Pioneer Funds â Global Multi

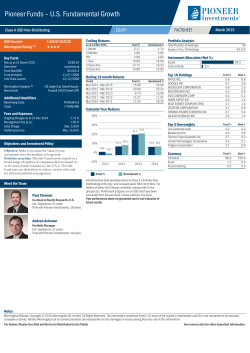

Pioneer Funds – Global Multi-Asset Target Income MULTI-ASSET Class A USD Distributing Quarterly ISIN Number LU0914277297 Key Facts Nav as at 30 April 2015 Domiciled Fund Size (Mil) Fund Inception Unit Class Launch Benchmark $67.1 Luxembourg $501.0 02/05/2013 02/05/2013 No Benchmark PGMAAUD LX L759A1161 Fund % Benchmark % 1 Month 3 Months YTD 1 Year 3 Years Ann. 3 Years Cum. Since Inception Ann. Inception Cum. -0.15 1.55 2.85 5.55 6.24 12.83 - Period Mar 2014 - Mar 2015 Fund % Benchmark % 6.42 - 1.74 % Max. 5.00% ¹ Estimate due to recent changes in cost components charged to the Unit class. Objectives and Investment Policy Objective: Seeks to provide income and, secondarily, to increase the value of your investment over the medium to long term. Portfolio securities: The Sub-Fund mainly invests in a broad range of securities from around the world, including emerging markets. This may include equities, government and corporate bonds and money market securities. The Sub-Fund’s bond investments may be of any quality (investment grade or below). The Sub-Fund may use derivatives to reduce various risks, for efficient portfolio management or as a way to gain exposure (either long or short) to various assets, markets or income streams. This may generate a high level of leverage. In particular, the Sub-Fund will invest in short and medium-term interest rate swaps and may also use options to generate additional income. Meet the Team Francesco Sandrini Head of Multi-Asset Securities Solutions Ind. Experience: 17 years Time with Pioneer Investments: 17 years Thomas Kruse Head of Risk Overlay & Income Strategies Ind. Experience: 20 years Time with Pioneer Investments: 15 years April 2015 Portfolio Analysis as at 30 Apr 2015 Calendar Year Returns (Net) Fees and Expenses Ongoing Charges¹ Entry Charge Trailing Returns (Net) Rolling 12 month Returns (Net) Additional Identifiers Bloomberg Code Cusip FACTSHEET Fund % Total Number of Holdings Assets in Top 10 Holdings Cash at Bank 305 26.4 % 3.4 % Top 5 Equities Fund % Bmk % 0.7 0.7 0.7 0.6 0.6 - Fund % Bmk % 4.1 4.0 - 3.5 - 3.5 - 2.7 - Currency Fund % Bmk % US Dollar Japanese Yen Australian Dollar Danish Krone Hong Kong Dollar Pound Sterling Mexican Peso Canadian Dollar Others 100.8 -1.0 -0.7 0.6 0.3 -0.2 0.1 -0.1 0.3 - APPLE INC AXA SA VIVENDI SA ALLIANZ SE CASINO GUICHARD PERRACHON SA Top 5 Bonds Austria (Republic Of) 3.9% (07/15/2020) Finland (Republic Of) 3.5% (04/15/2021) Netherlands (Kingdom Of) 7.5% (01/15/2023) France (Republic Of) 8.3% (04/25/2022) Fiat Finance And Trade Ltd. 7.0% (03/23/2017) ʼ3HUIRUPDQFHGDWDSURYLGHGUHIHUVWR&ODVV$86'ROODU'LVWULEXWLQJ4XDUWHUO\8QLWVRQO\DQGLVEDVHGXSRQ1$9QHWRIIHHVZLWK dividends re-invested. For details of other Unit Classes available, please refer to the prospectus. Investors should be aware of the impact of fluctuations in the exchange rate. Past performance does not guarantee and is not indicative of future results. Risk and Reward Profile Lower Risk (not-risk free) Lower Potential Reward 1 2 3 4 5 6 7 Higher Risk Higher Potential Reward What does this risk indicator mean? The above risk indicator ranks potential risk and reward and is based on medium-term volatility (how sharply the Sub-Fund’s actual or estimated unit price has gone up and down over five years). Historical data, such as that used in calculating this synthetic indicator, may not be a reliable indication of the future risk profile of the Sub-Fund. The Sub-Fund's risk indicator is not guaranteed and may change over time. The Sub-Fund’s risk category reflects the risk profile of the mix of asset classes in which it invests. For unhedged currency classes, exchange rate movements may affect the risk indicator where the currency of the underlying investments differs from the currency of the unit class. Additional key risks: The risk indicator reflects market conditions of recent years and may not adequately capture the following additional key risks of the Sub-Fund: Counterparty risk: Contract parties may default on their obligations under derivatives contracts entered into with the Sub-Fund. Credit risk: The issuers of bonds held by the Sub-Fund may fail to pay principal or interest due. Higher yielding bonds may carry greater credit risk. Liquidity risk: In adverse market conditions, securities that are liquid may become difficult to value, buy or sell, which could affect the Sub-Fund’s ability to process redemption requests. Operational risk: Losses may occur due to human error or omission, process errors, system disruptions or external events. Derivatives risk: Derivatives create leverage in the Sub-Fund and may cause movements in the value of the underlying investments to amplify gains or losses to the Sub-Fund. Emerging market risk: Some of the countries invested in may carry higher political, legal, economic and liquidity risks than investments in more developed countries. See reverse side for other important information. Pioneer Funds – Global Multi-Asset Target Income Sector (Equities) Financials Cons Disc Telecoms April 2015 Country (Equities) Fund % United States France Germany United Kingdom Spain Others 10.5 5.1 4.5 3.0 1.7 8.3 Credit Rating Fund % Bmk % - IT Industrials Health Care Utilities Consumer Staples Materials Credit Exposure (%) Bmk % Int. Rate Exposure (%) 9.7 8.1 7.0 5.5 4.9 24.2 - -2.8 0.2 -19.0 -2.6 0.0 6.1 France Italy United States United Kingdom Netherlands Others Bmk % AAA 18.6 AA 17.3 A 6.6 BBB 8.9 BB 3.3 B and Below 4.9 NR -0.01 ʼ&UHGLW5DWLQJGDWDXVHVDQDYHUDJHRIDYDLODEOHUDWLQJVDFURVV S&P, Moodys and Fitch. In the case of sovereign bonds that are not rated by any of the 3 referenced rating agencies, an average of the issuer rating is used. Energy Country (Bonds) Asset Allocation (Bonds) Government Financials Non Financials Emerging Government Emerging Non Financials Quasi Govt Emerging Financials Emerging Quasi Govt Covered Fund % Bmk % 38.2 9.5 6.0 2.6 1.9 0.6 0.3 0.3 0.1 - Fund % Disclaimer Pioneer Funds – Global Multi-Asset Target Income is a sub-fund (the “Sub-Fund”) of Pioneer Funds (the “Fund”), a fonds commun de placement with several separate sub-funds established under the laws of the Grand Duchy of Luxembourg subject to supervision by the Commission de Surveillance du Secteur Financier and qualifying as an Undertaking for Collective Investment in Transferrable Securities (“UCITS”). This material is not a Prospectus and does not constitute an offer to buy or a solicitation to sell any units of the Fund or any services, by or to anyone in any jurisdiction in which such offer or solicitation would be unlawful or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation including in the United States or in any of its territories or possessions subject to its jurisdiction where no offer or solicitation is made to or for the benefit of any Restricted U.S. Investor (as defined in the Prospectus of the Fund). The Fund has not been registered in the United States under the Investment Company Act of 1940 and units of the Fund are not registered in the United States under the Securities Act of 1933. This document is not intended for and no reliance can be placed on this document by retail clients in jurisdictions where the Sub-Fund is not registered for public offering and such clients should not be provided with this document. Investors should consult their professional adviser for details of registration. In particular, the Sub-Fund is not registered or otherwise notified for public offering with the relevant authorities of any Central American, South American, Latin American or Caribbean country. Past performance does not guarantee and is not indicative of future results. The value of investments is not guaranteed and may go down as well as up. The amount returned may not be as much as the amount invested. More recent returns may be different than those shown. Investors are strongly advised to seek independent advice before investing in the Sub-Fund. Unless otherwise stated all information contained in this document is from Pioneer Investments and is as at 30/04/2015. Investors should consider the Sub-Fund’s investment objectives, risk, charges and expenses carefully before investing. The Prospectus contains this and other information about the Sub-Fund and this material is authorised for use only when preceded or accompanied by a current prospectus which clients should obtain from their professional adviser. The Sub-Fund’s Prospectus and Key Investor Information document (“KIID”) are also available in an officially accepted language in your jurisdiction on www.pioneerinvestments.eu. Any statements made herein are qualified in their entirety by the terms of the current Prospectus. This content of this document is approved by Pioneer Global Investments Limited (“PGIL”), 1 George’s Quay Plaza, George’s Quay, Dublin 2, Ireland Call +353 1 480 2000. In the UK, it is directed at professional clients and not at retail clients and it is approved for distribution by PGIL (London Branch), Portland House, 8th Floor, Bressenden Place, London SW1E 5BH. PGIL is authorised and regulated by the Central Bank of Ireland and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority (“FCA”) are available from us on request. The Fund is an unregulated collective investment scheme under the UK Financial Services and Markets Act 2000 and therefore does not carry the protection provided by the UK regulatory system. Pioneer Funds Distributor, Inc., 60 State Street, Boston, MA 02109 (“PFD”), a U.S.-registered broker-dealer, provides marketing services in connection with the distribution of Pioneer Investments’ products. PFD markets these products to financial intermediaries, both within and outside of the U.S. (in jurisdictions where permitted to do so) for sale to clients who are not United States persons. Pioneer Investments is a trading name of the Pioneer Global Asset Management S.p.A. group of companies. Date of First Use: 15/05/2015. Notes The Global Industry Classification Standard (GICS) SM was developed by and is the exclusive property and a service mark of Standard & Poor's and MSCI. Neither Standard & Poor's, MSCI nor any other party involved in making or compiling any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the forgoing, in no event shall Standard & Poor's, MSCI, any of their affiliates or any third party involved in making or compiling any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. Pioneer Global Investments Limited

© Copyright 2026