can also be upgraded to serve another Christmas. To some extent, this can be a threat to the market for ready-made Christmas decorations. A seasonal market such as Christmas can be attractive in a concept where other festive occasions are also considered (Valentine’s Day, weddings, Easter, birthdays, etc.), or where the exporter already has a footing in the regular midmarket for home decoration. E-commerce is growing in importance. Consider targeting online retailers, in order to reach a broader range of customers. This means, however, supplying small batches/ individually packed items, being prepared to pre-stock, and offering more just-in-time supply concepts. Since e-commerce is expected to grow explosively in the coming years, this is a strategy for exporters with the possibility to scale up in a short span of time. DC exporters may offer Christmas items that leave something to the imagination of Slovakian consumers who are keen to make their own decorations by offering semifinished items or items that can be decorated by the consumer (e.g. wooden Christmas tree that can be painted or decorated). Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer CBI Product Factsheet: Christmas Articles in Slovakia Market Competitiveness Please refer to CBI Market Competitiveness for Home Decoration, because Christmas article competitiveness does not differ significantly from this general overview. A special ritual of Christmas is that of consumers making their own decorations, either for themselves or as a gift. This substitution is a tiny threat for DC exporters. However, suppliers can deal with this by offering semi-finished items or items that consumers can use to decorate themselves. Useful Sources Trade fairs are very important for the promotion of your Christmas articles in Slovakia. They are important to show yourself and for networking. The following fairs are outside Slovakia but they attract many international players: Ambiente : http://www.ambiente.messefrankfurt.com Maison et Objet : http://www.maison-objet.com Xmas world: http://christmasworld.messefrankfurt.com This survey was compiled for CBI by ProFound – Advisers In Development in collaboration with CBI sector expert Kees Bronk (GO - Good Oppertunity) Disclaimer CBI market information tools: http://www.cbi.eu/disclaimer Source: CBI Market Information Database • URL: www.cbi.eu • Contact: [email protected] • www.cbi.eu/disclaimer

© Copyright 2026