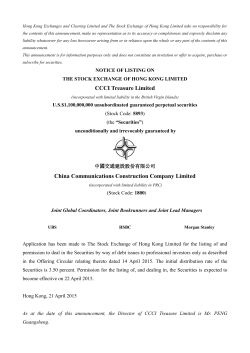

Preliminary Prospectus