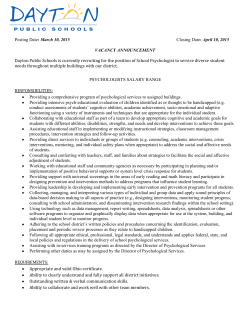

Disclosure to a Psychological Audience