View the Presentation (PDF 707 KB)

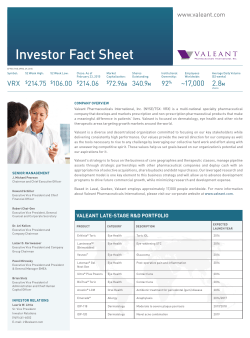

Valeant Pharmaceuticals International, Inc. 2015 Annual Meeting May 19, 2015 Laval, Quebec, Canada Introductions Board of Directors Ronald Farmer Colleen Goggins Robert Ingram (Lead Director) Anders Lönner Theo Melas-Kyriazi Robert Power Norma Provencio Howard Schiller Katharine Stevenson Jeffery Ubben J. Michael Pearson (Chairman) Executive Management Robert Chai-Onn Dr. Ari Kellen Laizer Kornwasser Dr. Pavel Mirovsky Brian Stolz Anne Whitaker Valeant Pharmaceuticals International, Inc. 2015 Annual Meeting May 19, 2015 Laval, Quebec, Canada Shareholder Voting Results All Directors >90% Say on Pay (Executive Compensation) >90% PricewaterhouseCoopers as Auditors >90% 4 Valeant Pharmaceuticals International, Inc. 2015 Annual Meeting May 19, 2015 Laval, Quebec, Canada Forward-looking Statements Certain statements made in this presentation may constitute forward-looking statements, including, but not limited to, statements regarding the timing of and outcome of regulatory approvals and commercial plans with respect to product candidates and product launches, future manufacturing capabilities, debt reduction, acquisition capacity, shareholder return and future operational performance, including guidance and outlook with respect to revenue and earnings. Forward-looking statements may generally be identified by the use of the words “anticipates,” “expects,” “intends,” “plans,” “should,” “could,” “would,” “may,” “will,” “believes,” “estimates,” “potential,” “target,” or “continue” and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, risks and uncertainties discussed in the Company's most recent annual or quarterly report and detailed from time to time in Valeant’s other filings with the Securities and Exchange Commission and the Canadian Securities Administrators, which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Valeant undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect actual outcomes. Who Is Valeant? Focused, multinational specialty pharmaceutical company $75B+ Market Cap Headquartered in Laval, Quebec, Canada (NYSE/TSX: VRX) Unconventional Business Model Decentralized operating model Geographical and product diversity Focus on faster-growing geographies and therapeutic categories Durable product portfolio with limited patent risk Significant cash pay component / low exposure to government reimbursement Financially disciplined M&A Ownership Culture Shareholder friendly executive compensation and corporate governance Commitment to Innovation Emphasis on bringing new products to the market (output), through internal R&D, acquisitions and licensing (input) Focus on late-stage and lower-risk development projects Proven track record of delivering industry leading returns to shareholders 7 Highly Diversified Business Portfolio Based on pro forma 2015 revenues excluding effect of inventory By Geography Canada / Australia 6% By Business Latin America 4% BGx/Gx Western Europe 8% 9% Devices 1 14% Asia 8% 15% Emerging Europe, Africa, & Middle East 10% OTC / Solutions United States 64% 62% Rx Emerging Markets = ~20% 1 8 Includes contact lens, and surgical devices Salix at a Glance Mid-sized specialty pharma company that is a clear leader in the GI market Ranked #1 GI sales force 3 of the past 4 years(a) Xifaxan: Approved for Hepatic Encephalopathy (HE) and Traveler’s Diarrhea PDUFA date for IBS-D – May 28, 2015 Other major products for Ulcerative Colitis (Apriso and Uceris) and opioid induced constipation (Relistor) with attractive growth prospects Attractive, low-risk short-term pipeline Traveler’s Diarrhea & Hepatic Encephalopathy (HE) Ulcerative Colitis Ulcerative Colitis Xifaxan IBS-D indication Relistor oral indication (approval expected 2016/2017) Xifaxan Early decompensated liver cirrhosis indication (a) Source: IMS 9 Opioid Induced Constipation Valeant’s Approach to Innovation Innovation critical to the industry and to Valeant We source innovation through our internal R&D, acquisitions, inlicensing We have acquired terrific set of capabilities and technologies over time Dow (Dermatology Rx and OTC) Bausch + Lomb (e.g., Contact lens, surgical, ophthalmology Rx, OTC) Additional external collaborations (e.g., Emerade) We run a lean R&D model focused on productivity – outputs measured against inputs Leverage industry overcapacity Outsource commodity services Focus on critical skills and capabilities needed to bring new technologies to market Spend according to promise of programs - for short and long term Results of this approach: 20 launches in the US in 2014; rich pipeline of products for the future sourced from inside, acquisitions and inlicensing 10 Key R&D Milestones for 2015 Product Category Action Status EnVista Toric Eye Health File PMA 1H 2015 Additional studies requested To Be Filed mid- 2016 Luminesse™ (Brimonidine) Eye Health File NDA 1H 2015 Filed NDA in March Vesneo (glaucoma) Eye Health File NDA 1H 2015 On Track Lotemax Gel Next Gen Eye Health File NDA 2H 2015 Filing delayed until mid-2016 Ultra Multi Focal Eye Health File PMA 1H 2015 Approved Ultra Toric Eye Health File PMA 2H 2015 Approved BioTrue Toric Eye Health File PMA 2H 2015 Approved Derm Initiate Phase III 1H 2015 Phase III Initiated Derm Initiate Phase II 2H 2015 On Track Oral Health File NDA 2H 2015 On Track Gastrointestinal PDUFA Date May 28 On Track IDP-118 (moderate to severe plaque psoriasis) IDP – 120 (novel acne combination ) Arestin LCM Xifaxan (IBS-D Indication) 11 Dermatology Launch Products Leading branded product for onychomycosis among dermatologists and podiatrists Current sales annualizing at >$400M Recently launched 8 ml bottle; strong uptake Weekly TRx’s up 100% YTD New DTC campaign driving further growth Continued franchise growth with sales up 50% Y/Y Launch ahead of expectations with current run-rate greater than $75M Combined Onexton and Luzu run-rate revenues ~$100M; well above our projection of $75M for 2015 12 Jublia TRx Growth Since Launch TRxs 30,000 25,000 • 1Q 2015 sales >$60 million • Annualized run rate >$400 million 20,000 DTC TV 15,000 10,000 5,000 0 13 ~25,000 Luzu TRx Growth 2015 TRxs 2,200 2,038 2,000 1,800 1,600 1,400 1,200 1,000 800 14 Onexton TRx Growth Since Launch TRxs Annualized run rate >$75 million 7,000 5,946 6,000 5,000 4,000 3,000 2,000 1,000 0 1/9 1/16 1/23 1/30 2/6 2/13 2/20 2/27 3/6 15 3/13 3/20 3/27 4/3 4/10 4/17 4/24 5/8 Ex-U.S. Launches Strong launch in Canada Surpassed generic Lamisil and is now the number 1 prescribed product for onychomycosis Launched in Sweden, UK, and Germany Ongoing registrations around the world Achieved 25% share in Sweden in less than one year Branded Gx Launches 200+ launches across EMEA region in 2014 200+ launches expected in 2015 16 Contact Lens Launch Products Continuing to sell to capacity First full manufacturing line installed and validated, producing commercial product 2nd commercial line expected in Q3 2015 Selected Ex-US launches planned for 2H 2015 Multifocal and Toric offerings approved, expected to launch in Q4 2015 and Q1 2016 respectively Three consecutive quarters of 100%+ growth in the US Multifocal launch underway Launched in China Q2, 2015 17 U.S. Consumer Launch Products Continued expansion of the franchise with 9 launches planned in 2015 26% Y/Y growth in 2014 44% Y/Y growth in Q1, 2015 Expected to achieve revenues ~$150MM in 2015 Fastest growing product in category 18%+ growth Y/Y, ~17% market share Brand growing 20%, driven by launch of Soothe XP Recent launch; ~10% market share of category already achieved 18 Salix Late Stage Pipeline and Launch Products May 28th PDUFA date for IBS-D Currently in labeling discussions with FDA Launched Q4, 2014 Only recombinant product available for HAE Continued strong sales uptake Uceris tablets launched February 2013 Foam launch expected Q3/4 2015 Expect to file NDA for oral by end of Q2 2015 19 2015 - Validation of Valeant’s Business Model Robust organic growth profile Rich pipeline of low-risk R&D programs Internal development – e.g. IDP-118, IDP-120, Onexton Acquisitions – e.g. Vesneo, Luminesse, Ultra Product acquisitions/licenses – e.g. Emerade, Croma Strong cash flows and balance sheet Double-digit organic growth expected in 2015, 2016 and continued strong growth beyond Geographical and product diversification creates lower-risk profile Durable product portfolio limits patent expiry exposure Expected EBITDA >$7.5B in 2016 Commitment to reduce leverage to < 4x by 2H of 2016 Enhanced capacity to continue acquisition activity as well as opportunistically pay down debt and/or buy back shares Disciplined approach to business development Continue to be disciplined with capital deployment to generate above average returns for shareholders 20 Valeant’s Execution Track Record Valeant Management Team Performance* USD $250 $200 >3,000% price adjusted increase in VRX share price (Feb 2008 to today) Consistently exceeded expectations $150 $100 $50 $0 2008 2009 2010 2011 2012 2013 VRX *Adjusted for Valeant/Biovail merger. 21 2014 2015 Valeant Pharmaceuticals International, Inc. 2015 Annual Meeting May 19, 2015 Laval, Quebec, Canada

© Copyright 2026