RBI Relaxes MFI Regulations to Spur Growth

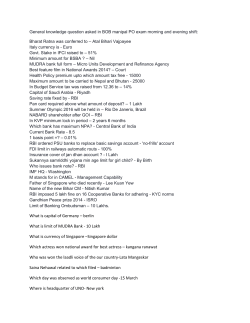

FIMPACT Newsletter No. 81 (dated 20th April 2015). Contact us at [email protected] In the previous newsletter dated April 13, 2015, we highlighted the affirmation of BBB+ rating by ARC ratings and Baa3 rating by Moody’s Investor Service to Government of India’s sovereign debt. In this newsletter we take a look at the relaxations in MFIs’ lending norms recently announced by RBI and the potential impact of such measures on the performance of NBFC-MFIs and the microfinance sector. In its Monetary Policy Statement on April 7, 2015, the RBI, based on the recommendations of the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households (Nachiket Mor Committee), announced several relaxations in the operations of NBFC-MFIs. It may be noted that severe restrictions had been placed on lending norms, product features and other operational aspects of NBFC-MFIs in 2011 following the Andhra Pradesh Crisis. The relaxations are largely seen as an improvement in RBI’s confidence in the sector. Summary of regulatory changes announced: Annual household income Impact - • Urban/semi-urban borrower limit increasd to Rs. 160,000 from Rs. 120,000 • Rural borrower limit increasd to Rs. 100,000 from Rs. 60,000 Total indebtedness Impact - • Doubled to Rs. 100,000 from Rs. 50,000 • Consumption loans towards education and medical expenses to be excluded in computation of total indebtedness Loan size Impact - • First cycle - increased to Rs. 60,000 from Rs. 35,000 • Subsequent cycles - increased to Rs. 100,000 from Rs. 50,000 Minimum IGL portfolio Impact - • Decreased from 70% to 50% What gave RBI the confidence? We feel that the following factors contributed to improving RBI’s confidence in the Sector: - Proactive role played by credit bureaus With the number of credit records nearing 150 million, MFI-focussed credit bureaus have built a robust platform to assist MFIs in loan underwriting. The technology platform has also constantly evolved to allow for the nuances of the sector such as non-availability of a single unique identifier, duplicate records, incomplete records etc. - Evolution of MFIN as a SRO The industry associated was granted the status of a Self-Regulatory Organisation a few months back and has been on the forefront in representing NBFC-MFIs among regulators and the FIMPACT Newsletter No. 81 (dated 20th April 2015). Contact us at [email protected] government. As an SRO, MFIN has also ensures that its members adhere to a mandated code of conduct and also provides forums to its members for dispute and grievance redressals. - Good quality of assets The sector has demonstrated a steady reduction in the level of bad assets with the PAR-30 dropping to nearly 0.3% in December 2014 from nearly 2% in December 2011. Impact of Relaxations – Largely positive, but important to remain cautious The consensus opinion of the change in regulations is that the RBI has provided a significant boost to the MFI sector as it provides for portfolio growth, widening coverage, improvement in operating efficiency and offering a wider product bouquet. Increase in the debt ceiling has been a long standing demand from MFIs as the old ceiling of Rs. 50,000 was fixed in 2011, and has not been adjusted for inflation since then. India Ratings points out in its report dated April 15, 2015, that agricultural and non-agricultural rural wages have increased by 70% and 100%, respectively since January 2011. From an MFI’s growth point of view, the aggregate loan portfolio can be potentially doubled by only increasing the loan size to the existing microfinance borrowers (i.e., without expanding their coverage), apart from the higher amount of consumption loans (medical and education purposes) that can be provided to existing borrowers. Another important relaxation allowed by the RBI is to reduce the share of income generating loans to 50% of an MFI’s loan portfolio from 70% earlier. As these measures could potentially increase the share of consumption loans in the portfolio, it would be important to build in some credit checks in the loan appraisal process as the viability of the JLG model at these loan sizes has not been tested in India. The India Ratings report also points out that the headroom provided by the RBI on loan sizes ensures that MFIs need not dilute their underwriting standards to showcase portfolio growth over the next 5 years. However, given the jump in the equity and funding inflow into the sector in the past couple of years, MFIs would be under tremendous pressure to grow and it is important to ensure that the underwriting standards and core principles of JLG/SHG are adhered to. Having said that, the average loan amount per borrower and the loan balance per borrower as compared to per capita GNI are the lowest in India among its peer group (table below) and there is a lot of scope to bridge this gap through microfinance. Amounts in US$ India Cambodia Cameroon Colombia Dominican Republic Ecuador Mexico Average Loan balance per borrower 2012 157.19 465.90 2,061.56 1,589.15 454.86 2013 160.73 985.98 2,542.55 1,422.60 428.66 944.80 2,557.08 1,190.32 791.92 Average loan balance per borrower / GNI per capita 2012 2013 11% 11% 55% 117% 153% 193% 26% 24% 9% 8% 2,523.06 374.86 2,770.01 385.74 5,064.72 583.91 59% 4% 2014 65% 4% FIMPACT Newsletter No. 81 (dated 20th April 2015). Contact us at [email protected] Nigeria Panama Paraguay Peru 615.32 3,254.66 1,184.85 2,549.71 890.44 2,940.47 1,361.05 2,029.02 226.33 6,076.51 1,747.70 2,024.52 44% 42% 37% 48% 64% 38% 42% 40% Source: Mixmarket.org Who regulates MFIs? This show of confidence in the microfinance sector from RBI comes in at a time when Mudra Bank is being proposed as a new Regulator for Microfinance Institutions by the Union Government. The RBI has indicated that it would continue to regulate MFIs which are constituted as NBFCs, and also that it would be unable to regulate MFIs which are not NBFCs. The industry body for NBFC-MFIs, MFIN is also of the view that NBFC-MFIs should continue to be regulated by RBI and has made representations to the Ministry of Finance to this effect. If the finance ministry were to take cognizance of this view, then Mudra Bank may be asked to regulate MFIs other than those already falling under RBI’s purview such as NGOs, Trusts, Cooperative Societies etc., which could result two regulators regulating the microfinance sector. The finance ministry is likely to announce its decision on the sector regulator in the Bill for setting up Mudra Bank, which will be shortly introduced in the parliament. Conclusion The changes introduced by RBI are largely positive for the sector and will herald a strong medium term growth in MFIs’ portfolio. The average microfinance loan per capita as compared to per capita GNI is among the lowest in India at 11% while it is in the range of 50-100% in other countries which have a high penetration of MFI. MFIs are exposed to higher credit risk and it remains to be seen if MFIs tighten their underwriting standards to deal with the same. Investors’ confidence has returned and concerns on both equity and debt availability to the sector have been addressed to a large extent. Given the current state of affairs, the potential for growth and penetration is significant and all stakeholders – borrowers, investors, regulators, government – would like to witness cautious and responsible growth by MFIs.

© Copyright 2026