p o s s i b i l i t... Auto SpeciAl SAveS Summer!

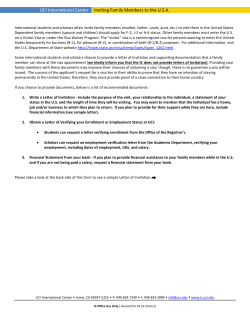

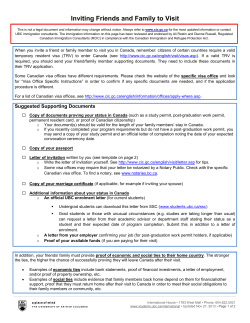

possibilities Published for the members of Ascend Federal Credit Union Auto Special Saves Summer! I N SI D E quick reads e-pay promo mortgage rates near record lows auto special youth promo money market account phising scams plastic cash shred day • aug 7 financial center update ju ly 2 0 1 0 Mortgage Rates near Record Lows! Don’t let this opportunity slip away! Think your chance to buy a home has slipped away? Think again. raise your hand if you wanT e-pay! quick readS If you missed out on the first-time homebuyer incentives from the federal government, you can still tie down a great mortgage rate. In fact, the rates on Ascend’s balloon loans are near record lows. A balloon mortgage from Ascend puts home ownership within reach. Don’t let this opportunity slip away! Make an appointment with an Ascend Mortgage Service Representative by calling 1-800-342-3086, ext. 1300, or 1-931-454-1300. For our latest rates, visit ascendfcu.org. Services Venture and Go youth account members ages 17-21 receive a complimentary subscription to Brass magazine. Check out the latest issue by visiting our Web site at ascendfcu.org. Scholarship Winners Announced In May, Ascend awarded $12,500 to help members continue their education after high school. For complete details, please visit ascendfcu.org. Current Promotions July 1-Sept. 4 Auto Loan Special Upcoming Promotions Aug. 1-31 Youth Account Promotion Shred Day Avoid identity theft by shredding your documents! Ascend will host a Shred Day from 9-11 a.m. on Saturday, Aug. 7, at the Shelbyville financial center on 1900 N. Main St. We are developing a special promotion on our credit card slated for Oct. 1 through Nov. 30. Keep an eye on ascendfcu.org and the October issue of Possibilities for details. Tired of getting buried under a pile of bills every month? If you’re ready for a green alternative to a mailbox full of paper, it’s time to start paying your bills electronically with E-PAY. E-PAY is Ascend Federal Credit Union’s free online bill payment service. Set up automatic recurring payments, or make quick one-time payments. Get a report of past payments, or see what’s scheduled to go out this week. “Whoa there,” you say. “The Internet is a big scary place where people are just waiting to steal my identity. What about security?” Glad you asked. E-PAY is ready to serve you behind passwordprotected E-BRANCH. In fact, all it takes is a quick trip to E-BRANCH and a few mouse clicks to register for E-PAY. Or, call 800-342-3086 for more info. h oliday closings All credit union offices will be closed Monday, July 5 for Independence Day and Monday, Sept. 6 for Labor Day. Think of E-PAY as your life preserver in a sea of paper. Get on board with Ascend’s free, green and secure way to pay bills today! turn to someone you can trust "People helping people" is the fundamental philosophy on which credit unions were built. More consumers are discovering that credit unions have some important characteristics not always found at other financial institutions, such as personal service and customer advocacy. When you become a member of Ascend Federal Credit Union, you'll always have a place where you belong. We offer a wide variety of programs and services designed to meet the unique needs of our members. Our member-focused staff will be here to assist you face-to-face and answer any questions you may have. Data from Forrester Research Inc. shows that customers of the biggest banks in the U.S. are the least likely to believe their financial institution does what's best for them as opposed to what's best for the bottom line, according to the 2009 Customer Advocacy Rankings. Americans often are wary of doing business with large profit-driven financial organizations - they believe these companies are only interested in their own bottom lines. Whether it's to open a new account, to ask about a loan, or for any of your financial needs, stop in and see us today. We are here for you. Credit unions, however, continue to remain near the top of the rankings, as they have in previous years, with 70% of credit union members saying their financial institution puts their interests first. Members trust their credit unions, which are not-for-profit organizations. Members know the people at their credit union care about them and have the members' best interest at heart. •3• possibilities • july Auto Special Saves Summer! Are Your Kids Excited About Going Back to School? Probably not. But at least they can be prepared with a Discover, Venture or Go account from Ascend. It’s never too early to share the importance of saving with your children, and an Ascend youth account is a great place to start. Each account has incentives to encourage young people to spend and save wisely. Plus, youth account holders can participate in drawings based on how they use their account. During the month of August, when your children open a youth account or convert their existing Ascend savings account to a youth account, they can register for a chance to win a $100 cash prize that will be given away at each of our 15 financial centers. You can’t make them look forward to school, but you can help them look forward to saving with a Discover, Venture or Go account from Ascend. Open a youth account for your child by visiting your nearest Ascend financial center. We will even make the initial $5 deposit to open the account! We will draw for the $100 cash prizes Sept. 1, so open an Ascend youth account today! No purchase necessary to register or win. Registration forms will be available inside the financial centers during the month of August. Ascend Federal Credit Union employees, officials and any of their family members are not eligible to enter the drawing. Keep It Liquid with Ascend’s Money Market Account Afraid buying a new car will sink your plans for summer fun? Keep your plans afloat with an Ascend auto loan. People tell you to keep your emergency fund liquid – or easily accessible. Now through Sept. 4, finance a new or used car – or refinance from a competitor with a term of up to 60 months – and make no payments for 90 days. If the amount you finance is at least $10,000, we’ll pay you $100 (new auto loan) or $50 (used auto loan)1. Great idea, but you want a better rate than a Share (savings) account. Plus, with a 36-month term, qualified members receive rates as low as 3.99% APR2 for a new auto or 4.24% APR2 for a used one. Great rates, great terms and cash back! Save your summer with Ascend’s auto special. Apply at your nearest Ascend financial center, online at ascendfcu.org or via LoanLine at 1-800-342-3086, ext. 1123. Request the cash-back incentive when closing the loan at your nearest Ascend financial center. To qualify, loans must be approved and processed at a credit union financial center (indirect lending does not qualify for the special). The incentive will be deposited to your Share account after you make your first payment. 1 The quoted APR (annual percentage rate) is a fixed rate based on your credit score, a 36-month term, use of Ascend’s Freedom Card, and authorization of payments through payroll deduction, direct deposit, or as an ACH payment. You will be informed of the APR for which you qualify before you become contractually liable for the loan account. All loans subject to credit approval. Rates subject to change without notice. 2 Consider a Money Market account (MMA) from Ascend. Basically, there are two key advantages to an Ascend MMA: 1. The more you save, the better your rate. It just takes $2,500 to open an Ascend MMA. The account is tiered to earn a higher Annual Percentage Yield (APY) for balances maintained over $2,500, and the rate you earn grows the more you save. 2. You can make six free withdrawals per month. If you need to make more, it’s just $10 per transaction. Plus, your Ascend MMA is insured by the National Credit Union Administration, an agency of the federal government. Whether you’re saving for a big purchase or looking for a safe place to park your emergency fund, make the most of your large savings balance with an MMA from Ascend. Open your MMA today by visiting your nearest Ascend financial center, or call 800-342-3086 for more information. •5• possibilities • july Phishers Use Email, Text Messaging, and Phone Calls to Scam CU Members Criminal phishing (email), smishing (text messaging) and vishing (telephone) attacks increased nearly 600 percent in 2009, according to the Anti-Phishing Working Group. How Full is Your Filing Cabinet? If you’re still receiving your monthly statement in the mail, chances are your filing cabinet is getting pretty full. Time to put it on a diet with e-statements from Ascend. An e-statement is the safe, convenient, and paper-free way to receive your monthly statement. Register for e-statements by logging into E-BRANCH and selecting “Account Access,” then “Online Statements.” Read and accept the disclosure. When your statement is ready, we’ll send you an email. Log into EBRANCH, and your e-statement will be waiting for you. Help your filing cabinet lose a few pounds. Register for e-statements from Ascend today. Encourage Independence, Responsibility with a Student Visa from Ascend College is the perfect time to begin learning how to use credit wisely. It’s also the perfect time to fall into a trap of variable interest rates and annual fees when all you wanted was a free T-shirt. Send your young adult back to college with a credit card from a financial institution you know and trust. A Student Visa from Ascend has a low, fixed 9.90% Annual Percentage Rate (APR), no annual fee and no transaction fee for cash advances. Using an Ascend Student Visa responsibly is a great way to build a solid credit history, which will help with future purchases like a car or house. Unsuspecting credit union members continue to respond to fraudsters who contact them through various methods to obtain their personal or financial information. These scams are welldesigned to mimic legitimate organizations (including credit unions), so it’s often too late when members realize they’ve been swindled. “Your account has been temporarily suspended because of a security breach at our credit union. Please provide your information to our security department to reactivate your account.” “Your loan is delinquent. Payment is needed immediately.” Encourage your college student to apply for a Student Visa at ascendfcu.org or at any Ascend financial center. Ascend Federal Credit Union will never telephone you or send you a letter, e-mail or text message asking for your account number, credit card number, user name, password, or Social Security number. To protect yourself, • Don’t respond to e-mails, text messages or telephone calls The following are examples of phishing requests mimicking credit unions: “Your credit card was suspended. Our customer service department needs your information to reinstate your card.” Some credit union members are also receiving text messages indicating their card has been deactivated, and to re-activate the card, they must enter their 16-digit card number, CVV2/ CVC2, card expiration date, and/or personal identification number (PIN). asking for personal identification or financial information; • If you compromise any personal or account information, take action immediately by alerting Ascend Federal Credit Union, placing fraud alerts on your credit files, and monitoring your account statements for unauthorized transactions; and • Report scams to the Federal Trade Commission by calling 1-877-IDTHEFT. If you have a question about any request that supposedly comes from Ascend, call 800-342-3086. “You can receive a reduced interest rate on your loan. We need to confirm your information.” reso l u t i onCash s yo uFits can k e e p! Plastic Everyone What’s the perfect gift that’s guaranteed to fit? Cash. What’s more convenient to carry than a pocket full of cash? Plastic. What would you get if you joined the convenience of plastic with the spendability of cash? Plastic cash! Your gift-giving problems are solved. Behold _ Ascend’s Visa gift card. Get to your nearest Ascend financial center and pick up your own gift card in denominations from $10 to $500. The price of each card is the face value plus a small service fee of $2.50. The fortunate recipient of your portable plastic present can use it virtually anywhere Visa is accepted.* So, whether it’s a birthday, baby shower, wedding, or Christmas gift, Ascend’s Visa gift card is the perfect fit! Pick yours up today. *The Visa gift cards cannot be used to pay at the pump for gasoline, hotel and car rentals. The card will be activated 24 hours after it is purchased, If the card has not been used after seven months, there will be a $3 per month fee deducted from the balance on the card. Complete disclosures are provided with card purchase. •7• possibilities • july Join Us for Shred Day Aug. 7! Ascend is helping members prevent identity theft with a Shred Day at the Shelbyville financial center. From 9-11 a.m. on Saturday, Aug. 7, you are invited to bring documents to be shredded to the parking lot of the new Shelbyville financial center located at 1900 N. Main St. Where Will You Go with Visa TravelMoney? Summertime means travel time, and that means it’s time to get Visa TravelMoney from Ascend! Visa TravelMoney is a reloadable card that can be used to make purchases at all Visa locations domestically and internationally. Simply deposit funds from your Ascend checking or savings account via a secure Web site, present your card at the time of purchase, and the amount will be deducted from the card balance. You can also use the card to withdraw cash at ATMs. For complete details about Visa TravelMoney, call 800-342-3086 or visit your nearest Ascend financial center. You can cancel the Visa TravelMoney card if it’s lost or stolen, and you can easily transfer use of the card to your spouse and children. Travel and emergency assistance services, lost luggage insurance and security benefits are available to Visa TravelMoney cardholders. Cash-Free, Check-Free: Freedom Card! When was the last time you used cash or wrote a check? If you have a Freedom Card from Ascend, it might’ve been awhile. When you use a Freedom Card, funds are immediately deducted from your Ascend Share Draft (checking) account. You can use it anywhere Visa debit cards are accepted, which means you save money by not ordering checks. If you absolutely must have cash, you can use your Freedom Card for fee-free transactions at more than 200 proprietary and network ATMs. What could make this piece of plastic even better? How about this: Active Freedom Card users receive a quarter percent rate reduction on new or used auto loans. What are you waiting for? Order your Freedom Card by calling 800-342-3086, or visit your nearest Ascend financial center. If you already own a Freedom Card, use it for the ultimate in shopping freedom! Please limit items you bring to Shred Day to no more than two boxes. No newspaper or cardboard; paper only. Sign up for e-statements and register for a chance to win a personal shredder to be given away Aug. 9.* The last Shred Day of 2010 is scheduled for Nov. 6 at the Elm Hill financial center. Victory Station Manager Crystal Glenn presents Cade Ashley with a shredder he won as part of Victory Station’s Shred Day that was held May 1. *No purchase necessary to register or win. Registration forms will be available inside the Shelbyville financial center until Aug. 7. Ascend Federal Credit Union employees, officials and any of their family members are not eligible to enter the drawing. talking to aging parents about their finances Do you know how your parents are managing their finances? If the answer is no, it may be time to have a conversation with them. Few people enjoy talking about money, but it can help ensure your parents’ well-being. • Bill-paying: Have your parents been unable to pay bills or purchase essential items? If so, help them revise their budget. Are there expenses that can be cut or reduced? Is there a way to increase their income, such as through a part-time job? Encourage your parents to contact the creditors/service providers for bills they cannot pay. • Long-term care costs: If your parents do not already have a plan for financing their long-term care, help them create one. It may be difficult to save enough to completely cover their costs. One option is to purchase long-term care insurance. Since there are many provisions to consider, you and your parents may want to talk with an insurance advisor about what would best meet their needs. • Salespeople/scammers: If someone is trying to sell your parents an annuity or other investment opportunity, review it in detail to see if it makes sense financially. If they are getting calls from telemarketers, sign them up on the National Do Not Call Registry (888-3821222). Discuss common scams, and encourage them to talk to you before sending money to someone. • Estate planning: If you are not sure if your parents have a will, ask. Those with more complicated financial situations may want to have their will drafted by a lawyer, but others may be able to create one with the aid of a book or software. Also discuss if they have other estate planning documents, such as durable power of attorney for healthcare and finances. Looking for financial advice? As a benefit of your membership, you have access to BALANCE, a free financial education and counseling service. Call 888-456-2227 to speak with a BALANCE representative, or visit ascendfcu.org for more information. •9• possibilities • july 5 9 t h Annual M e e t i n g – Mar c h 20, 2010 Trust is everything. Retirement, Insurance & Investments from a Trusted Partner A Message from the MEMBERS Financial Services Program Designed exclusively for credit union members, and located right here at the credit union, the MEMBERS Financial Services Program is a full-service financial advisory program. We provide retirement, insurance and investment services to members like you. We’re here to help you and your family through a lifetime of financial planning needs – from those just starting a savings plan, to those with sizable assets looking for more sophisticated management tools. The MEMBERS Financial Services Program is staffed by Randall W. Harris, CFP®*, ChFC, a knowledgeable and experienced financial advisor devoted to serving all your retirement, insurance and investment needs. Randall has 28 years experience in the financial industry, and understands the importance of a trusted partner. He has been serving members of Ascend Federal Credit Union since 1998. Be assured Randall will provide you with the same personalized attention you’ve come to expect from your credit union. Call 931-454-1307 or 800-342-3086 extension 1307 today for a no-cost, no-obligation appointment. The meeting was called to order by Chairman Braker at 1:05 p.m. on March 20, 2010, at the Tullahoma High School Lecture Hall in Tullahoma, Tenn. Reports of Chairman, Treasurer, and Supervisory Committee Chairman Braker reported copies of the officials' reports were included in the 2009 Annual Report, which are available at all Ascend financial centers. Additional copies were on hand for any member wishing to obtain one. Board of Directors Randal Braker, Chairman Lou Deken, Vice Chairman Peggy Gray, Treasurer Carolyn Stone, Secretary Bruce Runyan Jim Ward Bob Burt Lee Parker Supervisory Committee Anthony Taylor Pat Eagan Old Business None The 59th Annual Meeting of Ascend Federal Credit Union was held March 20 at Tullahoma High School. Door prize winners included, from left, Martha Maierbacher, who won a gift basket donated by Audax Strategies; Carl Ledbetter, $50; Barbara Myers, $100; Kathy Marlin, $50; and Peggy Lewis, a gift basket from Audax Strategies. Board Development Committee Jim Smith Caren Gabriel, president and chief executive officer, was acknowledged to the membership present at the meeting. Quorum Anthony Taylor, Supervisory Committee member, reported a quorum was present. Approximately 60 members were in attendance. Some of the products and services available include: • Retirement Planning • 401(k) / Pension Rollovers • Wealth Management • Life Insurance • Education Funding • Long-Term Care Insurance • Mutual Funds • Tax-managed Investing* *Representatives are not tax advisors. For more information regarding your specific tax situation, please consult a tax professional. Representatives are registered, securities are sold, and investment advisory services offered through CUNA Brokerage Services, Inc. (CBSI), member FINRA/SIPC, a registered broker/dealer and investment advisor, 2000 Heritage Way, Waverly, Iowa 50677, toll-free (866) 512-6109. Nondeposit investment and insurance products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by the financial institution. CBSI is under contract with the financial institution, through the financial services program, to make securities available to members. *The CFP certification marks are not affiliate with CUNA Brokerages Services, Inc. B2MM-0906-C110 Approval of Minutes Chairman Braker announced the minutes of the Annual Meeting held on March 29, 2009, were distributed in the July 2009 issue of Possibilities. The floor was opened for questions and/ or comments. A motion was made by Bob Burt and seconded by Bruce Runyan to approve the minutes dated March 29, 2009, as written. The motion carried unanimously. Introduction of Officials Chairman Braker began by introducing the officials in attendance as follows: Trust us to guide you through life’s financial journey. Trust is everything – especially when it comes to your insurance and investments. That’s why we are honored to have been chosen by Ascend Federal Credit Union as the financial services partner to serve the needs of members like you. Opening Remarks and Call to Order On behalf of the Board of Directors and staff of Ascend Federal Credit Union, Chairman Randal Braker welcomed the membership to the credit union’s 59th Annual Meeting. Chairman Braker continued by providing a brief overview of current challenges for the credit union industry, upcoming promotions and special events for 2010. © CUNA Mutual Group New Business Election Results - Chairman Braker explained that there were no qualifying petitions received this year; therefore, in accordance with the credit union's Bylaws, the nominees presented by the Nominating Committee were elected by acclamation. Officials elected for a three-year term were Louis R. Deken, R. Bruce Runyan, and Peggy R. Gray. Adjournment There being no further business, Chairman Braker asked for a motion to adjourn the business meeting at 1:10 p.m. A motion was made by Burt and seconded by Runyan to adjourn the 59th Annual Meeting of Ascend Federal Credit Union. The motion carried unanimously. Door Prizes Upon arrival at the meeting, members were given a numbered ticket qualifying them for door prizes. Following adjournment of the meeting, drawings were held to award five prizes including two gift baskets contributed by Audax Strategies and three cash prizes totaling $200. Members were excused from the meeting. • 11 • possibilities • july presorted Standard u.s. postage paid Nashville, TN Permit #1 p.o. box 1210 520 Airpark Drive Tullahoma, TN 37388 for our members i n the home of: We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act. This credit union is federally insured by the National Credit Union Administration. Membership is limited. lo cat i on s www.ascendfcu.org • [email protected] • 1-800-342-3086 Corporate Headquarters Lewisburg Nashville P.O. Box 1210 520 Airpark Drive Tullahoma, TN 37388 1372 Rock Crusher Road Lewisburg, TN 37091 6201 Centennial Blvd. Nashville, TN 37209 Manchester 2600 Elm Hill Pike Nashville, TN 37214 Arnold Air Force Base 452 N. Hap Arnold Drive Arnold AFB, TN 37389 Columbia 1929 McArthur St. Manchester, TN 37355 mcminnville 981 W. James Campbell Blvd. Columbia, TN 38401 Three Star Mall 1410 Sparta St. McMinnville, TN 37110 cool springs Murfreesboro 3150 Aspen Grove Drive Franklin, TN 37067 1250 W. Clark Blvd. Murfreesboro, TN 37129 Franklin County 750 S. Church St. Murfreesboro, TN 37130 2459 Decherd Blvd. Winchester, TN 37398 Shelbyville 1900 N. Main St. Shelbyville, TN 37160 Smyrna 769 Nissan Drive Smyrna, TN 37167 Tullahoma 1611 N. Jackson St. Tullahoma, TN 37388 4051 Franklin Road Murfreesboro, TN 37128 Raising Possibilities

© Copyright 2026