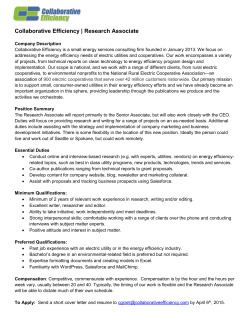

SOCENT Pub 2015-08 (wp15022).