2015 CONTAINER SHIPPING OUTLOOK

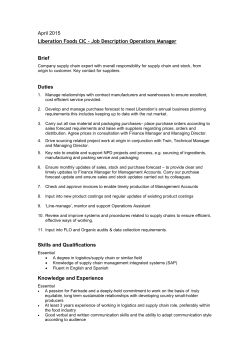

2015 CONTAINER SHIPPING OUTLOOK By Mario O. Moreno Economist, JOC, IHS Weak 2015 Outlook for U.S. Container Trade • 2015 imports forecast downgraded on severity of West Coast port congestion, weak January volume • Imports demand fundamentals, however, are sound: US economic expansion will continue driven by consumer spending and homebuilding • 2015 exports forecast downgraded on lingering effects from west coast ports congestion, strong dollar, weak demand from emerging Asia, Japan, Europe • Economic activity in top-market China will continue to decelerate in 2015, restrained by imbalances in credit, housing Adverse effects from West Coast port congestion to restrain imports growth in 2015 • U.S. Imports via Ocean Container In Millions of TEUs and Annual Growth Imports (LHS) 19.5 U.S. imports forecast to grow only 1.7% in 2015, downgraded from +6.8% on adverse effects from West Coast port congestion Source: JOC Container Shipping Outlook 19.0 • • January imports down 9.3% YoY; February volume expected to be dissapointing 17.5 Diverted cargo: rerouting to Canadian, Mexican ports 16.5 Demand fundamentals are solid: strengthening economy, strong dollar 19.3 19.0 6.0% 17.0 7.0% 6.0% 18.5 5.0% 17.9 18.0 • YoY Growth (RHS) 4.0% 17.4 16.9 2.7% 3.2% 3.0% 2.7% 1.7% 2.0% 16.0 1.0% 15.5 0.0% 2011 2012 2013 2014 3 2015f The US economic expansion will continue • Accelerations in consumer spending and homebuilding will boost real GDP growth from 2.4% in 2014 to 3.0% in 2015. • Consumers will step up spending in response to lower energy prices and robust gains in employment, real income, and net worth – a positive for imports. • The recovery in homebuilding will gain momentum as labor markets improve and credit standards ease. • A strong dollar, sharp cutbacks in energy-related investments, will be restraints on economic growth. • Interest rates expected to move upwards over the next three years as monetary accommodation is gradually withdrawn. Durable goods lead growth in US consumer spending Real Consumer Spending US housing starts will continue to recover in response to growth in employment and income Housing Starts Despite Tentative Labor Agreement, Damage to 1Q Volume is Done • • • US imports from FE Asia forecast to grow only 1.6% in 2015, downgraded from +6.8% China’s manufacturing industries restructuring from cheap and fast production to higher value-added, more sophisticated manufacturing By end of 2015, China will account for 64.7% of total inbound trade from FEA, merely unchanged from 2007 U.S. Imports from Far East Asia To Decelerate the Pace in 2015 Forecast 20% FE Asia China Vietnam Source: JOC Container Shipping Outlook 18% 16% 14% 12% 10% 8% 6% 5.7% 4% 1.6% 2% • Imports from Vietnam will continue to grow at much faster pace on lower sourcing costs 0% 2010 2011 2012 2013 2014 2015 U.S. Exports via Ocean Container Second Straight Down Year for US exports • • • U.S. exports forecast to decline 4.4% in 2015, downgraded from -0.1% on lingering effects from West Coast port congestion Business lost for lack of dependability In Millions of TEUs and Annual Growth Exports (LHS) 12.4 12.2 12.0 YoY Growth (RHS) 8.0% Source: JOC Container Shipping Outlook 12.2 6.6% 11.9 6.0% 11.9 11.9 11.8 2.7% 2.0% 11.6 Dollar expected to gain 10% of value on average this year over 2014 average 11.4 0.0% 11.4 Global economy, exc. NAFTA, will pick up in 2015 bolstered by lower oil prices, accommodative monetary policies. 0.0% -2.0% -2.4% 11.2 • 4.0% 11.0 -4.0% -4.4% 10.8 -6.0% 2011 2012 2013 2014 8 2015f A gradual acceleration in the global economy • The global economy, excluding NAFTA, is forecast to expand 2.8% in 2015, supported by lower oil prices and accommodative monetary policies • The Eurozone’s modest recovery is gaining momentum, aided by monetary stimulus, euro depreciation, and pent-up demand. • South America’s economic growth has slowed, with Argentina and Venezuela in recession and Brazil stagnating • Uneven growth paths in the Asia-Pacific region U.S. Exports to Far East Asia to Decline for 2nd Straight Year Soft Demand from China, Japan to Restrain Growth in ‘15 • • • • US exports to FE Asia forecast to decline 4.9% in 2015 China’s growth will slow to 6.5% in 2015, restrained by imbalances in credit, housing, and industrial markets By end of 2015, China will account for 43.6% of total outbound trade to FEA, up strongly by 9.0% from 2007 Exports to Japan forecast to decline for 4th consecutive year as its economy continues to travel a slow growth path Forecast 15% FE Asia China Japan Source: JOC Container Shipping Outlook 10% 5% 0% -3.0% -5% -4.9% -10% -15% 2010 2011 2012 2013 2014 2015 Summary 1. Despite tentative labor agreement, damage to 1Q volume is done. 2. U.S. imports forecast to modestly expand in 2015 on improving economy, but restrained by adverse effects from severe West Coast port congestion. 3. The US expansion is led by domestic demand, as consumer spending and residential construction accelerate. 4. U.S. exports forecast to decline for second straight year in 2015 on rising dollar, lingering effects from West Coast labor dispute, soft demand from emerging markets. 5. Uneven growth paths in the Asia-Pacific region: China’s locomotive role in the region is diminishing. THANK YOU! Follow me on Twitter: @MarioMoreno_JoC JOC Insights, JOC Container Shipping Outlook, JOC Port Forecast

© Copyright 2026