HSBC - Chinese Equities

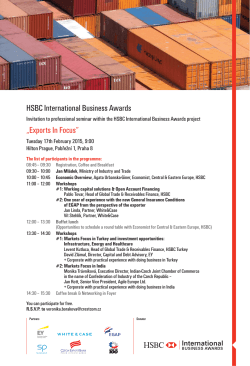

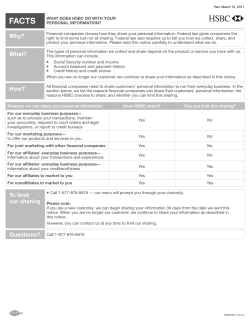

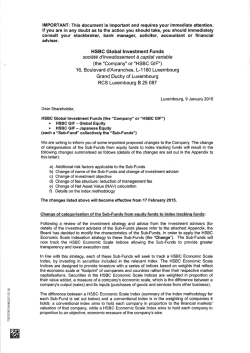

One-on-One interview Chinese Equities Implications of property easing and relaxation of investment rules Mandy Chan Head of China and HK Equities March 2015 "The reduction in down-payment for second home mortgages, changes to property transaction tax should help stimulate home sales, support the second-hand property market, and facilitate upgrading demand." - Mandy Chan, Head of China and HK Equities The government announced property easing measures. What are the potential implications? • The government announced a cut to both China's mortgage down payment requirement and property transaction tax policy on 30 March 2015. • Specifically, the down payment requirement for all second mortgages has been lowered from 60-70% to 40%. The magnitude of this round of policy easing is better than market expectation, as the market was only expecting a reduction of 50%. • For mortgages taken out against the housing provident fund, the down payment requirement for buyers borrowing for their first mortgage has been lowered from 30% to 20%. • Meanwhile, the property transaction tax on homes owned over 2 years will also be waived (lowered from the previous 5 years). • These, in combination with the two recent policy rate cuts, should help stimulate home sales, support the second-hand property market, and facilitate upgrading demand. Following the rally in the A-share market in Q4 2014, the offshore H-share market is trading at a significant discount to its domestic counterparts, as shown by the Hang Seng China AH Premium Index below. The arbitrage opportunities could not be fully exploited even with the launch of Stock Connect. For mainland retail investors to be qualified to invest in Hong Kong shares through Stock Connect Southbound trading, they were required to have a minimum account balance of RMB500,000. Based on China securities clearing house's latest data, by the end of Oct 2014, around 6% of total accounts met the qualification. As of March 20, 2015, total A share accounts was 147 million. For onshore institutional investors, their appetite in H-share market through South Bound trade of Stock Connect was very limited due to the QDII status requirement. Hence, the relaxation in trading rules should create attractive opportunities for onshore institutional investors to diversify their portfolios. Meanwhile, CSRC has relaxed the rules for domestic mutual funds to invest in Hong Kong equities. What is the significance of this move? The China Securities Regulatory Commission (CSRC) announced on 27 March 2015, that newly established domestic mutual funds in mainland China will be allowed to invest in Hong Kong stock market through Shanghai-Hong Kong Stock Connect without Qualified Domestic Institutional Investor (QDII) quota. Existing funds can do the same on condition that this is not inconsistent with their mandate and their clients are informed. No CSRC approval is necessary. The announcement could be a catalyst for the H-share market as valuations are attractive and the recent regulation could increase investor appetite. Source: Bloomberg, data as at 30 March 2015. For illustrative purposes only. Levels above 100 indicate that dual-listed A-shares are trading at a premium to H-share counterparts. How has the market reacted to this news? • The Hang Seng China Enterprises Index (HSCEI) rose 3.4% after the announcement, while the Hang Seng Index gained 1.5%. Net buy orders from Shanghai to Hong Kong via Stock Connect reached a new high of RMB2.56 billion. • Meanwhile, onshore equities, as measured by CSI 300 Index, rose 2.9% after the central bank governor said the government can do more to support growth in China. • The Shanghai property index had jumped 7.3% before the People’s Bank of China (PBoC) cut the down-payment requirement for some second homes. What is the impact of these developments on the HGIF Chinese Equity Fund? • We remain positive on Chinese equities in general, over the medium to long term. • HSCEI is now trading at a forward Price-to-Earnings (PE) of 8.6x (vs. 14.8x of CSI 300). The portfolio is overweight on industrials, and continues to favour H-shares that are trading at deep discount to their A-share counterparts, especially airlines and construction firms. • The small-mid-cap space in Hong Kong will benefit given their attractive valuations, of around 10x to 50x PE. In comparison, the companies listed in ChiNext, the Shenzhen version of NASDAQ, are trading at 50x to 150x PE ratio. • The portfolio continues to be positive on property companies focusing on tier 1 cities given we see potential for undersupply later in the year, while valuations remain at attractive levels. Given that the recently announced easing measures were even higher than the market's expectation, this should be positive for the portfolio. Source: HSBC Global Asset Management, data as at 30 March 2015. Data shown is for illustrative purposes only and does not constitute any investment recommendation. 2 Disclaimer This document is prepared for general information purposes only and the opinions expressed are subject to change without notice. The opinions expressed herein should not be considered to be a recommendation by HSBC Global Asset Management (Singapore) Limited to any reader of this material to buy or sell securities, commodities, currencies or other investments referred to herein. It is published for information only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. This document does not constitute an offering document. Investors should not invest in the Fund solely based on the information provided in this document and should read the offering document of the Fund for details. Investors may wish to seek advice from a financial adviser before purchasing units in the fund. In the event that the investor chooses not to seek advice from a financial adviser, he should consider whether the fund in question is suitable for him. Investment involves risk. The past performance of any fund and the manager and any economic and market trends/forecasts are not necessarily indicative of the future or likely performance of the fund. The value of investments and units may go down as well as up, and the investor may not get back the original sum invested. Investors and potential investors should read the Singapore prospectus (including the risk warnings) which is available at HSBC Global Asset Management (Singapore) Limited or its authorised distributors, before investing. Changes in rates of currency exchange may affect significantly the value of the investment. HSBC Holdings plc, its subsidiaries and other associated companies which are its subsidiaries, and including without limitation HSBC Global Asset Management (Singapore) Limited (collectively, the “HSBC Group”), affiliates and clients of the HSBC Group, and directors and/or staff of any of the foregoing may, at any time, have a position in the markets referred to herein, and may buy or sell securities, currencies, or any other financial instruments in such markets. HSBC Global Asset Management (Singapore) Limited has based this document on information obtained from sources it believes to be reliable but which it has not independently verified. Care has been taken to ensure the accuracy and completeness of this presentation but HSBC Global Asset Management (Singapore) Limited and HSBC Group accept no responsibility or liability for any errors or omissions contained therein. HSBC Global Asset Management (Singapore) Limited 21 Collyer Quay #06-01 HSBC Building Singapore 049320 Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324 Website: www.assetmanagement.hsbc.com/sg Company Registration No. 198602036R 3

© Copyright 2026