According to a criminal complaint

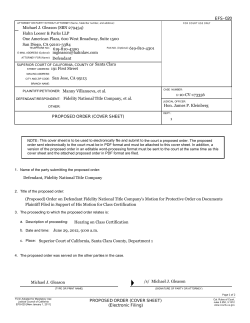

State of Minnesota County of Washington District Court 10th Judicial District Prosecutor File No. Court File No. State of Minnesota, CR-2015-221 82-CR-15-1075 COMPLAINT Plaintiff, Summons vs. DAVID WEBSTER ECKBERG DOB: 08/31/1951 5055 Normandale Avenue N Stillwater, MN 55082 Defendant. The Complainant submits this complaint to the Court and states that there is probable cause to believe Defendant committed the following offense(s): COUNT I Charge: Taxes-failure to pay or collect-F Minnesota Statute: 289A.63.1(b), with reference to: 289A.63.1(b) Maximum Sentence: 5 years, $10,000 or both Offense Level: Felony Offense Date (on or about): 02/28/2010 to 02/05/2012 Control #(ICR#): 20120014 Charge Description: willfully attempt to evade or defeat a tax law by failing to remit a tax when required to do so; Sales and Alcohol Tax due to be collected and remitted on or before February 5, 2011 COUNT II Charge: Taxes-failure to pay or collect-F Minnesota Statute: 289A.63.1(b), with reference to: 289A.63.1(b) Maximum Sentence: 5 years, $10,000 or both Offense Level: Felony Offense Date (on or about): 02/28/2010 to 02/05/2012 Control #(ICR#): 20120014 Charge Description: willfully attempt to evade or defeat a tax law by failing to remit a tax when required to do so; Sales and Alcohol Tax due to be collected and remitted on or before February 5, 2012 COUNT III Charge: Taxes-failure to pay or collect-F Minnesota Statute: 289A.63.1(b), with reference to: 289A.63.1(b) Maximum Sentence: 5 years, $10,000 or both Offense Level: Felony Offense Date (on or about): 02/28/2010 to 02/05/2012 1 Control #(ICR#): 20120014 Charge Description: willfully attempt to evade or defeat a tax law by failing to remit a tax when required to do so; Non-Resident Entertainment Tax due to be collected and remitted on or before February 28, 2010 2 STATEMENT OF PROBABLE CAUSE The Complainant states that the following facts establish probable cause: I, Jeff Slater, am a manager and supervisor for the Minnesota Department of Revenue. My duties include responsibility for the Criminal Investigation Division (CID) of the Minnesota Department of Revenue (MNDOR). MNDOR/CID is responsible for criminal investigations into alleged violations of the tax laws of the State of Minnesota. In January 2012, the Office of the Washington County Attorney in Stillwater, Minnesota sought the assistance of MNDOR/CID for possible felony tax violations committed by David Webster Eckberg, the Defendant herein by and through corporate entities of which he was the principal. Those corporate entities included the Lumberjack Days Festival Association (LDFA) and St. Croix Events, Inc. (SCE). Possible tax violations had come to light as a result of an investigation by the Stillwater Police Department and the Washington County Sheriff's Office into events and activities of the Defendant surrounding the operation by the Defendant of a large community festival in Stillwater, Minnesota known as Lumberjack Days that was operated by and with these business entities run by the Defendant. As part of that investigation the Washington County Attorney's Office also retained the service of a private forensic accounting entity. The MNDOR case was assigned to Investigator Michael Morehead of CID. Morehead conducted an extensive investigation of many aspects of the operation of the Lumberjack Days activities by the Defendant. Morehead put several aspects of the criminal revenue investigation on hiatus subsequent to the Defendant being criminally charged with multiple felony counts in Washington County District Court. Upon conclusion of that prosecution with the Defendant's conviction for felony issuance of worthless checks Morehead resumed the investigation. I have reviewed the files, records and research of the investigation conducted by Agent Morehead. Based upon the investigation of Morehead and the files and records referenced in this Complaint, I believe the following information to be true and correct. TRUST TAXES GENERALLY Sales Tax, Alcohol Tax and Non-Resident Entertainment (NRE) Taxes are trust taxes. Any entity that has sales or activities subject to trust taxes must register with the Minnesota Department of Revenue. MNDOR assigns a business ID number and sets up filing and remitting periods. Both the business and business owners are responsible for meeting all filing and remittance obligations. MNDOR effectively partners with a business and "trusts" the business to collect taxes and turn them over to MNDOR. The tax arises the moment a taxable sale is made or a transaction occurs and immediately becomes the property of the Minnesota Department of Revenue. The taxes are to be set aside and held in trust by the vendor until remitted to MNDOR. For NRE Taxes the tax is generally withheld from the advance payment made to the entertainer by the promoter. Most entertainment contracts list the NRE Tax as withheld causing the NRE tax to come into existence the moment the contract payment is made. Trust tax money belongs to the State of Minnesota the moment it comes into existence. The failure to remit a trust tax is akin to felony theft of government funds. Willful failure to remit trust taxes is a felony violation of Minn. Stat. 289A.63(l)(b). LDFA was a 501(c)(4) non-profit entity that conducted activities subject to Minnesota Sales Tax, Alcohol Tax, and NRE Tax. It had a legal duty to register with MNDOR and comply with all MNDOR requirements including filing and remitting requirements. LDFA never registered with MNDOR. It contracted with SCE as its agent or otherwise simply allowed SCE to handle its affairs. Delegation of duties to SCE did not relieve LDFA and its officers from liability for taxes. SCE, a professional event management business, is registered with MNDOR for a variety of taxes including Sales Tax. It took on LDFA's tax filing duties as evidenced by its filing of LDFA's Federal Form 990's and multiple requests for legal tax advice regarding SCE's need to collect and remit Sales Tax for LDFA events. LDFA, SCE, and their representative the Defendant were required to remit all taxes when due. Both organizations and the Defendant failed to meet 3 this obligation. SALES AND ALCOHOL TAX INVESTIGATION MNDOR/CID has found through experience large festivals operated by promoters are rarely exempt from Sales and Alcohol Taxes. While reviewing items seized from the Defendant's home with a search warrant Morehead noted a 1999 letter to Defendant from his attorney Cass Weil. A copy of that letter was sent to the Defendant with a request he waive attorney/client privilege so Morehead could interview his attorney. The waiver was signed by the Defendant. This led to an interview of the attorneys by Morehead. Weil was given a copy of his 1999 letter regarding Sales Tax. Weil strongly denied his letter was a legal opinion that LDFA was not subject to Sales Tax. He stated he was never given enough information about the operation of LDFA to render a legal opinion. He stated the letter did not state Lumberjack Days Festival was exempt from Minnesota Sales Tax. When he was asked for a new Sales Tax opinion in 2011 he referred the request to Yuri Berndt, a tax expert attorney. Yuri Berndt was shown by Morehead his 2011 letter regarding Sales Tax for LDFA. He stated he was never asked for a full legal opinion as to the Sales Tax liability of LDFA in 2011. He indicated he was never given enough information to render a legal analysis of LDFA's liability for Sales Tax. Neither Mr. Berndt nor Mr. Weil knew the Defendant was filing Federal Form 990's listing LDFA as a 501(c)(4) non-profit rather than as 501(c)(3) non-profit. Morehead gave Berndt some facts about the operation of Lumberjack Days Festival and its relationship with St. Croix Events, Inc. Based on that information Berndt stated Lumberjack Days Festival Association would be subject to Sales Tax. Sales Tax Audit Activity DOR employee Demko conducted a Sales Tax audit of St. Croix Events, Inc. for tax years 2008 through 2010 starting in February 2011. She was interviewed as part of the investigation. She interviewed the Defendant and corresponded with him via phone, mail and e-mails from February 2011 until the audit closed on 10-24-2011. Demko was told by or led to believe by comments made by the Defendant any Sales Taxes for events managed by St. Croix Events, Inc. were the responsibility of vendors at the events or customers of St. Croix Events, Inc. The Defendant specifically told her that there were no admission charges for LDFA. Her notes indicate she was led to believe Lumberjack Days Festival Association was a 501(c)(3) non-profit. During her audit she raised issues about the difference between 2009 deposits and revenues. 2009 total revenues were at least $200,000 lower than total deposits. The Defendant suggested short term loans from credit cards might explain the difference. She concluded her audit finding $899.48 in taxes along with interest and other charges for a total of $1,114.57. This amount was assessed to St. Croix Events, Inc. on 10-14-2011. Based on the Defendant's statements she never looked at Sales Taxes for beverage sales or admissions. The Defendant wrote a letter to MNDOR seeking an abatement of penalties. He also stated he now fully understood his tax obligations and would comply with them in the future. His request for penalty abatement was granted. The debt from the Demko Sales Tax audit remains outstanding. Demko was contacted shortly after the CID investigation started. She was surprised to learn LDFA charged admission to some of its events, sold beer and pop, that it relied upon St. Croix Events, Inc. to handle all of its tax matters and it was not a 501(c)(3). Sales Tax Analysis and Conclusions Both the 1999 and the 2011 legal opinion letter discuss aspects of Minnesota Statute 297A. The statute was rewritten after 1999 and the pertinent references made in the 1999 letter were recodified under 297A(14). The basic requirements remained the same. 297A(14) (a) (1-2) requires a non-profit keep its own books and use all net proceeds for charitable, religious or educational purposes. That later part of the statute describes a 501(c)(3) non-profit. LDFA was a 501(c)(4) non-profit and had no restrictions on funding only charitable, religious or educational entities. LDFA was created primarily by Stillwater business people for the purpose of holding a festival to bring people and money to Stillwater. 297A(14)(b)(2) states all profits must be used exclusively for charitable, religious, or educational purposes. 4 LDFA board members described the LDFA/SCE contract as a risk and reward contract. SCE took in whatever profits could be made from the event. There is no record of any money ever going to any charitable, religious or educational entity or ever being intended to go to such entities. 297A(14)(b)(3) requires separate accounting records. No such records for LDFA have been found to exist. The various records discovered to date are so comingled with other records as to make a realistic accounting of any entity nearly impossible. 297A(14)(b)(7) makes LDFA ineligible for Sales Tax exemption since it entered into a risk and reward contract with SCE and its annual benefits were less than the taxes that would have been generated. 297A(14)(c) excludes non-profits that share net earnings with private individuals. LDFA clearly intended to share profits with SCE. LDFA sold beer and other beverages at its festivals. MNDOR files associated with this case have copies of liquor permits, information from beer vendors, excerpts from a criminal complaint and testimony from many witnesses. Fanfare Attractions records show how much money was collected from booths making taxable sales. Using this information the Sales Tax Division staff was able to make estimates of taxes owed. The Defendant is a business person who has been in the promotion business for decades and who routinely filed Federal Form 990's for his client. He failed to file and remit Sales and Alcohol Taxes for all years that SCE operated the Lumberjack Days Festival. SCE's tax obligations transfer personally to the Defendant since he is an officer and owner. The Sales and Alcohol Tax debt exceeds $100,000 and may be more than $121,000 for the years covered by MNDOR's investigation. NON-RESIDENT ENTERTAINERS TAX INVESTIGATION Non-Resident Entertainer Tax Audit Activity Review of St. Croix Events, Inc. files noted an outstanding debt for Non-Resident Entertainer Tax (NRE). An NRE audit was started in 2008 after the MNDOR Withholding Division was alerted to NRE problems with St. Croix Events, Inc. Non-Resident Entertainers Tax is mandated by MN Stat. 290.920. It is a 2% tax on the gross amount of money paid to entertainers from outside of Minnesota. Subd. 7 of the Statute mandates the tax be withheld at the time of payment by the person or entity making the payment to the non-resident entertainer. It is therefore a Withholding tax and the MNDOR Withholding Division administers it. Sudb. 7 states MN Stat. 289A.63, the criminal penalties statute, applies to MN. Stat. 290.9201. Sudb. 8 states that NRE Tax must be deposited with the Commissioner of Revenue. As a trust tax it automatically comes into existence the moment the entertainer agrees to a contract, payment is made and money is deducted. The tax is withheld from the contract payment like any other withholding trust tax and is legally the property of MNDOR. The promoter is "trusted" to retain the tax and remit it according to MNDOR required deadlines. An NRE deposit form and the NRE Tax must be deposited with MNDOR by the last day of the month following any performance. The promoter is required to give each entertainer a Form 1099-MISC. The promoter must file an annual form summarizing the previous year's NRE withholding for all events. The promoter is required to list all 1099-MISCs issued on annual form. The form is due by February 28. An NRE audit began after entertainers filed for their NRE 2007 tax refunds and no NRE forms were found for either Lumberjack Days Festival Association or St. Croix Events, Inc. Messages were left with St. Croix Events, Inc. on June 8, 2008, January 8, 2009, and February 11, 2009. The Defendant was finally contacted on February 12, 2009. He indicated he would be meeting with his accountants on 2-17-2009. On 4-252009 an auditor's note states the Defendant admitted St. Croix Events, Inc. paid entertainers. The note states Defendant admitted learning in 2008 that St. Croix Events, Inc. was responsible for NRE Taxes. Mr. Eckberg retained attorney Yuri Berndt to handle the NRE matters effective 5-12-2009. Twelve more notes after Mr. Berndt was retained until 6-7-2010 document repeated efforts by the auditors to bring the Defendant into compliance. The Withholding Division completed a NRE audit on St. Croix Events for tax years 2006 through 2009. The audit resulted in a tax debt of $14,780.70, including penalties and interest, effective October 14, 2010. The 5 Defendant filed an appeal asking the overall debt be reduced. The taxes were not remitted and on April 22, 2011, a Collections Division Demand to Pay letter was issued to St. Croix Events, Inc. The Collections letter offered a payment plan for the NRE Tax and it appears that St. Croix Events, Inc. entered into a payment plan shortly thereafter. The Defendant's appeal letter stated he was now aware of his NRE obligations and would comply with all future NRE obligations. On March 1, 2011, the Defendant's appeal was denied. The 2011 festival was held and NRE Taxes for that year were withheld. No required forms were filed and no NRE Taxes were remitted for 2011. In November 2011 St. Croix Events, Inc. was in default for its 2006-2009 NRE taxes and the payment plan was terminated. The NRE debt for those years remains outstanding. St. Croix Events, Inc. did file and remit required NRE related forms and taxes for tax year 2010. This established the Defendant knew of his obligations. No filings or tax remittances have been received for tax year 2011, the last year St. Croix Events, Inc. held a Lumberjack Days Festival using out of state entertainers. T.E.A. Productions is owned and operated by Jack Thibault. He was issued a subpoena for testimony and records and was interviewed. He described himself as a talent buyer who helps pair up entertainers with events. He has worked with the Defendant for many years lining up musical acts to perform at Lumberjack Days. He provided some records covering contracts for Lumberjack Days Festivals in 2008, 2009 and 2011. He was shown flyers for Lumberjack Days Festivals in 2009 and 2011. He pointed out the musical groups he arranged. In 2009 Creedence Clearwater Revisited played on Friday night July 24th. The contract was for $55,000 less 2% Minnesota State Entertainers Tax. He furnished a copy of the contract that included the 2% Withholding. On Saturday July 25, 2009 The Wallflowers performed as the main act. He thought their contract was for $50,000 and 2% would have been withheld. He also arranged a smaller act, the Bottle Rockets, for a fee of $2,500. The 2% Tax would also have been withheld from their contract. In 2010, the band Chicago performed on July 24th. Their fee was $100,000 and the contract clearly stated a 2% MN Entertainers Tax was withheld. Mr. Thibault provided a copy of the contract listing the 2% Withholding. the Defendant filed and remitted NRE forms and taxes for 2010 performers. This establishes he knew of his filing and remitting obligations. In 2011 Collective Soul was the main act on Friday July 22nd. Their fee was $50,000 less the 2% MN Entertainers Tax. Mr. Thibault supplied a copy of the contract showing the withholding. That act was rained out. The status of the NRE is not known at this time. On Saturday July 23 the main act was Smash Mouth. Mr. Thibault recalled their fee was $50,000 and there would have been a 2% MN Entertainment Tax withholding. Mr. Thibault was shown various NRE forms. He stated his office manager always made sure the promoter had these forms and if they did not have them she would send them out. Mr. Thibault stated the Defendant knew about the Minnesota Non-Resident Entertainers Tax requirements for many years. Attorney Interview Relating to NRE Tax One of the topics discussed with defendant's attorneys was NRE Taxes. Mr. Berndt confirmed he was retained in about May of 2009 by the Defendant to represent him before the Minnesota Department of Revenue regarding issues related to Non-Resident Entertainer Taxes. He indicated he fully briefed the Defendant on the topic and the Defendant understood his Non-Resident Entertainer Tax obligations. Evidence shows the NRE forms for 2009 were never filed and NRE Taxes were never remitted for 2009. The Defendant admits he knew in 2008 of his NRE obligations. He was represented by a competent attorney prior to the 2009 festival who stated the Defendant was fully informed of his NRE obligations. The Defendant as a shareholder and operator of St. Croix Events, Inc., a Minnesota S-Corporation operating as a promotion business, willfully failed to remit annual Sales Tax with the Minnesota Department of Revenue for the years 2010 and 2011 in violation of MN Stat. 289A.63Subd. 1(b). MN Stat. 289A.63A Subd. 1(b) states "A person required to pay or to collect and remit a tax, who willfully attempts to evade or defeat a tax law by failing to do so when required, is guilty of a felony." The Defendant is personally 6 responsible for remitting all taxes associated with the S-Corporation, St. Croix Events, Inc. The Defendant took on responsibility for handling the tax related matters of Lumberjack Days Festival Association. Every year the Defendant operated a festival he had Sales Tax obligations. Each year that sales taxes are not remitted is considered a separate crime. At a minimum he was required to remit, by February 5th all Sales Taxes and related Alcohol Taxes for the previous year. For the year 2010 the Defendant operated a Minnesota S-Corporation known as St. Croix Events, Inc., whose primary offices, like Defendant's home address, were located in Washington County. St. Croix Events, Inc. acted as promoter for various events including Lumberjack Days Festival held in Stillwater, Minnesota. St. Croix Events, Inc. handled all key aspects of the operation of Lumberjack Days Festival including tax matters. More than $204,000 in sales subject to Minnesota Sales Tax and more than $119,000 in sales subject to Alcohol Taxes were made during Lumberjack Days in 2010. St. Croix Events, Inc. knew or should have known as a professional promoter the sales made by Lumberjack Days Festival were subject to Minnesota Sales Tax and related Alcohol Tax, thereby requiring the Defendant to remit an estimated $17,255 in annual Sales and Alcohol Taxes no later than February 5, 2011 to the Minnesota Department of Revenue. The Defendant willfully failed to remit any Sales or Alcohol Taxes for 2010 by the due date in violation of MN Stat. 289A.63 Subd. 1(a). For the year 2011 the Defendant operated a Minnesota S-Corporation known as St. Croix Events, Inc., whose primary offices, like the Defendant's home address, were located in Washington County. St. Croix Events, Inc. acted as promoter for various events including the annual Lumberjack Days held in Stillwater, Minnesota. St. Croix Events, Inc. handled all key aspects of the operation of Lumberjack Days including tax matters. More than $102,000 in sales subject to Minnesota Sales Tax and more than $50,000 in sales subject to Alcohol Taxes were made during Lumberjack Days in 2011. St. Croix Events, Inc. knew or should have known as a professional promoter the sales made by Lumberjack Days Festival were subject to Minnesota Sales Tax and related Alcohol Tax, thereby requiring the Defendant to remit an estimated $8,390 in annual Sales and Alcohol Taxes no later than February 5, 2012, with the Minnesota Department of Revenue. The Defendant willfully failed to remit any Sales or Alcohol taxes for 2011 by the due date in violation of MN Stat. 289A.63 Subd. 1(a). The Defendant as shareholder and operator of St. Croix Events, Inc., operating as a promotion business, willfully failed to file required Non-Resident Entertainers' Tax returns with the Minnesota Department of Revenue for the year 2009 in violation of MN Statutes 290.9201 and 289A.63 Subd. 1(a), as a felony. MN Stat. 289A.63 Subd. 1(a) states "A person required to file a return, report or other document who willfully attempts in any manner to evade or defeat a tax by failing to file it when required, is guilty of a felony." The Defendant was personally responsible for filing all tax returns for his S-Corporation, St. Croix Events, Inc., including required Non-Resident Entertainers' Tax returns (NRE) required pursuant to MN Stat. 290.9201. St. Croix Events, Inc.'s oldest NRE tax filing obligation for Lumberjack Days events that is within the six year statute of limitations is for tax year 2009. The form ETD was due on August 31, 2009, the end of the month following the July 2009 Lumberjack Days performances. Promoters are also required to file Form ETA, Promoters Annual Reconciliation, at the end of every tax year. The filing deadline is February 28 after the close of a tax year. Form ETA for tax year 2009 was due on Feb. 28, 2010. The Defendant as shareholder and operator of St. Croix Events, Inc., a Minnesota S-Corporation operating as a promotion business, willfully failed to remit required Non-Resident Entertainers' Taxes with the Minnesota Department of Revenue for the year 2009 in violation of MN Statutes 290.9201 and 289A.63 Subd 1, as a felony. MN Stat. 289A.63A Subd. 1(b) states "A person required to pay or collect and remit a tax, who willfully attempts to evade or defeat a tax law by failing to do so when required, is guilty of a felony." The Defendant is personally responsible for remitting all taxes associated with St. Croix Events, Inc. As a promoter his company took on responsibility for handling the tax related matters of the clients. At a minimum he was required to remit NRE Tax the month following a performance in Minnesota. He was required to remit NRE Taxes annually by the following February 28th of each tax year. St. Croix Events, Inc.'s oldest NRE Tax remittance obligation that is within the six year statute of limitations is for tax year 7 2009. Taxes for Lumberjack Days Festival July 2009 performances were due on August 31, 2009. Promoters are also required to remit NRE Taxes using form ETA, Promoters Annual Reconciliation, at the end of every tax year. The filing deadline is February 28 after the close of a tax year. Form ETA for tax year 2009 was due on Feb. 28, 2010. For the year 2009 the Defendant operated a Minnesota S-Corporation known as St. Croix Events, Inc., whose primary offices were located in Washington County. The 2009 Minnesota Non-Resident Entertainers' Tax remittance (ETA), for entertainers paid by St. Croix Events, Inc. in 2009, was due no later than February 28, 2010. The Defendant willfully failed to timely remit the Non-Resident Entertainers' Taxes (ETA) by the due date of February 28, 2010 in violation of MN Statutes 290.9201 and 289A.63 Subd. 1(b). 8 SIGNATURES AND APPROVALS Complainant requests that Defendant, subject to bail or conditions of release, be: (1) arrested or that other lawful steps be taken to obtain Defendant's appearance in court; or (2) detained, if already in custody, pending further proceedings; and that said Defendant otherwise be dealt with according to law. Complainant Jeff Slater Revenue Special Investigator 600 Robert Street N St. Paul, MN 55146-6590 Electronically Signed: 03/17/2015 08:48 AM Subscribed and sworn to before the undersigned. Notary Public or Judicial Official Cindy Glaser-OBrien Commission expires: 01/31/2017 Notary Public, County of Ramsey Electronically Signed: 600 Robert Street N 03/17/2015 08:54 AM St. Paul, MN 55146-6590 Notary ID: 31051833 Being authorized to prosecute the offenses charged, I approve this complaint. Prosecuting Attorney Richard D. Hodsdon Assistant Washington County Arttorney PO Box 6 15015 62nd Street North Stillwater, MN 55082 (651) 430-6115 9 Electronically Signed: 03/16/2015 02:10 PM FINDING OF PROBABLE CAUSE From the above sworn facts, and any supporting affidavits or supplemental sworn testimony, I, the Issuing Officer, have determined that probable cause exists to support, subject to bail or conditions of release where applicable, Defendant’s arrest or other lawful steps be taken to obtain Defendant’s appearance in court, or Defendant’s detention, if already in custody, pending further proceedings. Defendant is therefore charged with the above-stated offense(s). X SUMMONS THEREFORE YOU, THE DEFENDANT, ARE SUMMONED to appear on ________ ___, _____ at _____ AM/PM before the above-named court at 14949 62nd Street N PO Box 3802, Stillwater, MN 55082-3802 to answer this complaint. IF YOU FAIL TO APPEAR in response to this SUMMONS, a WARRANT FOR YOUR ARREST shall be issued. WARRANT To the Sheriff of the above-named county; or other person authorized to execute this warrant: I order, in the name of the State of Minnesota, that the Defendant be apprehended and arrested without delay and brought promptly before the court (if in session), and if not, before a Judge or Judicial Officer of such court without unnecessary delay, and in any event not later than 36 hours after the arrest or as soon as such Judge or Judicial Officer is available to be dealt with according to law. Execute in MN Only Execute Nationwide Execute in Border States ORDER OF DETENTION Since the Defendant is already in custody, I order, subject to bail or conditions of release, that the Defendant continue to be detained pending further proceedings. Bail: $ Conditions of Release: This complaint is issued by the undersigned Judge as of the following date: March 17, 2015. Judicial Officer Gary Schurrer judge Electronically Signed: 03/17/2015 10:08 AM Sworn testimony has been given before the Judicial Officer by the following witnesses: COUNTY OF WASHINGTON STATE OF MINNESOTA Clerk's Signature or File Stamp: State of Minnesota Plaintiff RETURN OF SERVICE vs. I hereby Certify and Return that I have served a copy of this Summons upon the Defendant herein named. David Webster Eckberg Signature of Authorized Service Agent: Defendant 10

© Copyright 2026