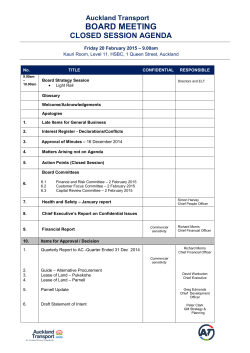

here - HGT Law