Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

Interlinked Contracts: An Empirical

Study

Hui-wen Koo, Chen-ying Huang and

Kamhon Kan

March 26, 2015

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Conclusions

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Interlinkage is a contractual arrangement between

two parties that combines transactions across

multiple markets.

Example prevalent in a developing country:

◮

◮

◮

A monopsonist middleman buys crops from a

farmer at price P .

The middleman also provides the farmer a

production loan with interest rate i.

The middleman will decide {P, i}.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Conclusions

Definition of interlinkage

◮

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

Q: Why should the middleman offer a loan to his

farmers? What is the interest rate, i, the

middleman will charge?

Traditional wisdom: i is a usurious rate

Gangopadhyay and Sengupta (1987):

i ≤ the middleman’s cost of capital

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

Gangopadhyay and Sengupta (1987):

◮

◮

L: production loan a farmer takes

f (L): an increasing and concave production

function

Given the middleman’s terms {P, i}, the farmer

will decide how much to borrow:

maxL πf = P f (L) − (1 + i)L.

F OC : f ′(L) = (1 + i)/P

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

The middleman sells crops in a competitive market

at price v, and his cost of capital is r. He wishes to:

max{P,i} πm = vf (L) − (1 + r)L − P f (L) + (1 + i)L

s.t. f ′ (L) = (1 + i)/P (IC)

P f (L) − (1 + i)L ≥ A (IR),

where A is the farmer’s opportunity cost.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

The middleman’s optimal strategy:

◮

Choose {P, i} to induce the farmer to borrow L

so that the joint surplus,

S(L) ≡ πf + πm = vf (L) − (1 + r)L,

is maximized.

◮

Then suppress the farmer’s profit, πf , to his

opportunity cost, A.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

To achieve the maximum joint surplus S ∗, the

optimal L∗ satisfies:

f ′ (L∗) = (1 + r)/v,

while the IC constraint is:

f ′ (L∗) = (1 + i)/P.

Any {P, i} satisfying

(1+i)/P = (1+r)/v or P/v = (1+i)/(1+r) ≡ α.

yields the maximum joint surplus.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

The farmer’s share of surplus is:

πf /S ∗ = (P f (L∗)−(1+i)L∗)/(vf (L∗)−(1+r)L∗) = α.

To choose α = A/S ∗ makes the farmer receives A.

In sum, in the optimal interlinked contracts,

P/v = (1 + i)/(1 + r) = A/S ∗.

The middleman will provide loan to the farmer only

when the farmer’s opportunity cost is less than the

maximal joint surplus. So, A/S ∗ ≤ 1 and it implies

that i ≤ r.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

It is difficult to collect the terms of trade

between the middleman and the farmer.

This paper uses the contracts between Taiwanese

cane farmers and Japanese sugar mills in the

colonial era to test the theory, because the

situation fits the theory’s framework.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

Each sugar mill was a monopsonist in its local

region thanks to regulation. Before the planting

season, mills would announce their future

contracts for cane. Considering the terms,

farmers were free to choose cane or other crops

to plant.

Most sugar produced in Taiwan was exported to

Japan, where the Japanese and other foreign

manufacturers competed to sell it.

Mills provided their cane farmers with loans.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

300

250

sum

200

150

fertilizers

100

working capital

50

others

seeds

9

0

8

1

9

3

9

/4

8

/3

7

/3

9

3

9

3

1

1

6

7

6

/3

5

/3

9

3

9

3

1

1

4

5

4

/3

3

/3

9

3

9

3

1

1

2

3

2

/3

1

/3

9

3

9

3

1

1

0

1

0

/3

9

/3

9

3

9

2

1

1

8

9

9

2

8

/2

7

/2

1

9

2

6

/2

9

2

1

1

6

7

5

9

2

1

9

2

5

/2

4

4

/2

1

1

9

2

3

/2

3

2

/2

9

2

1

9

2

1

1

9

2

0

/2

1

/2

1

2

0

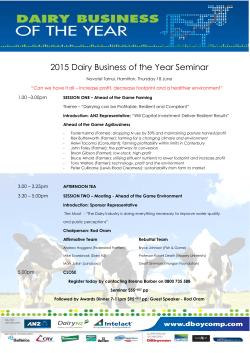

Figure: Average Loan (yuan/chia)

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

We have to modify the model to fit the data.

◮

◮

◮

Price discrimination between paddy farmers (rice

growers) and dry-field farmers (potato growers)

because of their different opportunity costs to

plant cane (A1 < A2 ).

The interest rate was not differentiated among

farmers. Otherwise farmers qualifying for the

lowest rate would borrow and then transfer their

loans to other farmers.

A mill’s contract is: {i, P1, P2 }.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

1.2

village credit unions’ average

1

mills’ average

0.8

0.6

0.4

0.2

0

1930/31

1931/32

1932/33

1933/34

1934/35

1935/36

1936/37

1937/38

1938/39

1939/40

Figure: Monthly Interest Rate (%)

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

v/P2 > (1 + r)/(1 + i)?

1930/31 橋仔頭, units = yuan/1000gin

Ps = 121.7 (the 1928 future price of sugar)

c = 25.58 (production cost)

φ = 0.1519 (the conversion ratio)

v = (Ps − c)φ = 14.6

P2 = 5

For r < 192%, the inequality holds only if i < 0.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

Why not negative interest rate?

Loans on fertilizers were probably interest free.

While the stated interest rate was said clearly to

apply to loans on working capital and tenants’

rent payments, no contract ever discussed how to

calculate interest payments for fertilizer loans.

《農業基本調查書》: 28.98% of mills’ loans were

free of interest.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

All contracts stated that fertilizer loans were

given out in-kind, and mills would charge farmers

no more than the cost.

1930/31 台東, the aboriginal cane farmers

received 20% of their ammonium sulfate and

50% of their calcium superphosphate for free.

This in fact made interest rates negative.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

Working capital loans, unlike fertilizer loans, were

lent in cash. If working capital loans were free of

interest, or if the mill subsidized working capital

loans, farmers would be induced to borrow to

finance other needs as well.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

To control for farmer’s moral hazard: In the case

that i was lower than the market rate, cane

farmers would use a mill’s loan to finance their

other needs, or even take the arbitrage

opportunity to lend money from the mill to

others at the market rate.

Mills were apparently aware of this problem and

their contracts stipulated that if a farmer was

caught using the loan for other purposes, he was

subject to a fine two to three times the amount

of his loan.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

Literature

Where to find data to test the theory?

Model modification

Conclusions

Conclusions:

◮

Our findings support Gangopadhyay and

Sengupta (1987) who proposed that when a

production loan is interlinked with other trade,

the creditor is willing to ask for an interest rate

lower than its cost of capital, and the loss in

lending will be more than compensated by profit

in the other trade.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

Definition of interlinkage

◮

◮

Literature

Where to find data to test the theory?

Model modification

Conclusions

The interest rate is not as low as their model

predicts. We conjecture that it is because too

low an interest rate would encourage farmers to

borrow more than their investment needs.

The terms in the contracts are largely consistent

with the second best interest rate and the

optimal cane price.

Hui-wen Koo, Chen-ying Huang and Kamhon Kan

Interlinked Contracts: An Empirical Study

© Copyright 2026