Corporate Fact Sheet - Valeant Pharmaceuticals

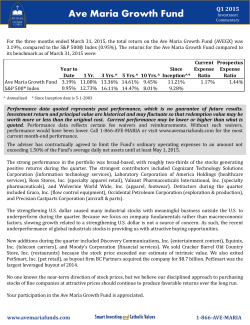

www.valeant.com Investor Fact Sheet EFFECTIVE APRIL 29, 2015 Symbol: 52 Week High: VRX $ 52 Week Low: 214.75 $106.00 Close: As of February 23, 2015 214.06 $ Market Capitalization: Shares Outstanding: 72.96B 340.9M $ Institutional Ownership: 92% Employees Worldwide: ~17,000 Average Daily Volume (52 weeks) 2.8M shares COMPANY OVERVIEW Valeant Pharmaceuticals International, Inc. (NYSE/TSX: VRX) is a multi-national specialty pharmaceutical company that develops and markets prescription and non-prescription pharmaceutical products that make a meaningful difference in patients’ lives. Valeant is focused on dermatology, eye health and other niche therapeutic areas targeting growth markets around the world. Valeant is a diverse and decentralized organization committed to focusing on our key stakeholders while delivering consistently high performance. Our values provide the overall direction for our company as well as the tools necessary to rise to any challenge by leveraging our collective hard work and effort along with an unwavering competitive spirit. These values help us set goals based on our organization’s potential and our aspirations for it. SENIOR MANAGEMENT J. Michael Pearson Chairman and Chief Executive Officer Howard Schiller Executive Vice President and Chief Financial Officer Robert Chai-Onn Executive Vice President, General Counsel and Corporate Secretary Valeant’s strategy is to focus on the business of core geographies and therapeutic classes, manage pipeline assets through strategic partnerships with other pharmaceutical companies and deploy cash with an appropriate mix of selective acquisitions, share buybacks and debt repurchases. Our leveraged research and development model is one key element to this business strategy and will allow us to advance development programs to drive future commercial growth, while minimizing research and development expense. Based in Laval, Quebec, Valeant employs approximately 17,000 people worldwide. For more information about Valeant Pharmaceuticals International, please visit our corporate website at www.valeant.com. VALEANT LATE-STAGE R&D PORTFOLIO Dr. Ari Kellen Executive Vice President and Company Chairman PRODUCT CATEGORY DESCRIPTION EXPECTED LAUNCH YEAR EnVista® Toric Eye Health Toric IOL 2016 Laizer D. Kornwasser Executive Vice President and Company Group Chairman Luminesse™ (Brimonidine) Eye Health Eye-whitening OTC 2016 Vesneo™ Eye Health Glaucoma 2016 Lotemax® Gel Next Gen Eye Health Post-operative pain and inflammation 2016 Ultra® Plus Powers Eye Health Contact lens 2016 BioTrue® Toric Eye Health Contact lens 2016 Arestin® LCM Oral Health Antibiotic treatment for periodontal (gum) disease 2016 Emerade® Allergy Anaphylaxis 2016/2017 IDP-118 Dermatology Moderate to severe plaque psoriasis 2017/2018 IDP-120 Dermatology Novel acne combination 2019 Pavel Mirovsky Executive Vice President and President & General Manager EMEA Brian Stolz Executive Vice President of Administration and Chief Human Capital Officer INVESTOR RELATIONS Laurie W. Little Sr. Vice President Investor Relations (949) 461-6002 E-mail: [email protected] REVENUE CASH EPS 8B $8.26 B 8.0 7B 7.0 6B 6.0 $5.76 B 5B $8.34 $6.24 4.0 3B $4.51 •Valeant expands Bausch + Lomb manufacturing facility, adding 120 new jobs in Rochester, N.Y. $2.93 2.0 $2.46 B 1B •FDA approves Onexton™ Gel for the treatment of acne vulgaris 3.0 $3.55 B 2B •Valeant completes its acquisition of substantially all the assets of Dendreon Corporation. 5.0 4B $2.05 •Sale of fillers and toxin assets to Galderma completed 1.0 $1.18 B 500 M 0 2010 2011 2012 2013 2014 * A s a result of the Biovail’s merger with Valeant, revenue reflects Biovial standalone operations as they existed prior to the completion of the merger and combined Valeant’s results only for the period subsequent to the completion of the merger on September 28, 2010. 2010 HIGHLIGHTS •Valeant completes its acquisition of Salix Pharmaceuticals. 2011 2012 2013 2014 *A s a result of the Biovail’s merger with Valeant, Cash EPS reflects Biovial standalone operations as they existed prior to the completion of the merger and combined Valeant’s results only for the period subsequent to the completion of the merger on September 28, 2010. •Valeant completes acquisition of PreCision Dermatology •FDA approves Jublia for treatment of onychomycosis RECENT VALEANT ACQUISITIONS Bausch + Lomb In August 2013, Valeant completed its acquisition of Bausch + Lomb. The integration of Valeant’s eye care businesses into Bausch + Lomb’s operations offers a vast product portfolio and a full array of innovative products in the development pipeline focused on protecting, enhancing and restoring people’s eyesight. The acquisition has also served to establish Valeant’s presence in such emerging markets as China, among others. Solta Medical, Inc. On January 23, 2014, Valeant completed its acquisition of Solta Medical. Solta designs, develops, manufactures and markets energy-based medical device systems for aesthetic applications. PreCision Dermatology, Inc. On July 8, 2014, Valeant completed its acquisition of PreCision Dermatology, Inc., which develops and markets high-quality dermatology products treating a number of topical disease states such as acne and atopic dermatitis. Dendreon Corporation On February 23, 2015, Valeant completed its acquisition of substantially all of the assets of Dendreon Corporation, following approval from the Bankruptcy Court. These assets include the worldwide rights to PROVENGE® (sipuleucel-T), an immunotherapy treatment designed to treat advanced prostate cancer. Salix Pharmaceuticals On April 1, 2015, Valeant completed its acquisition of Salix Pharmaceuticals Ltd., a specialty pharmaceutical company that offers innovative gastrointestinal treatments. VALEANT PHARMACEUTICALS INTERNATIONAL, INC. ORGANIC GROWTH - BY SEGMENT FOR THE THREE MONTHS ENDED MARCH 31, 2015 (in millions) PRODUCT SALES QTD REVENUES SAME STORE(C) PRO FORMA(C) Total U.S.(a) $1382.4 26% 36% ROW Developed (b) $348.8 -1% -1% Developed Markets $1,731.1 18% 25% Emerging Markets $416.4 7% 7% $2147.5 15% 21% TOTAL PRODUCT SALES (a) Includes Valeant’s attributable portion of revenue from joint ventures (JV) - $0.6M Q1’15 and $0.7M Q1’14. (b) Includes Valeant’s attributable portion of revenue from joint ventures (JV) - $3.1M Q1’14. (c)Organic Growth Definitions: Same Store (SS): This measure provides growth rates for businesses that have been owned for one year or more. ((Current Year Total product sales – acquisitions within the last year + YoY FX impact)- (Prior Year Total product sales – divestitures & discontinuations))/( Prior Year Total product sales – divestitures & discontinuations). Pro Forma (PF): This measure provides year over year growth rates for the entire business, including those that have been acquired within the last year.

© Copyright 2026