KL WtE Conference April2015_InSWA.pptx

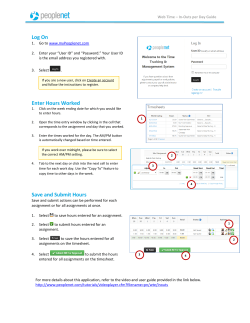

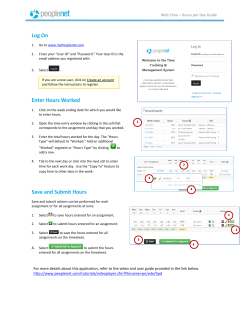

Waste to Energy in Indonesia Challenges and Opportunities Dini Trisyanti Deputy of Capacity Building and Technical Assistance Indonesia Solid Waste Association (InSWA) ISWA BEACON CONFERENCE Kuala Lumpur, Malaysia, April 16 – 17, 2015 InSWA at a glance ¤ Born in Jakarta, October 2003 ¤ ISWA National Member since 2012 ¤ Members: waste operators, consultants, manufacturers, individuals ¤ Main activity: bridging/mediation of waste stakeholders (private-government-community) and capacity building Outline ¤ The municipal solid waste profile ¤ Regulation and institutional framework ¤ Waste to energy status ¤ Financing issues ¤ Social concerns The Archipelago of Indonesia http://www.ceritaindonesia.web.id • 250 million population in 1.9 million km2 • 34 provinces, 511 municipalities, 17,000 islands • GDP 3,500 USD/capita Cities and Waste Criteria Ci#es with > 1 million popula#on Ci#es with 500.000 – 1 million popula#on Ci#es with 250.000 – 500.000 popula#on Ci#es with < 250.000 popula#on Category of Number Population Waste City of city proportion generation rate proportion Metropolitan 15 17% 37% Big 15 Medium Small 481 83% 63% Source: Jalan Terjal Bersihkan Negeri, SWI-InSWA, 2014 and Indonesia Domestic Solid Waste Statistic, MoE, 2008 MSW Composition and Characteristic Organic Plastic Paper Metal Woods, Glass, Rubber, Fabric, Sand, Other 17% 2% 9% 14% 58% Source: Indonesia Domestic Solid Waste Statistic, MoE, 2008 Heating value : 2100 – 2300 kcal/kg (LHV) 4600 – 5200 kcal/kg (HHV) Source: Draft Academic Paper RDF Guideline, 2015, MoE-SWI-InSWA MSW Generation Rate Group Area Waste Genera7on Waste Rate (million ton/ Genera7on year) (%) Sumatera 8.7 Java 21.2 Balinusra (Bali and 1.3 Nusa Tenggara) Kalimantan 2.3 Sumapapua (Sulawesi 5.0 Maluku Papua) TOTAL/NATIONAL 38.5 22.6 55.1 3.4 Popula7on Served by MSW Service (%) 48 59 47 6.0 12.9 46 68 100 56 Source: Indonesia Domestic Solid Waste Statistic, MoE, 2008 MSW Operational 3% Proportion (%) 14% Transported to Landfill Buried, Burnt Composted, other Disposed 14% 69% Source: Indonesia Domestic Solid Waste Statistic, MoE, 2008 • Most of the waste is collected and transported to landfill (open dumping, controlled, sanitary) • Recyclables to informal sector + Waste Bank movement • Compostable is partly treated in TPS 3R or TPA (landfill) Big Cities Landfills No. Name of Landfill City Province 1 Bantargebang DKI Jakarta DKI Jakarta 2 Sarimuk# Bandung West Java 3 4 5 6 7 Yogyakarta Surabaya Bekasi Denpasar Medan Yogyakarta East Java West Java Bali North Sumatera Banten West Java Central Java Piyungan Benowo Sumur Batu Suwung Terjun 8 Rawa Kucing 9 Cipayung 10 Ja#barang Tangerang Depok Semarang Source: SWI-InSWA, 2015 No. Name of Landfill City 11 Sukawinatan Palembang 13 Cipeucang Province South Sumatera Makassar South Sulawesi Tangerang Selatan Banten 14 Galuga Bogor 15 Punggur Batam 12 Tamangapa 16 17 18 19 Muara Fajar Bakung Supiturang Air Dingin 20 Bukit Pinang West Java Kepulauan Riau Pekanbaru Riau Bandar Lampung Lampung Malang East Java Padang West Sumatera Samarinda East Kalimantan Total population served: 42 millions inhabitants Estimated waste generation served: 21,000 tons/day Big Landfills – Sumatera Medan City Terjun Landfill Own: Public 1 municipali#es Popula#on: 2 mil Padang City Air Dingin Landfill Own: Public 1 municipali#es Popula#on: 0,79 mil Bandar Lampung City Bakung Landfill Own: Public 1 municipali#es Popula#on: 0,88 mil Pekanbaru City Muara Fajar Landfill Own: Public 1 municipali#es Popula#on: 0,88 mil Batam City Punggur Landfill Own: Public 1 municipali#es Popula#on: 0,91 mil Palembang City Sukawinatan Landfill Own: Public 1 municipali#es Popula#on: 1,4 mil Source: SWI-InSWA, 2015 Big Landfills – Java and Bali Jakarta City Bantargebang Landfill Own: Public&private 5 municipali#es Popula#on: 9,5 mil Tangerang City Rawa Kucing Landfill Ownership: Public 1 municipali#es Popula#on: 1,7 mil Bekasi city Sumur Batu Landfill Own: Public 1municipality Popula#on : 2,3 mil Depok City Cipayung Landfill Own: Public 1 municipali#es Popula#on: 1,7mil Semarang City Ja#barang Landfill Own: Public 1 municipali#es Popula#on: 1,5 mil Denpasar City Suwung Landfill Own: Public 4 municipali#es Popula#on: 2,2 mil South Tangerang City Cipeucang Landfill Own: Public 1 municipali#es Popula#on: 1,2 mil Bogor City Galuga Landfill Own: Public 1 municipali#es Popula#on: 0,95 mil Source: SWI-InSWA, 2015 Surabaya City BenowoLandfill Own: Public &Private 1 municipali#es Popula#on: 2,7 mil Bandung City Sarimuk# Landfill Own: Public 3 municipali#es Popula#on: 4,7 mil Yogyakarta City Piyungan Landfill Own: Public 3 municipali#es Popula#on: 3,4 mil Malang City Supiturang Landfill Own: Public 1 municipali#es Popula#on: 0,82 mil Big Landfills – Kalimantan and Sulawesi KALIMANTAN Samarinda City Bukit Pinang Landfill Own: Public 1 municipali#es Popula#on: 0,68 mil Source: SWI-InSWA, 2015 SULAWESI Makasar City Tamangapa Landfill Own: Public 1 municipali#es Popula#on: 1,3 mil The Urgency for MSW Treatment ¤ Waste dumping sites are tickling bombs for metropolitan and big cities ¤ Community based initiatives are encouraging to some extent, but the scaling up and sustainability are always in question ¤ Waste to Energy becomes more and more in favored, as a way out to reduce burden of waste while resulting benefit to human needs (energy) ¤ Central and local government have recognized this importance, and initiated programs with international donors, private sectors, etc. to speed up implementation of WtE in Indonesia MSW Operational System Collection Transport Source: National Development Planning Agency Presentation on WtE Week, 2014 Final Treatment (WTE) Most interesting for investors Regulation and Institutional Framework Presidential Decree 67/2005 and its addendum Ministry of Energy and Mineral Resources National Development Planning Agency Ministry of Environment and Forestry Law on Limited Enterprise (PT), Tax etc • • Municipal Government Ministry of Public Works and Housing Law 18/2008 on Waste Management MEMR Ministerial Decree 19/2013 on Feed in Tariff Government Regulation 50/2007 on Local Cooperation Central!Government! ! Ministry!of! Public!Works! National!Planning! Development! Agency! ! Ministry!of!Energy! and!Mineral! Resources! Formulation!of! PPP!Regulations! ! 1.!INVESTMENT!COST!grant:! C Landfill!infrastructure! C Heavy!equipment! (trucks,!excavators,!etc)! 2.!Ministerial!Regulations! ! Ministry!of! Environment!and! Forestry! Policies!and!strategies!on!Waste! to!Energy!development!(Feed!in! Tariff,!permit!procedure,!etc)! ! Province! Guidelines:! C Legislations! (Law,! Regulation,!Act)! C Formulation! of! quality! standards! ! ! Specific!Grant! ! City/Regency! O&M!COST! coordination!and! supervision!function! ! Operation!and! Maintenance! Regulation and Institutional Concern ¤ Misunderstanding that WtE is perceived as opportunity for earning income from electricity etc. while undermining the cost needed for tipping fee etc. ¤ Unclear leading sector: Environment, Public Works (Infrastructure), or Energy. Disputes and conflicting regulations ¤ Low capacity of local government to provide Feasibility Study and involvement in WtE project implementation ¤ From grant type of procurement to commercially (full or partial) driven investment for MSW infrastructure ¤ Un-conducive political condition Waste to Energy Status ¤ Direct use of landfill gas : ¤ i.e. methane gas is captured, treated, and distributed using rather traditional piping system to inhabitants surrounding the landfill area ¤ Installed in more than 26 landfills ¤ Electricity from landfill gas: only 2 landfills (Suwung in Bali and Bantargebang in Jakarta) with total contracted capacity 14.5 MW ¤ No (zero) WtE incinerator (thermal) is in place ¤ Refused Derived Fuel (RDF) and Anaerobic Digestion are applied in small scale (pilot projects) Direct Use of Landfill Gas Gas capturing Gas treatment • TPA Kepanjen and TPA Supiturang, Malang • Operated by Local Government (public) Source: InSWA Visit, 2013 – 2014 Gas utilization Electricity and Flaring of Landfill Gas • MSW based power plant (12.5 MW) • Bantargebang Landfill, Jakarta (located in Bekasi) Bekasi• 65,000ton year /PDD estimate Operated PER/ T. Navigat Organic 91,000ton(private) . CO2.eq March 2010~June2012 Source: Jakarta Government, 2014 • Flaring of landfill gas (PDD es#mate 91,000 ton CO2eq for 2010-‐2012) • Sumurbatu Landfill, Bekasi • Operated by PT. Gikoko Kogyo (private) • CDM based project Source: PT. Gikoko, 2012 Scheme of Waste to Energy of Bandung City Combustion System Leachate treatment Bottom Ash Treatment Fly Ash Treatment Water Treatment • • • • • Treatment type : incinerator Located in the eastern part of the city, Gedebage Total of 20 hectares consist of 5 ha for the Plant and 15 ha for green zone Capacity of 1,000 ton/day Form of coopera#on : Build Operate Transfer (BOT) Source: Bandung Municipality Presentation on WtE Week, 2014 Indonesia Energy Mix Source: MEMR Presentation on WtE Week, 2014 New and Renewable Energy Roadmap Source: MEMR Presentation on WtE Week, 2014 Source: MEMR Presentation on WtE Week, 2014 Bioenergy Based Power Plant Source: MEMR Presentation on WtE Week, 2014 • Unstable landfill gas captured due to poor landfill management system • Requirement and procedure of Power Purchase Agreement (PPA). Not only modes of technology is proven, but also applicability in the similar capacity. Current Project Implementation No Location 1) TPA Bantar Gebang III Jakarta 2) SPA Sunter Jakarta *) (incinerator) TPA Sumur Batu Bekasi 3) Capacity 5 x 2 MW 14 MW 3 x 1 MW Developers Investment PT OVI Energy Rp. 300 billion DKI Jakarta Local Government PT Gikoko Kogyo Rp. 625 billion Rp. 562,5 billion Rp. 40 billion 4) Gedebage Bandung **) (incinerator) 7 MW PT Bandung Raya Indah Lestari 5) TPA Telaga Punggur Batam (thermal) TPA Sukawinatan Palembang TPA Benowo Surabaya 14 MW Batam Local Government USD 150 million 0.5 MW DGNREEC Rp. 30 billion PT Sumber Organic Rp. 316 billion 6) 7) 9 MW Source: MEMR Presentation on WtE Week, 2014 *) Jakarta : pending to contract award (bid process since 2011) **) Bandung : bid winner announced in 2014 but postponed implementa#on due to social protest Financing Capacity Municipality Waste Generation Average MSW Budget Allocation Investment Needed for Treatment Technology Estimated Tipping Fee Needed Rp 42 billion/ year Solo 265 ton/day Rp. 6 billion/ year Rp 417 billion (Incenerator) Bandung 1.850 ton/ day Rp. 67 billion/ year Rp 1.650 billion Rp 185 billion/ (incinerator) year Batam 1.000 ton/ day Rp. 30-40 billion/year Rp 1.500 billion Rp 80 billion/ (Incenerator) year Source: National Development Planning Agency Presentation on WtE Week, 2014 MSW Budget Priority Municipality Total Municipal Budget Waste Disposal Budget Proportion of Waste Disposal Budget Yogyakarta Province (Kartamantul) Rp. 1.6 trillion Rp. 3,4 billion 0.2 % Pekalongan Rp. 722 billion Rp. 2.4 billion 0.3 % Balikpapan Rp. 3 trillion Rp. 11.6 billion 0.4 % Palu Rp. 949 billion Rp. 1.8 billion 0.19 % Source: SWI – InSWA Analysis from Publication Materials on WtE Week, 2014 Retribution vs O&M Cost Sumber: WJEMP 3-11 Review Masterplan DKI, 2006 In many cases, municipality subsidizes MSW cost for ‘rich’ people Investment Mechanism ¤ Public Private Partnership (PPP) ¤ Presidential Decree 67/2005 and its addendum ¤ Applied in WtE projects in Jakarta, Bandung, and Batam ¤ Some project preparations have been initiated and supported by central governments and international donors ¤ Business to Business ¤ Local regulation (Perda) needed for zoning system of MSW ¤ In preparation by Jakarta Province, for commercial and industrial area identified as more than 40% of total service area PPP Scheme Responsible Team for Partnership Agreement (PJPK) Bid award leier Bid Winner Company Municipal Cleansing Agency PPP Agreement Power Purchase Agreement Deed of Company Establishment Waste supply Credit Agreement O & M Contractor Consultant Source: National Development Planning Agency Presentation on WtE Week, 2014 Commercial Framework for WtE Source: National Development Planning Agency Presentation on WtE Week, 2014 Business to Business Scheme • MSW service to noncommercial area • Waste tariff policy License, Permit Business to Business Agreement Transport to Landfill On-site treatment (WtE) Local Government no longer collects and transports to landfill for waste generated in commercial area (need local regulation) Financial Issues ¤ Financial capacity is often low. For some ‘rich’ cities, need to divert budget allocation from transportationdisposal to treatment. ¤ But overall, difficult to obtain local budget approved by executive and legislative. ¤ Bankable proposal – business feasibility of WtE investment project ¤ ‘Promising offers’ to local government in a form of zero tipping fee, modern technology, etc. Social Concern ¤ 3R : Waste Bank movement achievement (MoE, 2013) ¤ 17 provinces; 55 municipalities; 1,136 waste banks, ¤ 2,262 ton/month waste collected, IDR 15 billion (USD 1.1 million) / month recyclable sales ¤ Landfill gas to energy: ¤ Gas incentive to community surrounding ¤ Social acceptance and participatory monitoring ¤ WtE incinerator (thermal): ¤ Divided group: (1) strongly against, (2) supportive, (3) feel necessary but not sure ¤ Limited information on proven, safe, and sound technology ¤ Transparency of bid process, emission and operational standard Conclusion ¤ WtE is very potential in Indonesia, given the urgency of waste problems and energy policy towards New and Renewable Energy (NRE). However, the existing WtE application is more on direct use of landfill gas (utilized by surrounding household). Electricity generation (followed by power purchase agreement) is still limited. ¤ Local governments’ mind set that realizing waste needs sufficient management cost rather than looking at energy sales as source of income is crucial. Otherwise, financial feasibility of WtE is in question; investors already see Indonesia as risky and unproven market. ¤ In national level, synchronized regulation and synergized institution are also the keys. MSW based power plant projects should be more realized as commercially driven investment (PPP scheme, B to B), rather than physical infrastructure grant. ¤ Transparency of procurement and sufficient-neutral-valid information on technology application are critical in gaining public trust and social acceptance for implementation of WtE incinerator plant. Thank You. Terima Kasih Indonesia Solid Waste Association (InSWA) Secretariat: Jl. Krekot Bunder IV Blok H No 19, Pasar Baru, Jakarta-Pusat [email protected], [email protected] http://inswa.or.id Field Office: TPS 3R RAWASARI Jl. Rawa Kerbau 5A- Rawasari Selatan, Cempaka Putih Timur, Jakarta Pusat 10510 Telp: (+62-21) 4627 1206 Fax :(+62-21) 4627 1207

© Copyright 2026