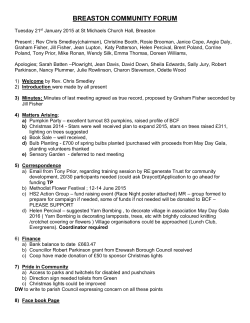

ADV Part 2A/B - Gerstein Fisher