Solutions for Early Supply Chain Finance Access

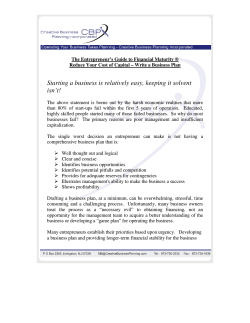

GTR SUPPLY CHAIN SCF SOLUTIONS Banks look set to meet growing demand for even earlier access to supply chain finance by adopting new tools and solutions that leverage on the latest technologies. Liz Salecka reports. s suppliers’ demand for both pre-shipment and post-shipment finance grows, both global banks and large corporate buyers are exploring new ways of securing its provision and speeding up its release. Many of them are considering new solutions such as the bank payment obligation (BPO) to provide suppliers with new opportunities to access finance at earlier stages in their supply chain cycles, such as the pre-shipment phase. “Global demand for supply chain finance continues to evolve across both developed and emerging markets and it is now firmly entrenched as a mainstream trade financing solution among corporates and international banks,” says Kuresh Sarjan, managing director and head of global trade and supply chain, Asia Pacific at Bank of America Merrill Lynch (BofAML), pointing out that demand for supply chain finance has now moved beyond industries such as retailing to encompass commodities, pharmaceuticals and the Fast-Moving Consumers Goods (FMCG) sectors. “This is where post-shipment financing opportunities with suppliers, regardless of size, have expanded 52 | GLOBAL TRADE REVIEW materially,” he says. “Post-shipment and post-acceptance financing should continue to dominate the market for some time, but pre-trade financing facilitates trade and supports growth and supply chain stability as well,” adds Daniel Schmand, head of trade finance and cash management corporates Emea at Deutsche Bank. He notes that while awareness of supply chain finance solutions has “rocketed” in recent years, the focus has always been on the later part of the supply chain. “Demand for earlier solutions is growing as they become better-known, but there is still a trade financing gap in various regions,” he says. Banking on the BPO One tool that is expected to play a key role in facilitating the early provision of finance to suppliers is the BPO, an electronic payment guarantee and risk mitigation instrument that is transmitted from a buyer’s bank to a supplier’s bank, providing the latter with the security it needs to release funds. At Swift, André Casterman, managing director and global head of corporate and supply chain markets, explains that use of the BPO enables finance to be offered to suppliers much earlier than in traditional supply chain finance programmes. “Whereas finance has been typically offered once an invoice is approved, it can now be offered at the purchase order stage,” he says. “When offering financing against approved invoices, banks are helping suppliers to access working capital facilities sooner, but they are financing transactions that are already complete – the physical transaction is over. The BPO is positioned as a tool that will extend opportunities for banks by enabling them to offer financing at the purchase order stage so that the supplier can receive pre-shipment or postshipment (pre-invoice approval) finance.” Schmand at Deutsche Bank also believes that the BPO is the most likely instrument to fill in the gaps when it comes to early financing. “It is certainly one of the best options,” he says. “The BPO combines the advantages of automation and digital processing with the security of letters of credit, and it is the combination of both that allows for more flexible financing, including pre-trade finance.” Although other instruments, most notably letters of credit, have enabled WWW.GTREVIEW.COM GTR SUPPLY CHAIN SCF SOLUTIONS “THE BPO DOES IMPROVE DATA SHARING AMONG BANKS BUT AS OF YET WE ARE NOT SEEING MANY CLIENTS DEMANDING SOLUTIONS BASED ON IT.” Bertrand de Comminges, HSBC André Casterman, Swift Ray Zabarte, RBS the provision of pre-shipment finance to suppliers to fund production in the past, the BPO offers a number of advantages over these traditional tools. As Casterman explains: the BPO does exactly the same as letters of credit – but much faster. “The BPO is most relevant to those corporates that want to accelerate processing,” he says. “Also, it does not require the extensive trade expertise that is needed to prepare traditional letter of credit documentation. It relies on the transmission of electronic data between two banks and this takes away the requirement placed on corporates to prepare trade documents. The complexity is on the bank side.” Sarjan at BofAML agrees that the BPO will support suppliers’ requirements for purchase order-based pre-shipment financing because it offers increased visibility into the purchase order and other relevant data, thereby providing additional comfort to the financing bank. Because the BPO flow can cover the end-to-end supply chain process from purchase order to settlement, “over time, banks will be better positioned to understand the suppliers’ relationship with the buyer and ensure that their ‘informed risk decisions’ are not based purely on supplier credit standing when extending pre-shipment finance”, he says. However, some banks believe that a number of issues must still be considered when securing the provision of early finance to suppliers using the BPO. At RBS, Ray Zabarte, head of trade services, global transaction services, acknowledges that there is an opportunity for banks to create new solutions around the BPO, but adds: “At the end of the day, banks still need to follow the basic rules of lending – they are taking a risk on a transaction and they need to look at who is ‘going to make good’ the debt created. The commitment of the buyer’s bank may be enough for a seller’s bank to release early finance, but it is still not clear at what stage in the cycle this will happen.” WWW.GTREVIEW.COM Buyers too must be certain they will receive the goods from their suppliers when arranging a BPO with their bank. “Before a bank issues a BPO for its client (the buyer), the bank would normally require the buyer’s indemnity so the buyer too must be certain that the seller will meet its obligations,” Zabarte explains. There are also some concerns over the relatively slow take-up of the BPO. “The BPO does improve data sharing among banks but as of yet we are not seeing many clients demanding solutions based on it,” says Bertrand de Comminges, global product head of structured solutions at HSBC. “What we are waiting for now with the BPO is demand from our client base. As a bank we are ready to adjust our operational model with new solutions that are centred on our clients’ needs.” E-bills of lading add speed While the BPO, once it becomes widely adopted, should help to secure time and cost savings over the use of traditional trade finance instruments, while also offering risk mitigation, another instrument that offers opportunities to improve efficiencies is the e-bill of lading. Casterman notes that it offers both speed and simplicity. “The e-bill of lading is all about accelerating the processing and dispatch of the documentation needed to enable banks to offer early finance to suppliers,” he says. However, while an e-bill of lading can help to mitigate risks, it does not eliminate them. “The e-bill of lading is considered as collateral by banks and can mitigate the risk involved when offering early financing. It serves as a document of title and, when held by a bank, is a proof of ownership – the bank owns the goods that are being shipped,” says Casterman. “However, while it serves as title documentation, it does not serve as assurance that the goods will be paid for, so a payment guarantee instrument, such as a letter of credit or the BPO, is still needed.” However, this does not mean that the e-bill of lading will not play a future role in the provision of finance. At Bolero, Paul Mallon, director of legal and regulatory affairs, believes that e-bills of lading can help to secure the financing offered to shipping companies. “Shippers with a steady and predictable flow of e-bills of lading could use those bills as collateral for a general facility,” he says. “This is, in part, because e-bills of lading are capable of being transferred very quickly. If a bank holds e-bills of lading covering sufficient value, it would then be able to enforce in the event of a shipper’s default.” He notes that, theoretically, the same result could be achieved using traditional paper bills of lading. “However, the slow movement of paper bills leads to inefficiencies, which could result in a negative operational impact,” he says. “The use of e-bills of lading allows for shippers (as beneficiaries) to get paid more quickly because the necessary documents are received sooner and payment can be processed at an earlier stage when compared with paper bills of lading.” Meanwhile, Zabarte believes that the issue of e-bills of lading could serve as security for a BPO. “Once an e-bill of lading, which serves as evidence of the goods having been loaded, is issued, then there should be no problems in enabling the data match under a BPO. Any earlier than that, the buyer must be satisfied with the various stages of the production process that have taken place to ascertain that the goods are on their way,” he says, pointing out that there is more scope for BPOs to be used to offer earlier finance to suppliers where a buyer has very tight control over its supply chain. “There will be product development by banks in this space [BPO] at some time in the future. I believe that the date on which an e-bill of lading is issued could serve as a hook or a point in time at which BPO data can be matched and early finance released.” MARCH/APRIL 2015 | 53 GTR SUPPLY CHAIN SCF SOLUTIONS EXTENDED SCF OPPORTUNITY SCF PROCESSES EXPLAINED PURCHASE ORDER PRODUCTION CERTIFICATES DELIVERY TRANSPORT DOCUMENTS INVOICE INVOICE ISSUANCE GOODS ACCEPTANCE INVOICE APPROVAL PAYMENT INITIATION PAYMENT Daniel Schmand, Deutsche Bank The role of electronic presentation The growing use of electronic platforms to transmit not only e-bills of lading but a range of trade documentation including letters of credit is expected to play a key role in speeding up the processes involved in securing the provision of early finance to suppliers. Schmand points out that, by enabling corporates and banks to dematerialise their workflow and send a set of documentation electronically, solutions such as Bolero’s document presentation application (e-Presentation) are facilitating the use of tools, which enable early access to financing. “Many of these tools work in tandem and all bring us closer to a more automated environment with optimum security and transparency,” he says. “In Asia, and other regions, we are increasingly seeing e-bills of lading used where all the parties – the buyer, suppliers and carrier – have access to an electronic platform for presenting documents electronically,” adds Sarjan. “In our experience, such arrangements are extremely beneficial for corporates in industries where just-in-time delivery of goods is imperative due to storage space constraints or the inherent nature of the goods traded.” However, there are still cost considerations when it comes to the use of electronic trade platforms. Sarjan believes that the entry/ subscription costs for platforms such as Bolero and essDOCS are a barrier for wider adoption by SME suppliers. “To date, electronic platforms continue to be most used by the largest 54 | GLOBAL TRADE REVIEW HIGHER RISK PAYMENT ASSURANCE & FINANCING SERVICES LOW RISK CURRENT SCF SCOPE “MANY OF THESE TOOLS WORK IN TANDEM AND BRING US CLOSER TO AN AUTOMATED ENVIRONMENT.” ORDERING (EARLY) PAYMENT SERVICES NO RISK Today’s SCF offerings start when invoices are approved whereas buyers and sellers need risk and financing services as soon as the PO is agreed corporates,” adds Casterman. “However, e-presentation as a solution is increasingly now being adopted by mid-caps too.” He acknowledges that all electronic platforms which enable the e-presentation of trade documents, including letters of credit, help corporates to accelerate the exchange of information, and work in a better way with their banks. “However, the BPO, which digitises information flows in the bank-to-bank space, offers a speed element. Where electronic platforms are used, they still need to be supported by a paper processes where a letter of credit is used.” Direct debit mandates When it comes to the provision of early access to finance for suppliers, there have also been suggestions that where buyers have set up direct debit mandates to pay their suppliers, this too could mitigate the risks banks face in making such funding available. This is particularly relevant today given the introduction of the Single Euro Payments Area (SEPA), which has led to the use of a standardised direct debit instrument – SEPA Direct Debit (SDD) – for crossborder payments across the euro area. The new payment instrument is expected to find increased traction in the business-to-business space, with some buyers opting to use it to make regular payments to their suppliers. Schmand points out that SEPA’s standardisation of formats has enabled various kinds of payments to be ‘bundled’ together, streamlining corporates’ workflows. “This enhanced integration reduces costs and possibilities for error for financing on both sides of the equation. SEPA harmonisation has given corporates improved access to lower cost financing – and further innovation may yet follow,” he says. “A SEPA Direct Debit Mandate is seen as part of an overall transaction,” adds de Comminges, noting that the existence of direct debit mandates has been taken into account by banks when rolling out receivables-based programmes. “SEPA has a real part to play in facilitating greater standardisation in the way payment data is shared between buyers, sellers and their banks.” Meanwhile, Casterman acknowledges that the direct debit instrument does ensure that payment will be made on a certain date, providing security to those suppliers that have agreements as longterm suppliers to buyers. However, it is unlikely to become a key payment tool that smaller SME suppliers will benefit from. “Direct debit mandates are most likely to be used where the supplier is the dominant party and the buyer has strong trust in the supplier – the buyer has no choice other than to accept the supplier’s terms for a direct debit mandate to be set up,” he says. “SMEs, which need early access to finance, do not have the force required to ask their clients to set up direct debit mandates.” For these reasons, he believes that direct debit mandates are most likely to be the preserve of very large utilities organisations and service providers such as insurance companies. “It is also very unlikely that these types of organisation will require early access to funds,” he explains. WWW.GTREVIEW.COM

© Copyright 2026