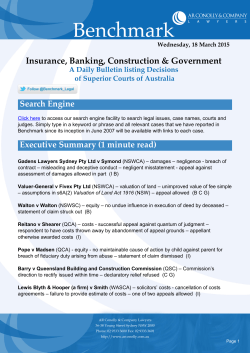

The Lawyers Weekly - March 20, 2015