Book of Abstracts 2nd Annual International Conference on

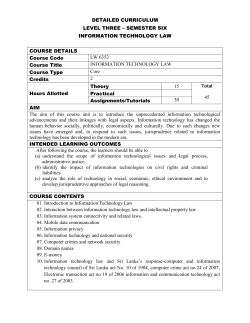

Book of Abstracts 2nd Annual International Conference on Accounting and Finance– 2015 ICAF-2015 25th– 27th May 2015 The International Institute of Knowledge Management (TIIKM) Colombo, Sri Lanka Committee of the ICAF- 2015 The International Institute of Knowledge Management (TIIKM) Fax: +94(0) 113098521 [email protected] Disclaimer The responsibility for opinions expressed, in articles, studies and other contributions in this publication rests solely with their authors, and this publication does not constitute an endorsement by the ICAF or TIIKM of the opinions so expressed in them. Official website of the conference www.financeconference.co Book of Abstracts of the 2nd Annual International Conference on Accounting and Finance, 2015 Edited by Dilan Rathnayake and Others 40 pages ISBN: 978-955-4903-40-1 Copyright @ TIIKM All rights are reserved according to the code of intellectual property act of Sri Lanka, 2003 Published by The International Institute of Knowledge Management (TIIKM) Tel: +94(0) 11 3098521 Fax: +94(0) 11 2835571 ii Hosted By: Management and Science University, Malaysia. Independent University, Bangladesh. Organized by: The International Institute of Knowledge Management (TIIKM) ICAF Committee PROF. P.S.M. GUNARATNE (Conference Chair, ICAF) Department of Finance, Faculty of Management & Finance University of Colombo, Sri Lanka. DR. PARITOSH BASU (Session Chair, ICAF) Senior Professor, School of Business Management, The NMIMS University, Mumbai, India. MR. ISANKA. P. GAMAGE (Conference Program Chair, ICAF) The International Institute of Knowledge Management MR. OSHADEE WITHANAWASAM (Conference Publication Chair, ICAF) The International Institute of Knowledge Management MISS. SUVINIE .S. RAJAPAKSHA (Conference Coordinator, ICAF) The International Institute of Knowledge Management iii Editorial Board-ICOM Board- ICAF -2013 2015 Editorial Editor in Chief Prof. P.S.M. Gunaratne, Department of Finance, Faculty of Management & Finance University of Colombo, Sri Lanka. Editorial Board Mr. D. T. Rathnayake, Faculty of Management Studies and Commerce, University of Sri Jayewardenepura, Sri Lanka The Editorial Board is not responsible for the content of any research paper. Scientific Committee - ICAF - 2015 Prof. Oyaziwo Aluede, Department Of Educational Foundations And Management, Ambrose Alli Prof. P.S.M. Gunaratne, Department of Finance, Faculty of Management & Finance University of Colombo, Sri Lanka. Dr. Paritosh Chandra Basu, School of Business Management, The NMIMS University, Mumbai, India. Prof. Chandrasekhar Krishnamurti, School of Commerce, University of Southern Queensland, Australia. Emeritus Prof. Neave, Edwin, Queens School of Business, Canada. Prof. Rajendra P. Srivastava, School of Business, The University of Kansas, United States. Prof. Soumya Guha Deb, The Xavier Institute of Management, Bhubaneswar, India. Prof. Madhu Veeraraghavan, T.A. Pai Management Institute, Manipal, India. Dr. Maran Marimuthu, Universiti Teknologi PETRONAS, Malaysia. Prof. Kamran Ahmed, La Trobe University, Australia. Dr. Mohd Norfian Alifiah, Universiti Teknologi Malaysia, Malaysia. Prof. W. Robert Reed, Department of Economics and Finance, University of Canterbury, New Zealand. Dr. Guneratne Wickremasinghe, Accounting & Finance at Victoria University, Australia. Prof. Robin H. Luo, La Trobe University, Australia. Prof. Rafael Hernandez Barros, Universidad Complutense de Madrid, Spain. Dr. Samiul Parvez Ahmed, School of Business, Independent University, Bangladesh. Dr. Pavnesh Kumar, Indira Gandhi National Tribal University, India. Dr. Sarwar Uddin Ahmed, School of Business, Independent University, Bangladesh. iv Table of Contents Page No Plenary Speech 01. International Convergence of Accounting Standards and Quality of Financial Reporting 03 Dr. Paritosh Chandra Basu, School of Business Management, The NMIMS University, Mumbai, India. Oral Presentations Sustainability Management both at Corporate and National Level with a 4p* Approach – Impact of Regulatory Measures 02. Agency Costs or Accrual Quality: What Do Investors Care More About When Valuing a Dual Class Firm? 09 Assist. Prof. Jagjit S. Saini 03. Impact of Green Accounting on National Policy Decisions 10 Dr. TR. Rajeswari 04. Accounting Analysis of Mining Company in Indonesia under the New Indonesian Accounting Standard and Good Corporate Governance Regulations for the Financial Performance in Indonesia Mining Company 11 Mr. Heykal, Mohamad Deregulation of Financial Markets and Corporate Governance 05. Corporate Governance and Dividend Pay-out Policy: An Empirical Investigation on Financially Distressed Firms in Malaysia 15 Dr. Maran Marimuthu 06. Corporate Social Responsibility Development of Banking Industry in Hong Kong 16 Mr. Yam Tsz Kit 07. Long Run Determinants of Equity Foreign Portfolio Investment (Efpi) in Sri Lanka: A Time Series Analysis with Autoregressive Distributive Lag (Ardl) Approach Mr. G.D. Kapila Kumara v 17 08. The Effect of Board Size and Composition on the Financial Performance of Nigerian Banks 18 Dr. Muhammad Tanko Enhancement of Corporate Financial Performance 09. Is Australian Directors’ Remuneration Linked to the Earning Predictability of the Company? (Practice in the Australian Stock Exchange Listed) 21 Mr. Aloysius Harry Mukti 10. Stock Return and Weather: Evidence from Dhaka Stock Exchange (DSE) 22 Mr. Mohammad Fahad Noor 11. Tri Variate Analysis to Measure Performance Efficiency of Indian Private Banking Sector 23 Assoc. Prof. Mariappan Perumal 12. Cash Flow Patterns: A Predictive Sign of Financial Distress 24 Assoc. Prof. Amrizah Kamaluddin Economic Turmoil’s and Stability of Banks and other Financial Institutions 13. Financial Performance differences between privately-owned versus state-owned banks: Evidence from Bangladesh 27 Mr. Saquib Shahriar 14. Efficiency Comparison between Licensed Commercial Banks and Licensed Specialized Banks 28 Ms. E.M.N.N. Ekanayake 15. Microfinance Institutions’ Competition in Northern Region of Thailand Assist. Prof. Saleepon Ravipan vi 29 Virtual Presentations 16. The Diffusion of ‘New Public Financial Management (NPFM) Innovations in Developing Countries: Evidence from Sri Lanka 35 Mr. Thusitha Dissanayake 17. Factors Affecting to Risk Management Efficiency of Listed Commercial Banks in Sri Lanka 36 Ms. S.D.P.Piyananda 18. The Determinants of Earnings Management: An Empirical Study of Firms Listed on Hochiminh Stock Exchange, Vietnam 37 Ms. Hoai Anh Le Thi 19. Corporate Governance, Financial Soundness and Economic Development: Empirical Evidence from Malaysia, Indonesia, and Turkey Mr. Wahua Lawrence vii 38 viii 2nd Annual International Conference on Accounting and Finance PLENARY SPEECH Page | 1 2nd Annual 2|Page International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [01] INTERNATIONAL CONVERGENCE OF ACCOUNTING STANDARDS AND QUALITY OF FINANCIAL REPORTING Dr. Paritosh Basu NMIMS School of Business Management The NMIMS University, Mumbai. India ABSTRACT Emerging countries are continuously vying for their prominence of position within the dynamic global business ecosystem which is more and more being infested with volatility, uncertainty, complexity, ambiguity and geo-physical insecurity. Corporate houses there are battling with challenges inter alia of financial reporting using an internationally acceptable standard. The question is whether it is a matter of choice or a national cum micro-level business strategy. Possible benefits could be from bringing in global orientation to business and having better access to developed markets for cheaper funds. The debate is round the questions whether it will facilitate the process of reflecting appropriate business value, achieving quantum jump in governance standards and result in total transparency with critical focus on risks, sensitivity, complex measurements and impact analyses of large one-off transactions. Their doubt seems to be whether one global financial reporting standard will ultimately be a reality or not when certain developed nations are still debating. Emerging nations are also tossing with the idea of either adopting one global standard like IFRS or converging towards it through the country’s own standard with certain carve outs. One more school of thought is to adopt dual strategies by adopting the convergence route for the country in general and permitting large corporations to adopt one standard like IFRS? How far convergence route will deter deriving benefits from enhanced credibility and comparability of financial statements, global orientation of business, and easier access to cheaper finance is also being reflected upon. The plenary speech followed by the panel discussion session will deal with the above issues. Keywords: Global, Standard, Financial Reporting, Convergence, Adoption Page | 3 2nd Annual 4|Page International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance ORAL PRESENTATIONS Page | 5 2nd Annual 6|Page International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance Technical Session 01 Galadari Hotel, Sustainability Management both at Corporate and National Level with a 4P* Approach – Impact of Regulatory Measures Colombo Session Chair: 26th May 2015 03.45 p.m.-05.15 p.m. Bougainvillea, Dr. Paritosh Basu 01 Agency Costs or Accrual Quality: What Do Investors Care More About when Valuing a Dual Class Firm? Assist. Prof. Jagjit S. Saini 02 Impact of Green Accounting on National Policy Decisions Dr. TR. Rajeswari 03 Accounting Analysis of Mining Company in Indonesia Under the New Indonesian Accounting Standard and Good Corporate Governance Regulations for the Financial Performance in Indonesia Mining Company Mr. Heykal Mohamed Page | 7 2nd Annual 8|Page International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [02] AGENCY COSTS OR ACCRUAL QUALITY: WHAT DO INVESTORS CARE MORE ABOUT WHEN VALUING A DUAL CLASS FIRM? Jagjit S. Saini1, James DeMello1 and Onur Arugaslan1 Western Michigan University1 ABSTRACT The purpose of this paper is to examine what do investors care about more when valuing a firm’s stock – the agency costs or the accrual quality. Specifically, we examine the effect of stock ownership structure on the informativeness and predictability of the earnings as capitalized in stock valuation. Using a sample of firms issuing multiple classes of stock (hereafter dual class firms) and firms issuing single class of stock (hereafter single class firms), we measure the effect of firm’s ownership structure (dual class versus single class) on the earnings response coefficients (ERCs) of prior, current, and future period earnings. The dual class firms have greater agency cost but higher accrual quality compared to the single class firms. We find that current annual returns of the firm are negatively associated with dual class ownership structure and that earnings informativeness and predictability are decreasing in dual class ownership of the firm as reflected in decreasing ERCs. This indicates that investors weigh agency costs more than the accrual quality in evaluating the earnings of dual class firms. This study adds to prior literature on dual class ownership which reports greater agency costs and better accrual quality at dual class firms in contrast to single class firms. This study also contributes to the literature on earnings informativeness and predictability by evaluating the effect of ownership structure on the ERCs of the firm. Keywords: Earnings response coefficient, dual class firms, single class firms, agency costs, accrual quality Page | 9 2nd Annual International Conference on Accounting and Finance [03] IMPACT OF GREEN ACCOUNTING ON NATIONAL POLICY DECIONS Dr. TR. Rajeswari Sri Sathya Sai Institute of Higher Learning, Anantapur Campus ABSTRACT Currently a society’s well-being is measured by GDP per capita and / or Human Development Index (HDI). Governments, world over use these data in their policy decisions. However these two indices ignore the economic worth of the contribution of natural capital and innumerable intangibles to the well-being of the society. An attempt is made in this paper to study how ‘Green Accounting’ can provide inputs to measure real economic development of a society. The paper demonstrates with hypothetical examples how policy decisions at national level can significantly vary if relevant input regarding natural capital is used/ignored. Further it explains that necessary input can be collected and presented through ‘Green Accounting’ practices that can enhance the quality of decisions to build intergenerational well-being. Suggestions to create awareness at individual, social, national and international level to understand the economic worth of natural capital and its contribution to economic development and well-being is also presented. The study is exploratory in nature and the required data has been collected from secondary published sources. Keywords: Green Accounting, Natural Capital, Intergenerational well being 10 | P a g e 2nd Annual International Conference on Accounting and Finance [04] ACCOUNTING ANALYSIS OF MINING COMPANY IN INDONESIA UNDER THE NEW INDONESIAN ACCOUNTING STANDARD AND GOOD CORPORATE GOVERNANCE REGULATIONS FOR THE FINANCIAL PERFORMANCE IN INDONESIA MINING COMPANY Mohamad Heykal1, Engelwati Gani1 and Armanto Witjaksono1 Bina Nusantara University, Jakarta Indonesia1 ABSTRACT The development of the mining industry in Indonesia from the first and until now has been proven in some areas. The mining industry is one of the pillars of the Indonesia national economy. Mining activities began with the exploration and exploitation activities are sometimes done for decades in which, it also results in the mining industry was very different from other industries, including other capital-intensive industries. This study was qualitative research that conducted at two different mining activity companies. One is general mining company and the other is coal mining company The data that collected for this research is the combination between primary data where the researchers came to the site of the company in Sumatra dan Bangka island and also secondary from the financial report of the company that come from the Indonesian Stock Exchange . From the research it appears that Indonesian Accounting Standard Number 33 had been imposed by the mining company entities and also they implement Standard number 50 and number 55 about financial instrument. In addition, both companies are also equally imposing number 64 which deals with the exploration and evaluation of mineral resources. Beside that there are 17 Indonesian accounting standard that also implemented by that companies. That standard is an implementation of the application of international accounting standards based on IFRS. IAS 64 as an example of an implementation of IFRS number 6. While in the corporate governance policies that have been made by the two companies did not have any impact on the operational performance of mining companies and mineral coal mining in Indonesia. Keywords: Accounting, mining, financial Page | 11 2nd Annual 12 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance Technical Session 02 09.00 a.m.-11.00 a.m. Deregulation of financial markets and corporate governance Anthurium, Session Chair: Galadari Hotel, Prof. P.S.M. Gunaratne 27th May 2015 Colombo 01 Corporate Governance and Dividend Pay-Out Policy: An Empirical Investigation on Financially Distressed Firms in Malaysia Dr. Maran Marimuthu 02 Corporate Social Responsibility Development of Banking Industry in Hong Kong Mr. Yam Tsz Kit 03 Long Run Determinants of Equity Foreign Portfolio Investment (Efpi) in Sri Lanka: A Time Series Analysis with Autoregressive Distributive Lag (Ardl) Approach Mr. G.D. Kapila Kumara 04 The Effect of Board Size and Composition on the Financial Performance of Nigerian Banks Prof. Muhammad Tanko Page | 13 2nd Annual 14 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [05] CORPORATE GOVERNANCE AND DIVIDEND PAY-OUT POLICY: AN EMPIRICAL INVESTIGATION ON FINANCIALLY DISTRESSED FIRMS IN MALAYSIA Dr. Maran Marimuthu1, Dr. Ravichandran Subramaniam2, Dr. Lai Fong Woon3 and Assoc Prof. Dr. Lawrence Arokiasamy4 Universiti Teknologi PETRONAS, Malaysia1,3 Monash University, Malaysia2 UCSI University, Malaysia4 ABSTRACT The primary focus of this paper is to investigate the association between various corporate governance attributes and dividend pay-out policy and the survival likelihood of distressed firms. Findings show that distressed companies continue paying dividends despite their dismal performance. Hence, this paper examines the association of various corporate governance attributes of distressed firms. It also evaluates what motivates distressed firms to pay out dividends even when their performance is deteriorating. Data are obtained public listed firms that fall under the PN17 companies using annual reports and financial databases over the period 2008-2014. PN 17 companies are referred as financially distressed companies. Econometrics Methodology is adopted to deal with both time series and cross-sectional data of about 150 companies. The corporate governance variables include board composition, board size, CEO duality, outside turnover, block holder ownership, inside ownership and creditor involvement. The financial variables include current ratios, financial leverage, total assets/sales, market risk, return on sales, interest coverage and total assets. “Cox Proportional Hazards” Model will then be used to measure the likelihood of business failure. This study offers more insights for both academics and decision makers in relation financial distress and shareholder value maximization. Keywords: distressed firms, corporate governance, financial performance, dividend pay-out policy Page | 15 2nd Annual International Conference on Accounting and Finance [06] CORPORATE SOCIAL RESPONSIBILITY DEVELOPMENT OF BANKING INDUSTRY IN HONG KONG Yam Tsz Kit The University of Hong Kong ABSTRACT Hong Kong is well known as the global financial center, where most of the multinational financial corporations run their office in the city. The paper would start with the general situation current trends of banking sectors in Hong Kong. Then, the definition of corporate social responsibility (CSR) would be discussed. Afterwards, the recent CSR development in the banking sectors would be analyzed by the financial budget on CSR, as well as the social impact in a 10 years’ timeframe. The social impact would show in a more quantitative ways such as the number of volunteer hours contributed. Information would be mostly based on the annual report of the banks. Then, the analysis would start to compare the CSR effort based on the scale of the corporation itself. It is expected that the bigger the business scale, the more resources and thus more mature CSR development on the company. Other than that, in order to understand more about the cultural differences between the banking corporations from various origins, the CSR policy divergence of the local banks, Chinesebased banks and foreign-owned banks would be compared with samples. The paper would provide a clearer understanding of the CSR development in Hong Kong, and shows the degree of impacts towards the city in trend. Keywords: CSR, Hong Kong, Banking Industry, Trends, CSR Financial Budget, Social Impact 16 | P a g e 2nd Annual International Conference on Accounting and Finance [07] LONG RUN DETERMINANTS OF EQUITY FOREIGN PORTFOLIO INVESTMENT (EFPI) IN SRI LANKA: A TIME SERIES ANALYSIS WITH AUTOREGRESSIVE DISTRIBUTIVE LAG (ARDL) APPROACH G.D. Kapila Kumara1 and D.A.I Dayaratne2 Department of Economics, University of Colombo, Sri Lanka 1 Department of Accountancy and Finance, Sabaragamuwa University of Sri Lanka 2 ABSTRACT Equity Foreign Portfolio Investment (EFPI) is useful in many ways to enhance the efficiency and the liquidity of capital markets. In Sri Lanka, foreign investors are holding 25 per cent of market capitalization at Colombo Stock Exchange (CSE), the only stock exchange in Sri Lanka, while actively contributing to the market turnover. Unlike foreign direct investment, EFPI is more vulnerable. The international fund managers consider many factors in investing on developing countries. Thus, this study attempts to explore the long-run determinants of EFPI in Sri Lanka using the autoregressive distributed lagged (ARDL) model covering the monthly time series data from 2004 to 2013. The analysis is further extended as pre-war and post-war period, by splitting the dataset. The study used seven explanatory variables suggested by the literatures. A long-run relationship is found only for the entire period, not for the spitted periods. Accordingly, Market Returns of S&P500, Sri Lanka’s foreign reserve position measured in Months of Imports, Sri Lanka’s Three-Month Treasury Bill’s Rates and Exchange Rate-USD/LKR are statistically significant and have long-run positive effect on EFPI. The rest of the explanatory variables (Market Returns at CSE, London Inter-Bank Offered Rates, Inflation in Sri Lanka) are statistically insignificant. It was further revealed that there is a short-run causality running from Three-Month Treasury Bill’s rates and Exchange Rates-USD/LKR towards EFPI at CSE. These findings would be useful for policy makers and market intermediates to estimate and forecast EFPI at CSE while contributing to the literature and paves the way for further studies. Keywords: Equity Foreign Portfolio Investment (EFPI), Market Capitalization, Colombo Stock Exchange (CSE), Autoregressive Distributed Lagged (ARDL) Model. Page | 17 2nd Annual International Conference on Accounting and Finance [08] THE EFFECT OF BOARD SIZE AND COMPOSITION ON THE FINANCIAL PERFORMANCE OF NIGERIAN BANKS Muhammad Tanko School of Management Science. National Open University of Nigeria, Lagos ABSTRACT This paper analyzed the effects of board size and board composition on the performance of Nigerian banks. The financial statements of nine banks were used as a sample for the period of nine years and the data collected were analyzed using the multivariate regression analysis. The paper found that board size has significant negative impact on the performance of banks in Nigeria. This signifies that an increase in Board size would lead to a decrease in ROE and ROA. On the other hand, board composition has a significant positive effect on the performance of banks in Nigeria. This signifies that an increase in Board composition would lead to a decrease in ROE and ROA. It is recommended that bank's should have adequate board size to the scale and complexity of the organisation’s operations and be composed in such a way as to ensure diversity of experience without compromising independence, compatibility, integrity and availability of members to attend meetings. The board size should not be too large and must be made up of qualified professionals who are conversant with oversight function. The Board should comprise of a mix of executive and non-executive directors, headed by a Chairman. Keywords: Board Size, Board Composition and Nigerian Banks Financial Performance 18 | P a g e 2nd Annual International Conference on Accounting and Finance Technical Session 03 27th May 2015 11.00 a.m.-01.00 p.m. Anthurium, Galadari Hotel, Colombo Enhancement of Human Rights and corporate financial Women Rights performance Session Chair: Session Chair: Ms. Dr. Paritosh Basu M.A.D.S.J.S Niriella and Prof. Jasbir Singh 01 Is Australian Directors’ Remuneration Linked to the Earning Predictability of the Company? Mr. Aloysius Harry Mukti 02 Stock Return and Weather: Evidence from Dhaka Stock Exchange (DSE) Mr. Mohammad Fahad Noor 03 Tri Variate Analysis to Measure Performance Efficiency of Indian Private Banking Sector Assoc. Prof. Mariappan Perumal 04 Cash Flow Patterns: A Predictive Sign of Financial Distress Assoc. Prof. Amrizah Kamaluddin Page | 19 2nd Annual 20 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [09] IS AUSTRALIAN DIRECTORS’ REMUNERATION LINKED TO THE EARNING PREDICTABILITY OF THE COMPANY? (PRACTICE IN THE AUSTRALIAN STOCK EXCHANGE LISTED) Aloysius Harry Mukti Business School, Pelita Harapan University, Tangerang, Indonesia ABSTRACT This study examined and answered the research question on whether or not the remuneration of the members of the Board of Directors (BOD) as a reward for their performance, has a predictive value to generate future earnings for the company. Based on the 2010 total remuneration package received by the Board of Directors and the earnings of the firm for the same period, earning predictability was measured using the Forward Earning Response Coefficient (FERC) model. The results proved that the Directors’ remuneration evidenced a positive correlation with future company earnings. Statistical method applying the Multiple Regression Analysis, thru EVIEWS. The positive accounting theory explains the predictive value of BOD remuneration package on future company earnings as the result of the maximum efforts exerted by the BOD to generate earnings in ways, both positive and negative. The latter may imply certain practices, which may be dysfunctional in nature, but are resorted to in order to benefit and earn revenues for the company. Keywords: Compensation, Future Earnings Responses Coefficient (FERC), Predictability, Earning Page | 21 2nd Annual International Conference on Accounting and Finance [10] STOCK RETURN AND WEATHER: EVIDENCE FROM DHAKA STOCK EXCHANGE (DSE) Dr. Sarwar Uddin Ahmed1, Mohammad Fahad Noor1 and Dr. Samiul Parvez Ahmed1 School of Business, Independent University, Bangladesh1 ABSTRACT The relationship between weather and stock market returns has been the subject of extensive empirical studies, as psychological literature has shown that mood substantially affects judgment, risk assessment and decision-making, and the influences of weather on mood are well demonstrated. Various literatures have confirmed an existence of a significant relationship between temperature, cloud cover and stock returns. On this background, the aim of this paper is to check whether any such relationship exists by taking the case of Dhaka Stock Exchange. In doing so we have used cloud coverage and all share price index for the period of 1993-2013. Various parametric and nonparametric tests including F-test, Kruskal-Wallis and Chi-square test have been applied. Mean returns before and after automation are classified into five level of cloudiness. Results of the empirical analysis showed that, there is no significant influence of weather on stock prices in Dhaka Stock Exchange. Keywords: weather, mood, stock return 22 | P a g e 2nd Annual International Conference on Accounting and Finance [11] TRI VARIATE ANALYSIS TO MEASURE PERFORMANCE EFFICIENCY OF INDIAN PRIVATE BANKING SECTOR P. Mariappan1, Dr S. Lakshmi2 and G. Sreeaarthi3 Bishop Heber College – Tamil Nadu, India1,3 Umayal Ramanathan Women’s College, Karaikudi 2 ABSTRACT The aim of the research work is to investigate and examine the performance efficiency of the Private Sector Banks of India individually and identify the best performing Bank. For this study, researchers collected data on the private sector Bank for the financial years 2004-2013 from the official websites of individually them considering six input and four output variables. The Data Envelopment Analysis [DEA] technique has been employed; BCG Matrix [Efficiency with ROI ] and GE Mckinsey matrix [Efficiency with ROI] for same. Our Study reveals that as per the analysis of DEA:Development Credit Bank, HDFC Bank and Karur Vysa Bank secures the top position, according to BCG Matrix: Karur Vysa Bank and South Indian Bank tops the list and as per McKinsey Matrix: Karur Vysa Bank and Dhanalakshmi Bank are those Banks lies on HM [High Quadrant]. By merging all the analysis, the researcher identifies that among the private sector Banks, namely KarurVysa Bank is functioning effectively. Keywords: DEA, Return on Investment, Efficiency, Private Sector Banks Page | 23 2nd Annual International Conference on Accounting and Finance [12] CASH FLOW PATTERNS: A PREDICTIVE SIGN OF FINANCIAL DISTRESS Adriana Shamsudin1, Amrizah Kamaluddin1 and Arun Mohamed1 Faculty of Accountancy, University Technology Mara (UiTM) 1 ABSTRACT Studies have proven that during distressed situation, information on earnings become less reliable to measure company’s performance and claimed that the cash flows information are more relevant. A relatively simple and convenient way to analyse a company’s financial status is to examine the patterns of cash flow. The cash flow patterns derived from positive and negative signs of its cash flow components that consist of operating, investing and financing activities. The current study examined whether the trend of cash flow patterns can predict financial distress incidence within one to three years before being classified as distressed companies. The data comprised of 124 Malaysian public listed companies covering the period of 2006 to 2013. The results revealed that one year before distressed, most of the distressed companies indicated positive cash flow from their operating activities and increased investments in noncurrent assets. Another common cash flow trend reflected in the distressed companies was the positive cash flow for both operating and investing activities but negative cash flow in financing activities. This pattern evidenced that excess cash generated from operating activities combined with cash obtained from disposal of the noncurrent assets were used to repay the long term debt and dividend. The results provide an alternative tool to the investors to predict occurrence of impending financial distress. Keywords: cash flow, cash flow patterns, financial distressed, operating, investing and financing activities 24 | P a g e 2nd Annual International Conference on Accounting and Finance Technical Session 04 27th March 2015 02.00 p.m.-03.30 p.m. Economic turmoil’s and stability of banks and other financial institutions Anthurium, Galadari Hotel, Session Chair: Prof. P.S.M. Gunaratne Colombo 01 Financial Performance differences between privatelyowned versus state-owned banks: Evidence from Bangladesh Mr. Saquib Shahriar 02 Efficiency Comparison between Licensed Commercial Banks and Licensed Specialised Banks Ms. E.M.N.N. Ekanayake 03 Microfinance Institutions’ Competition in Northern Region of Thailand Assist. Prof. Saleepon Ravipan Page | 25 2nd Annual 26 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [13] FINANCIAL PERFORMANCE DIFFERENCES BETWEEN PRIVATELY-OWNED VERSUS STATE-OWNED BANKS: EVIDENCE FROM BANGLADESH Saquib Shahriar Independent University, Bangladesh ABSTRACT This paper examines the financial performance difference between privately-owned and state-owned banks in Bangladesh. The sample size consisted of 20 banks with data from 2007 to 2014 used to compare between them. Income and balance sheet characteristics and efficiency measures were used to compare the performances of these banks. The empirical results support the hypotheses that private banks are more efficient than state-owned banks. We also found that state-owned banks performed poorly compared to private banks, with lesser profit and also performing poorly on all the financial performance indicators. In the recent past, the percentage of default rate also increased in the stateowned banks compared to private banks, and it was found that as the extent of state ownership increases the banks default rate on loans also increased, as such the performance of state-owned banks deteriorated significantly. Lastly, we found that the asset quality in the state-owned banks deteriorated drastically in the recent past, resulting in financial distress in the economy. Keywords: State ownership, private banks, bank performance, Bangladesh . Page | 27 2nd Annual International Conference on Accounting and Finance [14] EFFICIENCY COMPARISON BETWEEN LICENSED COMMERCIAL BANKS AND LICENSED SPECIALISED BANKS E.M.N.N. Ekanayake University of Colombo, Sri Lanka ABSTRACT The banking sector in Sri Lanka, which comprises with Licensed Commercial Banks and Licensed Specialized Banks dominate the country’s financial sector in terms of assets. The main objective of this study is to determine the efficiency differences in the performance of licensed commercial banks and licensed specialized banks over the period of 2005-2012. Minitab and SPSS statistical software have been used in analyzing the data calculated by using ten efficiency ratios for 15 banks. According to the findings, specialized banks have outperformed commercial banks by performing better with nine ratios; return on equity, return on assets, employment costs to total assets, noninterest income to total assets, overhead costs to total assets, provisions to total loans, interest margin to loans and deposits, interest margin to total assets and expenses to income ratio. Commercial banks are efficient than the specialized banks only in managing their non-performing loans. Therefore it is evident that the specialized banks have performed more efficiently compared to the commercial banks in Sri Lanka. The relatively concentrated activities of specialized banks may have facilitated them to achieve higher efficiencies than commercial banks, which are exposed to higher levels of risks. Keywords: efficiency, commercial banks, specialized banks 28 | P a g e 2nd Annual International Conference on Accounting and Finance [15] MICROFINANCE INSTITUTIONS’ COMPETITION IN NORTHERN REGION OF THAILAND Ravipan Saleepon Srinakarinwirot University ABSTRACT The aim of this empirical research is to assess the level of competition appearance in the Microfinance Institutions (MFIs) in northern region of Thailand after financial crisis in 1997. The analysis employs a widely used non-structural methodology by Panzar and Rosse. Because actually every Microfinance Institutions have faced with the dilemma of balance profitability on one hand and liquidity as well solvency. MFIs ‘competition have affected the profitability and solvency in the same time. From the study was found that the competitions’ between MFIs in northern region of Thailand are low competition. This empirical work has attempted to measure the level of competition by H statistics (H) demonstrated that the differences between price (interest revenue) and cost (interest expenses) likely wider than before 1997. It indicated the more monopoly power of MFIs in northern region of Thailand. Keywords: Microfinance Institutions, Competition, Panzar-Rosse Page | 29 2nd Annual 30 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance VIRTUAL PRESENTATIONS Page | 31 2nd Annual 32 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance VIRTUAL PRESENTATIONS 01 The Diffusion of ‘New Public Financial Management (NPFM) Innovations in Developing Countries: Evidence from Sri Lanka Mr. Thusitha Dissanayake 02 The Determinants of Earnings Management: An Empirical Study of Firms Listed on Hochiminh Stock Exchange, Vietnam Hoai Anh Le Thi 03 Factors Affecting to Risk Management Efficiency of Listed Commercial Banks in Sri Lanka Ms. S.D.P.Piyananda 04 Corporate Governance, Financial Soundness and Economic Development: Empirical Evidence from Malaysia, Indonesia, and Turkey Wahua, Lawrence http://financeconference.co/2015/virtual/ Page | 33 2nd Annual 34 | P a g e International Conference on Accounting and Finance 2nd Annual International Conference on Accounting and Finance [16] THE DIFFUSION OF ‘NEW PUBLIC FINANCIAL MANAGEMENT (NPFM) INNOVATIONS IN DEVELOPING COUNTRIES: EVIDENCE FROM SRI LANKA Dissanayake Thusitha School of Accounting, RMIT University ABSTRACT In recent years, new forms of accounting techniques and practice have played a central role in the reform of the public sector. But little is known about the process of which accounting innovation is diffused throughout public sector organisations. This thesis examines the diffusion of New Public Financial Management (NPFM) innovation,-across the central-provincial-local level of government (vertical diffusion) in Sri Lanka. Based on the Diffusion of Innovation Theory and using triangular approach to data collection arising from a content analysis of official documentation, semi-structured interviews, and a survey targeting Chief Financial Officers (CFO) in the public sector, the process of diffusion and adoption of accounting innovation is reconstructed and the critical success factors and mechanisms explaining this process are identified. This study is contributed to existing public sector accounting reforms literature by focussing on the manner and means of diffusion and by eliciting the views of key actors in the diffusion process enabling successful adoption in emerging countries. This thesis also provides a clearer understanding of diffusion process in emerging country, which might be helpful for both policy makers and policy implementers to attain the expected benefit from the policy. Keywords: Diffusion, Innovation, New Public Financial Management, Sri Lankan public sector . Page | 35 2nd Annual International Conference on Accounting and Finance [17] FACTORS AFFECTING TO RISK MANAGEMNET EFFICIENCY OF LISTED COMMECIAL BANKS IN SRI LANKA S.D.P.Piyananda1 and J.M.R.Fernando1 University of Kelaniya, Sri Lanka1 ABSTRACT This study aims to identify the most important bank specific and macroeconomic variables that are affecting to the risk management efficiency of listed commercial banks in Sri Lanka, by studying their financial statements for the period of 2008 to 2012. Multiple regression analysis and the Correlation Coefficients (Pearson Correlation) are used as the data analysis tools. Capital Adequacy Ratio (CAR) is used as the dependent variable to present the risk management efficiency of banks and independent variables include the credit risk, liquidity risk, Return on Assets (ROA), banks’ size, and operational efficiency as the bank- specific factors while inflation and GDP growth rate included as the macroeconomic variables. Findings of this study revealed that liquidity risk, ROA and banks’ size are the important factors of determining the degree of CAR of commercial banks in Sri Lanka. Macroeconomic variables do not have huge impact on determination of CAR. Correlation coefficient shows that there is a significant positive relationship between CAR and each of the independent variables including liquidity risk, credit risk, ROA and operational efficiency while banks’ size has significant negative relationship. Further as shown by the results of the study independent variables combined have relatively high effect on the dependent variable and changes that can occur within, as the interpretation of the independent variables of the dependent variable reached approximately 82.3%. Key words: Capital adequacy Ratio, Macroeconomic Variables, Risk Management, Bank-specific factors, Sri Lankan commercial banks. 36 | P a g e 2nd Annual International Conference on Accounting and Finance [18] THE DETERMINANTS OF EARNINGS MANAGEMENT: AN EMPIRICAL STUDY OF FIRMS LISTED ON HOCHIMINH STOCK EXCHANGE, VIETNAM Hoai Anh Le Thi Hue University of Economics ABSTRACT Earnings management is the manager’s intervention in accounting information to mislead stakeholders about the firm’s financial performance or to affect contractual outcomes depending on earnings figure. This practice is problematic in Vietnam because it is seriously eroding of users’ trust on the quality of disclosed information. Therefore, the purpose of this paper is to investigate what factors determine earnings management of listed firms on hochiminh stock exchange. Base on this study, recommendations will be made to support users in making right decisions and facilitate regulators, policy makers and standards setters in setting new policies and standards to curb earnings management. To achieve the aims of this study, the empirical analysis is conducted by dividing factors into two subgroups: internal (firm size, CEO duality ) and external (debt covenant contract and audit quality). The impact of these factors on earnings management is determined by using descriptive statistics and multiple regression analysis. Earnings management is measured by discretionary accruals through deangelo’s model. Pilot analysis has revealed that ceo duality and indebtedness are positively associated with earnings management, whereas firm size and the choice of big 4 auditors are negatively related to earnings management. Keywords: Earnings Management, Factors, Hochiminh Stock Exchange, Listed Firms, Deangelo’s Model Page | 37 2nd Annual International Conference on Accounting and Finance [19] CORPORATE GOVERNANCE, FINANCIAL SOUNDNESS AND ECONOMIC DEVELOPMENT: EMPIRICAL EVIDENCE FROM MALAYSIA, INDONESIA, AND TURKEY Wahua, Lawrence Al-Madinah International University (MEDIU), Malaysia Abstract This work investigated the effects of countries’ corporate governance (CCG) and yearlytrend of activities (Year-factor) on Malaysian, Indonesian, and Turkish economic development, and deposit-taking banks' (DTBs’) financial soundness for the periods 2010 – 2014, after controlling for the impacts of board effectiveness, management efficiency, and stakeholders’ (Fund-providers, Personnel, Suppliers, and Governments) influence. CCG and Year-factor were proxied with dummy codes (in line with Univariate and Multivariate GLMs techniques). Capital adequacy, assets quality, and profitability were proxies of financial soundness; DTBs’ interest income proxied economic development; performing loans index proxied board effectiveness; operational efficiency ratio proxied management efficiency; stakeholders’ financial-benefits/net income ratio proxied stakeholders' influence. IMF’s country-level aggregate-data were used in quantifying the dependent and control variables, while SPSS-General Linear Models (GLM) data analysis technique was used. Year-factor had no statistical significant effect on all the dependent variables, implying that the studied DTBs had stable operations within 2010-2014. Countries’ corporate governance showed significant effects on the studied DTBs’ interest income, capital adequacy, assets quality and profitability when the impacts of board effectiveness, managerial efficiency, and stakeholders influence were individually, jointly, and severally controlled/not controlled, with the greatest effects being on assets quality and profitability, followed by interest income, while capital adequacy came last. Malaysian, Indonesian and Turkish corporate governance showed highest, higher, and high significant effect on the dependent variables respectively. Countries’ corporate governance is the key determinant of organisations’ performances; it is more than firms’ internal corporate governance and includes countries’ values, cultural, legal, political, economical, social, technological systems, and international-relations. Keywords: Corporate Governance, Financial Soundness, Economic Development 38 | P a g e 2nd Annual International Conference on Accounting and Finance Page | 39 2nd Annual 40 | P a g e International Conference on Accounting and Finance

© Copyright 2026