Recurring Deposits Plan

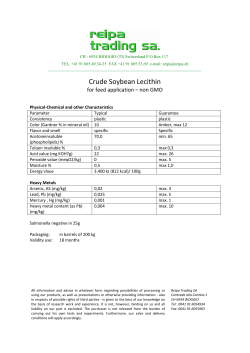

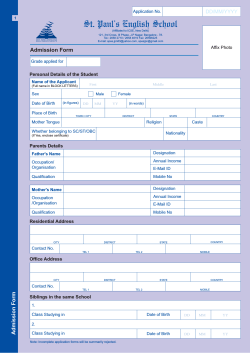

Credit Rating 'A A A' ‘FAAA’ & ‘MAAA’ rating affirmed for 20 consecutive years by CRISIL & ICRA respectively. RECURRING DEPOSITS (RD) PLAN (Maturity Value) (Fixed Rate Option) Period (Months) Rate of Interest (p.a.)* Maturity Value # ( ` ) 12 8.50% 12,553 24 8.50% 26,172 36 8.50% 40,950 * Interest is compounded annually on March 31. 48 8.50% 56,983 # Subject to (a) TDS where applicable (b) receipt of funds on 1st day of every month (c) Monthly Installment Amount ` 1000/- 60 8.50% 74,379 Period (Months) Rate of Interest (p.a.) 12 - 60 8.50% Minimum Monthly Savings Amount - ` 2000/- Product Features: ● ● ● ● Monthly Savings Plan: RD is a monthly savings plan where one can save as little as ` 2000 per month and accumulate a larger capital for future needs. Convenience: RD provides the convenience of ECS (Debit clearing) facility where the monthly savings amount is automatically transferred from the depositor’s bank account to the RD account every month on pre-determined dates. Flexibility: Depositor has the flexibility to choose any deposit period between 12 and 60 months to plan the future needs. Accumulation of interest: Interest will be accrued and credited (net of TDS) on 31st March every year. HOW TO OPEN THE ACCOUNT To open the account, one needs to submit the following • Deposit application form, along with KYC documents • Account Payee cheque for the initial monthly savings amount drawn in favour of HDFC Ltd. • ECS (debit clearing) Mandate for the subsequent deposit installments. Interest Rates are subject to change and the rate applicable would be the rate prevalent on the date of deposit. RATES EFFECTIVE FROM MAY 19, 2015 HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED Regd. Office: Ramon House, H T Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020. Phones: 022-67546060 (for Deposits only) Toll Free No. 1-800-22-2022 (From MTNL & BSNL Phones) CIN: L70100MH1977PLC019916 www.hdfc.com Our loan facilities : Housing loans, Home Improvement loans, Home Extension loans, Loans to Professionals and much more Terms & Conditions When the date of maturity falls on any day on which HDFC's office remains closed the repayment will be made on the next working day. Repayment of deposit will be made by crediting the amount directly to first depositor's bank account through NEFT. DEPOSIT CAN BE PLACED BY Resident Individuals and Hindu Undivided Family. This plan is available only at those centres where ECS/Debit Clearing facility is available. MODE OF ACCEPTANCE & OPERATION Resident Individuals can open the RD account by remitting the first month’s savings amount through an account payee cheque drawn in favour of HDFC Ltd, along with duly filled-in application form and ECS (debit clearing) Mandate. The subsequent month’s savings installments will be directly transferred through the ECS (debit clearing) system on predetermined dates every month as indicated in the application form/mandate. HDFC will issue a Deposit Receipt for the initial deposit amount at the time of opening the account indicating terms of the deposit. A consolidated statement of account giving details of all transactions will be sent annually as of 31st March. List of cities where ECS (debit-clearing) facility currently available is provided on the reverse of the ECS Mandate Form. Pre-determined date for installment payment 1st, 11th, 21st of every calendar month or next working day in case the date falls on any bank holiday or Sunday. INTEREST Fixed rate option: Interest rate under this plan would be fixed for the entire period of the deposit. Interest will be computed on each installment amount from the respective deposit date until March 31st / maturity date and credited (net of TDS, if any) to the deposit account. Interest for the subsequent year/s would be computed on the accumulated balance (principal and interest) as of March 31st until the next March 31st or maturity date whichever is earlier. DEDUCTION OF INCOME TAX AT SOURCE (TDS) Income tax will be deducted at source under Section 194A of the Income Tax Act, 1961, at the rates in force. If the depositor is not liable to pay income tax and the interest to be paid/credited in a financial year does not exceed the maximum amount which is not chargeable to income tax, the depositor may submit a declaration in Form No. 15G so that income tax is not deducted at source. In such cases, PAN (Permanent Account Number) must be quoted in Form 15G, else the form is invalid. Senior Citizens (60 years and above) may submit a declaration in Form No. 15H. Section 139A(5A) of the Income-tax Act, 1961 requires every person receiving any sum or income from which tax has been deducted to intimate his PAN to the person responsible for deducting such tax. Further, 139A(5B) requires the person deducting such tax to indicate the PAN on the TDS certificate. In case PAN is not mentioned, the rate of TDS would be 20% as per section 206AA(1) of the Income-Tax Act, 1961. In case of deposits of ` 50,000 and above, it is mandatory to furnish PAN. PREMATURE WITHDRAWAL Request for premature withdrawal may be permitted at the sole discretion of the Corporation only and cannot be claimed as a matter of right by the depositor, subject to the Housing Finance Companies (NHB) Directions, 2010 as applicable from time to time. Premature withdrawal will not be allowed before completion of 3 months from the date of deposit. In case of request for premature withdrawal after the expiry of three months, the rates given in the following table shall apply. Months completed from the date of deposit Rate of Interest Payable After 3 months but before 6 months The maximum interest payable shall be 4% per annum for individual depositor, and no interest in case of other category of depositors. The interest payable shall be 1% lower than the interest rate applicable for the period for which the deposit has run or if no rate has been specified for that period, then 2% lower than the minimum rate at which the public deposits are accepted by HDFC. The interest rate applicable for the period for which deposit has run would be considered as applicable on the respective interest reset dates. After 6 months but before the date of maturity The brokerage is paid upfront for the entire period of deposit to our authorised agent. In case of premature withdrawal the brokerage is payable for the period completed and excess brokerage paid will be recovered from the deposit amount. RENEWAL AND REPAYMENT OF DEPOSIT For renewal or repayment of deposit, the duly discharged deposit receipt must be surrendered to HDFC before the date of maturity. In case of renewal, the prescribed application form signed by all depositors is also required to be submitted simultaneously. NOMINATION FACILITY Individual depositor/s, singly or jointly, can nominate a single person under this facility. In case the deposit is placed in the name of a minor the nomination can be made only by a person lawfully entitled to act on behalf of the minor. Power of attorney holder or any person acting in representative capacity as holder of an office or otherwise cannot nominate. The nominee shall have the right to receive the amount due in respect of the deposit and payment by HDFC to the nominee shall constitute full discharge to HDFC of its liabilty in respect of the deposit. Nominees' name will be printed on the Fixed Deposit receipt, unless mentioned otherwise. 'KNOW YOUR CUSTOMER (KYC)' COMPLIANCE In terms of the Prevention of Money Laundering Act, 2002, the rules notified thereunder and KYC Guidelines issued by the National Housing Bank (NHB), every depositor is required to comply with the KYC requirements by submitting the following documents: a) Latest photograph b) Certified copy of the proof of identify c) Certified copy of the proof of address In case the depositor has already submitted the above documents in his earlier deposit, then he need not submit the above documents again, but has to provide the reference of his customer number or deposit number. GENERAL In the event of death of the first / sole depositor the repayment of deposit and payment of interest will be made to the joint depositor first in order of survivor/s / nominee on submission of death certificate without reference to the heirs and/or legal representatives of the deceased. Any discharge given by the first-named depositor for principal and/or interest will be valid and binding on all joint depositors. Deposits with HDFC are not transferable. Applications should be complete in all respects and HDFC has a right to accept or reject any application without notice, subject to the Housing Finance Companies (NHB) Directions, 2010. Shareholders, Home Loan customers, customers referred by staff and high value depositors may be offered an additional interest rate as decided by management from time to time. In case such deposits are generated through our authorised agents, commission on such deposits would be adjusted appropriately. The Corporation has been assigned a rating of 'FAAA' by CRISIL and 'MAAA' by ICRA for its fixed deposits. Total amount of exposure including the non-fund based facilities, to companies in the same group or other entities or business ventures in which directors and/or the Corporation are holding substantial interest as on March 31, 2014 was ` 13,744.66 crores. The deposits solicited by the Corporation are not insured. HDFC has a right to change, amend, add or delete the terms and conditions without notice, subject to the Housing Finance Companies (NHB) Directions, 2010, as applicable, from time to time. In case of any deficiency of the Corporation in servicing its deposits, the depositor may approach the National Consumers Disputes Redressal Forum, the State Level Consumers Disputes Redressal Forum or the District Level Consumers Dispute Redressal Forum for relief. In case of non-repayment of the deposit or part thereof in accordance with the terms and conditions of the deposit, the depositor may make an application to an authorised officer of the National Housing Bank. The financial position of the Corporation as disclosed and the representations made in the application form are true and correct and that the corporation and its Board of Directors are responsible for the correctness and veracity thereof. The deposit acceptance activities of the corporation are regulated by the National Housing Bank. It must, however, be distinctly understood that the National Housing Bank does not undertake any responsibility for the financial soundness of the Corporation or for the correctness of any of the statements or the representations made or opinions expressed by the Corporation, and for repayment of deposit/discharge of liabilities by the corporation. HDFC Deposits programme is designed in accordance with NHB Regulations with the objective to channelise resources for housing. FOR AUTHORISED AGENTS Agents are not authorised to accept cash from depositors or issue receipt on behalf of HDFC for deposits. Please ensure that your name and code number is clearly mentioned in the box provided in the Application Form to enable payment of brokerage. Application Forms received without your name and code number will not be considered for payment of brokerage. Ensure that Bank Mandate filled in by the depositor is dully filled in and signed by the depositor for remitting subsequent installments. The mandate form has to be attested by the depositor's bank and should be submitted to HDFC along with application for further action. Brokerage will be paid to Authorised Agents at the rate decided by the management. PROVISIONAL RECEIPT Date: _____________________ www.hdfc.com Received from _________________________________________________ cheque / HDFC Deposit Receipt No. __________________________________ for ` ________________ dated ___________ drawn on ________________________________________________ Bank _______________________ Branch for HDFC Recurring Deposits Plan (RDP) for a period of _____ months @ _______% per annum For HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED VALID SUBJECT TO REALISATION OF CHEQUE Authorised Signatory We also accept Deposits from Religious Trusts, Educational Institutions & Charitable Trusts "A LITTLE SAVING TODAY FOR A SECURE TOMORROW" HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED Regd. Office: Ramon House, H T Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020. CIN: L70100MH1977PLC019916 Agent’s Name: Code No.: www.hdfc.com APPLICATION FORM FOR RECURRING DEPOSITS (RD) PLAN PLEASE USE BLOCK LETTERS AND TICK ✓ IN APPROPRIATE PLACES (PREFERABLY IN BLACK INK) Date : __________________ Agents are not permitted to accept cash with application form and issue receipt. HDFC will in no way be responsible for such or other wrong tenders. I/We apply for opening a deposit account under Recurring Deposits Plan at Rate of Interest (On the date of opening deposit): Interest Rate Option : • Fixed Rate (for 12-36 Months) Member of public CATEGORY : STATUS: Resident Individual Branch for a period of months. % p.a. IGNORE if already submitted earlier • Variable Rate (for 48-72 Months) Share holder Affix a latest photograph. (DO NOT STAPLE) Director/Relative of Director Hindu Undivided Family DEPOSIT REPAYABLE TO: Employee First Depositor First Depositor or Survivor/s Date of Birth Gender Depositor's Name (in Block Letters) Compulsory M/F 1. First / Sole Guardian's Name (in case of Minor) 2. Second ADDRESS OF FIRST/SOLE DEPOSITOR Income-tax Permanent Account No. (PAN) for 1st Depositor : City: Pin: Tax to be deducted Yes No If No please furnish form no.15 G/H immediately. Email/SMS alerts for all transactions relating to my Mobile: deposit/s with HDFC may be sent to the following: E-mail: (Pan is compulsory on Form 15G or Form 15H) If ‘KNOW YOUR CUSTOMER (KYC)’ information is already submitted, Please Mention Your Customer Number for First Depositor: OR Kindly Submit Proof of Identity and Residence for our records. Proof of Identity (Submit ANY ONE of the following certified documents) Passport Photo PAN Card Voter's Identity Card Driving License Proof of Address (Submit ANY ONE of the following certified documents) Latest Telephone Bill UID / Aadhaar Card Latest Electricity / Gas Bill Latest Bank Account Statement Any other Identification with Photograph (Subject to satisfaction of HDFC) Registered Rent Agreement PAYMENT DETAILS Cheque No.: BANK DETAILS Bank Account No. Dated : MICR Code : Installment Amount Rs.: Name of the Bank : IFSC Code : Latest Demat Account Statement Ration Card Any other Address Proof (Subject to satisfaction of HDFC) Branch : The above Bank account information must match with the ECS (debit clearing) Mandate given to HDFC towards monthly contributions into the RD account. Also please note that HDFC will credit the repayment proceeds (including accumulated interest) to the above bank account upon the depositor submitting discharged receipt for the same. I/We hereby declare that the first named depositor is the beneficial owner of this deposit and as such he/she should be treated as the payee for the purpose of tax deduction under Section 194A of the Income Tax Act, 1961. I/We hereby agree to abide by the attached terms and conditions governing this deposit plan. I/We have gone through the financial and other statements/particulars/representations furnished/made by the Corporation and after careful consideration I/We am/are making the deposit with the Corporation at my/our own risk and volition. I/We further declare that, I/We am/are authorized to make this deposit and that the amount kept in the deposit is through legitimate source and does not involve directly or indirectly any proceeds of schedule of offence and/or is not designed for the purpose of any contravention or evasion of the provisions of the Prevention of Money Laundering Act, 2002 and any Rules, Regulations, Notifications, Guidelines or Directions thereunder, as amended from time to time. I/ We shall provide any further information and fully co-operate in any investigation as and when required by the Corporation in accordance to the applicable Law. I/We further affirm that the information/details provided by me/us is/are true and correct in all respect and nothing has been concealed. SIGNATURE OF DEPOSITOR(S) First/Sole/ Guardian : Second : ✄ ✄ MANDATE FORM FOR ECS (DEBIT CLEARING) I/We hereby, authorise HDFC Ltd. and their authorised service providers to debit my/our following bank account by ECS (Debit Clearing) for collection of RD monthly savings amount. Bank Name Branch Name Bank City Account Number Account Type 9 Digit MICR Code Savings Current (Please enter 9 digit number that appears after the cheque number) Accountholder Name as in Bank Account Name of the Scheme Date of Effect (Tick the date) Recurring Deposits Plan 1st 11th 21st Periodicity Amount of Installment Number of Installments Start Date* End Date Monthly *There should be a minimum gap of 20 days and a maximum of 50 days between the account opening date and the first installment of RD through ECS (Debit Clearing) I hereby declare that the particulars given above are correct and complete. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I would not hold the user institution responsible. I have read the terms and conditions of this product and shall abide by the same and agree to discharge the responsibility expected of me as a participant under the scheme. Account Holder's Signature/s (As in Bank Records) BANKER'S ATTESTATION (FOR BANK USE ONLY) Certified that the signature of account holder and the details of Bank account and its MICR code are correct as per our records. Ref No.: Signature of Authorised Official from Bank (Bank Stamp and Date) Bank Account Number FORM DA - 1 NOMINATION (Must be signed by the depositor(s) & witnessed) Nomination under Section 36B of the National Housing Bank Act 1987 and Rule 2(1) of the Banking Companies (Nomination) Rule 1985 in respect of HDFC deposits. I/We nominate the following person to whom in the event of my / our / minor's death the amount of this deposit may be returned by HDFC Ltd. and Nominees' name shall/shall not be printed on the Fixed Deposit receipt. Name of Nominee Flat No. & Bldg. Name Road No. / Name City Pin Code State Tel./Mobile Relationship with Depositor (if any) Age of nominee Date of Birth of nominee (if minor)* * As the nominee is a minor on this date, I/We appoint (Name, address & age) to receive the amount of the deposit on behalf of the nominee in the event of my / our / minor's death during the minority of the nominee. * Leave out if nominee is not a minor. Where deposits are made in the name of a minor, the nomination should be signed by a person lawfully entitled to act on behalf of the minor. Names and Addresses of witnesses for nomination. (Only in case of Thumb impression(s)) 1) SIGNATURE OF DEPOSITOR(S) FOR NOMINATION 2) Place & Date Place & Date Signature of witness(es) Signature of witness(es) SECOND : _______________________________ FOR OFFICE USE ONLY Deposit Receipt No. Stationery Serial No. Date of Receipt Date of Deposit Checked by Authorised by List of cities where ECS (debit clearing) facility is currently available Agra Ahmedabad Allahabad Amritsar Anand Asansol Aurangabad Belgaum Bengaluru Bijapur Bikaner Burdwan Chandigarh Chennai Coimbatore Cuttack Davangere Dehradun Gadag Gangtok Gorakhpur Gulbarga Guwahati Gwalior Haldia Hassan Hubli Jaipur Jalandhar Jammu Jamnagar Jamshedpur Jodhpur Kakinada Kanpur Kolhapur Ludhiana Madurai Mandya Mangalore Mumbai Mysore Nagpur Nashik Nellore Pune Raichur Raipur Rajkot Ranchi Salem Shillong Shimla Shimoga Tiruchirapalli Tirunelveli Tirupati Tirupur Thrissur Tumkur Udaipur Udupi Vadodara Bhavnagar Bhilwara Bhopal Bhubaneshwar Dhanbad Durgapur Ernakulum Erode Hyderabad Imphal Indore Jabalpur Kolkata Kota Kozhikode Lucknow New-Delhi Panaji Patna Puducherry Sholapur Siliguri Surat Thiruvananthapuram Varanasi Vijayawada Visakhapatnam G146/05/15/25 FIRST/SOLE/ GUARDIAN : _______________________________ (d) Brief particulars of the management of the Corporation: PAR TICULARS AS REQUIRED UNDER NON BANKING FINANCIAL PARTICULARS ANIES AND MISCELLANEOUS NON BANKING COMP ANIES COMPANIES COMPANIES COMP (ADVER TISEMENT) RULES 1977. (ADVERTISEMENT) HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED Registered Office: Ramon House, H T Parekh Marg, 169, Backbay Reclamation, Churchgate, Mumbai 400 020. Corporate Office: HUL House, H T Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai 400 020. Deposit Centre: Mistry Bhavan, 122, Backbay Reclamation, Churchgate, Mumbai 400 020. Phones: 67546060 (for Deposits only), 66316000, 22820282. Fax: 22821366. (a) Name of the Company: HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED (HDFC) (CIN: L70100MH1977PLC019916) (b) Date of Incorporation: October 17, 1977 The Corporation is managed by the Board of Directors comprising of eminent persons with wide experience and knowledge. Subject to superintendence, direction and control of the Board of Directors, substantial powers of management are vested in three of its Executive Directors, viz., Mr. Keki M Mistry, Vice Chairman & Chief Executive Officer, Ms. Renu Sud Karnad, Managing Director and Mr. V. Srinivasa Rangan, Executive Director. (e) Names, addresses and occupations of the Directors: NAME ADDRESS OCCUPATION Mr. Deepak S. Parekh (Chairman) Housing Development Finance Corpn. Ltd., Ramon House, H. T. Parekh Marg, 169, Backbay Reclamation, Mumbai 400 020. Bansi S Mehta & Company, Chartered Accountants, Merchant Chamber, 41, New Marine Lines, Mumbai 400 020. Flat No. 5, Priya Co-op. Hsg. Soc. Ltd, 9, Khan Abdul Gaffar Khan Road, Worli Sea Face, Mumbai 400 030. The Peerless General Finance and Investment Co. Ltd. Anuj Chambers, 24B Park Street, 5th Floor, Kolkata 700 016. Bldg No.17, Flat No.31, MHB Colony, Opp Lilavati Hospital, Bandra Reclamation, Bandra (W), Mumbai 400 050. Flat No. 2102, Planet Godrej Aqua Tower II, K K Marg, Jacob Circle, Mahalaxmi, Mumbai 400 011. Development Credit Bank Limited, Peninsula Business Park, Tower A, 6th Floor, Senapati Bapat Marg, Lower Parel, Mumbai 400 013. 4, Babar Road, Near Bengali Market, New Delhi 110 001. 7 Beldih Lake, Northern Town, Jamshedpur, Jharkhand 831 001 Housing Development Finance Corpn. Ltd., Ramon House, H. T. Parekh Marg, 169, Backbay Reclamation, Mumbai 400 020. Housing Development Finance Corpn. Ltd., The Capital Court, Munirka, Outer Ring Road, Olof Palme Marg, New Delhi 110 067. Housing Development Finance Corpn. Ltd., Ramon House, H. T. Parekh Marg, 169, Backbay Reclamation, Mumbai 400 020. Professional Director Mr. B. S. Mehta Mr. D. M. Sukthankar Mr. D. N. Ghosh (c) Business carried on by the Company and its subsidiaries with details of branches: HDFC is a public limited company primarily engaged in the business of providing housing finance by creating an institutional facility for meeting the needs of people for long-term finance for purchase/construction of residential houses anywhere in India. The Corporation has fifteen wholly owned and nine other subsidiaries viz.: l HDFC Developers Limited carries on the business of real estate development l HDFC Investments Limited carries on the business of investments in stocks, shares, debentures and other securities l HDFC Holdings Limited carries on the business of investments in stocks, shares, debentures and other securities l HDFC Trustee Company Limited acts as a Trustee for HDFC Mutual Fund l HDFC Realty Limited is engaged in the business of real estate broking and related services l HDFC Ventures Trustee Company Limited acts as a Trustee for HDFC Property Fund l HDFC Property Ventures Limited is engaged in advisory services l HDFC Sales Private Limited acts as a distributor of home loans and other financial products l HDFC Education and Development Services Private Limited is engaged in the provision of education services l Windermere Properties Private Limited is engaged in monetising value of properties owned l Grandeur Properties Private Limited is engaged in monetising value of properties owned l Winchester Properties Private Limited is engaged in monetising value of properties owned l Pentagram Properties Private Limited is engaged in monetising value of properties owned l Haddock Properties Private Limited is engaged in monetising value of properties owned l HDFC Venture Capital Limited carries on the business of managing HDFC Property Fund l HDFC Standard Life Insurance Company Limited is engaged in the business of life insurance l HDFC ERGO General Insurance Company Limited is engaged in the business of general insurance l HDFC Asset Management Company Limited carries on the business of managing Mutual Fund schemes l GRUH Finance Limited is engaged in the business of providing housing finance l Griha Investments, (Mauritius) a wholly owned subsidiary of HDFC Holdings Limited acts as an investment manager to HI-REF International LLC and its subsidiaries in Mauritius l Credila Financial Services Private Limited is engaged in providing education loan for higher studies l HDFC Pension Management Company Limited, a wholly owned subsidiary of HDFC Standard Life Insurance Company Limited acts as a pension fund manager l Griha Pte. Limited, a wholly owned subsidiary of HDFC Investments Limited carries out private equity asset/fund management/investment advisory services l H T Parekh Foundation, a not for profit company licensed under section 25 of the Companies Act, 1956. The Corporation has Branch Offices/Service Centers at the following places: AGRA Tel: 0562-2526769/70. AHMEDABAD (Navrangpura) Tel: 079-66307000. Extn. 110 (for Deposits Only). AHMEDABAD (Maninagar) Tel: 64501855. AHMEDABAD (Satellite) Tel: 079-64501864. AHMEDNAGAR Tel: 0241-6605222. AJMER Tel: 0145-5120888 (for Deposits Only), 5120888, 2433392. AKOLA Tel: 0724-2442454, 2430244. ALWAR Tel: 0144-2702739. ALLAHABAD Tel: 0532-2260325. AMBALA Tel: 0171-2630880, 2630711. AMRAVATI Tel: 0721-2666009/987. AMRITSAR Tel: 0183-5010512, 2500851. ANAND Tel: 02692-255514/7. ANKLESHWAR Tel: 02646-227771/2. AURANGABAD Tel: 0240-6616503 (for Deposits Only), 6616510, 6616500. BAREILLY Tel: 0581-2477496. BEAWAR Tel: 01462-251691, 513888, 513788. BELGAUM Tel: 0831-2427091-93. BENGALURU (Kasturba Road) Tel: 080-41183213 (for Deposits Only), 41183000, 41183232. BENGALURU (Rajaji Nagar) Tel: 080-23506416/17/46. BENGALURU (Electronic City) Tel: 9900950600. BENGALURU (Jayanagar) Tel: 080-26653336 (for Deposits Only), 26544471. BENGALURU (Koramangala) Tel: 080-25501089 (for Deposits Only), 25633478. BENGALURU (Marathahalli) Tel: 080-41183000/25400232. BENGALURU (Sahakaranagar) Tel: 080-23626361/62. BHARUCH Tel: 02642-238444, 238555. BHATINDA Tel: 0164-501 2218-19. BHILAI Tel: 0788-4040840/1. BHILWARA Tel: 01482-232901/2 (for Deposits Only), 232902. BHIWADI Tel: 01493-512739, 512849. BHOPAL (MP Nagar) Tel: 07554047700 (for Deposits Only), 4277772, 4273330. BHOPAL (Kamla Bhawan) Tel: 0755-4229990. BHUBANESWAR Tel: 0674-2531350 (for Deposits Only), 2395060. BHUBANESWAR (Patia) Tel: 0674-2726724/8/9. BIKANER Tel: 0151-5130716, 5130715. BILASPUR Tel: 7752-432301/2/3. BULDHANA Tel: 07262-246301/2. CALICUT Tel: 0495-2367656/7. CHANDIGARH Tel: 0172-3011324 (for Deposits Only), 3989123, 3011300. CHANDRAPUR Tel: 07172-271563-5. CHENNAI (Anna Salai) Tel: 044-28599322/52 (for Deposits Only), 28599300. CHENNAI (Adyar) Tel: 044-23452003. CHENNAI (Anna Nagar) Tel: 044-23451998/1999. CHENNAI (Kodambakkam) Tel: 044-23454008 (for Deposits Only), Tel: 24815656, 24815005. CHENNAI (OMR) Tel: 044-23454004/4003. CHENNAI (Porur) Tel: 044-24764071, 24764081. CHENNAI (Tambaram) Tel: 044-23454001-05. CHENNAI (Velacherry) Tel: 044-2246 3711/2246 3712. CHENNAI (DLF IT Park) Tel: 044-22520635, 22520735. CHENNAI (Egmore) Tel: 044-2345 2070/71. CHENNAI (Ambattur) Tel: 044-2345 2077/2078/2079. COIMBATORE (Kamaraj Road) Tel: 0422-4343913 (for Deposits Only), 4301100. COIMBATORE (NSR Road) Tel: 0422-4399881/2. COIMBATORE (Ganapathy Sathy) Tel: 0422-4200211/4200311. CUTTACK Tel: 0671-2332109 (for Deposits Only), 2332061, 2332093. DEHRADUN (Rajpur Road) Tel: 0135-3052222/58 (for Deposits Only), 6672222, 18604204222. DEWAS Tel: 07272-254550, 404285. DHULE Tel: 02562-273500. DURGAPUR Tel: 0343-2549776 (for Deposits Only), 2549778. ERODE Tel: 0424-2240928/29. FARIDABAD Tel: 0129-2226912/6. GANDHIDHAM Tel: 02836-228704/5. GANDHINAGAR Tel: 079-65727261/2/3. GHAZIABAD (Lohia Nagar) Tel: 0120-2721446, 2723116. GHAZIABAD (Vaishali) Tel: 0120-4233253-54. GOA Tel: 0832-2234172 (for Deposits Only), 2234 172. GORAKHPUR Tel: 0551-3248100. GULBARGA Tel: 08472241966. GUNTUR Tel: 0863-2217538/2268628. GURGAON (Mehrauli-Gurgaon Road) Tel: 0124-4061772-3, 4060961. GURGAON (Sector 14) Tel: 0124-4367801/2. GUWAHATI (Six Mile) Tel: 0361-2360063. GUWAHATI (Chenikuthi) Tel: 0361-6118888 (for Deposits Only). GWALIOR Tel: 07514011970/1/3. HALDWANI Tel: 05946-311000. HARIDWAR Tel: 01334-324100, 265325. HISAR Tel: 01662-313106. HOSUR Tel: 04344-244888/247444. HUBLI Tel: 0836-2356345. HYDERABAD (Basheer Bagh) Tel: 040-67699040 (for Deposits Only), 66475001 (10 lines). HYDERABAD (Dilsukhnagar) Tel: 040-24540845/47. HYDERABAD (Gachibowli) Tel: 040-23006347, 23006348. HYDERABAD (Kukatpally) Tel: 040-64632500 (for Deposits Only), 23155944. HYDERABAD (Panjagutta) Tel: 040-67699101 (for Deposits Only), 23414855/6. SECUNDERABAD (Tarnaka) Tel: 040-27014041, 27006950. INDORE (M G Road) Tel: 0731-4252432 (for Deposits Only), 4223300, 4433333. INDORE (Vijay Nagar) Tel: 0731-4756400-10. INDORE (Prabhu Nagar) Tel: 0731-4028222. IRINJALAKUDA Tel: 0480-2821589. JABALPUR Tel: 0761-4092000. JAIPUR (Ashok Marg) Tel: 0141-5150804/05 (for Deposits Only), 5150888, 2377171-3. JAIPUR (Jagatpura) Tel: 0141-5141888, 5141015, 5141017. JAIPUR (Mansarovar) Tel: 0141-2781981, 2780989. JAIPUR (Vaishali Nagar) Tel: 0141-5110410, 5110411. JALANDHAR Tel: 0181-2277444/45/46. JALGAON Tel: 0257-2220762. JAMMU Tel: 01912477707/08 (for Deposits Only), 2477709. JAMNAGAR Tel: 0288-6450156, 6450158. JAMSHEDPUR Tel: 0657-2428733/2424518 (for Deposits Only), 2756517, 6458733. JHANSI Tel: 0510 -3290532. JODHPUR Tel: 0291-5134888, 2644448, 2644449. KAKINADA Tel: 0884-6568002/3. KANHANGAD Tel: 0467-2200 599/699. KANNUR Tel: 0497-2765850. KANPUR Tel: 0512-2306744/60 (for Deposits Only), 3259998, 2306744. KARNAL Tel: 0184-645 1231-32. KOCHI (M. G. Road) Tel: 0484-3011228/32 (for Deposits Only), 3011200. KOCHI (Aluva) Tel: 0484-2629575/4456999. KOCHI (Kakkanad) Tel: 0484-2415555, 6493030. KOCHI (Palarivattom) Tel: 0484-2803043, 2803082. KOLHAPUR Tel: 0231-2664034/ 2664035. KOLKATA (Jeevandeep) 23215060, 23018 300, 22886256, 22884645. KOLKATA (Behala) Tel: 033-24468392. KOLKATA (Chandannagore) Tel: 033 – 26830059/64589933. KOLKATA (Cooke and Kelvey) Tel: 033 – 66086200 (for Deposits only). KOLKATA (Garia) Tel: 033-24351082, 24357011. KOLKATA (Salt Lake City) Tel: 033-23215949, 23217009. KOLLAM Tel: 0474-3255000, 2762551/2. KOTA Tel: 0744-2436981 (for Deposits Only), 2436981, 2436982. KOTTAYAM Tel: 0481-2304985, 2566136. LUCKNOW (Ashok Marg) Tel: 0522-3982623 (for Deposits Only), 3989123. LUCKNOW (Aliganj) Tel: 0522-2763494 (for Deposits Only), 3263952, 2745249. LUCKNOW (Gomti Nagar) Tel: 0522-2303770. LUDHIANA (Pakhowal Road) Tel: 0161-2429856, 5025184. LUDHIANA (Chandigarh Road) Tel: 0161-2680043, 2680045. MADURAI Tel: 0452-2350720. MALAPPURAM Tel: 0483-2738873/4. MANGALORE Tel: 0824-2445220. MATHURA Tel: 0565-2420116, 2420117. MARTHANDAM Tel: 04651-271744, 272744. MEERUT 4058791/2/3/4. MEHSANA Tel: 02762-654001/02. MOGA Tel: 01636-509020-21. MOHALI Tel: 0172-2220116, 2220130, 2225774. MORADABAD Tel: 0591-2485100. MUMBAI (Churchgate) Tel: 022-67546060 (for Deposits Only) 66316000, 22820282. MUMBAI (Andheri East) Tel: 022-26839958/60 (for Deposits Only), 26830048/ 49/50. MUMBAI (Andheri West) Tel: 022-26733981-3. MUMBAI (Andheri-Kurla Road) Tel: 022-28304251-3. MUMBAI (Bandra – Kurla Complex) Tel: 022-26500951/52/53. MUMBAI (Borivali-Ramdas Sutrale Marg) Tel: 022-2893 7152/55, 28907153. Mumbai [Borivali-L T Road (Deposits)] Tel: 022-28937000, 28937001. MUMBAI (Chembur) Tel: 022-25291188/8838. Mumbai [Dadar (Investor Services Dept.)] Tel: 022-61413902 (for Deposits Only), 24146267/68, 61413900. MUMBAI [Ghatkopar (Deposits)] Tel: 022-25011284. Mumbai (Goregaon) Tel: 022-67546111. Mumbai (Goregaon – East) Tel: 022-28497102/3, 28497104/5. MUMBAI (Lower Parel) 6620 0000. MUMBAI (Malad) Tel: 022-28813676 (for Deposits Only), Tel: 022-65990488/89/ 90. MUMBAI (Mira Road) Tel: 022-65990265/66/67. MUMBAI (Mulund) Tel: 022-25675733 (for Deposits Only), 022-25655633/ 733. MUMBAI (Parel – Credit Risk Management) Tel: 022-66113033/34 (for Deposits Only), 66113000. MUMBAI (Vikhroli) Tel: 022-25186624/25/26. MUMBAI (Virar) Tel: 0250-2511654-6. AMBERNATH Tel: 0251-2603168/9. BOISAR Tel : 02525-645435, 645433. DOMBIVALI Tel: 0251-2861473 (for Deposits Only), 0251-2861473/74. KALYAN Tel: 0251-2201580/3. THANE (Gokhale Road) Tel: 022-65288415 (for Deposits Only), 25451114-6. THANE (Vikas Complex) Tel: 022-25471568/70. VASHI (Navi Mumbai) Tel: 022-27892911 (for Deposits Only), 65165201-4. KOPARKHAIRANE (Navi Mumbai) Tel: 022-27550615-18. SEAWOODS (Navi Mumbai) Tel: 022-27718787, 27718789. NEW PANVEL Tel: 022-65166242/3/4. MUVATTUPUZHA Tel: 0485-2833533. MYSORE Tel: 0821-2545614, 2545615. NAGERCOIL Tel: 04652-325500, 237192/93, 227044. NAGPUR (Civil Line) Tel: 0712-6620518 (for Deposits Only), 2566000, 2527888, 2522123. NAGPUR (Kadbi Chowk) Tel: 0712-2542918. NAGPUR (Khamla Ring Road) Tel: 0712-2289220. NASHIK (Sharanpur Link Road) Tel: 0253-6606808 (for Deposits Only), 6606000. NASHIK (Indira Nagar) Tel: 0253-6611938, 6611939. NASHIK (Panchavati) Tel: 0253-6452177. NASHIK ROAD Tel: 0253-2459925/26 (for Deposits Only), 2459924, 2459925. NELLORE Tel: 0861-2302347. NEW DELHI (Munirka) Tel: 011-41596618 / 19 / 70 (for Deposits Only), 41115111. NEW DELHI (Dwarka) Tel: 011-45572405, 45572406. NEW DELHI (Lodhi Road) Tel: 011-43792100, 24601574, 24601577, 24643755. NEW DELHI (Netaji Subhash Place) Tel: 011-47292032/33/34. NEW DELHI (Vikas Puri) Tel: 011-28540989/90. NEW DELHI (Connaught Place) Tel: 011-41514836 (for Deposits only), 011-41514836. NOIDA Tel: 0120-4351299/ 302/303/304. NOIDA (Sector 62) Tel: 0120-2405501, 2405502. PALAKKAD Tel: 0491-2536481/2. PANCHKULA Tel: 0172-2556464/2556426. PATIALA Tel: 0175-2209273, 5002786. PATHANKOT Tel: 0186-2230452, 2220453. PATHANAMTHITTA Tel: 0468-2271372. PATNA Tel: 0612-6458889/2501194 (for Deposits Only), 2502522-23. PITHAMPUR Tel: 07292-252127, 400964. PUDUCHERRY Tel.: 0413-2205421/2205431. PUNE (University Road) Tel: 020-25505121/22 (for Deposits Only), 25505000. PUNE (Baner) Tel: 020-66057077/78. PUNE (Camp) Tel: 020-26351738, 26348602. PUNE (Chinchwad) Tel: 020-27371736, 27370219. PUNE (Hadapsar-Magarpatta City) Tel: 020-26898395, 26898412. PUNE (Kothrud) Tel: 020-25453592/3. PUNE (Nagar Road) Tel: 020-26685258, 26699149. PUNE (Sinhagad Road) Tel: 020-24350084/24350151. RAJAHMUNDRY Tel: 0883-6578181. RAIPUR Tel: 0771-4243100 (for Deposits Only), 4243110-25. RAJKOT Tel: 0281-6641147/6 (for Deposits Only), 2472337/8. RANCHI Tel: 0281-2331055/ 09431389684 (for Deposits Only), 2331055, 2330823. RATLAM Tel: 07412-406666. RATNAGIRI Tel: 02352-224022, 224023. REWARI Tel: 1274-22112/3. ROHTAK Tel: 01262-255467/8/9. ROPAR Tel: 01881-224986, 226986. ROURKELA Tel: 0661-2401061/60. RUDRAPUR Tel: 05944-244422, 606888, 18604204222. SAGAR Tel: 07582-406093/227503. SALEM Tel: 0427-2314486/7. SAHARANPUR Tel: 0132-2760200. SANGLI Tel: 0233-2329892/3. SATARA Tel: 02162-226400, 227901. SILIGURI Tel: 0353-2640716. SHIMLA Tel: 0177-2626711. SOLAPUR Tel: 0217-2316804/5. SURAT (Adajan) Tel: 0261-6711933/35 (for Deposits only), 6711800. SURAT (Majura Gate) Tel: 0261-2479371, 2475954. SURAT (City Light) Tel: 0261-2213201/2. TIRUPATI Tel: 0877-6645833, 6645834. THIRUVALLA Tel: 0469-2600051. THIRUVANANTHAPURAM (Vazhuthacaud) Tel: 0471-3020300/2324224 (for Deposits Only), 3255000, 2325731. THIRUVANANTHAPURAM (Technopark) Tel: 0471-2700701. THIRUVANANTHAPURAM (Kazhakuttam) Tel: 0471-2417708. THIRUVANANTHAPURAM (Mavelikkara) Tel: 0479-2344411/2. THRISSUR Tel: 0487-2389790/1/2. TIRUCHIRAPALLI Tel: 04312412744, 2414744. TIRUNELVELI Tel: 0462-3255000, 2577822/833. TIRUPPUR Tel: 0421-4242901-2. TUTICORIN Tel: 0461-3255000, 2300707/807. UDAIPUR Tel: 0294-5100850 (for Deposits Only), 5100840/50. UJJAIN Tel: 0734-4010222. VADODARA (Race Course) Tel: 0265-2356837 (for Deposits Only), 2308400, 2356397, 2320240. VADODARA (Waghodia Road) Tel: 0265-2514164, 2512364. VAPI Tel: 0260-2462573/93. VARANASI Tel: 05422420485/86. VIJAYAWADA Tel: 0866-2483262. VISAKHAPATNAM Tel: 0891-2552876. YAMUNA NAGAR Tel: 01732-320547. International offices: DUBAI Tel: +971-4-3961825. LONDON Tel: + 44 (0) 20 7872 5545, + 44 (0) 20 7872 5547 and + 44 (0) 20 7872 5542. SINGAPORE Tel: + 65 65367000. Dr. S. A. Dave Dr. Ram S. Tarneja Mr. Nasser Munjee Dr. Bimal Jalan Dr. J. J. Irani Mr. V. Srinivasa Rangan (Executive Director) Ms. Renu Sud Karnad (Managing Director) Mr. Keki M. Mistry (Vice Chairman & Chief Executive Officer) Practising Chartered Accountant Professional Director Professional Director Professional Director Management Professional Professional Director Professional Director Professional Director Company Executive Company Executive Company Executive (f & g) Profits and Dividends: Financial Year Ended 31.03.2014 31.03.2013 31.03.2012 Profit before tax (` in crores) 7,440.24 6,572.84 5,665.62 Equity Dividend Per share ((`)) 14.00* 12.50 11.00 Profit after tax (` in crores) 5,440.24 4,848.34 4,122.62 * Subject to Shareholders’ approval. (h) Summarized financial position of the Corporation as in the two audited balance sheets immediately preceding the date of advertisement: (` in crores) As at March 31, 2014 Liabilities Paid-up Equity Share Capital 312.10 Reserves and Surplus 27,643.09 Secured Loans 1,10,186.37 Unsecured Loans 41,208.32 Current Liabilities and Provisions 46,407.51 Total 2,25,757.39 Assets Loans 1,96,554.39 Fixed Assets 280.48 Investments 13,912.65 Current Assets, Loans and Advances 14,380.00 Deferred tax asset 629.87 Total 2,25,757.39 As at March 31, 2013 309.27 24,520.94 90,871.77 67,956.34 11,702.64 1,95,360.96 1,69,570.84 237.94 13,613.46 11,307.34 631.38 1,95,360.96 Brief particulars of Contingent Liabilities: Contingent liabilities in respect of guarantees provided by the Corporation is ` 435.26 crores (Previous year ` 203.00 crores), in respect of income tax demands, net of amounts provided for and disputed by the Corporation is ` 919.19 crores (Previous year ` 818.73 crores), in respect of corporate undertakings provided for securitisation of receivables ` 1,943.05 crores (previous year ` 1,939.31 crores) and in respect of disputed dues towards sales tax, wealth tax, interest on lease tax, and payments towards employer’s contribution to ESIC not provided for by the Corporation, amounts to ` 0.15 crores (Previous year ` 0.15 crores). (i) The amount of Public Deposits which the Corporation can raise under the Housing Finance Companies (NHB) Directions, 2010 is equivalent to 5 times of the net owned funds i.e. ` 1,01,425.40 crores whereas the total Public Deposits as on March 31, 2014 was ` 41,551.16 crores. The amount of aggregate deposits, including Public Deposits, which the Corporation can raise is 16 times of the net owned funds i.e. ` 3,24,561.28 crores whereas the aggregate deposits as on March 31, 2014 was ` 1,84,740.65 crores. (j) There are no overdue deposits other than unclaimed deposits. (k) We declare that: i) The Corporation has complied with the provisions of the Directions as applicable to it; ii) The compliance with the said Directions does not imply that repayment of deposits is guaranteed by the Reserve Bank of India and the National Housing Bank. iii) The deposits accepted by the Corporation are unsecured and rank pari passu with other unsecured liabilities, save and except the floating charge created on the statutory liquid assets maintained in terms of sub-sections (1) & (2) of Section 29B of the National Housing Bank Act, 1987, as may be prescribed by NHB, from time to time. The Corporation is having a valid Certificate of Registration dated 31-07-2001 issued by the National Housing Bank (NHB) under Section 29A of the National Housing Bank Act, 1987. However, the NHB does not accept any responsibility or guarantee about the present position as to the financial soundness of the Corporation or for the correctness of any of the statements or representations made or opinion expressed by the Corporation and for repayment of deposits/ discharge of liabilities by the Corporation. The above text has been approved by the Board of Directors at its meeting held on May 6, 2014 and is being issued on the authority and in the name of the Board of Directors of the Corporation and a copy signed by all Directors of the Corporation has been filed with the National Housing Bank, New Delhi. By Order of the Board Sd/Date: May 6, 2014 GIRISH V. KOLIYOTE Place: MUMBAI Company Secretary

© Copyright 2026