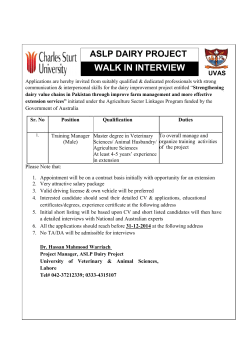

international