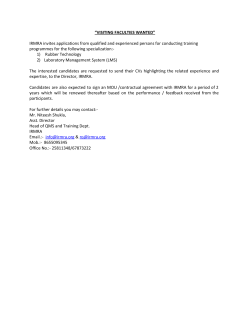

Notice of Annual Meeting of Stockholders