Pioneer Funds â Emerging Markets Bond Local Currencies

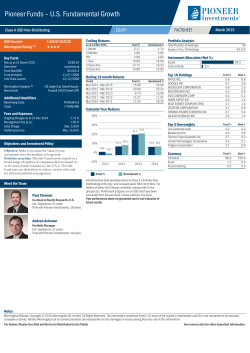

Pioneer Funds – Emerging Markets Bond Local Currencies BOND Class A USD Non-Distributing ISIN Number LU0441085775 Key Facts Nav as at 29 May 2015 Domiciled Fund Size (Mil) Fund Inception Unit Class Launch $72.6 Luxembourg $216.6 04/11/2009 09/12/2009 Morningstar Category ™ Global Emerging Markets Bond Local Currency JPM GBI-EM Global Diversified Index Benchmark Additional Identifiers Bloomberg Code Cusip PEMBUAA LX L759AW437 Trailing Returns Fund % Benchmark % 1 Month 3 Months YTD 1 Year 3 Years Ann. 5 Years Ann. -2.51 -2.86 -4.45 -15.02 -2.96 -0.61 -2.58 -2.72 -3.71 -10.67 -0.41 1.85 Period Fund % Benchmark % May 2014 - May 2015 May 2013 - May 2014 May 2012 - May 2013 May 2011 - May 2012 May 2010 - May 2011 -15.02 -0.86 8.47 -8.64 16.19 -10.67 -0.33 10.96 -5.55 17.44 Rolling 12 month Returns 1.69 % 1.20 % Max. 0.15% Max. 5.00% Max. 15.00% Objectives and Investment Policy Objective: Seeks to provide income and to increase the value of your investment over the medium to long-term. Portfolio securities: The Sub-Fund invests mainly in bonds from emerging markets that are denominated in a local currency. The Sub-Fund may also invest in bonds from any country that are denominated in other currencies, and may invest up to 25% of its assets in bonds with attached warrants and up to 5% in equities. The Sub-Fund may use derivatives to reduce various risks, for efficient portfolio management and as a way to gain exposure to various assets, markets or income streams. Meet the Team Hakan Aksoy Total Number of Holdings Total Number of Governments Total Number of Corporations Benchmark % ʼ3HUIRUPDQFHGDWDSURYLGHGUHIHUVWR&ODVV$86'ROODU1RQ Distributing only, and is based upon NAV net of fees. For details of other Unit Classes available, please refer to the prospectus. Performance figures are in USD and have been converted from the sub-fund's base currency, the Euro. As of 01/01/2015, this Sub-Fund utilizes a new benchmark: 'JPM GBI-EM Global Diversified Index'. The performance data from before that date relates to the Sub-Fund’s past performance against the previously applicable benchmark(s): 'JP Morgan GBI-EM Broad Diversified EUR Unhedged'. Past performance does not guarantee and is not indicative of future results. Emerging Markets Portfolio Manager Ind. Experience: 17 years Time with Pioneer Investments: 10 years 87 15 21 Instrument Allocation (Net %) Bond Interest Rate Derivatives Cash at Bank Equity FX Derivatives Credit Derivatives Top 10 Bonds Fund % Malaysia (Federation Of) 4.4% (11/29/2019) America Movil Sab De Cv 6.5% (12/05/2022) Poland (Republic Of) 5.3% (10/25/2020) Cooperatieve Centrale Raiffeisen-boerenleenbank Ba 0.5% (10/27/2016) Export-import Bank Of Korea 8.4% (07/06/2016) Mexico (United Mexican States) 10.0% (12/05/2024) Hungary (Republic Of) 7.5% (11/12/2020) Cooperatieve Centrale Raiffeisen-boerenleenbank Ba 0.5% (11/26/2021) Malaysia (Federation Of) 4.2% (07/15/2021) Emgesa Sa Esp 8.8% (01/25/2021) Currency Fund % May 2015 Portfolio Analysis as at 29 May 2015 Calendar Year Returns Fees and Expenses Ongoing Charges as at 31 Dec 2014 Management Fee (p.a.) Distribution Fee (p.a.) Entry Charge Performance Fee FACTSHEET Mexican Peso New Turkish Lira Brazilian Real Malaysian Ringgit South African Rand Others 3.2 3.0 2.9 2.9 2.8 2.8 2.5 2.3 2.2 2.0 Fund % Bmk % 11.6 10.2 9.5 9.3 9.1 50.5 10.0 9.6 10.0 10.0 10.0 50.4 ʼ&XUUHQF\GDWDUHIOHFWVWKHH[SRVXUHRII[GHULYDWLYHVDQGWKH market value of credit and interest rate derivatives. Credit Rating AAA AA A BBB BB B and Below NR Average Credit Quality Fund % Bmk % 2.2 10.1 33.3 32.2 6.9 1.0 4.4 0.0 0.1 38.2 54.7 6.6 0.0 0.4 A- ʼ&UHGLW5DWLQJGDWDDQG$YHUDJH&UHGLW4XDOLW\FDOFXODWLRQVXVH an average of available ratings across S&P, Moodys and Fitch. In the case of sovereign bonds that are not rated by any of the 3 referenced rating agencies, an average of the issuer rating is used. Non sovereign bonds that are not rated by any of the 3 referenced rating agencies are excluded from the Average Credit Quality calculation. Credit Rating data reflects the exposure of credit derivatives. For Broker/Dealer Use Only and Not to be Distributed to the Public See reverse side for other important information. Pioneer Funds – Emerging Markets Bond Local Currencies Asset Allocation Emerging Government Emerging Non Financials Emerging Quasi Govt Financials Emerging Financials Fund % Bmk % ʼ$VVHW$OORFDWLRQGDWDUHIOHFWVWKHH[SRVXUHRIFUHGLW derivatives. < 1 Year 1-3 Years 3-7 Years 7-11 Years 11+ Years FRN Effective Duration (Years) by Curve (Years) / Credit Rating Bond Analysis Rating <1 1-3 3-7 AAA AA A BBB BB B and Below NR Int Rate Total 0.01 0.0 0.01 0.01 0.0 0.0 0.01 0.0 0.04 0.0 0.1 0.1 0.1 0.0 0.0 0.02 0.1 0.4 0.02 0.1 0.7 0.5 0.2 0.0 0.0 0.3 1.8 Effective Duration (Yrs) Modified Duration (Yrs) Spread Duration (Yrs) Yield to Maturity (%) Yield to Worst (%) Current Yield (%) Time to Maturity (Yrs) Coupon (%) 7-11 0.0 0.0 0.6 0.4 0.1 0.0 0.1 -0.2 0.9 11+ 0.0 0.0 0.2 0.6 0.0 0.0 0.0 0.0 0.8 FRN Total 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.02 0.2 1.6 1.6 0.3 0.0 0.1 0.1 3.9 ʼ(IIHFWLYH'XUDWLRQ<HDUVE\&XUYH<HDUV&UHGLW5DWLQJGDWDXVHVDQ average of available ratings across S&P, Moodys and Fitch. In the case of sovereign bonds that are not rated by any of the 3 referenced rating agencies, an average of the issuer rating is used. Effective Duration (Years) by Curve (Years) / Credit Rating data reflects the exposure of credit and interest rate derivatives. Quasi Govt Curve May 2015 Fund % 9.7 29.0 45.9 12.8 9.4 0.2 ʼ&XUYHGDWDUHIOHFWVWKHH[SRVXUHRIFUHGLWDQGLQWHUHVWUDWH derivatives. Country South Africa Mexico Brazil Turkey Poland Korea United States Colombia Malaysia Netherlands Others Credit Exposure (%) Bmk % Int. Rate Exposure (%) Effective Duration (Years) Country Spr Dur (Years) 4.1 11.1 9.5 8.8 7.5 6.7 1.5 6.4 6.3 5.2 23.2 10.0 10.0 10.0 9.6 10.0 0.0 0.0 7.0 10.0 0.0 33.4 11.1 0.0 0.4 0.0 0.0 0.0 5.1 0.0 0.0 0.0 0.0 0.5 0.7 0.2 0.3 0.3 0.1 0.0 0.3 0.3 0.2 1.0 0.3 0.7 0.2 0.3 0.3 0.1 0.01 0.3 0.3 0.2 1.0 3.93 3.81 3.75 7.16 7.16 5.17 5.28 5.80 ʼ%RQG$QDO\VLVGDWDUHIOHFWVGHULYDWLYHVH[SRVXUH Risk Analysis Standard Deviation Sharpe Ratio Alpha Beta R-Squared Tracking Error Information Ratio 3 Years Since Launch 8.68% <0 -1.01% 0.97 0.97 1.45% -< 0 14.27% <0 -6.29% 1.00 0.38 11.19% <0 ʼ&RXQWU\GDWDUHIOHFWVWKHH[SRVXUHRIFUHGLWDQGLQWHUHVWUDWHGHULYDWLYHV Disclaimer This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any Restricted U.S. Investor (as defined in the prospectus of the Fund). The Fund has not been registered in the United States under the Investment Company Act of 1940 and units of the Fund are not registered in the United States under the Securities Act of 1933. Unless otherwise stated all information contained in this document is from Pioneer Investments and is as at 29/05/2015. Pioneer Funds – Emerging Markets Bond Local Currencies is a sub-fund (the “Sub-Fund”) of Pioneer Funds (the “Fund”), a fonds commun de placement with several separate sub-funds established under the laws of the Grand Duchy of Luxembourg. Past performance does not guarantee and is not indicative of future results. Unless otherwise stated, all views expressed are those of Pioneer Investments. These views are subject to change at any time based on market and other conditions and there can be no assurances that countries, markets or sectors will perform as expected. Investments involve certain risks, including political and currency risks. Investment return and principal value may go down as well as up and could result in the loss of all capital invested. More recent returns may be different than those shown. Please contact your sales representative for more current performance results. This material is not a prospectus and does not constitute an offer to buy or a solicitation to sell any units of the Fund or any services, by or to anyone in any jurisdiction in which such offer or solicitation would be unlawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation. For additional information on the Fund, a free prospectus should be requested from Pioneer Global Investments Limited (“PGIL”), 1 George’s Quay Plaza, George’s Quay, Dublin 2, Ireland. Call +353 1 480 2000 Fax +353 1 449 5000 or your local Pioneer Investments sales office. This document is not intended for and no reliance can be placed on this document by retail clients, to whom the document should not be provided. This content of this document is approved by Pioneer Global Investments Limited. In the UK, it is directed at professional clients and not at retail clients and it is approved for distribution by Pioneer Global Investments Limited (London Branch), Portland House, 8th Floor, Bressenden Place, London SW1E 5BH. Pioneer Global Investments Limited is authorised and regulated by the Central Bank of Ireland and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority (“FCA”) are available from us on request. The Fund is an unregulated collective investment scheme under the UK Financial Services and Markets Act 2000 and therefore does not carry the protection provided by the UK regulatory system. Pioneer Funds Distributor, Inc., 60 State Street, Boston, MA 02109 (“PFD”), a U.S.-registered broker-dealer, provides marketing services in connection with the distribution of Pioneer Investments’ products. PFD markets these products to financial intermediaries, both within and outside of the U.S. (in jurisdictions where permitted to do so) for sale to clients who are not United States persons. For Broker/Dealer Use Only and Not to be Distributed to the Public. Pioneer Investments is a trading name of the Pioneer Global Asset Management S.p.A. group of companies. Date of First Use: 11/06/2015. Notes This Sub-Fund uses derivatives. Derivatives exposure is not reflected in portfolio breakdowns in this document unless otherwise stated. For Broker/Dealer Use Only and Not to be Distributed to the Public Pioneer Global Investments Limited www.pioneerinvestments.com

© Copyright 2026