Exceptional People. Exceptional Experience.

Exceptional People. Exceptional Experience. Annual Report 2014 Making Insurance Exceptional Exceptional People. Exceptional Experience. T he employees and agents of NYCM Insurance, and the way they care for the policyholders we protect, have long exemplified superior commitment, compassion and performance. As we look back at the past year — one that was not easy for the property/casualty insurance industry in New York State — these qualities reached a higher level still. They were truly exceptional. Spirit of Caring The character of NYCM’s people is seen both in the quality of service they provide to insureds and the manner in which they serve their larger community. They demonstrate the latter with remarkable support of causes that benefit the community’s health and wellbeing in numerous ways — and they did so in unprecedented fashion this past year. We’ve highlighted some of those activities in this report. In the arena of customer service, one of the most exciting developments in 2014 was the implementation of our Customer Experience Project, which transitioned into a permanent department. This team of specialists is literally making a science of customer service: analyzing what every type of customer needs and expects from their insurance carrier, in every step of the process, and leading the way in strengthening NYCM’s service even further to ensure that every customer’s experience with us is not only a good one, it’s exceptional. One of the ways that was demonstrated in 2014 was proactive calls made to insureds in the storm-stricken Buffalo area in November, most of whom never had a claim, just to make sure they were all right. Our product development operations were also in high gear throughout the year, formulating a number of new or enhanced offerings to be introduced in 2015. One of them was NYCM’s Usage Based Insurance (UBI) program, which underwent extensive testing among employees and agents. Using on-vehicle data recording devices, the voluntary UBI feature will enable auto policyholders to earn premium discounts based on good driving habits. Another new product that progressed significantly in its development was NYCM’s new Business Owners Policy (BOP), named “Compass.” We anticipate a very positive reaction to that cutting-edge program and other forthcoming product introductions. NYCM Insurance Annual Report 2014 | Page 1 Answering the Call In the insurance business, more than most, every year brings unpredictability. Beyond providing the best insurance protection and service we can, we have little control over how much our policyholders will need to call upon that protection. Nor do they. Many insureds had to make that call in 2014, to recover from damages caused by storms and other severe weather that struck across the state. From the hail storm and tornadoes of the spring and summer, to the infamous Buffalo snow storm in November, no season was spared in a year that brought a total of nine major storm events. Those events generated nearly $25 million in incurred losses for NYCM Insurance. The combined impact of the storms and intense competition in the personal lines auto and homeowners marketplace pushed our combined loss and expense ratio for the year to 104.7 percent. Their effects also overshadowed the positive financial impact of loss adjustment expense reductions. That fiercely competitive marketplace contributed to a slight drop in direct written premiums, to $482 million from $484 million the previous year. Investment income was slightly less than the previous year due to a smaller increase in the equity market compared with 2013. Despite all of these challenges, however, NYCM Insurance had net income of $10.7 million in 2014. Assets & Surplus Grow for Third Consecutive Year NYCM Insurance concluded 2014 with record assets of $1.066 billion, an increase of $6.6 million over 2013. What’s more, our surplus or policyholders’ security fund grew by $13.6 million to $480.1 million. This marked the third consecutive year of growth in both of these key areas. A Certainty As another year unfolds — and with it another period of unpredictability for the property/casualty insurance industry, one thing is certain: our standard remains nothing less than to make insurance exceptional for each of the hundreds of thousands of policyholders we serve. We are grateful to them for giving us that privilege — and to NYCM’s employees and agents whose character and commitment continue to make that achievement possible. V. Daniel Robinson II President & Chief Executive Officer Page 2 | Saying it Best When it comes to understanding an insurance company’s financial strength, A. M. Best Company has long set the standard. When a carrier consistently earns that firm’s A or higher rating, it sends a strong message that the insurer can be counted upon by policyholders to deliver the protection it has promised. For 2014, A. M. Best reaffirmed NYCM Insurance’s A+ rating. It marked the 78th consecutive year that NYCM received an A or higher rating — a distinction held by only 59 other property/casualty insurers in the United States. Best’s Review, A. M. Best Company’s monthly magazine, has referred to this select group as “standing the test of time.” It’s a test re-taken every year. Among the Reasons Cited by A. M. Best Company for NYCM’s A+ Rating for 2014: “We’ve been seeing A’s and A-pluses next to our name for so long, it might be taken for granted,” notes NYCM President & CEO Dan Robinson. “However, it’s essential to remember that the mark represents a grade our company must earn annually based on our business performance. “Our results reflect the experience, expertise and sound judgment that the entire NYCM team applies to all aspects of our operations — to keep our company strong and among • Solid risk-adjusted capitalization and well-established market presence in New York; • Solid capital position and conservative operating strategies; • Solid net investment income, which has been a major contributor to positive pre-tax operating and net income; • Long-standing agency relationships and an advanced technology platform. the most reliable in the industry for policyholders.” NYCM Insurance Annual Report 2014 | Page 3 Bringing Warmth to America’s Greatest Heart & Walk It’s not unusual for temperatures to be on the chilly side when America’s Greatest Heart Run & Walk takes place each year. That makes the warmth exuded by team NYCM in their vibrant orange sweatshirts fitting — as well as symbolic of the several ways NYCM helps fuel the success of this remarkable event. Based on the campus of Utica College in Utica and encompassing surrounding communities, the Run & Walk raises life-changing funds for the American Heart Association to prevent, treat and defeat heart disease, stroke and other cardiovascular diseases. NYCM Insurance is a major sponsor of the Run & Walk. Its team of runners and walkers, perennially over 100 members strong, is one of the event’s largest — and in 2015 led all of 90 participating teams in dollars raised. At the center of that achievement was NYCM’s Executive Vice President & CFO Albert Pylinski, Jr., who not only led NYCM’s team in support generated, but for the third year in a row was the event’s top fundraiser overall. His leadership and dedication to the cause have led to him being named chairman of America’s Greatest Heart Run & Walk for 2016. Page 4 | Hitting Close to Home Putting the Freeze on ALS For decades, ALS — amyotrophic lateral sclerosis — was known mostly as Lou Gehrig’s disease, in memory of the New York Yankee great whose career and life it cut short. Gehrig’s famous “Today, I consider myself the luckiest man on the face of the earth” farewell speech almost romanticized his condition, masking the reality of its devastating consequences. Over the years, ALS remained largely a low-profile, misunderstood disease — except to its victims and their families. That changed dramatically in 2014 as the “Ice Bucket Challenge” raised unprecedented awareness of ALS as well as funding that might soon help bring the disease to its knees. NYCM Meets the Challenge In August, NYCM Insurance stepped up with several renditions of the Ice Bucket Challenge. Over 125 employees took their turn “under the bucket” to raise funds for the ALS Association. Kathy Bell, Senior Vice President of NYCM’s Regulatory and Legal Affairs Division, has seen the impact of ALS close up. She lost her mom, Beverly Smith, to the disease. Beverly was also a member of the NYCM family, having worked in the Claims Division. To Kathy, the Ice Bucket Challenge literally brought a flood of emotions: memories of her mother, excitement about the support generated for the cause, appreciation that so many cared and, of course, the “invigorating” feeling of being doused with ice and water for the cause. Beverly Smith “It was amazing,” Kathy said, “to have so many co-workers come up to me and say, ‘I really didn’t know what ALS is and what a terrible disease it is — and now I understand.’” Another moving experience was having a fellow employee share her experience. “I didn’t Kathy Bell know that Amy Wells of the Underwriting Division had also lost her mother to ALS. But when she saw the pictures of my mom on my ice bucket, she came up to me and said, “that makes me miss my mom so much.’ Now we’ll stay connected.” Of NYCM’s effort, Kathy said, “It showed the heart of this company. It starts with management and then all of the employees have huge hearts. They’re always reaching into their pockets, finding ways to help their fellow man.” As a result of last year’s global support of the Ice Bucket Challenge, the Association was able to commit $21.7 million to support programs and initiatives aimed at expediting the search for treatments and a cure. NYCM Insurance Annual Report 2014 | Page 5 Gus Macker Sponsorships a Winning Play for Communities Across New York Bringing good things — like sportsmanship, wholesome entertainment and support for charities — to great communities is something a company can never do too much of. That’s why NYCM Insurance has long taken pride in sponsoring Gus Macker Tournament Basketball. During the summer of 2014 that support and enthusiasm were stronger than ever at tournaments in Palmyra, Darien Lake, Hornell, Norwich, Olean and Syracuse. At each, NYCM sponsored the bracket tent and provided players with a basketball-shaped string bag and scorecard. The company added to the fun by giving away sunglasses, sunscreen, lip balm and sanitizing wipes. Their popularity might have been exceeded only by the free photos — customized by location — that participants could obtain at NYCM’s photo booth. Each tournament attracted at least 250 teams, with some drawing close to 400. Over the summer, more than 2,000 people followed the continuous bracket updates that were posted by location on NYCM’s Facebook page. Page 6 | “Passport to Wellness” has Employees on the Move To Better Health A passport is thought of as something that helps us move from one place to another, usually a foreign destination. That concept applies in much the same way to NYCM’s “365 Passport to Wellness” program that has employees on a journey toward improved health. They earn stamps for participating in a variety of wellness-related activities, with the stamps qualifying them for incentive awards. But the biggest reward is the health benefits they derive from integrating the program’s core tenants of weight management, physical fitness and good nutrition into their daily lifestyle. Along the way, the Passport program makes it fun and builds team spirit as well. “The concept is being healthy all year,” explains Michele Couperthwait, Vice President of People Development. “We want to incorporate all aspects of wellness into everyday life, to promote a healthy work and personal life 365 days a year for our employees.” Among the most popular From barbeques and dunkings, to activities are impromptu events Hawaiian days and Master Mind like a passing-the-football Challenges, Passport activities speak fun competition that took place in the and fitness in a variety ways. Underwriting Division just before the Super Bowl. NYCM Insurance Annual Report 2014 | Page 7 Combined Financial Report as of December 31, (000’s omitted) 2014 20132012 Bonds Equities Cash & Short Term Investments Premiums Receivable All Other Admitted Assets TOTAL ADMITTED ASSETS $773,564 98,127 13,010 117,273 64,031 $775,027 87,176 14,761 120,927 61,540 $736,369 54,805 34,611 122,784 77,120 $1,066,005 $1,059,431 $1,025,689 $307,967 237,305 40,670 $315,430 237,809 39,759 $329,780 235,829 36,228 $585,942 $592,998 $601,837 480,063 466,433 423,852 $1,066,005 $1,059,431 $1,025,689 $10,291 376 $36,089 (3,821) $22,552 (4,046) $10,667 $32,268 $18,506 Liabilities & Surplus Reserve for Claims and Claims Expense Reserve for Unearned Premiums Reserve for All Other Liabilities TOTAL LIABILITIES Surplus Policyholders’ Security Fund TOTAL Statement of Income Net Income Before Federal Income Tax Federal Income Tax Incurred NET INCOME Other Information Loss Ratio Expense Ratio Combined Ratio DIRECT WRITTEN PREMIUMS 73.6% 31.1% 68.0% 31.7% 70.8% 31.4% 104.7% 99.7% 102.2% $481,824 $484,042 Licensed Territories: New YorkAM Best Rating: A+ (Superior) 1,066,005 480,063 466,433 1,059,431 423,852 1,025,689 Total Admitted Assets Surplus 1,000,000 Page 8 | 200,000 $487,104 Directors VanNess D. Robinson Edward Gozigian H. William Smith, Jr. V. Daniel Robinson II Jennifer R. Haack William F. Streck, M.D. Chairman, Secretary New York Central Mutual President, Chief Executive Officer New York Central Mutual Albert Pylinski, Jr. Executive Vice President, Chief Financial Officer, Chief Risk Officer, Treasurer New York Central Mutual Daryl R. Forsythe Chairman NBT Bancorp, Inc. Attorney at Law Gozigian, Washburn & Clinton Private Investor Benjamin C. Nesbitt Retired - Senior Vice President, Bank Investments Wilber National Bank Retired President Smith Norwich, Inc. Retired - President, Chief Executive Officer Bassett Healthcare Howard C. Talbot, Jr. Robert W. Ranger Retired Director/Treasurer National Baseball Hall of Fame Charles R. Schanz Retired - Owner/Operator Horned Dorset LTD Peter L. Owens Michael R. Sweet Chairman USNY Bank President RWR Funding Bruce C. Wratten Owner/President C.R. Schanz, Inc. Officers VanNess D. Robinson Chairman/Secretary V. Daniel Robinson II Senior Vice President Privacy Officer Albert Pylinski, Jr. Senior Vice President Michael A. Perrino Senior Vice President Cheryl L. Robinson Senior Vice President Jeffrey R. Barrett Senior Vice President Assistant Vice President, Information Security Officer Michele D. Couperthwait Judith J. Schnitman Stephen M. Cembrinski Vice President William W. Couperthwait II Robert D. Snyder John E. Holdorf Vice President Douglas H. Franklin Vice President Kate M. Stacy Michael J. LaCava Mark A. Grygiel Diane R. Wildey Katharine S. Landers Vice President President/CEO Exec. Vice Pres./CFO/CRO/Treasurer First Senior Vice President First Senior Vice President Senior Vice President Senior Vice President Senior Vice President Senior Vice President Senior Vice President Julie D. Palmer Kevin L. Plows Jeremy J. Robinson Timothy A. Trueworthy Vice President Barbara A. Turnbull Vice President Mark R. VanDewerker Vice President Chad R. Barth Assistant Vice President Michael J. Millea Assistant Vice President Assistant Vice President Assistant Vice President Assistant Vice President James E. Potts, Jr. Vice President NYCM Insurance Annual Report 2014 | Page 9 New York Central Mutual Fire Insurance Company 1899 Central Plaza East Edmeston, NY 13335-1899 1-800-234-6926 • Fax: 607-965-2712 nycm.com A. Central Insurance Company 1899 Central Plaza East, Suite 2000 Edmeston, NY 13335-1898 1-800-234-6926 • Fax: 607-965-2250 acentralinsurance.com

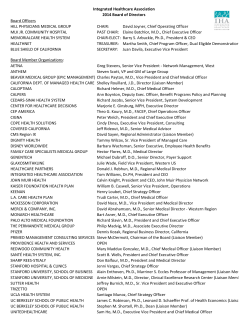

© Copyright 2026